The market has rallied impressively over the past several months, with the S&P 500 index reaching all-time highs that confirm a new bull market is underway in stocks. With this recent rally, some stock valuations may be stretched, making it harder to find deals. Good news for you: There are still plenty of deals to be had in the market today.

Bank stocks have been slow to recover amid the high interest rate environment, which has been a headwind to businesses. However, there are at least three bank stocks that still trade at incredibly cheap valuations and could be poised to take off.

Image source: Getty Images.

1. Citigroup

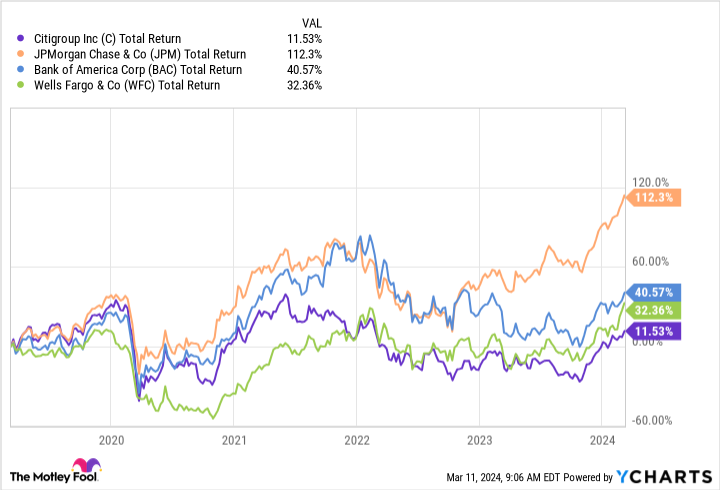

Citigroup (C 0.91%) is one of the largest banks in the U.S. but has struggled in recent years as its wide-ranging worldwide business endeavors has spread it too thin. Not only that, but a few years ago, the bank was fined $400 million for deficiencies in internal controls, risk management, and data governance. As a result, Citigroup’s performance struggled compared with that of its banking peers.

C Total Return Level data by YCharts

Because of its recent history of underperformance, Citigroup trades at a dirt cheap 33% discount to its tangible book value. In comparison, Bank of America and Wells Fargo trade at a 44% and 54% premium to book value, respectively.

Citigroup’s cheap valuation is one aspect that makes it appealing. However, the guidance of CEO Jane Fraser, if implemented, could give Citigroup a higher valuation. Fraser took over as CEO in 2021 and laid out plans to eliminate less profitable operations while leaning into those that will boost its efficiency. As part of this move, it announced it would wind down 13 global consumer franchises, reduce its workforce, consolidate operations, and streamline its business.

Some analysts are quite optimistic about its strategy. For example, Wells Fargo analyst Mike Mayo believes Citi’s stock price could reach $100 over the next three years. While Citigroup has its work cut out for it, its cheap valuation provides some margin of safety and makes it look like a good value stock to buy today.

2. Goldman Sachs

Rising interest rates have dampened investment banking activity over the past several years, impacting Goldman Sachs (GS -0.36%), one of the largest investment banks in the world.

In 2022, rising interest rates created an air of uncertainty around markets, including those for initial public offerings (IPOs) and mergers and acquisitions, both bread-and-butter businesses for investment bankers. According to the consulting firm PwC, the IPO markets over the last two years were some of the lowest-volume years in the U.S. In total, there were 175 IPOs in the past two years, well below 2021, which saw a whopping 951 IPOs.

Goldman Sachs’ investment banking revenue plummeted 56% over two years ending in 2023. It has also made other moves to consolidate its operations, like winding down its consumer business, which has been struggling for the past several years. The difficult environment has made it tough to be optimistic about Goldman Sachs. Today, the investment bank trades at 16.8 times earnings and just 9.9 times one-year forward earnings.

However, IPO markets are showing signs of life, with Reddit, Stripe, and Klarna being some of the most anticipated IPOs that could happen later in the year. If they launch successfully, it could be a good sign that risk appetite is back. If that’s the case, Goldman Sachs looks like an excellent bargain stock to pick up today before we see a further pickup in activity.

3. Lending Club

Lending Club (LC -0.13%) is a consumer-focused lender that helps consumers refinance their debt and roll it up into personal loans. With credit card debt topping $1.13 trillion, consumers have racked up debt at a time when credit card interest rates are near an all-time high.

This rising consumer debt could create a massive opportunity for Lending Club. The company started as a peer-to-peer lending platform in 2006 but has transformed into a consumer lender and a bank following its acquisition of Radius Bancorp in 2021. As a result, it holds about 15% to 25% of its highest-quality loans on its books, which can generate net interest income in addition to the revenue it earns for originating and selling its remaining loans to the market.

LendingClub CEO Scott Sanborn told investors, “We’ve been preparing our personal loans franchise to meet the historic refinance opportunity ahead.” To do so, Lending Club is developing products that allow members to sweep credit card balances into payment plans. In other words, customers can “top up” an existing personal loan, making it easy to manage their debt balance.

Consumers may consolidate their loans, especially if interest rates fall, benefiting LendingClub’s core business. If that’s the case, now could be an excellent time to scoop up shares, which are cheaply priced at an 18% discount to tangible book value and 11 times forward earnings, ahead of this historic refinancing opportunity.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has positions in LendingClub. The Motley Fool has positions in and recommends Bank of America, Goldman Sachs Group, and JPMorgan Chase. The Motley Fool has a disclosure policy.