The article “Robo-Advisors: A Well-Researched Topic” first appeared on Alpha Architect blog.

What are the new avenues and topics for future research? This article lays out a systematic literature review to begin to answer those questions and suggest future expansions of each stream.

Robo-advisors: A systematic literature review

- Giovanni Cardillo and Helen Chiappini

- Finance Research Letters

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- What are the major research streams on robo-advisors?

- What will future research streams on robo-advisors likely take?

What are the Academic Insights?

- Four groups of research on robo-advisors were identified:

- Attempts to classify robo-advisors: The analysis of attempts to classify reveals how flexible robo-advisors have become in financial practice. They may represent several business lines at once or a single business, either with humans or on an automated platform. Robo-advisors are not necessarily associated with financial institutions. Those that are, may be integrated at various levels and may generate additional fee revenue. Robo-advisors also represent active as well as passive managers with varying levels of intensity. On the passive side, robo-advisors assist in asset allocation, risk management, portfolio management including rebalancing. For active strategies, they are used to identify investments using artificial intelligence models and assist in managing changes in assets for individual clients. Three business models have been referred to in the literature. The D2C model utilizes online platforms that are completely automated with typical portfolio construction algorithms. The B2B model provides only digital support to a human advisor. The third is a hybrid of B2B +D2C models, where personal contact is paired with automated portfolio recommendations.

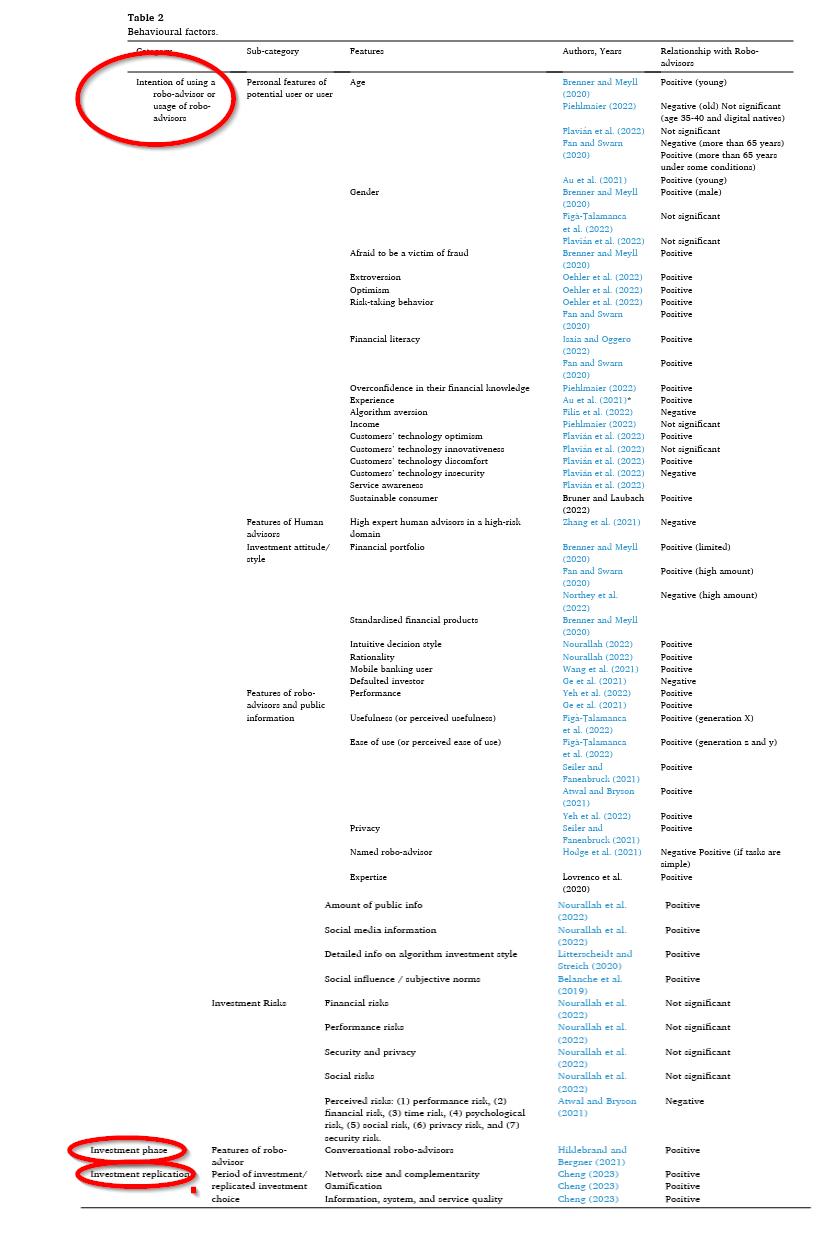

- Behavior, attitudes and traits: Descriptives related to the usage of robo-advisors are comprehensively covered in the research literature. Personality characteristics positively associated with usage include attitude toward risk, extroversion and optimism, fear of fraud, financial literacy and overconfidence, technological optimism, innovative attitude, and some level of discomfort (a surprise!). Traits negatively related include insecurity regarding technology and aversion to math modelling. Gender and level of income seem not to influence the use of robo-advisors. Characteristics of the specific robo-advisor also affect the likelihood of client usage. Ease of use is key for various generations, Gen X especially. Information sources about the advisor also matter. For example, clear and comprehensive descriptions of the math modelling and coverage by social media or personal acquaintances. For more details see Table 2 below.

- Performance: Robo-advisors do not outperform market indexes under static or dynamic conditions, with or without automated rebalances, or with a buy-and-hold strategy. Against human advisors, the results are similar although there may be advantages with targeted clienteles and degree of diversification. Robo-advisors are particularly helpful to clients with poorly diversified portfolios, low income and with low education levels.

- Algorithms and models are primarily based on Modern Portfolio Theory, with adjustments to include spending goals, risk tolerance and changing targets.

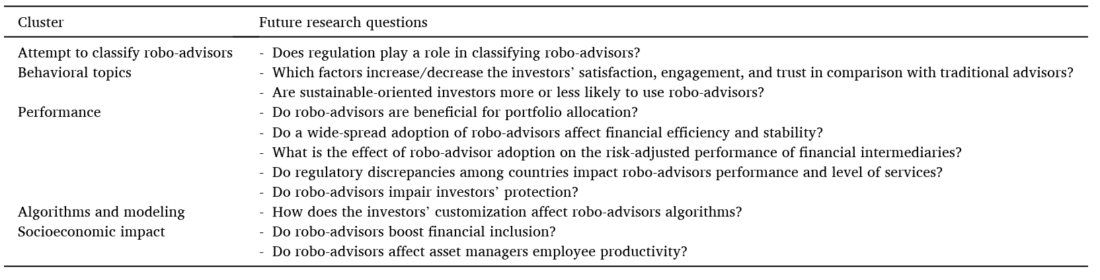

- The authors suggest future research on robo-advisor will likely expand the four categories as follows:

Why does it matter?

There are several beneficiaries for this literature review:

For researchers and scholars: a new set of research topics and a comprehensive review of topics that have been covered in the literature. For asset managers, banks, and other financial institutions interested in initiating robo-advisory operations or expanding current operations: studies on customer preferences, performance of robo-advisors relative to benchmarks, solutions based on AI, potential impact on employees. For regulators and supervisors: knowledge and insights on the impact robo-advisors may have on the business models for banks and on efficiency.

The most important chart from the paper

Abstract

Using a systematic literature review, our study analyzes articles on robo-advisors between 2017 and 2022. Our review identifies four relevant research streams: early classification of robo-advisors, behavioral topics, performance, and algorithm modelization. Finally, we propose relevant research questions for each stream, providing scholars with new research angles. Our considerations are also valuable for asset managers, banks, and other financial companies since adopting robo-advisors affects their business models through clients’ preferences and cost structure.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.