The energy sector has growth, value, and income written all over it.

Themes and market leaders define every bull market. Megacap tech-oriented growth stocks are the indisputable leaders of the broader market rally. And artificial intelligence continues to be a prevailing theme in the market.

At just under 4% of the S&P 500, the energy sector often flies under the radar. That’s especially true when growth themes are capturing the spotlight. But the energy sector has a rare blend of growth, value, and income that could support further upside.

Here’s why I think the energy sector will outperform the other 10 sectors in the S&P 500 in 2024.

Image source: Getty Images.

Pole position

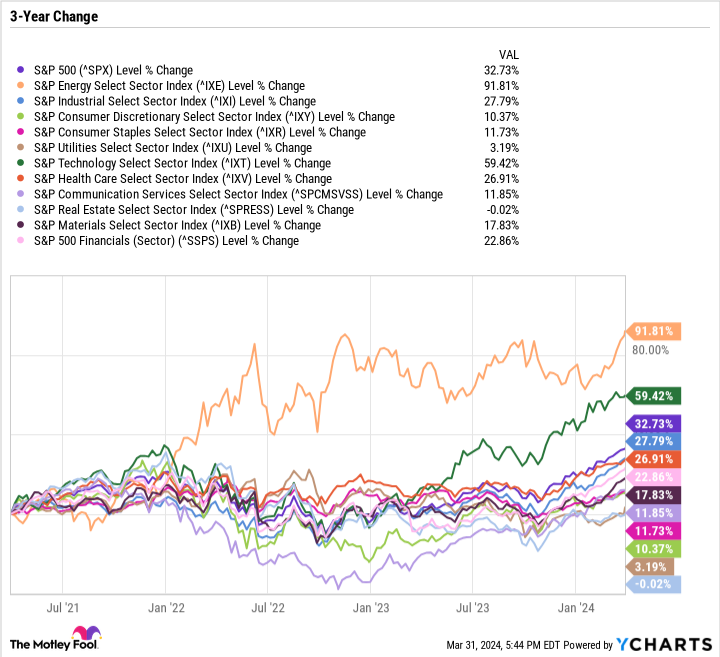

Picking the energy sector in early April is a bit unfair. With a 12.6% return, energy is the best-performing sector year to date (YTD) and has been one of just two sectors to outperform the S&P 500 over the last three years.

Almost all of the sector’s YTD gains came in March, largely in response to higher oil prices.

Ongoing geopolitical tensions

After a brutal COVID-19-induced downturn in early 2020, the oil and gas industry began to recover toward the end of that year as energy demands recovered globally. However, Russia’s invasion of Ukraine in February 2022 ensured that global oil and gas demand remained elevated as sanctions and supply constraints kicked in, ensuring the energy sector’s continued outperformance in the last 24 months.

Geopolitical tensions persist, so looking at global supply and demand isn’t always practical. Rather, it’s about where the supply comes from and who will buy it.

Securing reliable supply from the U.S. and its allies could be seen as more valuable to some countries than getting supply from elsewhere, which helps support increased U.S. exports of oil and gas.

Economic growth

Economic growth usually coincides with higher energy consumption, and therefore, higher demand. The prospect of lower interest rates could accelerate economic growth and help the oil and gas industry, as well as the renewable energy industry.

Renewables were hit hard by high interest rates because the cost of capital went up and the return on investment of many projects went down. By comparison, oil and gas companies that are free-cash-flow-positive don’t need to take on more debt. In fact, many are investing in low-carbon efforts.

The energy transition is a major long-term tailwind for renewables, but the world still depends on oil and gas to support economic growth.

Income and value

The Energy Select Sector SDPR Fund (XLE 1.07%) — one of the top ETFs in the space — has a price-to-earnings (P/E) ratio of just 8.7 and a yield of 3.5%. Earnings would have to fall by more than two-thirds for the sector to trade at the same valuation as the S&P 500. Meanwhile, the yield of the S&P 500 is just 1.3%.

The energy sector has the value and income boxes checked. It also has growth, with earnings for many companies reaching record highs in 2022. I don’t expect 2024 earnings to reach that level, but if this year is anything like 2023, the energy sector will do very well.

Many integrated majors and exploration and production (E&P) companies base their targets on oil prices far below current levels. ExxonMobil‘s (XOM 1.38%) corporate plan through 2027 uses Brent (the international benchmark) crude oil prices of $60 per barrel. Meanwhile, ConocoPhillips — the largest independent U.S.-based E&P — structured its 10-year plan on a West Texas Intermediate (the U.S. benchmark) crude oil price per barrel of $60.

The current Brent price is $87 and the WTI price is $83 — providing a nice margin of error. In 2023, Brent averaged $82.49 per barrel and WTI averaged $77.64. Last year, many producers were able to boost production, capital expenditures, dividends, and buybacks.

Foundational investments in the energy sector

E&P companies often benefit the most from higher oil and gas prices, but they are also the most vulnerable to a downturn. A balanced approach is to start with an integrated major, like ExxonMobil or Chevron. Exxon has paid and raised its dividend for 41 consecutive years, and Chevron is close behind with a 37-year streak. Both companies have global exposure and don’t solely depend on U.S. production. They also have sizable refining businesses and the cash to diversify into low-carbon solutions.

Another option is through an exchange-traded fund (ETF), like the aforementioned Energy Select Sector SDPR Fund or the iShares Global Energy ETF (IXC 0.93%).

The Energy Select Sector SPDR fund invests in U.S. companies and has a 0.9% expense ratio. The Global Energy ETF doesn’t solely invest in U.S. companies, but has a higher 0.44% expense ratio.

Shell, TotalEnergies, BP, Canadian Natural Resources, and Enbridge are all top-10 holdings in the Global Energy ETF though these the Energy Select Sector SPDR fund does not include them because they aren’t based in the U.S.

With a 7.8 P/E ratio and a 3.4% dividend yield, the Global Energy ETF has roughly the same valuation and dividend yield as the Energy Select Fund.

For many investors, a 50-50 split of both ETFs or a 50-50 split of Exxon and Chevron could be the most straightforward starting point instead of an all-or-nothing approach.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BP, Chevron, and Enbridge. The Motley Fool recommends Canadian Natural Resources. The Motley Fool has a disclosure policy.