The market started recognizing the footwear company’s value again last autumn.

As I postulated in November, Crocs (CROX -1.01%) stock ended up being dirt cheap. Shares of the love-’em-or-hate-’em foam clogs company have rallied by more than 60% in the past six months. Management is trying to keep the business on track after experiencing some issues with HeyDude, the casual shoe brand that it acquired in early 2022.

By certain metrics, Crocs stock is still cheap — assuming that the company can get its growth back on track this year. Let’s find out the latest and what it means for investors.

HeyDude is still a major drag

Crocs acquired the HeyDude brand in early 2022 for $2.05 billion in cash (funded with debt) and the issuance of new stock to the HeyDude founder. It was meant to be a transformational move, adding a high-growth emerging shoe business that was expected to bring in no less than $700 million in sales in 2022 — complementing Crocs’ own iconic status among many loyal fans.

All started out well, but in 2023 it became clear that HeyDude had over-expanded. There was (and still is) too much inventory floating around. Crocs management is actively scaling back the number of retail partners and authorized digital distribution channels.

As a result, HeyDude sales were $949 million in 2023. That’s up significantly from where HeyDude was at the time of acquisition, but down from what ultimately ended up being an epic 2022 for the small casual lifestyle brand. HeyDude hauled in $986 million in 2022 sales, including the couple months prior to the acquisition, far in excess of Crocs’ original forecast.

The pain isn’t over yet either. In 2024, management expects HeyDude’s sales to be “flat to slightly up.” Reinvigorating sales growth at a healthy profit will be the priority. Management expects to be able to boost HeyDude’s adjusted operating profit margins, which would help the company overall to get back to a 25% margin in 2024, compared to just 22% last year.

Can the Crocs brand keep the business afloat?

Meanwhile, the foam clogs segment of this company had another stellar year in 2023, with total Crocs brand sales increasing by 13% to $3 billion. In its forecast, management struck a conservative, guiding for sales growth of 4% to 6% for the brand in 2024.

Clearly, at least for now as the global consumer continues to ease up on discretionary spending, this is no longer a growth business. Expansion into new geographies like Asia and new product categories like sandals can only go so far in this economy. So why did shares rocket higher in recent months? Earnings growth.

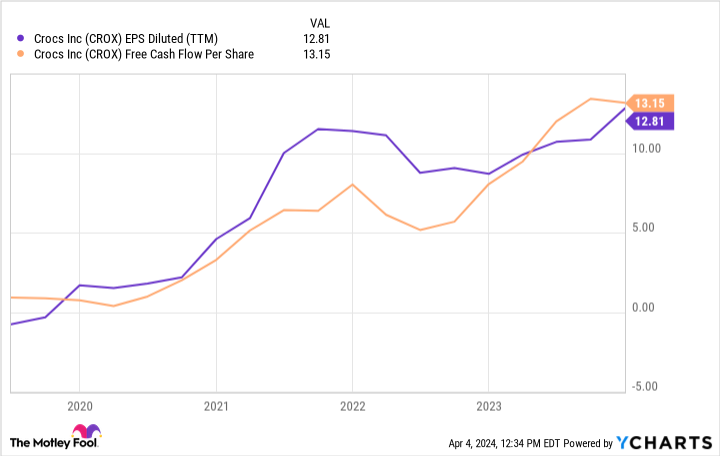

You see, even when factoring in the new shares issued for the purchase of HeyDude a couple of years ago, Crocs is back to generating all-time highs on earnings per share (EPS) and free cash flow (FCF) per share. On an adjusted basis (which backs out non-recurring items), EPS is expected to increase as much as 4% in 2024, excluding any positive benefit from share repurchases.

Data by YCharts.

Of course, don’t expect too much in the way of share repurchases just yet. Crocs still needs to pay down its long-term debt balance — $1.64 billion as of the end of 2023 (though that was down from $2.3 billion a year prior).

At any rate, with shares now trading for 11 times trailing 12-month EPS and 10 times FCF, Crocs stock looks much more fairly valued than it did last autumn. I’m content to keep holding the position I have. However, I’d like to see signs of a pick-up in growth, especially from HeyDudes later in 2024, before I nibble some more.