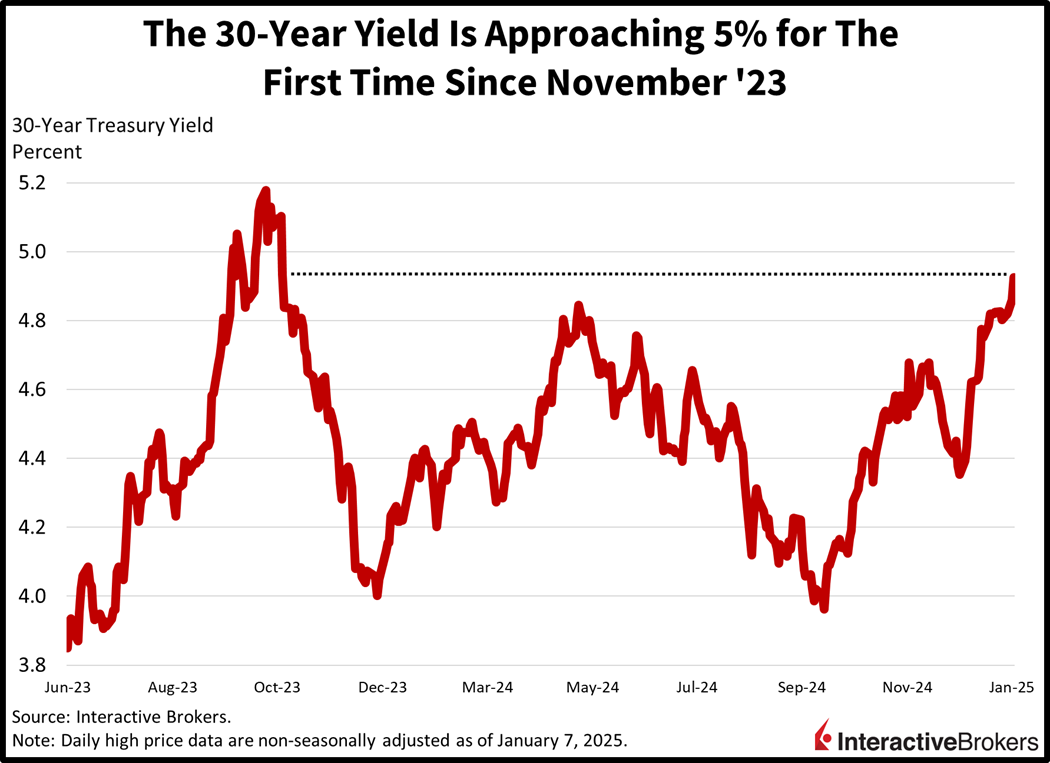

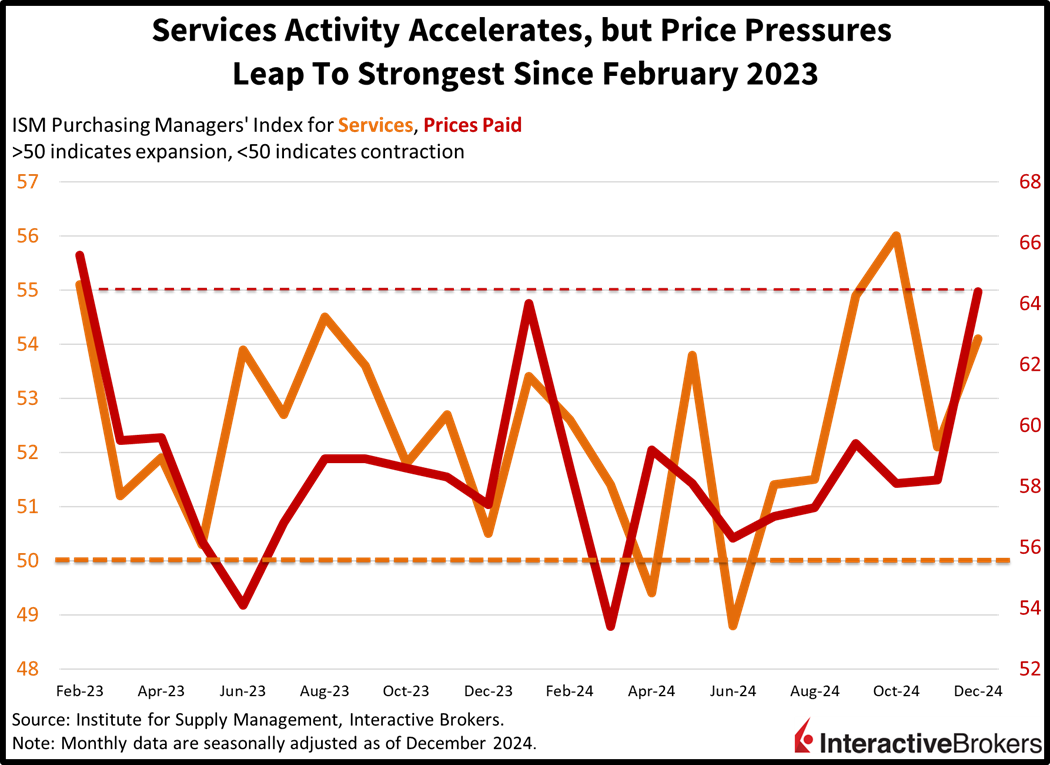

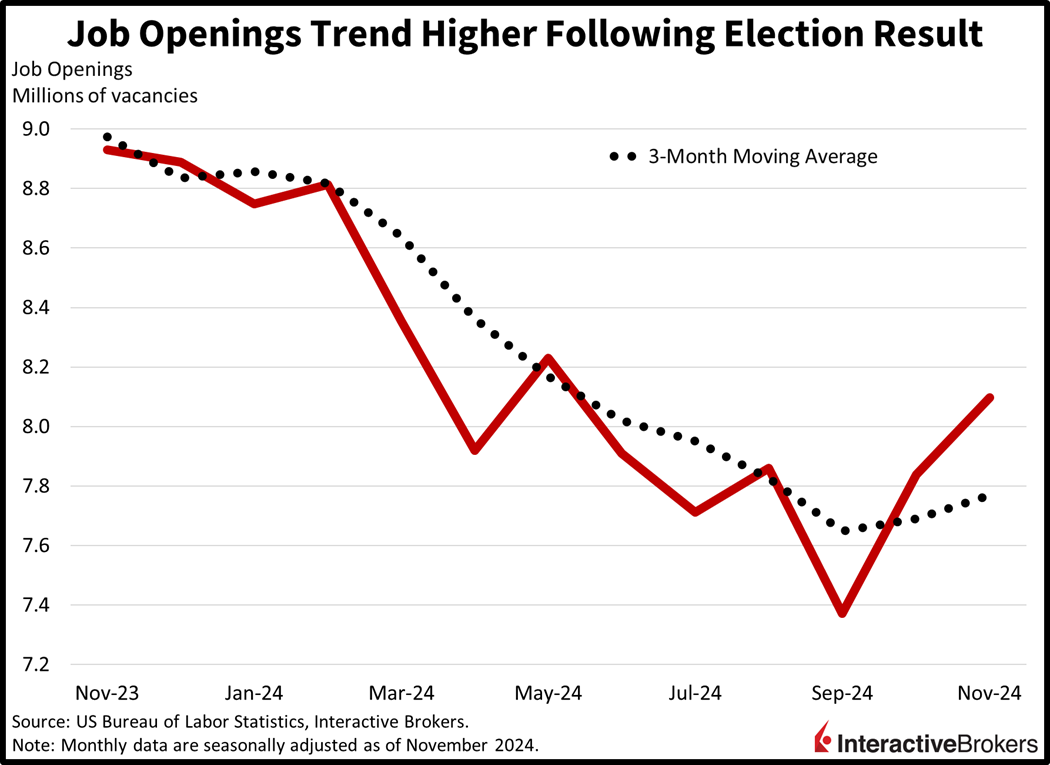

Markets started the morning in stride until a pair of economic releases sent yields to the nosebleeds and equities to the basement. The one-two punch was fueled by much stronger-than-expected results from ISM-services and JOLTS released at 10:00 am ET. The figures signal a US economy that is accelerating following the outcome of last November’s election, an overhang that kept corporates and consumers cautious due to the event’s uncertainty. But now that the hesitancy has been overcome, Wall Street’s focus has shifted to fiscal deficits, Trump tariffs and inflation, which have the potential to send rates further north, weighing on asset prices as a result. Indeed, the prices paid segment of ISM-services rose to a 22-month high while job openings climbed to the tallest level since May of last year. And debt dynamics are not a problem limited to just the states, with a poorly received UK auction for 30-year gilts propelling borrowing costs to the priciest degree since 1998.

ISM-Services Jumps

Economic activity accelerated last month following the results of the November election, with the Institute for Supply Management (ISM) reporting the third strongest figure of the year in December. The ISM’s Purchasing Managers’ Index for services rose to 54.1 last month, well above the contraction-expansion threshold at 50 while trouncing expectations of 53.3. Robust ordering drove sturdy business activity amidst modest hiring, but it also resulted in vigorous pricing power. The prices paid category rose to a whopping 64.4, the highest number since February 2023 and a sharp leap from the previous report’s 58.2. Services comprise roughly 70% of the US economy and a continuation of figures like these will certainly pause the Fed’s journey down the monetary policy stairs and send the long-end to the clouds.

JOLT Depicts Another Strong Month

The US labor market strengthened for the second consecutive month in November, according to the Job Openings and Labor Turnover Survey (JOLTS). Job openings rose to the highest level since May, coming in at 8.098 million, flying past projections of 7.7 million and September’s 7.839 million. Quits declined to 3.065 million from 3.283 million, however, indicating that employees may have less leverage in capturing better jobs elsewhere or perhaps they’re satisfied with their current bosses. Highlights featured gains of 273,000, 105,000 and 38,000 across the professional/business services, finance and insurance and private educational service categories but dipped by 89,000, 83,000 and 56,000 in the information, leisure/hospitality and manufacturing sectors.

European Inflation Returns

Inflation in the euro area, or the group of countries that use the euro, climbed 2.4% year over year (y/y) last month, according to preliminary data from Eurostat. The rate matched the consensus expectation but accelerated from 2.2% in November. On a month-over-month (m/m) basis, prices climbed 0.4% after falling 0.3% in November. Core inflation recorded a 2.7% y/y rate last month, matching the analyst expectation and November’s rate.

Price pressures were led by services and energy which rose 0.8% and 0.6% m/m while the food/alcohol/tobacco and non-energy industrial goods categories countered price increases with m/m declines of 0.1% each.

UK Shoppers Hold Back

UK consumers made a weak showing at cash registers during the final quarter of last year despite sales picking up in December, according to the British Retail Consortium. Fourth-quarter volume climbed only 0.4% y/y while purchases in December were 3.1% higher. The monthly gain reversed a 3.4% November plunge and surpassed expectations for a 0.2% dip. Retailers are struggling with the headwinds created by low consumer confidence, an income tax increase approved last year and overall economic weakness. A portion of December’s strength, furthermore, resulted from Black Friday occurring during the month compared to 2023, when the traditional start of holiday shopping was in November. Cashier transactions last month for non-food items at brick-and-mortar stores and online climbed y/y 4.4% and 11.1%, respectively, while food sales advanced 1.7%.

UK Home Prices Ease Modestly

After five consecutive months of UK home price increases, the cost of acquiring a house fell 0.2% m/m in December but still finished 2024 up 3.3% y/y, according to the Halifax Price Index (HPI). Analysts expected a m/m gain of 0.8%. In November, prices climbed 1.2% m/m and 4.7% y/y. Northern Ireland experienced the largest y/y increase at 7.4% while Northwest England produced gains of 5.3% and Wales properties jumped 4.6%. Higher incomes and anticipation of lower price thresholds at which home buyers must pay a stamp duty, or tax, on their purchases has helped stimulate sales.

When Good is Bad

Today’s strong economic growth trigged a green to red reversal with all major equity benchmarks and Treasurys taking meaningful losses. The Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial indices are down 1%, 0.5%, 0.4% and 0.1%. Sectoral breadth is actually positive, however, reflecting technology’s major role in the stock baskets. Consumer discretionary, technology and communication services are piloting the laggards; they’re down 1.3%, 1% and 0.7%. But seven of the eleven segments are up, with energy, materials and healthcare gaining 1.2%, 0.7% and 0.6%. Treasurys are shifting in bear-steepening fashion and changing hands at 4.31% and 4.7%, 4 and 7 basis points (bps) heavier on the session. Pricier borrowing costs stateside are helping the dollar, with its index up 19 bps as the greenback appreciates relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are tilted bullishly on the back of signals depicting accelerating activity stateside with crude oil, copper, gold and silver with 1.2%, 1.1%, 0.6% and 0.5%, but lumber is bucking the trend due to punishing mortgage rates; it’s lower by 0.3%. WTI crude, meanwhile, is trading at $74.33 per barrel on fears that Trump sanctions will weigh on supplies stemming from Tehran and Moscow.

Investors Crave Liquidity, Not Trump Bumps

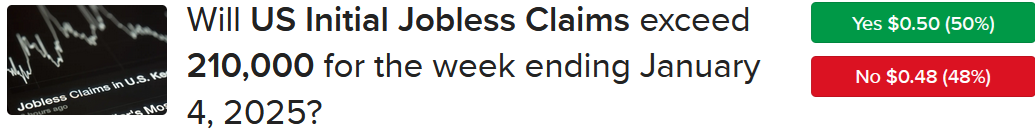

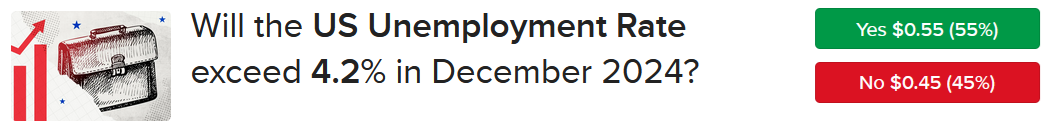

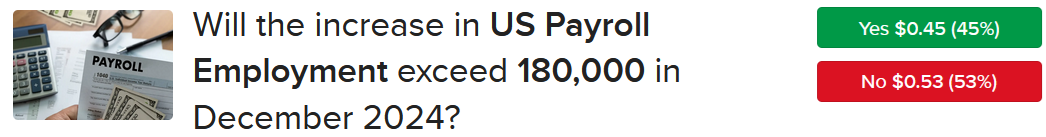

Today’s market reversal is emblematic of investors preferring favorable liquidity conditions rather than stronger business fundamentals. Indeed, these robust economic figures incrementally lead to a more apprehensive Federal Reserve, which essentially closes the door to further valuation expansion and places the burden on corporate earnings. Against this backdrop, Wall Street has to deal with uncertainty regarding a new president, which may end up bringing a desirable outcome in the medium-term but with Trump bumps along the way. As Trump approaches the helm, we’re compelled to remember the short-term turbulence required for Washington to get its way with trade partners and the other side of the aisle amidst the GOP carrying a slim majority. The tit-for-tat trade jabs and aggressive rhetoric aren’t conducive to smooth sailing rallies in markets. Finally, however, the brand new IBKR ForecastTrader offers investors the opportunity to focus their investments on the specific results of economic data releases, sovereign debt measures, elections results, etc. without having to worry about Trump bumps along the way. Indeed, the new administration will certainly bring us days where we’re up 0.5% in the morning but then down 2% by the afternoon, turning smiles into frowns as I explain in this recent CNBC interview.

Readers who are seeking real-time insights on the labor market can join me this Friday on X, formerly Twitter, at 8:00 a.m. as I provide a live presentation on the Jobs Report and associated forecast contracts. I hope you can join me.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.