Coinbase’s valuation looks sky-high, but there’s more to the story than meets the eye. Dig into two game-changing details below.

At first glance, Coinbase Global (COIN -6.56%) looks like a terrible investment right now.

The stock price has more than tripled in 52 weeks. The cryptocurrency exchange operator’s shares trade at the lofty valuation of 103 times free cash flows and 950 times earnings. I mean, it’s enough to make even seasoned growth investors reach for the smelling salt.

Many investors won’t look any further. Happy to skip this seemingly overvalued crypto stock, they move on to the next idea.

And that could be a big mistake. Coinbase is going through the usual four-year cycle of boom and bust in the crypto space, and the rising bottom-line profits barely clicked above the breakeven line so far.

Let me show you two reasons you should consider making Coinbase your next stock investment.

1. Coinbase runs a sophisticated business

Sure, Coinbase’s stock looks expensive at the moment. The crypto market is waking up from another cold, hard winter, and the whole industry is soaring. Bitcoin (BTC -5.38%) is up 138% over the last year, while Ethereum (ETH -8.46%) gained 85%. Low-priced altcoins are jumping even higher, led by Solana (SOL -12.78%) posting a 730% one-year gain. Coinbase saw a 270% return over the same period, and for good reason.

The company doesn’t build value by holding Bitcoin coins or Ethereum tokens. Its digital currency holdings are minimal and only used to facilitate its customers’ crypto trades as smoothly as possible. Coinbase doesn’t even record changing values in digital assets as a revenue item but as a part of its operating costs.

Instead, it makes money from transaction fees, interest and blockchain rewards, and subscription-style services. You know, pretty much like any ordinary bank, just based on a different set of financial assets. The company’s financial health is more closely related to basic interest in cryptocurrencies than to the price of any specific digital currency.

2. This crypto cycle is not like the others

Coinbase has been around since the early days of crypto. Founded in 2012, with only three cryptocurrencies on the market and one Bitcoin worth less than $7, the exchange has experienced three of Bitcoin’s halving cycles. The fourth one is coming up next week, cutting the rewards for mining Bitcoin in half again. Each halving so far has fueled a dramatic run-up in Bitcoin prices, giving the crypto industry another turn in the spotlight and inspiring larger transaction volumes across different digital coin types.

So, that scenario is about to play out again, but things are different this time. And it’s all about exchange-traded funds (ETFs) tied to Bitcoin’s spot price.

Spot Bitcoin ETFs give investors a radically different way to invest in this newfangled asset class. Instead of opening a new account with Coinbase or some other crypto exchange, learning a different set of trading rules and processes, and taking direct ownership of digital currencies, you can now make Bitcoin trades pretty much like you’d buy or sell an ordinary stock. The Securities and Exchange Commission (SEC) approved 11 applications for this brand-new ETF type in January, and they already manage more than $53 billion of Bitcoin assets.

The expected arrival of spot Bitcoin ETFs inspired an early start to the fourth halving surge. As noted earlier, many cryptocurrencies and related stocks have soared over the last year thanks to halving expectations, ETF plans, and a calmer economic inflation trend. On top of this robust launching pad, Coinbase will record higher trading volumes thanks to the new ETFs.

But wait a minute — why would that be a good thing? Aren’t these ETFs taking away potential crypto-trading volume from the Coinbase system?

Thanks for asking. As it turns out, most ETFs are using a third-party custodian service to execute Bitcoin trades and hold the crypto assets in a secure digital wallet. And nine of the 11 ETFs rely on Coinbase.

“We’re earning revenue, not just on custody, but also on trading and financing,” Coinbase CEO Brian Armstrong said on an earnings call in February, four weeks after the ETF approvals. “Every institution is now starting to hold crypto, the asset class will be a standard part of every diversified portfolio. The financial system is officially adopting crypto. This is really good, and Coinbase is the most trusted partner here.”

So, Coinbase found a new revenue stream while giving the whole crypto market a helpful push. That’s a win-win.

Coinbase is growing into its rich valuation

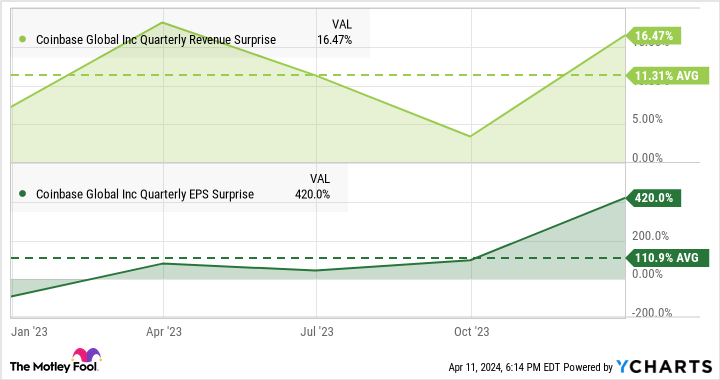

Coinbase’s valuation shrinks dramatically if you look forward to the incoming market surge. The stock trades at 12 times the average next-year revenue estimate and 108 times earnings projections. And in the last five quarterly reports, the company has exceeded the consensus revenue target by an average of 11% — and earnings have more than doubled the average Wall Street projections.

COIN Quarterly Revenue Surprise data by YCharts. EPS = earnings per share.

Past performance is no guarantee of future results, but Coinbase has a proven history of leaving analyst estimates behind — and the company has a unique set of growth-driving balls in the air right now. Keep this up throughout the 12-to-18-month span of the halving cycle’s bullish action, and the current stock price quickly starts to look cheap.

That’s why you should consider picking up a few Coinbase shares now. They will not stay this deceptively cheap forever.

Anders Bylund has positions in Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has a disclosure policy.