Stocks are continuing to struggle as interest rates and the dollar catch lifts from confrontational trade rhetoric, satisfactory economic data and signs of mounting inflationary pressures. Indeed, President Trump has heightened his tariff messaging just 12 days before his inauguration with remarks that include slapping heavy levies on the US’s northern and southern neighbors while also opining that Canada could become the 51st state. On the economic data front stateside, ADP reported lighter-than-expected hiring, but unemployment claims arrived beneath estimates across both the initial and continuing segments. Strong labor markets in the US and across most of the globe have certainly supported price pressures, especially among services, with inflation gauges from Australia and the EU arriving ahead of projections.

US Hiring Slows, But Is Still Healthy

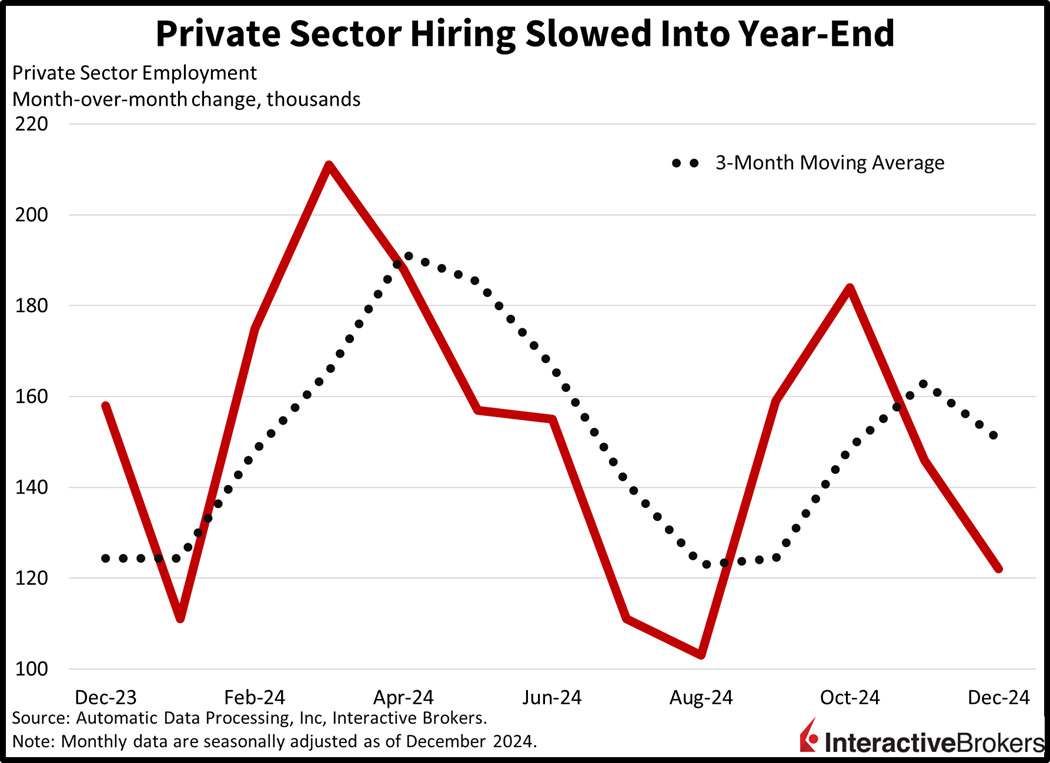

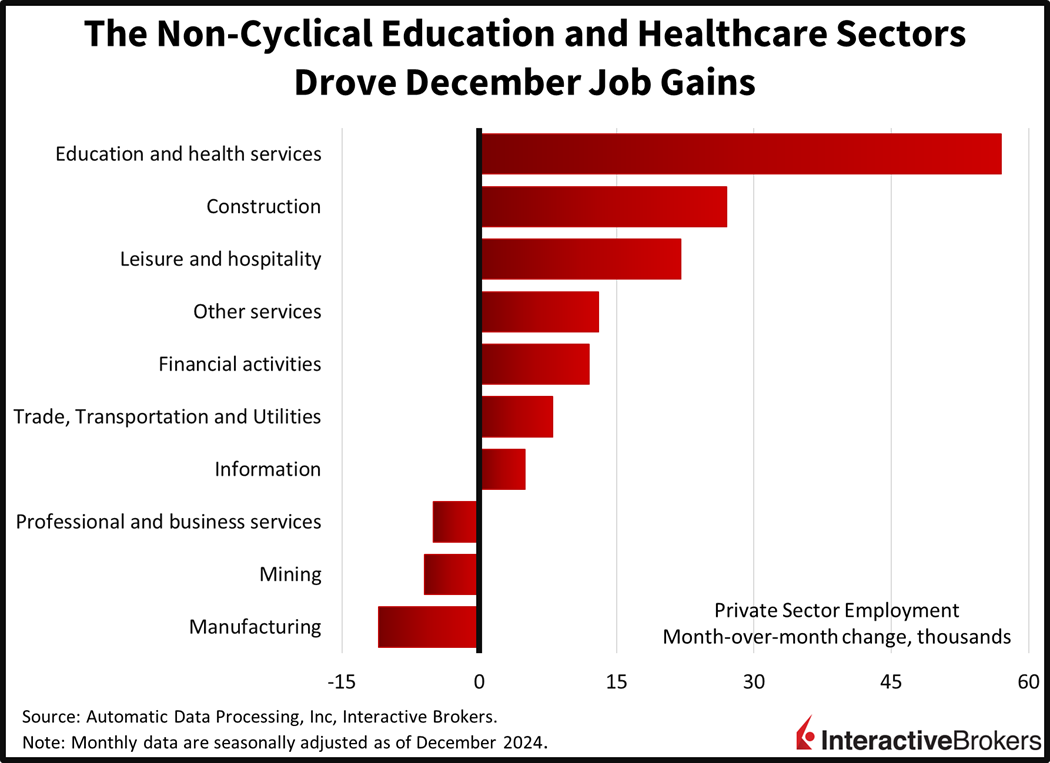

Private sector employers pared back hiring in December, while some sectors trimmed headcounts, according to payroll processing provider ADP. The 122,000 jobs added last month came in softer than the 140,000 projected and the 146,000 from November. The gains were concentrated in the non-cyclical education and health services segment, which augmented rosters by 57,000, but the cyclical construction and leisure/hospitality industries expanded rosters by 27,000 and 22,000. Meanwhile, the other services, financial activities, trade/transportation/utilities and information sections registered modest increases of below 14,000. Manufacturing reduced rosters by 11,000, its third-consecutive month of declines, while mining and professional/business services experienced drops of 6,000 and 5,000. Additionally, expansions were driven by large firms, posting growth of 97,000, but medium and small establishments barely hung on, registering modest advancements of 9,000 and 5,000.

Wage Bills Remain Heavy

Compensation trends remained robust, signaling continued inflationary pressures in the significant services sectors. While wage growth decelerated, it arrived far above levels that would be consistent with the Fed’s 2% inflation objective. Paycheck growth came in at 7.1% and 4.6% for job changers and job stayers, slight declines from November’s 7.2% and 4.8%.

Trump Deportations Could Be Inflationary

In another labor matter, an important inflationary risk going forward will be President Trump’s immigration policy and its impact on the work force and wage pressures. We already have a shortage of capable workers and are dealing with compensation bills that are too hot relative to central banks’ mandates. A lack of domestic workers and documented foreign laborers to replace folks that leave voluntarily or via enforcement actions can certainly complicate the employment market and drive price pressures north as a result.

Unemployment Lines Shorter than Expected

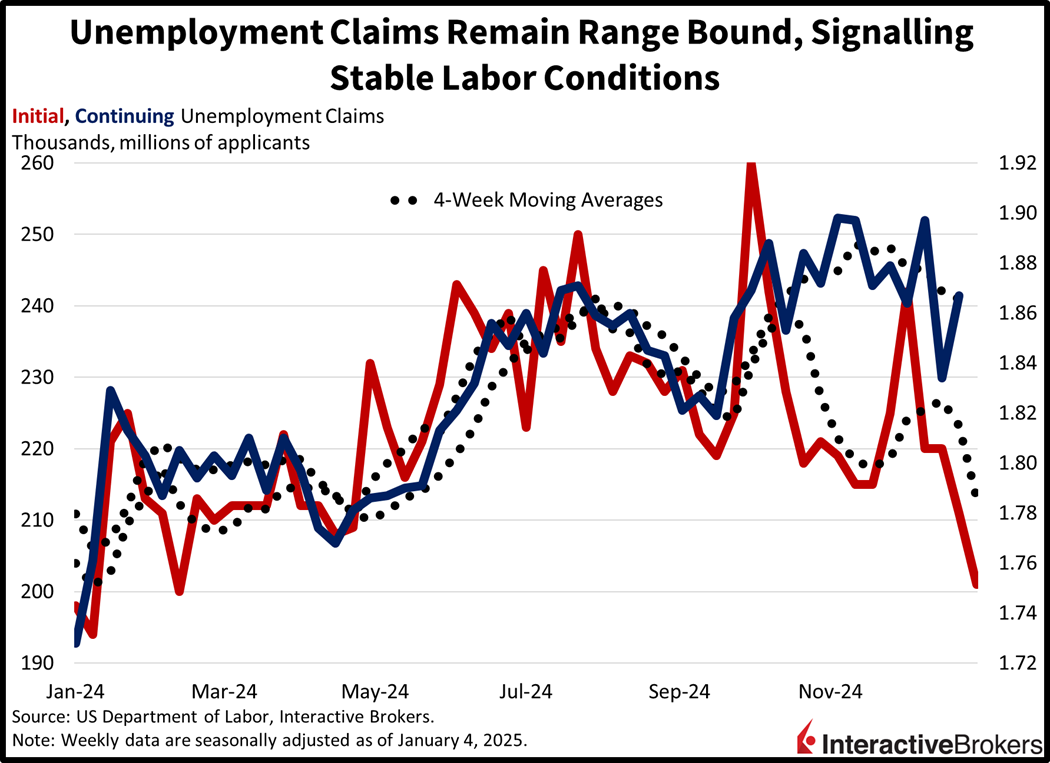

Against the backdrop of positive job growth and heavier wage bills, corporates see little reason to reduce their workforce levels, with unemployment claims arriving beneath projections in today’s US Department of Labor report. Initial unemployment claims dropped to 201,000 for the week ended January 4, beneath the 218,000 expected and the 211,000 from the prior period. Continuing claims rose during the prior 7-day stretch ended December 28, however, coming in at 1.867 million compared to the 1.834 million in the prior interval; the Street was anticipating 1.870 million. Four-week moving averages drifted south on both fronts from 223,250 and 1.869 million to 213,000 and 1.866 million.

Energy Costs Pump Up Europe PPI

Producer prices climbed 1.6% month over month (m/m) in the euro area, which consists of 20 European Union members that use the euro currency. The gain, attributed primarily to energy costs, surpassed the analyst expectation of 1.5% and October’s rate of only 0.4%. On a year-over-year basis (y/y), the Producer Price Index (PPI) dropped 1.2%, slightly better than the forecast for a deflationary read of -1.3% and the -3.3% figure in November.

The PPI’s m/m gain was driven by energy stickers, which bounced 5.4%. The increase was driven, in part, by a strong US dollar making imports of fuel and other items more expensive. Among other groups, non-durable consumer goods and capital goods registered no change while costs for intermediate goods and durable consumer products fell 0.1% and 0.2%, respectively.

European Sentiment Weakens

Euro area consumer confidence fell to -14.5 in December from -13.8 in November, matching a preliminary estimate and the analyst forecast. The result is an eight-month low, according to the European Commission. The organization notes that consumers have become increasingly “pessimistic about the general economic situation in their respective country.” Consumers have also scaled back spending plans. Sentiment regarding financial situations, however, was largely the same as in November. Consumers also increased their inflation expectations for the following 12 months from 2.5% in October to 2.6%. They also expect a 2.4% price increase for the next three years.

The Economic Sentiment Indicator also fell, dropping from 95.8 to 93.7, which is below the long-term average of 100 and the forecast of 95.6. In another matter, industrial sentiment weakened from -11.4 to -14.1.

Japan Consumer Optimism Also Weakens

Declining consumer confidence wasn’t limited to Europe with a similar gauge in Japan falling from 36.4 to 36.2 and missing the estimate for 36.6. Within the benchmark, consumers’ outlook for buying durable goods sank from 29.9 in November to 29.4 last month. The category regarding overall livelihood fell modestly from 34.3 to 34.1 while the outlook for income growth was unchanged at 40.2 and employment optimism strengthened from 41.0 to 41.2.

Australia Posts Mixed Inflation Results

The Australia Consumer Price Index recorded a 2.3% November y/y increase compared to the 2.1% rate in October and the 2.2% figure expected by the analyst consensus. The Core CPI, however, eased, dropping from 3.5% to 3.2%. Some of the largest price hikes occurred within the alcohol and tobacco category, education and insurance and financial services which saw charges increase 6.7%, 6.3% and 5.5% y/y. Housing, communication and transportation offered some relief, however, with prices increasing in the former two segments by just 1.2% and 0.1% while the latter sector saw costs decline 2.4% y/y during the period.

Equities Rise from Daily Lows

Equities are off their lows but still red across all the major, domestic benchmarks as stock investors witness a climbing greenback and a 5-handle on the 20-year Treasury bond. The Russell 2000, Nasdaq 100, S&P 500 and Dow Jones Industrial indices are down 0.9%, 0.2%, 0.1% and 0.1%. Sectoral breadth is negative with 9 of the 11 major segments trading lower and driven to the downside by communication services, utilities and consumer staples, which are losing 1%, 0.8% and 0.2%. Healthcare and materials are bucking the trend, gaining 0.4% and 0.3%. Treasury yields are rising slightly, with the 2- and 10-year maturities changing hands at 4.30% and 4.70%, 1 and 2 basis points (bps) heavier across both instruments. The greenback is soaring as currency traders perceive Trump tariffs through the lens of US relative outperformance. The Dollar Index is up a sharp 45 bps as American tender appreciates versus all of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian money. Commodities are mixed with copper, gold and silver up 1.9%, 0.7% and 0.3% but lumber and crude oil down 1.6% and 1.2%.

Friday Data Will Highlight Labor Market

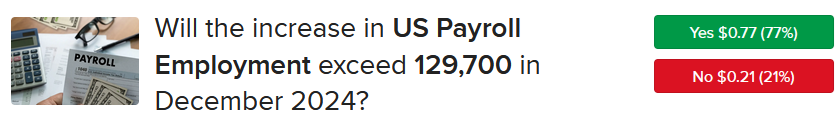

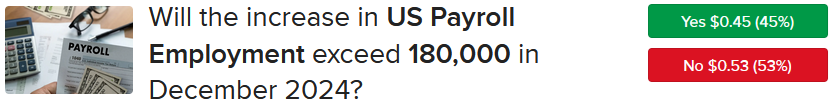

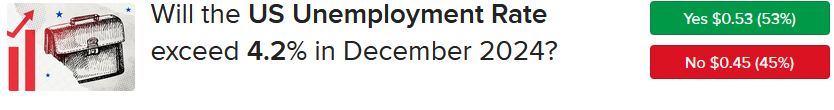

With the stock market closed tomorrow in memory of the late US President Jimmy Carter, investors are awaiting Jobs Friday for further clues on the state of labor conditions. Our IBKR ForecastTrader participants are entering bids for Forecast Contracts and our best guess is right around 175,000 job additions, which is currently loftier than Wall Street’s 154,000. Indeed, our participants price a figure above 180,000 with 45% odds while a number below 129,700 offers a probability of 21%. Turning to the unemployment rate, IBKR ForecastTraders and the Wall Street consensus are neck and neck at 4.2%. Finally, I’ll be covering the shifting expectations in our IBKR ForecastTrader market as well as moves in stocks, rates, currencies and commodities before and after the numbers are released. The session is set to begin bright and early this Friday morning at 8:00 am ET through a live event on X, formerly Twitter.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.