With a handful of trading days remaining to 2023, the stock market is poised to end the year up a respectable 25% or more. That’s despite a number of significant hurdles, from multiyear-high interest rates to ongoing fighting in Ukraine and the Middle East.

It’s important to point out that these returns are due mainly to the performance of a very small group of tech stocks that people are calling the Magnificent Seven. Composed of Apple, Alphabet (Google), Amazon, Meta Platforms (Facebook), Microsoft, Nvidia and Tesla, the group contributed roughly 60% to the S&P 500’s gains in 2023.

The Magnificent Seven resembles the FAANG stocks, which surged during the pandemic as housebound consumers spent their stimulus checks online. The investment case this time, though, is artificial intelligence, or AI. Nvidia, whose chips are used for AI work, is 2023’s best S&P 500 performer, up nearly 240% year-to-date.

Shipping Stocks Surge On Suez Canal Hostility

Speaking of unrest in the Middle East, recent Houthi militant attacks on ships in the Red Sea have significantly impacted global shipping routes, notably through the Suez Canal. The situation is causing reroutes, spurring longer voyage distances and higher rates, which we believe could be a tailwind for container shipping companies. Early last week, the Solactive Global Shipping Index, which launched in December 2015, hit a new all-time high.

The Suez Canal, a critical shipping lane with daily transits of 50 to 60 vessels, is now seeing diversions around Africa’s Cape of Good Hope, which add substantial time and distance to voyages. The reroute extends North European and North American voyages by as many as 2,500-3,500 nautical miles (NM), and up to 7,000 NM for some Mediterranean destinations, significantly increasing fuel costs. In addition, London’s marine insurance market has expanded its high-risk area in the Red Sea, raising shipping insurance premiums.

The list of carriers that had paused Red Sea transits and/or were rerouting around Africa include industry leaders such as Maersk, MSC, Hapag-Lloyd, Evergreen, Cosco and more.

It’s tempting to compare the current situation to the six-day blockage of the Suez Canal by Evergreen’s Ever Given in March 2021. Spot rates weren’t immediately affected at the time, rising about 158% within six months, from $4,300 per 40-foot equivalent until (FEU) to over $11,000 FEU. Past performance is no guarantee of future results, but a similar delay now could spark higher shipping rates by as soon as the Chinese New Year, which in 2024 falls on February 10.

Top 5 Articles Of 2023

Every year around this time, I share with you the five most-read articles I published in 2023. Revisit the highlights below, starting with number five, a Frank Talk on gold from last month.

5. Gold Prices Record Their Strongest October Surge In Nearly Half A Century

from November

Gold prices experienced their strongest October since 1978, rallying 7.3% to close at $1,983 an ounce, despite challenges from high Treasury yields and a strong U.S. dollar. The surge was attributed to various economic and geopolitical risks, including high national debt and ongoing recession concerns.

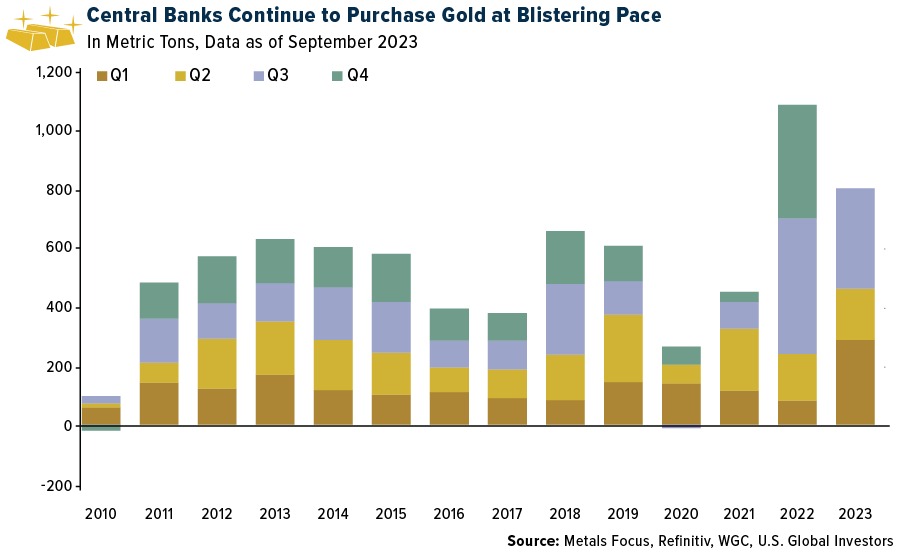

Although the metal appeared overbought, strong support was developing, suggesting the potential for further increases. Central banks have significantly increased their gold holdings, with purchases in the third quarter marking the second-largest on record, according to the World Gold Council (WGC). Countries such as China, Poland and Turkey led the buying spree, aiming to diversify away from the U.S. dollar.

Additionally, in Japan, gold prices reached record highs in response to the yen’s decline against the U.S. dollar and inflation concerns. This global context suggests that gold and gold mining equities might be a prudent investment strategy, especially in times of high inflation.

4. Ranking The 10 Most Popular Luxury Brands Online In 2023

from June

In April 2023, LVMH became the first European company ever to surpass $500 billion in market value, while its CEO, Bernard Arnault, briefly became the world’s wealthiest person. Shares of LVMH were up around 35% for the year on hopes that China’s long-awaited lifting of pandemic restrictions would be a tailwind for luxury stocks. In the end, China proved itself a dud as its economy slowed along with consumption and investment.

Looking ahead, we remain very bullish on the luxury market. As people in emerging countries join the global middle class, luxury’s customer base is expected to surge to 500 million people by 2030, up from 400 million in 2022, according to Bain & Company. India alone could mint between 35 and 40 million new middle- to high-income consumers, which would expand the size of its luxury market 3.5 times compared to today.

In this post from June, I shared with you the top 10 most popular luxury brands online, as ranked by Luxe Digital. Topping the list was Christian Dior, a key member of LVMH’s colossal luxury empire.

3. Copper Market Poised For Unprecedented Growth

from June

In June, Citi’s managing director for commodities research, Max Layton, advised investing in copper. The red metal’s price at the time, $8,300 a ton, was substantially below its 2021 peak, and Layton predicted a potential rise to $15,000 a ton by 2025, a jump that would “make oil’s 2008 bull run look like child’s play.”

Copper may need to jump to at least $15,000 to spur more companies to build new, critically needed mines, says billionaire Robert Friedland, founder of Ivanhoe Mines. That would be an increase of over 75% from today’s prices.

This bullish outlook is based on an expected supply-demand imbalance, with electric vehicles (EVs) requiring significantly more copper than traditional vehicles. EV sales are projected to reach 27 million by 2026, indicating a promising and potentially profitable future for the copper market.

2. Top 10 Gold And Precious Metal Mining Stocks Ranked By Free Cash Flow Yield

from July

In this post, I emphasized the importance of free cash flow (FCF) yield as a key metric for evaluating the financial health and operational efficiency of gold and precious metal mining companies. Free cash flow represents the cash remaining after a company has covered its operating expenses and capital expenditures, offering a more reliable measure of profitability than earnings or net income, as it’s less prone to manipulation.

The rankings suggest these companies—which include Impala Platinum Holdings, Dundee Precious Metals and Silver Lake Resources—are not only financially robust but also efficient in their operations, with the potential to pay dividends, buy back stock, reduce debt and invest in future growth.

1. Petrodollar Dusk, Petroyuan Dawn

from March

The world may be shifting away from the petrodollar. In place since the 1970s, this system bolsters the U.S. dollar’s status as the world’s reserve currency, but recent developments indicate a possible move away from the greenback, with countries like China and Russia considering or already settling trades in other currencies, notably the Chinese yuan.

Russia, China and other developing economies are diversifying their reserves by increasing their gold holdings, a move that could have long-term implications for investors. Among these include potential currency risks, commodity price volatility and an increased attractiveness of gold.

To our friends, family, investors and shareholders, we wish you a very Happy New Year!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Solactive Global Shipping Index is an index of the largest companies in the global shipping business. It includes companies from maritime transport, shipbuilding, ports and cruise line sectors. The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. It is not possible to invest in an index.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 9/30/2023: Tesla Inc., AP Moller – Maersk A/S, Evergreen Marine Corp., Cosco Shipping Holdings Co. Ltd., Ivanhoe Mines Ltd., LVMH Moet Hennessy Louis Vuitton, Impala Platinum Holdings Ltd., Dundee Precious Metals Inc.

—

Originally Posted December 26, 2023 – 2023 In Review: Stock Market Resilience And The Rise Of The Magnificent Seven

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.