Great investments don’t have to be thrilling. While it’s certainly exciting to see a stock jump 30% higher in a matter of days or weeks, it can also be extremely stressful to see that same stock plunge 50% or more when the market turns. Although it might sound counterintuitive in this era of commission-free trades carried out on smartphones, boring is often good when it comes to investing.

Stocks of successful companies are often the most boring securities to own. They rise at a slow and steady pace over many years, riding out bear markets along the way. The most successful investors in the world tend to recommend a boring, buy-and-hold investment approach for long-term investors, especially people who are saving for a comfortable retirement. Here are three boring stocks to buy and hold forever: January 2024 edition.

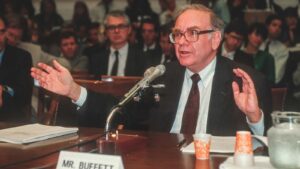

Berkshire Hathaway (BRK.A / BRK.B)

Berkshire Hathaway (NYSE:BRK.A/NYSE:BRK.B) is a holding company that owns a bunch of boring businesses and a bunch of boring stocks. And yet boring seems to work for Berkshire CEO Warren Buffett and the company’s shareholders. Companies owned by Berkshire include old economy names such as Fruit of the Loom underwear and General Re insurance. Berkshires $367 billion investment portfolio is concentrated in stocks such as Coca-Cola (NYSE:KO) and American Express (NYSE:AXP).

At every point in his career, Buffett has studiously avoided trends, fads and the new thing. Instead he has held firm to his basic philosophy of owning strong businesses that have a competitive advantage, no matter how boring they might be. It’s an approach that has paid off for Berkshire Hathaway and its stock. The Class B shares of the company have a long track record of beating the benchmark S&P 500. Over the past 12 months, the shares have gained nearly 20%.

Costco (COST)

Warehouse club and grocery retailer Costco (NASDAQ:COST) is by no means an exciting company. Costco is essentially the same today as it was when founded back in 1983. And in the last 40 years, the company has had only three CEOs, including Ron Vachris, who assumed the top job on Jan. 1 of this year. Even the $1.50 hotdog and pop deal has been the same since 1984. And yet, Costco continues to be a leader in the grocery sector, and its stock has a consistent track record of outperforming the market.

Over the past five years, COST stock has increased 231%, more than double the 82% gain in the benchmark S&P 500 index over the same period. Costco succeeds by offering its customers the best bang for their buck in the grocery aisle. It also sells gasoline, medication and alcohol at reduced prices that appeal to financially stressed consumers. The company rewards shareholders with special dividend payments, the most recent one being a $15 a share payment made on Jan. 12 of this year.

McDonald’s (MCD)

There have been a few changes at the Golden Arches over the years. The company sells better coffee now. The McRib comes and goes. The character Grimace is back and more popular with kids than ever before. But essentially, McDonald’s (NYSE:MCD) is the same today as it has been since its founding in 1955. That is to say it still sells mostly burgers, fries and soft drinks to consumers looking for a quick meal on the go. And that approach works. Today, MCD stock is trading at an all-time high, having risen 11% in the last year.

MCD stock isn’t flashy and it no longer grows at the brisk pace it once did. But it remains a steady compounder for long-term stockholders. It’s also one of the best dividend stocks around. McDonald’s paid its first dividend in 1976, and has increased its payout to shareholders every year since. Today, MCD stock pays a quarterly dividend of $1.67 a share, giving it a yield of 2.24%. The stock itself has risen at a slow and steady pace on the back of strong earnings and just broke above $300 a share for the first time.

On the date of publication, Joel Baglole did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.