These companies are crushing it in AI and could deliver major gains in the coming years.

The artificial intelligence (AI) market exploded last year after the launch of OpenAI’s ChatGPT reignited interest in the technology. Companies across tech pivoted their businesses to the budding sector in an effort to take their slice of a $200 billion pie.

The AI market is developing rapidly. Data from Grand View Research projects it to expand at a compound annual growth rate (CAGR) of 37% through 2030 and hit a valuation nearing $2 trillion. As a result, it’s not surprising that investors have flocked to the industry. Excitement over AI saw the Nasdaq-100 Technology Sector index rise 67% in 2023, creating more than a few millionaires along the way.

The market has shown no signs of slowing. AI can potentially boost many areas, from cloud computing to e-commerce, consumer products, autonomous vehicles, video games, and more. As a result, it’s not too late to invest in AI and enjoy significant gains from its development over the long term.

Here are three millionaire-maker AI stocks to buy this April.

1. Nvidia

It shouldn’t be too surprising to see Nvidia (NVDA -2.68%) on this list after the company cornered the market on AI chips last year. In 2023, Nvidia snapped up an estimated 90% market share in AI graphics processing units (GPUs), the chips necessary to train and run AI models.

Nvidia’s years of dominance in GPUs allowed it to get a headstart in AI over many of its competitors, leading its stock to rise 214% over the last year alongside soaring earnings.

In its most recent quarter (the fourth quarter of fiscal 2024, which ended in January), the company’s revenue increased by 265% year over year to $22 billion. Operating income jumped 983% to nearly $14 billion. This monster growth was primarily due to a 409% increase in data center revenue, reflecting a spike in AI GPU sales.

The vast potential of AI suggests chip demand will continue rising, and Nvidia will likely continue seeing major gains from the industry.

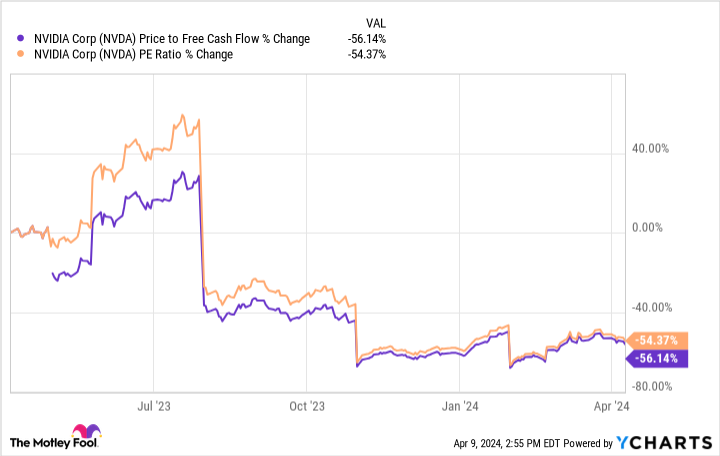

Data by YCharts.

Meanwhile, the chart above shows Nvidia’s price-to-free-cash-flow ratio and price-to-earnings (P/E) ratio plunged in the last year, indicating its stock is at one of its best-valued positions in 12 months. Consequently, now is an excellent time to consider investing in this millionaire-maker AI stock before it’s too late.

2. Microsoft

Microsoft (MSFT -1.41%) has grown into a tech behemoth, surpassing Apple as the world’s most valuable company by market cap earlier this year. The tech giant is home to some of the most widely recognizable brands, including Windows, Office, Azure, Xbox, and LinkedIn.

However, all eyes have been on Microsoft’s expanding position in AI this year. The company was an early investor in AI, sinking billions into a private company, OpenAI, in 2019. The lucrative partnership granted Microsoft access to some of the most advanced AI models in the industry and helped its stock rise more than 45% year over year.

Microsoft has used OpenAI’s technology to introduce AI features across its product lineup and get ahead of its rivals. In 2023, the company added new AI tools to its Azure cloud platform, integrated aspects of ChatGPT into its Bing search engine, and boosted productivity in its Office software suite by adding AI features. OpenAI’s models and Microsoft’s massive user base could make the company unstoppable in AI.

Microsoft’s P/E of 37 means its stock isn’t exactly trading at a bargain. However, its prominent role in AI and $67 billion in free cash flow make its stock worth the high price point, as it has the funds to continue investing in its business and retain its lead. I wouldn’t bet against Microsoft’s ability to create even more millionaires from investors willing to hold for the long term.

3. Advanced Micro Devices

Chip stocks have taken center stage amid soaring interest in AI, and Advanced Micro Devices (AMD -4.24%) is another attractive investment option. The company was slightly late to the AI party as Nvidia beat it to the market. However, AMD is investing heavily in the industry and has formed some lucrative partnerships that could take it far in AI over the long term.

Last December, the company unveiled its MI300X AI GPU. This new chip is designed to compete directly with Nvidia’s offerings and has already caught the attention of some of tech’s most prominent players, signing on Microsoft and Meta Platforms as clients.

Additionally, AMD wants to lead its own space within AI by doubling down on AI-powered PCs. According to research firm IDC, PC shipments are projected to see a major boost this year, with AI integration serving as a key catalyst. And a Canalys report predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

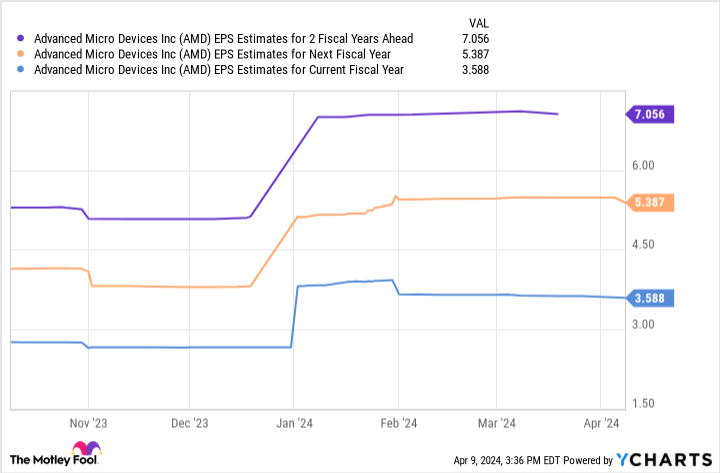

Data by YCharts.

This chart shows AMD’s stock has significant potential in the coming years. The company’s earnings could hit just over $7 per share over the next two fiscal years. Multiplying that figure by AMD’s forward P/E of 47 yields a stock price of $329.

Considering AMD’s current position, these projections would see its stock price rise 93% by fiscal 2026. Alongside growing prospects in AI, AMD is a stock that could make you a millionaire.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.