Shares of website building company Wix.com (WIX 5.95%) jumped on Wednesday after the company reported completed financial results for 2023. The company just capped off a good year that was better than what investors expected. That’s why Wix stock was up about 9% as of 10 a.m. ET.

How Wix turned things around

Wix generated record revenue of almost $1.6 billion in 2023, which was up 13% year over year. But I think the market is more impressed with its free cash flow of $182 million (when considering $66 million for capital expenditures), which was nearly a 12% margin — its highest in a few years.

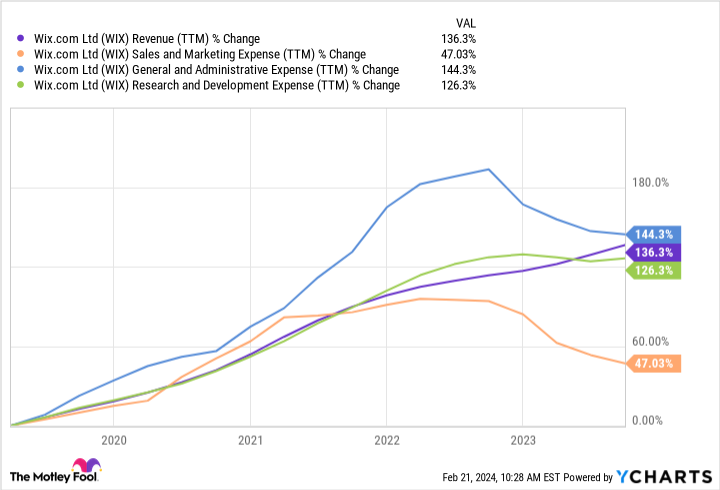

Despite its lackluster stock performance in recent years, Wix has continued setting revenue records. Moreover, most of its operating expenses have climbed at the same pace as revenue over the last five years except for one: sales and marketing. In 2023 alone, sales and marketing expenses came down 19% year over year, helping profits improve.

WIX Revenue (TTM) data by YCharts

Wix used to be more of a platform for individuals to build an online presence. But in recent years, more businesses have started using it. Moreover, the company has partnered with other businesses and freelancers to bring more users onto the platform. These newer initiatives are contributing to growth and require less marketing spend than targeting consumers.

Things continue to improve

For 2024, Wix expects positive trends to continue. Revenue for the year is expected to climb 11% to 13% from 2023, hitting new records. And its adjusted free-cash-flow margin is expected to be at least 21%, which is quite good.

That said, there is an asterisk to this free-cash-flow guidance because Wix’s management is excluding expenses related to its new headquarters. But even still, it’s undeniable that the company is showing operational improvements.

Trading at more than 20 times its adjusted free-cash-flow projections for 2024, Wix stock is probably close to fairly valued here. But management believes its growth will speed up in late 2024 and into 2025, which could provide more upside if management is right.

Jon Quast has positions in Wix.com. The Motley Fool has positions in and recommends Wix.com. The Motley Fool has a disclosure policy.