Enthusiasm for artificial intelligence (AI) helped launch a new bull market after bottoming in the fall of 2022. Some of Wall Street’s biggest runners have multiplied in value, trading as high as $1,000 per share today.

That means that investors may want to start looking for potential stock splits. Investors generally favor stock splits, and for good reason. It makes accumulating shares of a company far more manageable. But it’s important to know what a split does and doesn’t do.

Here is what you need to know. Plus, here are three prime AI stock-split candidates to watch.

What stock splits do — and don’t do

As you may already know, a stock split lowers a company’s share price. It does this by proportionately increasing the number of outstanding shares. For example, suppose you have stock XYZ that trades at $100 per share. Splitting the stock 5:1 would mean that each $100 share would turn into five $20 shares.

Companies split their stock for varied reasons, but it’s generally because they perceive that investors generally like lower share prices. It can break through some investors’ “psychological barrier” to buying shares above a certain price range. Announcing a split also has a propensity to draw investors’ attention to a company’s stock. Additionally, employees with stock-based compensation can manage their equity more easily and employers can arrange for stock-based compensation easier when share prices are lower. It’s easier to divvy up 100 pennies than a single dollar bill.

What stock splits don’t do is change the business’s intrinsic value. Always remember that the additional shares offset the lower price you see. In other words, a pie doesn’t get any bigger whether you cut it four ways, eight ways, or 16 ways. The slices change size, but the overall pie remains the same.

So, which companies might split their stocks next? These three artificial intelligence (AI) stocks are ripe for a split after going on epic runs.

1. Super Micro Computer

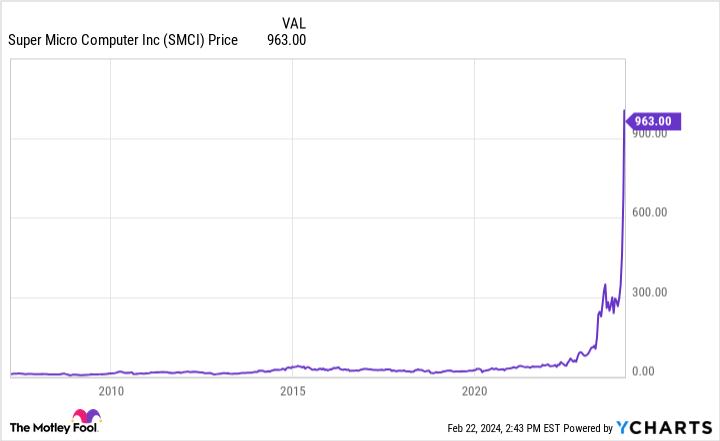

Modular server company Super Micro Computer (SMCI -11.84%) has seen its business take off in recent quarters. Companies investing in AI are seeking out SMCI’s turnkey computing systems. The company’s revenue more than doubled year over year in the second quarter of its fiscal year 2024, and management guided up to 219% year-over-year growth next quarter.

Supermicro, as it is also known, started with motherboards in the early 1990s and evolved as computers and servers advanced. The business went public in 2007 and has never split its stock. However, the stock’s remarkable recent performance has shares hovering near $1,000. That’s nearly a 3,000% gain over the past three years.

The company has paid stock-based compensation over the years, and some employees sitting on years-old equity may appreciate a stock split that helps them manage their newly found wealth. Additionally, the stock has become a big pill to swallow for individual investors who may not want to drop $1,000 to own one share of the company. A stock split makes a ton of sense here.

2. ASML

Photolithography equipment manufacturer ASML (ASML -1.95%) is another stock that’s enjoyed a magnificent run over the past few years. The company designs and sells equipment that uses ultraviolet light to print complex circuitry onto silicon wafers. The most advanced semiconductors, like those used to power the latest AI models, need specialized extreme ultraviolet light machines, and ASML is the only company that makes them.

That helps explain why ASML’s stock has done so well. ASML has split its stock multiple times before, so management has shown it’s willing to do so. However, it’s been a while. The last split occurred before 2015, and the stock has appreciated enormously since.

Analysts expect the business to grow earnings by an average of 20% annually over the next three to five years. Barring a sudden drop in the stock’s valuation, ASML could eventually trade at over $1,000 per share. Most stocks on U.S. exchanges trade under $1,000 per share, making it more plausible that a stock split could happen in the next few years.

3. Meta Platforms

Social media giant and AI innovator Meta Platforms (META -0.43%) didn’t seem like a stock-split candidate a year ago. The company struggled with privacy changes to iOS devices and was criticized for aggressive spending. The stock bottomed in late 2022 at roughly $90 per share.

But, as good CEOs do, Mark Zuckerberg adapted. Spending cuts and new AI-based advertising technology have sent the stock to nearly $500. Meta Platforms has never split its stock, but the company didn’t go public until 2012. The conversation about a stock split seems more appropriate than ever, with shares at all-time highs.

Meta’s core business, growing its social media audience and advertising, is still performing well. The company’s family of apps reached 3.98 billion monthly active users in 2023, a 6% increase over last year. Analysts see Meta’s earnings compounding at 20% annually for the next several years, adding more fuel to the odds that investors see a stock split occur.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Meta Platforms. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.