Confidence is a tricky thing to measure. We can generally tell if an individual possesses or lacks confidence but assessing it on a large scale is imperfect at best. After today’s University of Michigan report, we see that consumers have somewhat mixed feelings, even as investors remain extraordinarily confident.

There is no question that investor confidence is quite high. The S&P 500 (SPX) and Nasdaq 100 (NDX) completed their fourth straight upward months, while we see advances in a wide range of risk assets – bitcoin among them. This has occurred even as 2- and 10-year yields have risen over the course of this year and rate cut expectations have been cut in half. The Cboe Volatility Index (VIX) has returned to the lower end of its recent trading range, implying that demand for hedging from institutional investors remains low.

This morning’s Michigan numbers told a seemingly different story. Consumer Sentiment unexpectedly fell from 79.6 to 76.9. Current Conditions and Expectations also fell unexpectedly, while 1-year and 5-10 year Inflationary Expectations were unchanged at 3.0% and 2.9%, respectively. In theory, these might have put a damper on the stock market’s mood. In reality, it hasn’t provided an impediment to another day of modest rallies (so far).

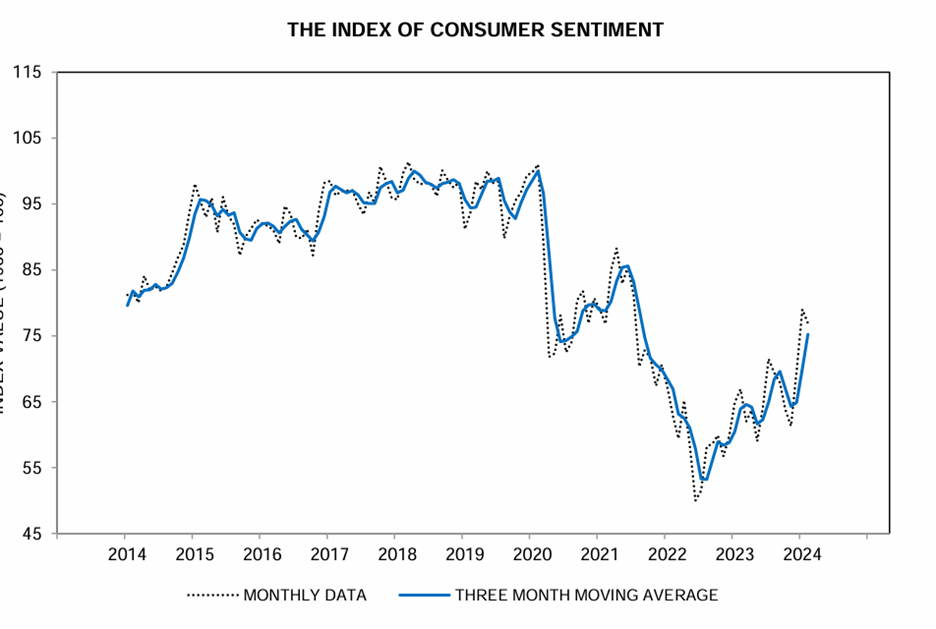

A little perspective helps. Despite today’s dip, sentiment has been generally trending higher, as show in the graph below:

Source: chicsr.pdf (umich.edu)

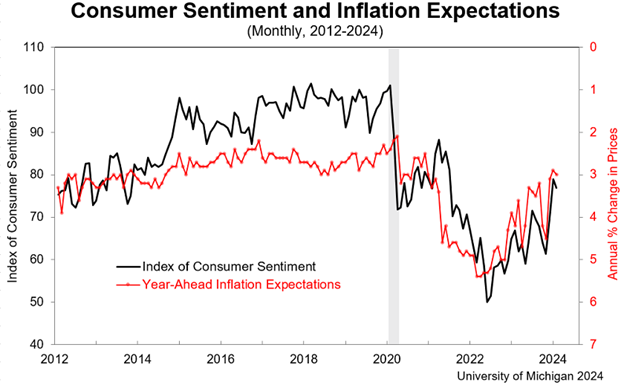

While we’re not back to pre-pandemic levels of confidence – not close, really – it’s clear that the recent readings have been showing steady improvement since bottoming out last year. It is also useful to note, as the graph below shows, that while inflationary expectations have steadily risen during the past couple of years, they are still only back to their own pre-pandemic levels. Remember, no one was particularly concerned about inflation at that time:

Source: featured-chart_large-8983b7d9.png (840×518) (umich.edu)

Thus, if consumer confidence is generally rising and inflationary expectations are not particularly troublesome, it is understandable why investors might be enthusiastic about stocks. But the picture emerging from the recent earnings reports from key retailers is not quite as clear.

After last week’s well-received results from Walmart (WMT), we questioned whether they were benefitting at the expense of some of their competitors, recognizing that we couldn’t tell for sure if shoppers were “trading down” to WMT until we heard from more of its peers. Yet even now, it’s hard to know.

Part of the mystery is that we have not yet heard from Target (TGT), a similar “big-box” store, but which is perceived as a bit higher-end than WMT. TJX (TJX), which deals much more in close-out type merchandise, handily beat its EPS estimate but only managed a modest 0.6% rally afterwards. A similar situation occurred yesterday in Best Buy (BBY), which opened sharply higher after its own earnings beat, but closed nearer to its day’s low with a 1.5% bump. Company managers remain skillful at managing both their bottom lines and their coverage analysts’ expectations, even if the market isn’t always quick to substantially reward the efforts.

Yet I look to comments made by Macy’s (M) management earlier this week. They too had the requisite EPS beat and a modest post-earnings rise, but the stock has sunk as the week progressed. The company’s namesake division, a mid-priced retailer, is being downsized with greater focus being placed on the upscale Bloomingdales division. This may be further evidence that middle income consumers are tightening their belts even as wealthier ones continue to spend.

This fits with the stock market narrative. Wealthier individuals are more likely to invest, and we see consistent flows of cash into equities and the like. Less wealthy individuals are tightening their belts, but we don’t see that immediately reflected in the broad market. Over time, if this trend persists, it will of course be reflected in a wide range of economic statistics and corporations.

But for now, those who have money are spending and investing it. They’re highly confident and the market reflects it.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.