Innovative AI Health Care Play Offers Major Growth Ahead

Profusa, Inc. (NASDAQ: PFSA) is an incredibly impressive company with a long R&D history, deep IP, and an enviable, diverse platform technology with multiple product pathways. The Company is migrating from the pre-revenue phase to commercialization, which can typically bode well for opportunistic investors. Management projects initial revenue generation in one segment in 2026 that could set the stage for Profusa to reach $250M in top-line via multiple product revenue segment offerings by 2030.

Reasons to Own Profusa Stock

- An Enviable Position- Profusa foundation & infrastructure set

- $100M invested in R&D over 10 years, including $30M invested by DARPA

- Accomplished team; 80 patents

- Company poised to dominate; no credible competitors; Multi-year head start with diverse offerings representing a $10.5B total addressable markets

- Attractive entry point at roughly $10m valuation

- Company provided $250M revenue guidance. Business model also offers earnings visibility aided by distributor deals and future approvals which could provide hockey stick growth to the valuation

- With product approved in EU, Profusa has migrated from development to commercial phase which typically serves as future catalyst for higher valuations ahead

- Profusa has invaluable street cred via validation from world renowned medical professionals and institutions

- Blue sky in the US (2026-2027) will seed the company in the EU with a very large market of 500M people with govt funding; 2027 and beyond the US market could potentially multiply the company’s revenues and profits due to an expanded market size

- Do Well by Doing Good – Profusa’s tissue monitoring technology could save thousands of people with diabetes and PAD from having limbs amputated

A Company Snapshot

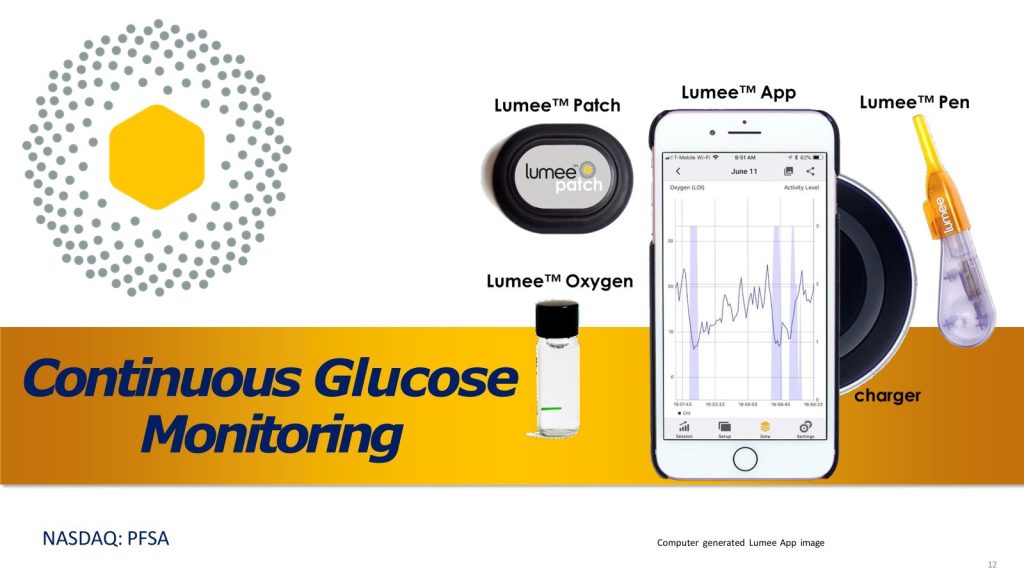

Profusa, Inc. is a commercial-stage digital health company located in the Bay Area developing a platform of new generation of bio-engineered sensors that empower the real-time monitoring of body chemistry for chronic disease management and health and wellness of individuals.

The Company is led by visionary scientific founders, an experienced management team and a world-class board of directors in the development of a new generation of tissue-integrated sensors to detect and continuously transmit actionable, medical-grade data for personal and medical use. With its long-lasting, injectable, and affordable biosensors and its intelligent data platform, Profusa aims to provide people with a personalized biochemical signature rooted in data that clinicians can trust and rely on.

Profusa has strong platform technology, which is set to yield multiple, sizable, commercial vertical revenue opportunities in the US and Europe. Based on estimates from Grandview Research (https://www.grandviewresearch.com/industry-analysis/pulse-oximeter-market), these opportunities represent a $10.5B total addressable market (TAM) on a global basis just in tissue and pulse oximetry oxygen monitoring by 2030. Today, an estimated 589M people across the globe suffer from diabetes, and this figure is projected to grow 45% by 2050, according to the International Diabetes Federation (https://diabetesatlas.org/).

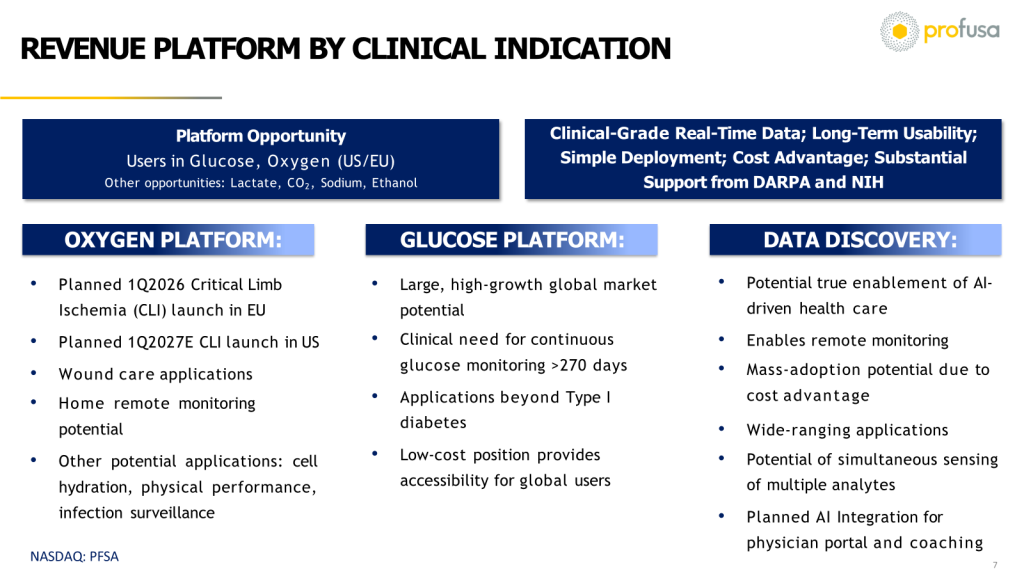

Diverse Lines, Massive Opportunities

Profusa currently focuses on two primary, simultaneous products:

- Tissue Oxygen Monitoring

- Continuous Glucose Monitoring

Approximately 6.5 million patients suffer from Critical Limb Ischemia (CLI) in the US, Europe, and Japan. The market opportunity is $4.9 billion, growing at an 8% CAGR. In 2025, an estimated 1.1 million CLI procedures were performed in the US and EU. Decision support is lacking resulting in decisions made based on just clinical experience. Clinicians need a tool like Profusa’s Lumee to provide objective information about tissue perfusion.

Lumee’s Oxygen Platform reports local tissue oxygen levels during PAD/CLI surgical intervention as well as post-operatively for 28 days and posed a low risk to patients during the study. The inherent benefits of this platform include:

- Actual case data

- Intra-operative GPS

- Data for real-time decisions

- Enables in-home monitoring

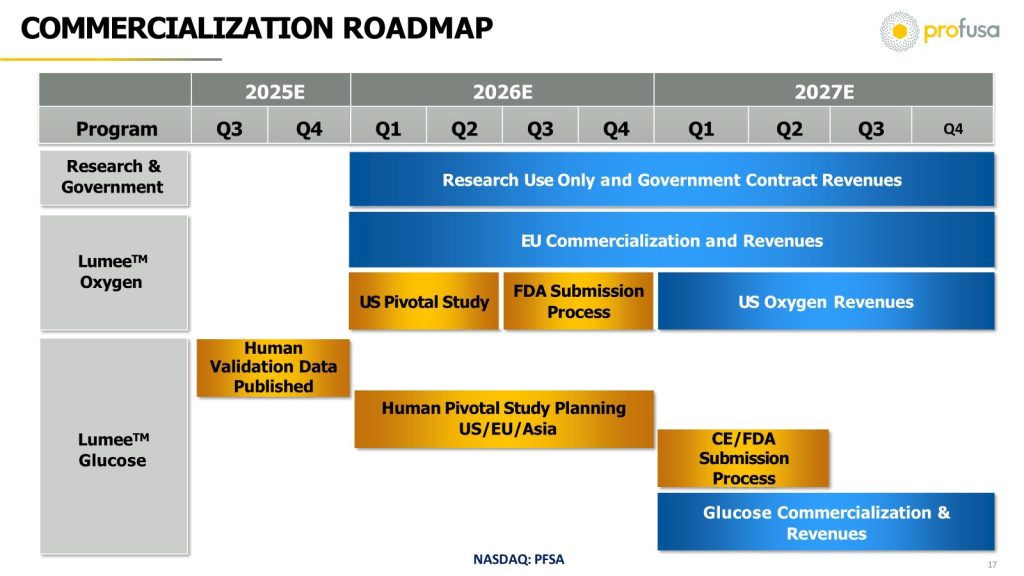

Recent News Serve as Catalysts for Profusa

- Profusa recently launched its Healthcare Research version of the Lumee tissue oxygen monitoring into the multi-billion-dollar contract research organizations (CRO) market.

- This strategic step is expected to generate immediate service-based revenue from research-only use.

- Initiative targets a high-growth segment of the pharmaceutical services industry, where demand is accelerating for more predictive, real-time biological data to improve drug development efficiency and decision-making.

- Profusa’s Lumee tissue oxygen products are commercially ready and available for immediate deployment, which will allow CRO partners to rapidly incorporate the technology into existing study designs

- Industry forecasts estimate the global pharmaceutical CRO market could expand from approximately $47.9B in 2025 to over $91.2B by 2034 at a CAGR of more than 7%, underscoring the expanding addressable opportunity for advanced biosensing platforms.

- The Company now offers the Lumee tissue oxygen system as commercial research-use-only (RUO) kits and a service-enabled platform for CRO partners, providing high demand, real-time data they can’t get from other sources

- Lumee tissue oxygen system supports research into complex biological processes such as tissue oxygenation dynamics in wound healing and tumor microenvironments in oncology — areas where oxygen plays a vital role

Profusa is positioned to reshape the continuous glucose monitoring (CGM) market. Its proprietary technology targets the estimated 589 million people living with diabetes worldwide, while many competing solutions address far narrower patient segments. Importantly, Profusa’s approach is expected to deliver this capability at a fraction of the cost of existing CGM technologies.

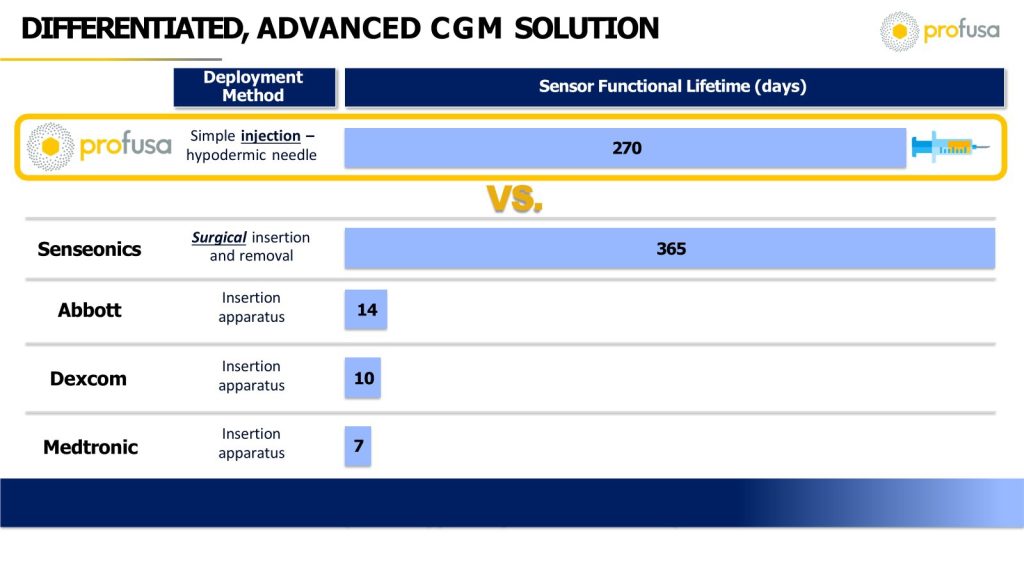

What may be even more remarkable are the deployment approach and core features of the Profusa technology as compared with competing products.

Given the deployment methods, sensor functionality terms, and cost, it is easy to see why the Profusa CGM (Lumee Glucose) product could become the preferred solution for clinicians and patients alike. And this market opportunity is slated to be huge, which plays right into the hands of Profusa. According to Strategic Market Research, the CGM market is expected to grow from $6B to $16B by 2030.

The Lumee Glucose clinical trial generated solid results.

The clinical trial evaluated the safety and functionality of the Profusa glucose platform, sensor, reader, and AI platform and over 270 days the safety profile was met. The trial was performed in four clinical sites (2 Europe, 2 Asia) with fifty-four enrolled subjects. A total of 108 sensors were injected and 398 study visits completed. There were 745 glucose traces collected with 18,000 paired reference points. Top-line results on the MARD scale showed functionality. Thus, Profusa has an executable clinical approval pathway.

Looking Ahead…

For the oxygen market, the Company’s distribution partners and internal commercial team will market directly to high volume hospital centers along with ambulatory centers and doctors’ offices which perform 1200-2700 procedures annually. Each center will require three kits to perform the annual procedures, and each procedure requires four sensors and pens. Management believes that each procedure could generate 600 EUR and 10,000 EUR per kit. The total addressable market potential is 1.1 million procedures EU/US markets, growing at 8% GAGR for oxygen platform. Oxygen 2026 revenue is expected to be up to $2.0M and projected to be over $100 million in 2030. Glucose revenue is projected to commence in 2027 with a 589M global user market potential and could quickly reach up to $150M in revenue by 2030, given its inherent competitive advantages. These two markets combined amount to a projected $250 million in annual sales for PFSA in just 4 short years.

Profusa Value Proposition

Profusa is in an unusual position. It sits in the catbird seat from the financial, capital markets, and R&D perspectives. More than $100M has been invested in its advanced, proprietary technology, along with $30M from DARPA. As of 4Q26, the Company has only drawn $12M on its $22M PIPE and $5M on its $100M equity line of credit. Furthermore, Profusa has initiated a Bitcoin treasury strategy and is leveraging its strong family office and venture capital support. Perhaps one reason there is so much support is that it has attracted DARPA and NIH funding is due in part to its eighty-five global patents issued or pending that is leading to the future introduction of differentiated technology primed to change the market.

Moreover, a series of clinical, regulatory, and commercialization milestones (including potential EU and US FDA approvals) lie ahead in 2026 and 2027 which can serve as drivers for the Company.

Valuation Potential

Public med-tech and digital health peers in continuous monitoring and sensor-enabled platforms—including Dexcom, Abbott, Senseonics, and Masimo—have historically traded in a broad range of approximately 4x to 8x forward price-to-sales as revenues scale and visibility improves. If Profusa were to reach $250M in annual revenues by 2030 and the fully diluted share count were to double from ~86M to ~172M shares, applying a conservative 4x-6x sales multiple would imply an enterprise value of $1.0–$1.5B, equating to roughly $5.80–$8.70 per share. Higher-end multiples, consistent with category leaders exhibiting durable recurring revenue and platform leverage, could offer additional upside.

While investors could benefit today from the ground floor commercial stage, Profusa’s deep funding, IP infrastructure, and AI-driven digital healthcare approach appear positioned to help drive hyper-growth in huge addressable markets in the years ahead.

Risks

Key risks include those that are specific to healthcare companies evolving from the pre-revenue to commercialization stages. These include delays in clinical testing, and development, along with potential regulatory approval hurdles, which may result in non-approval status for core products under development. Funding for the Company’ s current flagship products could become an issue. However, given the favorable access to funding, and management’s track record, we believe that this is not a significant risk. Finally, Profusa does carry capital markets risk, as a publicly traded company. These could include sharp swings in share price movement or liquidity, from time to time.

Worth a Closer Look…

With a plethora of competitive advantages and favorable positioning, we believe that at the least, Profusa Gold is worth a closer look, and even a deep dive. With a series of milestones ahead, the Company is positioned to ride future catalytic events.

Disclaimer: Please make sure to completely read and understand our disclaimer at https://www.wallstreetpr.com/disclaimer.html

About akchirpy

Contributor at WallStreetPR.