Momentum trading, a popular approach in short-term trading, revolves around spotting changing asset prices and capitalising on these changes by aligning positions with the anticipated price movement. Traders anticipate continued price momentum in the chosen direction, driving their investment decisions.

With this blog, you will learn all about this dynamic strategy driving success in financial markets. Moreover, we will discuss the intricacies of this approach, from its fundamental principles to its practical applications.

We will delve into the basics of momentum trading, the trading example with Python ending the blog with the FAQs to clarify and navigate the world of momentum trading with finesse.

Before moving ahead, you must know that the underlying principle for momentum trading is to “buy high and sell higher”, and vice-versa.

Let us find out more about momentum trading with this blog that covers:

- What is momentum trading?

- How does momentum trading work?

- Types of momentum trading

- Factors affecting momentum trading

- Long term vs. Short term momentum trading approaches

- Technical analysis tools or indicators for momentum trading

- A simple momentum trading strategy in Python

- How to start momentum trading?

- Risks involved while implementing momentum trading strategy

- Key takeaways while implementing momentum trading strategy

- FAQs about momentum trading

What is momentum trading?

Momentum trading involves buying or selling assets based on recent price trends. Traders seek assets with strong upward or downward momentum over a specified period, such as days or weeks.

This strategy relies on the idea that market trends persist before reversing, allowing traders to maximise returns by following the trend. Hence, you can analyse assets in the short-term and buy the assets whose price is rising. Then sell those assets when the price trend seems to become weak.

Successful momentum trading requires careful analysis of price movements and market conditions to identify opportunities and manage risk effectively. ⁽¹⁾

Fact:

Richard Driehaus, a famous investor, is considered the Father of Momentum Investing and his investing techniques have become the basics of Momentum Trading. Driehaus believed in selling the losers and letting the winners ride while reinvesting the money from the losers in other stocks that were beginning to show momentum.

Next, we will find out the working of momentum trading to learn the intricacies of this trading practice.

How does momentum trading work?

Let us take an example here to learn about the working of momentum trading.

Think of momentum trading as a moving car. The speed is slow as you start moving forward. This is when you identify a stock which is increasing in price.

As the car accelerates, the speed increases. If you have identified the stock and purchased it, your investment now starts to grow.

On seeing a red traffic signal, the car decelerates and the speed reduces. This is similar to when you exit your position at a profit on seeing a momentum loss in the asset price. ⁽²⁾

Going forward, let us see the steps below that take place in momentum trading.

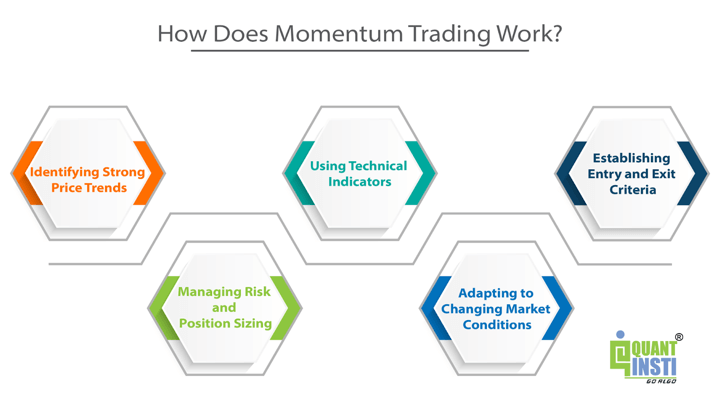

- Identifying Strong Price Trends: Momentum traders look for assets that have exhibited strong price movements in a particular direction over a defined period, such as days, weeks, or months. They typically focus on assets with significant price momentum, either upwards (bullish) or downwards (bearish).

- Using Technical Indicators: Momentum traders often use technical indicators to confirm price momentum and identify potential entry and exit points. Common indicators include moving averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and stochastic oscillators. These indicators help traders gauge the strength and direction of the price trend.

- Establishing Entry and Exit Criteria: Momentum traders establish specific criteria for entering and exiting trades based on their chosen indicators and trading strategy. For example, they may enter a long position (buy) when the price breaks above a certain moving average or when the RSI indicates oversold conditions. Conversely, they may enter a short position (sell) when the price breaks below a moving average or when the RSI indicates overbought conditions.

- Managing Risk and Position Sizing: Risk management is crucial in momentum trading to protect against losses. Traders typically set stop-loss orders to limit potential losses and use position sizing techniques to manage the amount of capital allocated to each trade relative to their overall portfolio size and risk tolerance.

- Adapting to Changing Market Conditions: Momentum traders continuously assess market conditions and adjust their strategies as needed to capitalise on new opportunities or mitigate risks. They remain flexible and responsive to changes in price trends, volatility, and other market factors.

Going forward, let us learn about the types of momentum trading.

Types of momentum trading

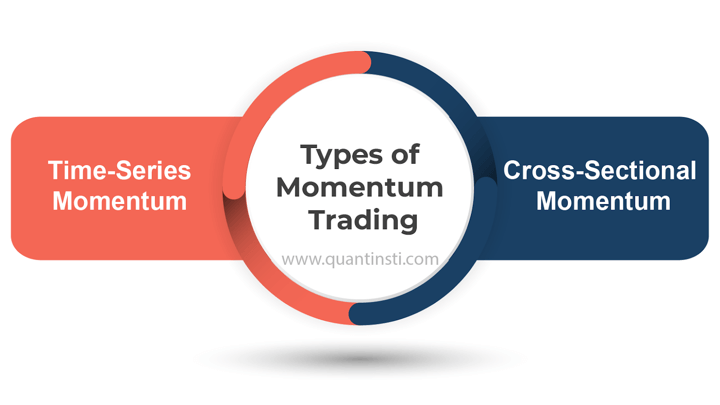

There are two main types of momentum trading which are:

Time-Series Momentum

- Application: In time-series momentum trading, traders assess the historical performance of individual assets over a specific period.

- Methodology: Traders identify assets that have achieved a certain percentage profit threshold over a specified historical period, such as the past 3, 6, or 12 months.

- Execution: Assets exceeding this threshold are bought, anticipating that their positive momentum will continue. The focus is solely on the performance of each asset relative to its own historical performance.

- Example: If a stock has gained more than 10% over the past 6 months, it may trigger a buy signal under a time-series momentum strategy.

Cross-Sectional Momentum

- Application: In cross-sectional momentum trading, traders compare the performance of assets relative to each other within a portfolio or universe of assets.

- Methodology: Traders rank assets based on their recent performance relative to other assets in the same universe. For instance, they may rank stocks based on their returns over the past 3 months.

- Execution: The top-performing assets (e.g., top 10) are bought, while the bottom-performing assets are either sold short or avoided. The focus is on selecting assets with the strongest relative performance compared to their peers.

- Example: If a stock ranks among the top 10 performers in terms of returns over the past 3 months compared to other stocks in the same sector, it may be considered for inclusion in a cross-sectional momentum strategy.

In summary, time-series momentum strategies focus on individual asset performance relative to their historical performance, while cross-sectional momentum strategies compare the performance of assets relative to each other within a portfolio or asset universe. Both types of momentum strategies aim to capitalise on trends and momentum in asset prices, but they differ in their approach to selecting assets for trading.

Certain factors affect momentum trading and it is important to know these factors to take necessary actions for lessening the harmful impacts of the same.

Factors affecting momentum trading

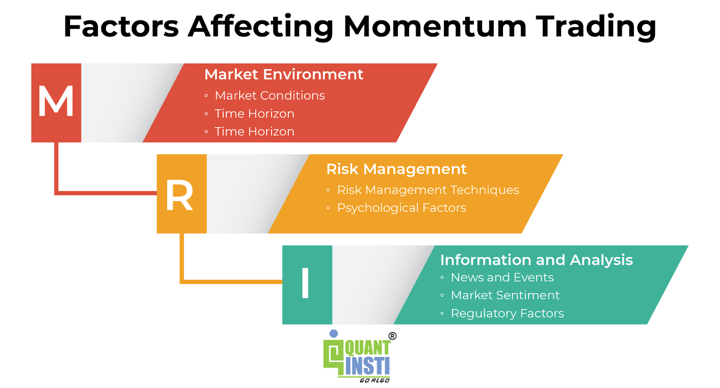

The short-term price change of an asset is affected by several factors. Some of the major factors as well as the sub-factors are as follows.

Market Environment

Market Conditions: The overall market environment, including trends, volatility, and liquidity, can significantly impact momentum trading. Strong trending markets with low volatility often provide favourable conditions for momentum strategies to thrive, as trends are more likely to persist. Conversely, choppy or range-bound markets with high volatility may result in false signals and challenges for momentum traders.

Time Horizon: The choice of time horizon or the duration over which momentum signals are evaluated can affect trading outcomes. Shorter-term momentum strategies may capture more frequent but smaller price movements, while longer-term strategies may aim to capitalise on more significant trends. Traders need to align their time horizons with their risk tolerance, trading style, and market conditions.

Asset Selection: The choice of assets to trade can significantly impact momentum trading performance. Different assets exhibit varying levels of momentum and volatility, and certain markets may be more conducive to momentum strategies than others. Traders need to select assets that demonstrate clear and persistent trends and avoid assets with choppy price action or low liquidity.

Risk Management

Risk Management Techniques: Effective risk management is critical for mitigating losses and preserving capital in momentum trading. For example, trend following strategies can be inherently risky, as they rely on trends continuing in the expected direction. Traders need to implement risk management techniques such as setting stop-loss orders, position sizing, and diversification to manage downside risk and protect against adverse market movements.

Psychological Factors: Trader psychology plays a significant role in momentum trading, as it can influence decision-making, risk-taking behaviour, and emotional responses to market fluctuations. Overconfidence, fear of missing out (FOMO), and reluctance to cut losses can lead to poor trading decisions and undermine the effectiveness of momentum strategies. Traders need to maintain discipline, manage emotions, and adhere to their trading plan to avoid behavioural biases.

Information and Analysis

News and Events: Market-moving news, economic data releases, geopolitical events, and corporate announcements can impact asset prices and disrupt existing trends. Momentum traders need to stay informed about relevant news and events that could affect their positions and adjust their trading strategies accordingly. Event-driven momentum traders may actively trade around specific catalysts to capitalise on short-term price movements.

Market Sentiment: Market sentiment, including investor sentiment and sentiment indicators, can influence the direction and strength of price trends. Bullish sentiment may fuel upward momentum, while bearish sentiment may lead to downward momentum. Momentum traders often monitor sentiment indicators, such as surveys, sentiment indices, and options positioning, to gauge market sentiment and identify potential trading opportunities.

Regulatory Factors: Regulatory changes, policy decisions, and interventions by central banks or government authorities can impact market dynamics and disrupt existing trends. Momentum traders need to stay informed about regulatory developments and anticipate their potential implications for asset prices. Regulatory announcements or interventions can trigger sudden reversals or accelerations in momentum, requiring traders to react swiftly and adjust their positions.

Let us now see the difference between long term and short term momentum trading.

Long term vs. Short term momentum trading approaches

Below is a detailed explanation of the difference between long and short term momentum trading approaches in a tabular format.

| Aspect | Long-Term Momentum Trading | Short-Term Momentum Trading |

| Time Horizon | Months to years | Minutes to days |

| Strategy | Identify sustained trends using technical indicators | Exploit short-lived price trends with intraday indicators |

| Risk-Return Profile | Potential for higher returns but with longer holding periods | Quick profits with higher frequency trading but also higher transaction costs |

| Fundamental Analysis | May incorporate fundamental analysis for validation | Less emphasis on fundamental analysis, focus on technical factors |

| Diversification | Diversify across multiple assets or sectors | May concentrate on highly liquid assets |

| Market Monitoring | Less frequent adjustments, less monitoring required | Requires active monitoring of intraday price movements and news |

| Psychological Factors | Lower stress due to longer holding periods | Higher stress due to rapid market fluctuations |

| Risk Management | Adjustments may be less frequent, long-term trends provide more stability | Requires tight stop-loss orders, precise timing, and disciplined risk management |

| Transaction Costs | Lower frequency trading, lower transaction costs | Higher frequency trading, increased transaction costs |

Now, let us see the technical analysis tools or indicators that help identify and confirm momentum trading opportunities.

Author: Chainika Thakar (Originally written by Gaurav Singh)

Stay tuned for the next installment to learn about Technical Analysis tools.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.