By C. Theodore Hicks II, CFP, CKA, CMT

1/ Mag 7 Breaks Down

2/ Approaching Support

3/ Energy & Commodities

4/ Energy Setting Up?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

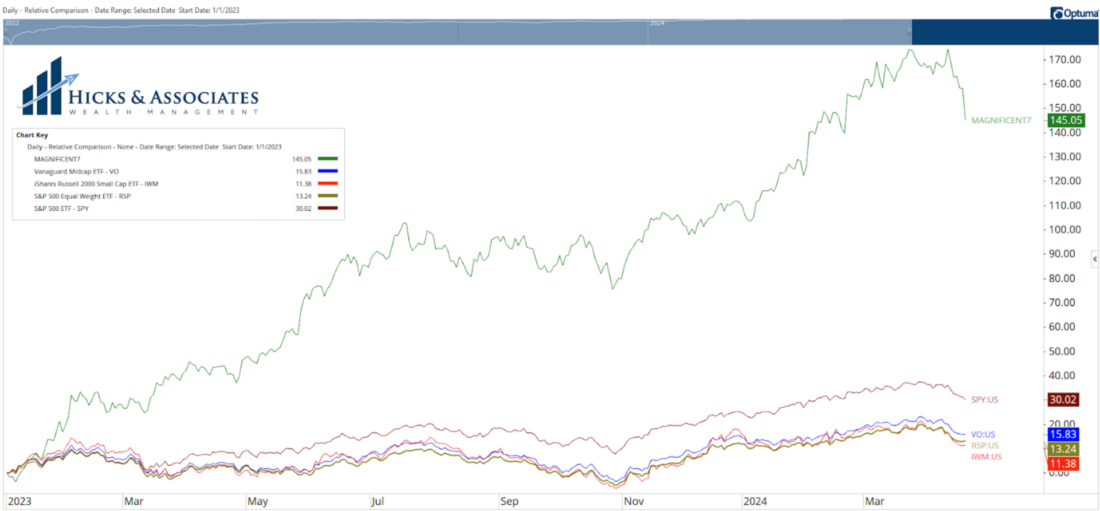

Mag 7 Breaks Down

Since the beginning of 2023, The Magnificent 7 have been leading the market, vastly outpacing everyone else. Chart 1 is a simple relative comparison showing the performance, since January 1, 2023, of The Magnificent 7, the S&P 500 (SPY), the equal-weight S&P 500 (RSP), mid-cap stocks (VO) and the iShares Russell 2000 small-caps (IWM).

While the month of April is historically a strong month, April 2024 has been very weak. While the S&P 500, both the cap-weighted version (SPY) and the equal-weighted version (RSP), is down ~5% for the month, The Magnificent 7 is down more than 8%.

In a bull market, corrections of 5-10% are incredibly common. As a result, we ought not be too concerned that we are experiencing such a correction. However, as tactical money managers, we cannot ignore that the leaders have been breaking down.

2/

Approaching Support

Chart 2 is showing the iShares Russell 3000 ETF (IWV) in the top pane. The bottom pane is showing the percentage of the stocks within this ETF that are trading above their 200-day moving average. We tend to examine the Russell 3000 as a measure of the market’s breadth as it captures about 95% of the United States’ stock market.

With this chart, we can see that 2023 saw very thin participation from the average stock. Throughout the year, many technicians pointed out the dangers of a stock market that was rising on the backs of so few stocks. If we are in a strong bull market, we should see the majority of stocks trading above their 200-day moving average. That just has not been true.

On this chart, we see two positives. First, while there is no doubt that this April pull-back has caused damage on the percent of stocks trading above their 200-day; the reality is that ~50% of the Russell 3000 constituents are still above this key level. That’s good news.

Furthermore, by zooming out, we can see that the current correction is ~1.5% away from the 2021 highs. If we are witnessing a correction within the confines of a bull-market, then it is reasonable for us to expect that these 2021 highs should serve as support. As a result, the correction might be just about over.

3/

Energy & Commodities

Chart 3 is again a relative comparison chart, this time showing the 11 sector ETFs since March 1st of this year. I’ve also added DJP, a commodity index ETF that I frequently use as a proxy for a broad basket of commodities. Note that financials (XLF) are barely positive. We can see that materials (XLB) is up 1.14% during this time period. At the top, we see energy (XLE) and commodities (DJP) followed closely by utilities (XLU). Generally speaking, this is not an encouraging sign as to what this implies.

4/

Energy Setting Up?

While commodities have gone on an absolute tear recently, DJP in particular only reclaimed its 200-day moving average on April 1st and that 200-day moving average has only recently begun to curl up. As a result, we would like to see a bit more continued strength before we consider adding it to our portfolios.

Energy, on the other hand, has been a bit stronger making it a little more attractive. However, we rarely just buy based on strength. We prefer to look for clean buy points. The energy rally has not, so far, offered one … yet. The mini-correction that we have witnessed in the energy sector these last six trading sessions might just be the beginning of the set-up required for a proper buy point.

—

Originally posted 22nd April, 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.