Price matters, and that’s what makes this consumer internet stock attractive right now.

The hottest stock of our time is definitely Nvidia. After rising over 1,000% in the last five years to a market cap greater than $2 trillion, Nvidia has made millions of dollars for investors who held for the long term.

But I’m here to tell you that investing in Nvidia today is a poor move. After seeing its stock go through such a meteoric rise, the company now trades at a price-to-earnings ratio (P/E) of 63, which is more than double the market average. This is after its earnings have gone up 800% in the last five years, too. Nvidia investors have gotten ahead of themselves, making the stock a risky purchase at today’s prices.

Instead, investors should look at Match Group (MTCH -0.84%). The online dating company is getting no love — pun intended — from investors today and trades at a cheap earnings multiple, even though it is poised to grow its earnings over the next few years and beyond. Here’s why you should buy Match Group stock for your portfolio right now.

Declining payers, implementing pricing power

Match Group stock is off 80% from all-time highs set in 2021. It has been a brutal few years for stockholders. Investors are selling shares for a few reasons, none more important than the trajectory of paying users at Tinder, Match Group’s top dating application. Paying users at Tinder have fallen for many quarters now, dipping 8% year over year in fourth-quarter 2023. Overall, Match Group’s paying users peaked in September 2022 at 16.5 million, and currently sit at 15.6 million.

This stagnation and decline in paying customers is a major concern, especially because the prior five to 10 years saw consistent growth in the online dating market. However, this does not tell the whole story. Match Group has been upping the price of Tinder subscriptions in recent quarters, which has led to revenue per paying user growing 21% year over year in Q4 of last year. Despite the narrative in the investing world that Tinder is a dying business, its direct revenue grew by 11% in the third and fourth quarters of 2023.

Tinder is implementing pricing power in an effective manner, even if it leads to a slight decline in paying users. There is one concern with Tinder’s business, though: A declining overall user base. While management doesn’t give out consistent numbers, they mentioned on a recent conference call that Tinder’s overall active users are declining slightly, which is something that needs to be fixed in order to maintain a healthy online dating marketplace. While it’s not the end of the world, this is an important metric for investors to track in the coming years.

Lots of cash flow to return to shareholders

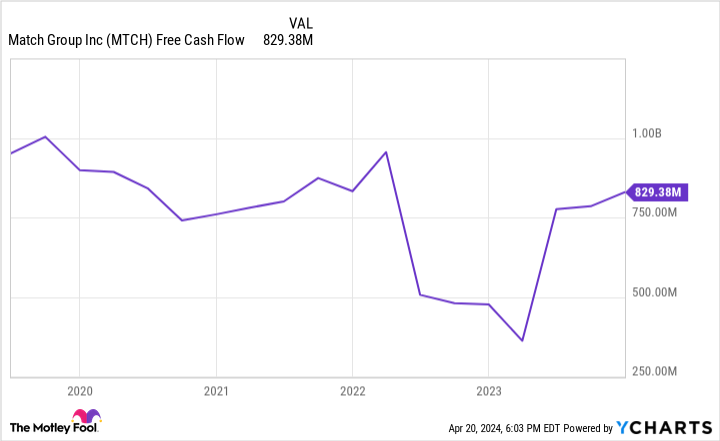

A great thing about Match Group’s business is that it is asset-light and generates a lot of cash flow. Free cash flow has been positive each of the last five years, and it hit roughly $830 million in 2023.

With this cash flow, Match Group is returning capital to shareholders through share repurchases. In 2022 and 2023, management spent over $1.1 billion buying back Match Group stock, leading shares outstanding to fall 6% from their peak. This trend should continue with a new $1 billion share repurchase program authorized at the end of 2023.

MTCH Free Cash Flow data by YCharts

The stock is cheap at these prices

Match Group stock looks optically cheap, especially when you consider its long-term growth potential. Its trailing P/E is 14, which is around half the S&P 500 average. And this is while revenue continues to climb, even with Tinder going through some growing pains at the moment. Match Group revenue grew 7% in 2022 and 6% in 2023. In 2024, management expects around 6% to 9% revenue growth.

Over the long term, the company has a long runway for growth if it can maintain its leadership position in online dating. Dating is a part of every culture, and just about everywhere these days is growing the number of its smartphone users. Analysts expect active smartphone users to grow from 6.8 billion in 2023 to 7.7 billion in 2027. Meanwhile, smartphone usage from existing users continues to grow year after year.

Match Group should benefit from growing smartphone usage as more people around the world turn to dating applications to find potential mates. Combine this with a cheap earnings ratio and a management team buying back stock, and Match Group looks like the perfect stock to buy at these discounted prices.

Brett Schafer has positions in Match Group. The Motley Fool has positions in and recommends Match Group and Nvidia. The Motley Fool has a disclosure policy.