Richmond Fed President Barkin’s comments this morning that additional rate hikes are still an option along with the release of sticky job openings data and better-than-expected manufacturing activity are dampening policy easing expectations. Investors are reacting by unloading assets as the January market swoon continues while they look ahead for today’s 2 p.m. release of last month’s Fed meeting minutes for clues into the direction of monetary policy. The level of enthusiasm for rate cuts expressed by committee members will be of particular interest, especially after many members walked back Chair Powell’s dovish tone in the days following the December meeting.

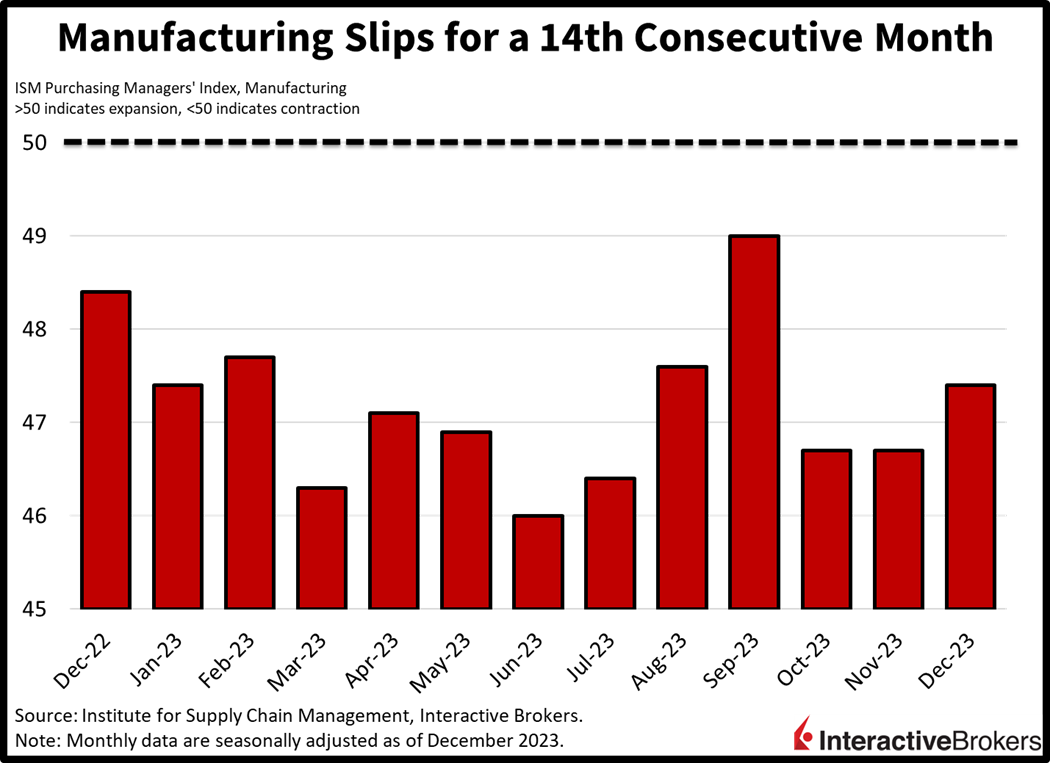

Manufacturing Remains in the Tombs

Manufacturing activity contracted in December, the 14th consecutive monthly decline, according to the ISM’s Purchasing Managers’ Index. At a level of 47.4, the decline was slower than the projected 47.1 and November’s 46.7 figure. Weak demand weighed most on the sector, pushing manufacturers to trim employment, cut prices, and reduce inventories while working on diminishing backlogs. During the month, elevated interest rates, lofty prices and reduced credit availability continued to be headwinds for large capital purchases.

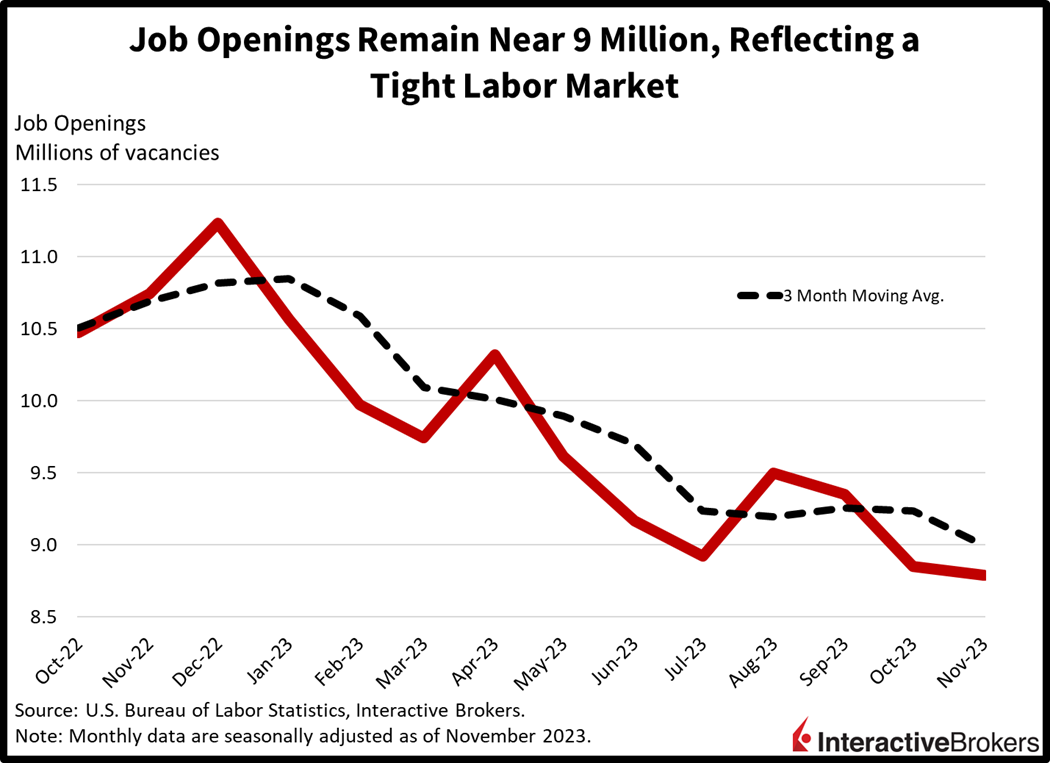

JOLTS Reflects Labor Tightness

Companies reported a healthy number of open positions in November, indicating that the labor market was still robust. Conversely, workers quit their employment less frequently, indicating a lesser level of confidence in finding alternative sources of income. November saw a minor decline in job openings, totaling 8.79 million as opposed to the 8.85 million projected, which would have remained constant from October. During the period, the number of quits decreased from 3.63 million to 3.47 million.

January Swoon Continues

Markets are getting pounded for the second consecutive day. Particularly noteworthy is the aggressive reversal in yields, with the 10-year Treasury flying past 4%. Yesterday’s trading day even featured some glitches, a sign of deteriorating liquidity, with the 1-month Treasury bill jumping to 6.13%. All major US stock indices are down, with the small-cap Russell 2000 leading the charge; it’s down 1.9%. The Nasdaq Composite, Dow Jones Industrial and S&P 500 indices are down 0.9%, 0.8% and 0.8%. All sectors are lower minus energy, with the real estate, materials and consumer discretionary segments dropping the hardest; they’re down 2.4%, 1.6% and 1.6%. Energy is up 0.7%, a result of spiking oil prices. In addition to conflicts at the Red Sea, today’s disruption at Libya’s 300,000 barrel per day Sharara oilfield added to supply concerns. WTI crude oil is up 3.1% or $2.21 to $72.65. Higher oil prices are also supporting loftier interest rates, with yields on the 2- and 10-year Treasury maturities up 4 and 5 basis points (bps) to 4.37% and 3.99%. The dollar is catching a bid for the same reasons, with the greenback’s index up 134 bps to 102.70. The US currency is gaining relative to the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars.

Middle East Conflict Intensifies

Recent optimism that Operation Prosperity Guardian would resolve conflicts in the Red Sea and allow shipping to proceed through the waterway without harassment proved premature this past weekend when four Houthi rebel boats attacked the Maersk Hanzghou. While Tehran’s backing of the rebels is being closely watched, the recent assassination of a senior Hamas leader in Beirut, is raising fears that the existing Middle East conflict could expand to Iran and Lebanon.

U.S. Navy helicopters this past weekend sank three of the four boats that attacked the Maersk Hanzghou and the container ship was able to continue sailing; however, its owner, Maersk, announced it would once again divert traffic around the Southern tip of Africa, increasing transit time by as much as two weeks. German-shipping company Hapag-Lloyd also said it will avoid the Red Sea, while most other shipping companies had yet to return to the waterway after initial attacks on ships by Houthi rebels.

The development is a setback for the global supply chain as Maersk’s earlier decision to resume shipping through the Red Sea-Suez Canal route was a vote of confidence that the multi-national Operation Prosperity Guardian was alleviating concerns about the waterway’s safety. While shippers face worries of physical damage and harm to employees in the Red Sea, they also face soaring war insurance costs. The conflict has caused shipping fees to increase dramatically and is also a blow to Beijing’s efforts to grow its exports, with shipments of automobiles from the country to Europe relying on the Red Sea route.

While the issue is increasing shipping expenses, it also underscores the volatile nature of geopolitics in the region. The rebels’ actions and support from Tehran are intended to show opposition to Israel’s military offensive against Hamas, while Lebanon-based Hezbollah has launched missile attacks against Israel. Even prior to the assassination of the Hamas leader in Beirut, former NATO Commander James Stavridis told MSNBC that he is extremely worried that the Israel-Hamas conflict could expand to other countries.

Some Forgot What a Sell-Off Feels Like

Following a strong equity and bond market rally featuring nine consecutive weekly gains, this week’s selling has caught market players off guard. Indeed, an abundance of sunshine can sometimes make us forget what rain feels like. Against this backdrop, meanwhile, stocks have a lot more room to fall, as the 10-year yield belongs closer to 4.5% when considering inflationary dynamics and fiscal conditions. Sticky inflation, characterized by the Consumer Price Index’s probable trough at 3%, and eye-watering U.S. Treasury debt issuance and total liabilities point to higher interest rates. With those points in mind, expectations for six fed rate cuts this year are excessive, with the central bank much more likely to do only three, beginning in May.

Join Me at The MoneyShow

I look forward to discussing the Federal Reserve’s challenging journey across the monetary bridge—or process of taming inflation while keeping growth positive—when I speak at the MoneyShow Virtual Expo. I will discuss economic and financial market conditions and place an emphasis on consumer spending, labor markets, equities, fixed-income, commodity trends, and monetary and fiscal policies. I will also cover the real estate, banking and manufacturing sectors. Please click below to receive a free pass to the online event, which is scheduled for 11:50 a.m. EST on Thursday, January 18. Register For Free Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.