The much-anticipated split finally took place. Here’s a look at the company’s prospects.

Chipotle (CMG -5.24%) has officially joined the stock split club after shares began trading at a fiftieth of their previous price. If you’re a shareholder, don’t panic. You’ll notice you have 50 times the shares you used to have. It’s essentially a wash in terms of net value for your portfolio.

So why did Chipotle do this? A forward split allows a company to make its shares accessible to a wider audience. For many retail traders, the more than $3,000 price tag that shares carried just a day ago was too steep. They were effectively locked out of the ability to invest. As Chipotle’s CFO noted, this is true for a lot of employees of Chipotle. Reducing the stock price allows for buy-in from employees on the ground floor.

Although the move doesn’t in and of itself change your portfolio value, it may have a positive effect on the stock price over time. Forward splits are often followed by upward movement in the stock price, but it’s hard to say if it’s just a coincidence, given that many forward stock splits happen when a stock already has positive momentum behind it.

Rather than getting hung up on any short-term movements in stock price, evaluate Chipotle as a business. Is it a good long-term investment? Let’s consider the company’s growth, the major selling point for many Chipotle investors.

Its revenue growth looks incredible compared to the competition

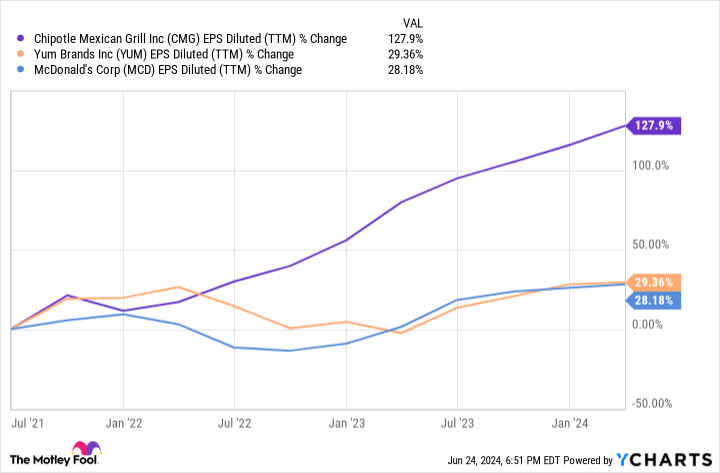

Chipotle is putting competitors like McDonald’s and Yum! — the company that owns Taco Bell, KFC, and other big fast food chains — to shame. Its earnings growth has been impressive, to say the least, and it’s why the company has seen its shares trade at a premium for some time. Look at the change in earnings per share (EPS) over the last three years for all three companies.

CMG EPS Diluted (TTM) data by YCharts

That kind of growth attracts attention and gives investors reason to accept a high valuation. And to be sure, Chipotle is currently trading at quite a premium. Its price-to-earnings ratio (P/E) is just south of 70, a valuation usually reserved for early stage tech companies. Both McDonald’s and Yum! have a P/E sitting just above 20. Is this markup really deserved?

It’s not all roses for Chipotle — investors need to read past the headlines

This growth certainly looks impressive. However, it’s a little more complicated. The more than 14% revenue growth Chipotle reported last quarter — the figure getting all the attention — comes not just from increased demand at existing stores but also from the company’s new-store expansion. As new Chipotle locations come online, revenue gets a bump.

Zooming in, we can see that comparable sales only jumped 7% for the same period. That is, average sales in the same store over a year’s time grew 7%. This growth rate, while respectable, makes the premium valuation look a little different. The company cannot open stores indefinitely, and eventually, markets will become saturated.

Chipotle is still mainly U.S.-based — there’s a lot of room to grow

Yet market saturation doesn’t look to be an issue any time soon. Chipotle agrees, as it has targeted 7,000 stores for the North American market, more than twice what it currently has.

Moreover, while the company has a smattering of locations elsewhere, its operations are almost entirely in North America. That means there are massive untapped markets for the company across the globe, and that’s not so true for the likes of McDonald’s. This is further reason to trust that Chipotle can sustain double-digit growth for some time.

While the high valuation does give me pause, I think that given the ample room to expand locations and its strong history of continued revenue growth over the years, Chipotle is still a good pick.

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.