Shares of Invesco QQQ Trust (QQQ 0.68%) were among the big winners on the stock market last year. The ETF that tracks the Nasdaq 100 soared 54% last year, according to data from S&P Global Market Intelligence.

A number of trends and events pushed the tech-heavy index fund last year, including the hype around new generative AI technologies, beaten-down share prices in the tech sector at the start of 2023, and layoffs and other cost-cutting moves by big tech companies that helped give profits a boost last year.

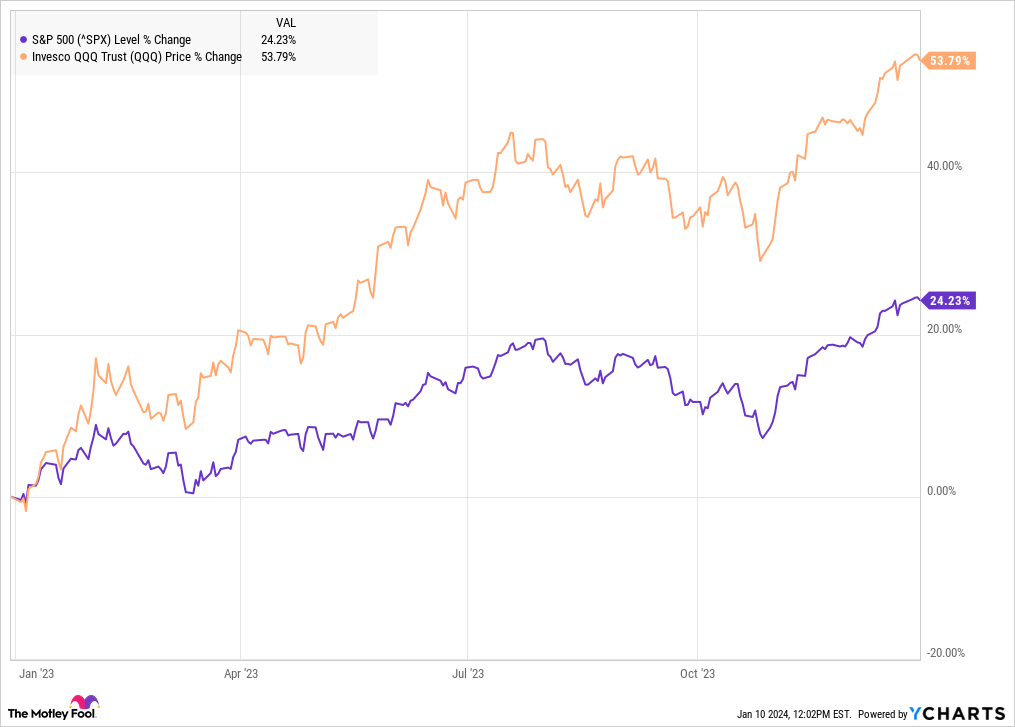

The chart below shows the ETF’s performance over the course of the year.

As you can see, the QQQ’s gains trended with the S&P 500 throughout the year, but it gained at a faster pace, reflecting the enthusiasm for AI and the low valuations of many big tech stocks at the start of the year.

Why tech stocks boomed last year

The Invesco QQQ Trust is made up of the 100 largest non-financial Nasdaq stocks, and the index is dominated by the Magnificent Seven stocks right now.

All of those stocks were big winners, and their gains reflect the trends that pushed the QQQ to huge gains.

For example, Nvidia (NVDA 2.28%) shares more than tripled last year as the company was far and away the biggest winner from demand for AI chips, and its revenue and profit margins soared. Meta Platforms (META 3.65%) stock also tripled as the company executed on its promise of a “Year of Efficiency,” slashing costs and boosting margins, and it benefited from a rebound in advertising demand as well.

Tesla (TSLA -0.43%) stock also doubled last year even as profits declined in its most recent quarter. Anticipation for its AI and autonomous vehicle technology helped lift the stock.

And big tech stocks like Microsoft, Apple, Alphabet, and Amazon rose on a combination of expanding profit margins, AI developments, and the perception that the economy would avoid a recession.

Image source: Getty Images.

What’s next for the Nasdaq QQQ ETF

The Nasdaq 100 currently trades at a price-to-earnings ratio of 29.1, which is significantly higher than where it was a year ago at 23.5, and even higher than the S&P 500’s at 21.6.

That price tag reflects the high expectations baked into the tech stocks thanks to the momentum in AI. However, profits should rise for big tech stocks this year, and AI momentum should continue as the investments we’ve seen over the last year start to pay off.

While investors shouldn’t expect another 54% gain from the QQQ ETF, it still seems well positioned for more gains as long as the economy can skirt a recession.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.