Why it may be better to remain patient.

Despite delivering solid fiscal third-quarter results at the start of the month, Apple (AAPL 1.37%) got caught up in the recent market sell-off. This tech-driven sell-off was accelerated by a small interest rate hike in Japan and the unwinding of the carry trade.

Market corrections are unavoidable, and they can open up good buying opportunities. Let’s look at Apple’s most recent results to see if this is a stock investors should be scooping up on this market dip.

Services revenue growth continues to lead the way

After watching its revenue decline by 4% in fiscal Q2, Apple managed to increase it by 5% year-over-year, to $85.8 billion, for fiscal Q3, which ended June 29. That came in just above analyst expectations for revenue of $84.5 billion.

Earnings per share grew 11% to $1.40, topping the $1.35 analyst consensus.

Revenue for Apple’s services segment, which includes its App Store and Apple TV, climbed 14% to $24.2 billion in the quarter. This segment carries much higher gross margins than the products segment, and its gross profits climbed 20% to $17.9 billion.

Product sales, meanwhile, rose nearly 2% to $61.6 billion, while gross profits edged up more than 1% to $21.8 billion.

iPhone sales declined by about 1% to $39.3 billion but came in slightly ahead of the $38.8 billion in sales that analysts had forecast. The company also said that sales rose on a constant-currency basis and that its installed iPhone user base hit “a new all-time high.”

iPad sales, meanwhile, saw a resurgence, climbing 24% to $7.2 billion on the back of the first new release of a tablet since 2022. The company said that about half of its iPad sales came from new users. Sales for wearables, home devices, and accessories — the segment that includes the Apple Watch and AirPods — rose 2% to $8.1 billion, while Mac sales rose 2% to $7 billion. About two-thirds of Apple Watch buyers and about half of MacBook Air buyers had never bought those items before.

Check out some numbers from the most recent quarter in the table below.

| Segment | Revenue Increase | Revenue | Gross Profit Increase | Gross Profit |

|---|---|---|---|---|

| Services | 14% | $24.2 billion | 20% | $17.9 billion |

| Products | 2% | $61.6 billion | 1% | $21.8 billion |

| 1% | $39.3 billion | |||

| 2% | $8.1 billion | |||

| 24% | $7.2 billion | |||

| 2% | $7.0 billion | |||

| Company Total | 4% | $85.8 billion | 9% | $39.7 billion |

Data source: Apple.

Mainland China continued to be a weak spot, with Apple revenue in the country down about 6.5%. However, the company said that its iPhone installed base hit a record high, while it saw a record number of users upgrade their iPhones in June.

Looking ahead, Apple forecast that its fiscal Q4 revenue would see growth similar to the 5% of fiscal Q3. It also expects double-digit services revenue growth, as in the prior three quarters.

Image source: Getty Images.

Is now the time to buy Apple stock?

Apple’s services businesses continue to shine with consistent midteens revenue growth. While iPhone sales remain lackluster, the company has been able to nicely grow profits due to the high-margin nature of its services offerings.

Meanwhile, the nice jump in iPad sales shows the impact a big product upgrade could have on the rest of its hardware business, including iPhone sales. As Apple continues to make strides in artificial intelligence (AI) with its Apple Intelligence offering, the introduction of a more substantial AI-powered iPhone upgrade could certainly help power hardware sales. Over the past few years, the upgrade cycle has slowed, as upgrades to the smartphone have been more incremental and investors are looking forward to something that will reverse that trend.

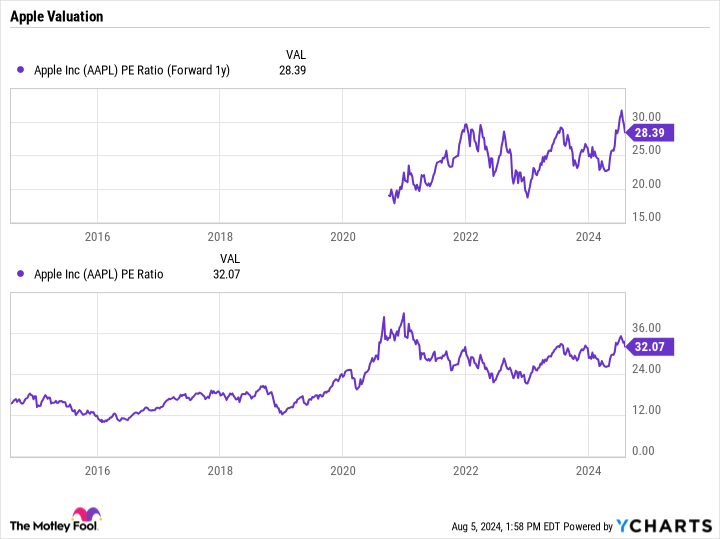

From a valuation perspective, Apple stock trades at a forward price-to-earnings (P/E) ratio of just above 28 based on fiscal 2025 analyst estimates. Before COVID locked down the economy, the stock generally traded at a much lower P/E.

AAPL PE Ratio (Forward 1y) data by YCharts

While Apple’s prospects are looking up due to the potential for an iPhone upgrade combined with the strength in its services business, the stock’s valuation remains lofty after the jump in P/E multiple without a corresponding jump in growth. If the stock’s valuation were to rerate back down to pre-COVID P/E multiples, there would be a lot of downside in the price from current levels.

Given the sudden shakiness in the market combined with its current valuation, I would wait for more of a pullback in Apple shares before looking to buy or add to the stock. There are currently more attractively valued stocks among the so-called “Magnificent Seven” stocks to consider buying before Apple. Meanwhile, even longtime Apple shareholder Warren Buffett cut his large Apple stake nearly in half, taking some nice profits in the process.