The CPI comes in hotter than expected … there’s trouble in the labor market that’s not getting attention … a week of layoffs … the SEC approves 11 bitcoin ETFs

The morning, the Consumer Price Index came in slightly hotter than expected.

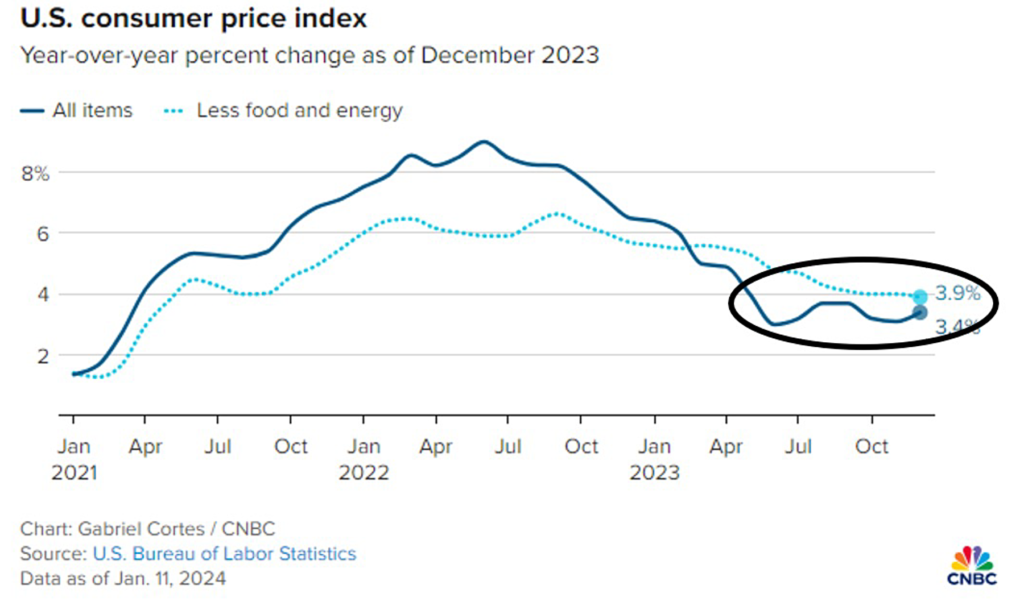

Headline inflation rose 3.4% on the year which topped the Dow Jones estimate of 3.2%. Month-to-month, the CPI rose 0.3%, also higher than the forecast of 0.2%.

Core CPI, which excludes volatile food and energy prices (which the Fed prefers to monitor), came in higher than expected. It climbed 3.9% on the year, above the estimate of 3.8%. For the month, the 0.3% gain matched forecasts.

Below, you can see inflation’s path over the past several years. Note how the decline in headline inflation has stalled out since June of last year (dark blue solid line). And core CPI has barely dropped since September (light blue dotted line).

You might think this uptick in inflation would create some concern in the futures market about the Fed’s rate-cut plans this year. Perhaps the odds of all those rate cuts, or when cuts would begin, would drop noticeably?

Not so much.

As I write Thursday morning, the CME Group’s FedWatch Tool shows that traders are still pricing in just about the same probability for the number of rate cuts in 2024. They’re also placing nearly the same odds on when those cuts will begin – March, with a 62% probability (yesterday, this probability was 64%).

Meanwhile, the market initially sold off on the news, but then battled back to end the day flat. Nothing in its reaction reveals any significant concern.

So, what’s the takeaway from this morning’s CPI print?

Nothing has changed. The data have not tempered Wall Street’s aggressive expectations for the Fed’s interest rate cuts this year.

Meanwhile, as everyone has been focusing on inflation, are we missing a stealth labor force collapse?

“Labor force collapse? Jeff, you fool! Last week, we had an incredibly strong payroll report. We’re nowhere close to a labor force collapse.”

Perhaps, but let’s investigate.

As we reported here in the Digest, last Friday, December’s jobs report showed that employers added 216,000 jobs while the unemployment rate held steady at 3.7%.

The expectation had been for a payroll increase of just 170,000 and a tick-up in the unemployment rate to 3.8%.

Based on these data, “collapse” is certainly a poor description of our labor force.

But to begin our alternative analysis, let’s jump to legendary investor Louis Navellier and his recent take in Accelerated Profits:

There’s a problem. We had a better-than-expected payroll report [last week]. But over 800,000 jobs disappeared.

The unemployment rate is still unchanged at 3.7%, but downward revisions of the previous couple of months are significant.

Meanwhile, labor force participation plunged – the biggest drop in almost three years. So, something weird is going on.

This is the time of year when the government does all of these weird seasonal adjustments on the payroll data, and next month will be even worse. So, we’re not going to have a payroll report with clean data until March.

I do not want the economic data to be manipulated, and [last week] especially in the payroll report, something smells.

Let me add to the skunk-like aroma…

Did you know that 10 out of the last 11 job prints have been revised lower?

How amazing that our government nearly always get the data wrong in just one direction that, coincidentally, helps keep a recession at bay.

What’s really happening with our labor force?

Last week’s payroll report came from the “establishment survey.” That’s the popular name for Labor Department’s payroll survey. But this isn’t the only gauge of our labor force.

The Bureau of Labor Statistics (BLS) conducts a phone survey, called the “Household Survey.” It contacts households directly to ask questions about the employment status of the household members.

So, how is our economy looking if we switch to this less-covered Household Survey metric?

Here’s the economics/investment website Unseen Opp:

…While the monthly nonfarm payrolls from the Establishment Survey indicated modest growth at 216K, the Household Survey showed a sharp decrease of 683K in the number of employed workers – the largest drop since the onset of COVID-19.

This decline in employment, coupled with the stark divergence between the two surveys, underscores deeper labor market issues.

You might be scratching your head…

How is the payroll report showing robust job creation of 216,000 while the Household Survey posts the largest decrease in employed workers since Covid?

Simple – people are working two jobs.

This means the number on the payrolls report remains high at the same time that many people can’t find quality full-time work.

Back to Unseen Opp:

…The breakdown of job types revealed a shocking decline in full-time positions by 1.531 million in December, counterbalanced by a surge in part-time workers.

The U.S. has seen a shift towards part-time employment since February 2023, with no net addition of full-time jobs, further complicating the employment landscape.

Multiple jobholders also surged by 222K, reaching a record high. This suggests that more workers are taking on multiple jobs to cope with economic conditions.

The labor market’s underlying weakness, especially in the full-time sector, casts a shadow on the optimistic headline figures and raises significant concerns about the real state of the job market.

Let me throw in one more aromatic detail for you.

Of the 216,000 jobs created in December, 52,000 of them were government jobs. In fact, in 2023, government job growth average 56,000 per month.

That’s more than double the government’s average monthly job creation number of 23,000 from 2022.

It’s not a great sign for the health of our labor market when one-quarter of job creation is government work.

Speaking of the private sector, let’s take a quick look at what’s happened so far this week

On Monday, Unity Software announced it’s cutting 25% of its headcount in a “company reset” …

On Tuesday, Duolingo reported it’s eliminating 10% of its contractors…

Also on Tuesday, Blackrock announced it’s slashing 3% of its global workforce…

On Wednesday, Amazon announced it’s letting go of hundreds of employees in its Prime Video and MGM Studios divisions…

Also on Wednesday, streaming platform Twitch reported it’s cutting 35% of its staff.

And just this morning, news from Google is that it’s eliminating hundreds of jobs across its engineering and hardware teams.

If we include layoffs from last December, the list of well-known companies slashing headcount expands to include Enphase, eBay, Intel, Bold, Cruise, Etsy, SmilesDirectClub, Twilio, and Spotify.

Given this fuller analysis of our labor market, should we question the “soft landing” narrative that everyone now believes?

Before you answer that, let’s throw in last week’s ISM data.

Back to Louis for what this is and its significance:

The second issue [from last week] is the ISM Service Report came out and was very poor. It was a big drop.

We’re still above “50,” so the service sector is still growing, but what a disaster and what a miss…

Manufacturing in America has contracted for 14 straight months according to ISM. The service side of our economy decelerated sharply in December, so we have to keep an eye on the economy.

The soft-landing talk is everywhere. Treasury Secretary Janet Yellen is even saying it. But it’s a close call.

Louis’ reference to Yellen makes me laugh. Her forecast feels about as trustworthy as that of a used car salesman.

Here’s Yellen:

The most likely outcome is that the economy will move forward toward a soft landing.

I should probably mention that this quote came from Yellen back when she was the San Francisco Fed President in October 2007, just two months before the financial crisis that nearly destroyed the global economy.

Below is her latest quote. We’ll circle back later this year in hopes she doesn’t go two-for-two:

What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue.

The problems in the labor market wouldn’t be so concerning if the market wasn’t pricing in a pillowy soft landing in 2024

As we’ve pointed out here in the Digest, the economy isn’t in awful shape. Things, in general, are fair.

The problem is that Wall Street is putting a “premium” price on the stock market, while the market is supported by only a “fair” economy.

With the ISM data and the lost jobs in the Household Survey that we’ve covered today as our backdrop, let’s recall that analysts are projecting earnings growth of 11.8% in 2024, according to FactSet.

According to YCharts, the average yearly S&P earnings growth rate is 9.03%.

In other words, despite 14 straight months of ISM contraction… despite the Household Survey’s 683K reduction in employed workers, the largest drop since the onset of COVID-19… we’re going to have above average earnings growth this year – that somehow won’t cause inflation to tick up at all (even though it ticked up this morning).

Such an outcome would be wonderful, but let’s be open-eyed about the risks to such a rosy forecast.

In the meantime, as has been our position for many months now, let’s continue trading bullishness higher for as long as it’s here. Just be ready to protect your portfolio if/when conditions change.

Before we sign off…

We’ll cover it in more detail in a future Digest, but last night, the SEC approved changes to allow for spot bitcoin ETFs.

From Yahoo! Finance:

Regulators on Wednesday gave money managers the green light to launch 11 spot bitcoin exchange-traded funds, allowing everyday investors to get exposure to the world’s largest cryptocurrency without having to own it..

The ETFs, which begin trading Thursday, could make bitcoin a potential staple in 401(k)s, IRAs, and pension plans and give it mainstream acceptance.

Though we wondered whether bitcoin would experience a “sell the news” pullback in the wake of this approval, so far, the opposite is happening. Bitcoin is up nearly 2% as I write, now above $47,500.

We think this is going to be an enormous tailwind for crypto over the next 12 months. More analysis on this to come…

Have a good evening,

Jeff Remsburg