Investors are digesting a buffet of economic data today ahead of tomorrow’s largely awaited Jackson Hole presentation by Federal Reserve Chair Jerome Powell. Indeed, the calendar featured flash PMIs for the EU & US, Unemployment Claims and Existing Home Sales, but the most influential figure of the morning happened to be US services activity, which accelerated at one of the briskest rates of the year. Stocks surrendered early advances as a result and yields gained upside momentum as rate watchers pared back expectations for the speed at which the Fed will walk down the monetary policy stairs. Talk of a 50-bp reduction next month is certainly winding down, with the IBKR Forecast Trader and Fed Funds Futures favoring a quarter point with probabilities at 85% and 76%, respectively.

Manufacturing Dwells in the Catacombs but Services Sector Expands

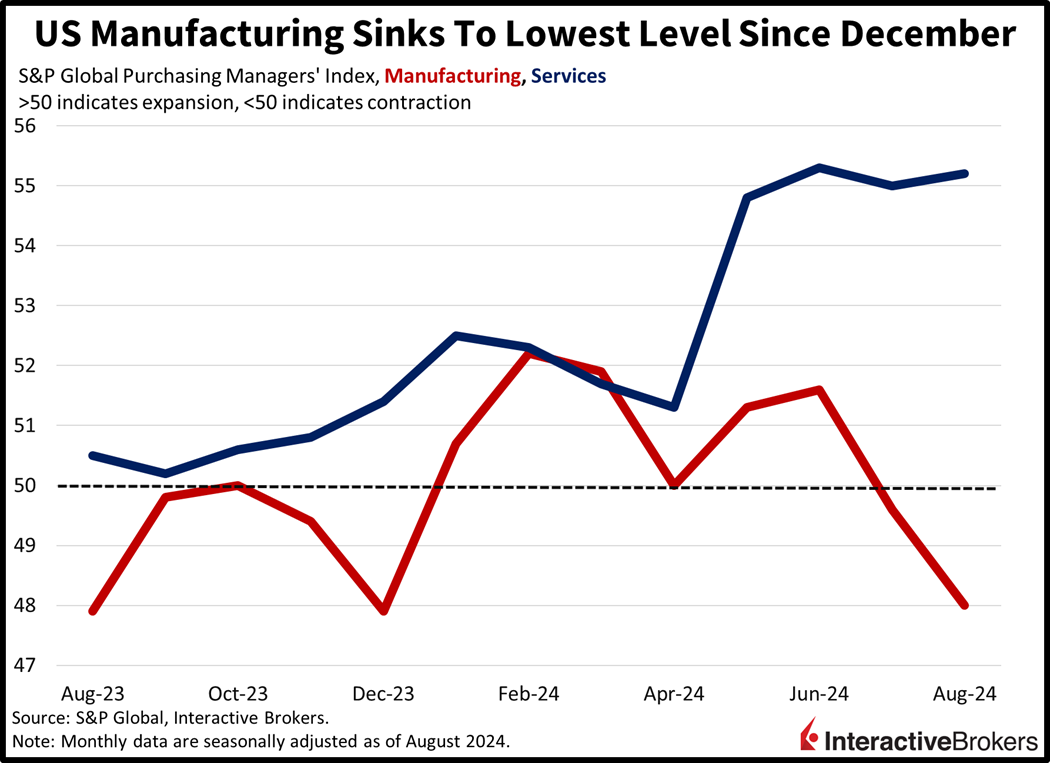

This month’s stateside economic activity remained buoyant even as manufacturing lingered in the tombs. August’s flash Purchasing Managers’ Indices (PMI) for Services and Manufacturing came in at 55.2 and 48, compared to expectations of 54 and 49.6 and July’s 55 and 49.6. The bifurcated action has certainly been a global phenomenon, with services consistently above the contraction-expansion threshold of 50, while manufacturing has persistently stayed beneath that level. In fact, the US category slipped to its deepest condition all year and to levels consistent with the 2008 recession.

The demand and confidence pictures were buoyant in services but dismal in manufacturing; nevertheless, hiring contracted across the board. The headcount reductions resulted from revenue weakness in the former sector, but the latter was hampered by staffing difficulties and challenges with replacing job leavers, pushing up labor costs. Input costs also increased due to loftier materials and shipping prices. Still, inflationary pressures remained subdued, as the expense pressure momentum wasn’t met with loftier stickers. The development points to servicers taking the hit to margins rather than passing rising charges to consumers in an effort to preserve revenues. The dynamic is consistent with fading corporate earnings prospects.

Eurozone PMIs Reflect Similar Trend

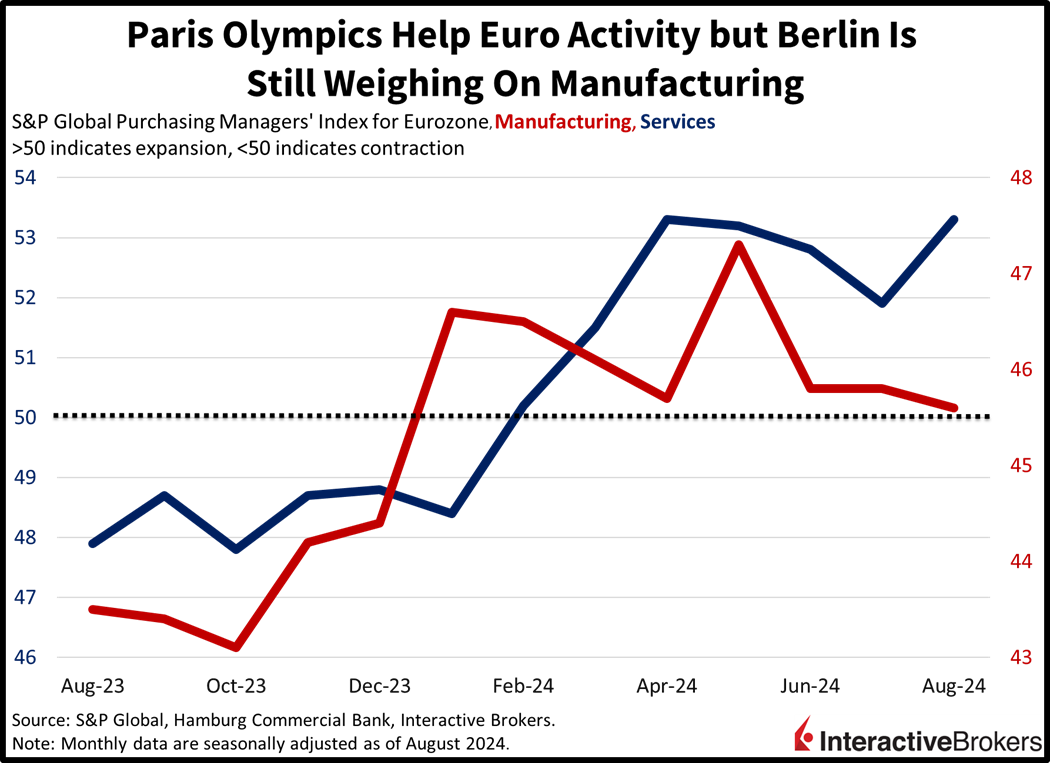

Across the Atlantic, eurozone flash PMIs similarly reflected strength in services but weakness in manufacturing. The PMIs arrived at 53.3 and 45.6, respectively, compared to projections of 51.9 and 45.8. Nonetheless, new orders, employment, and sentiment slipped. And while selling prices weakened, similar to the US, input costs rose. The Paris Olympics helped to propel figures overall, but sluggishness out of Berlin countered the buoyancy from the East. Finally, without fierce services spending due to the games, these figures would likely have been much weaker and are clouding the path down the monetary policy stairs for the European Central Bank.

Home Shoppers Emerge From Interest-Rate Hibernation

Turning to the real estate market, I’ve been calling for a recovery, including when I was interviewed live by Yahoo Finance in New York City last week. I based this outlook, in part, on my view folks are clamoring for the American Dream. The reduction in mortgage rates last month certainly brought in buyers, with the pace of existing home sales rising 1.3% month over month (m/m) to 3.95 million seasonally adjusted annualized units. July’s result was the first increase since February and exceeded expectations of 3.93 million as well as June’s 3.9 million. Inventories also rose to 1.33 million units, up 0.8% m/m as prospective sellers increasingly step in. Across regions, the Northeast, West, and South saw m/m transaction increases of 4.3%, 1.4% and 1.1% while the Midwest was unchanged.

Labor Market is Headwind for Inflation Doves

The anticipated journey down the monetary policy stairs is also slowing due to unemployment claims offering little surprises and coming in well-anchored. Initial unemployment claims climbed slightly to 232,000 from 228,000 for the week ended August 17 and arrived above the median estimate of 230,000. Similarly, continuing unemployment claims rose modestly to 1.863 million from 1.859 million for the week that finished on August 10, but below projections of 1.870 million. Four-week moving averages were bifurcated, however, with the initial segment slipping from 236,750 to 236,000 while continuing filings rose from 1.861 million to 1.866 million.

Consumers Say Bon Voyage to Retailers as They Splurge on Cruises

Increased marketing has helped Urban Outfitters modestly counter the impact of weakening consumer discretionary spending while in big-box discount land, BJ’s has experienced an uptick in store traffic, which has contributed to only subdued revenue growth. In other news, consumers are continuing to splurge on travel while artificial intelligence has helped Zoom Communications retain clients. Those trends surfaced in the following earnings developments:

- Urban Outfitters (URBN), which has retail stores with its namesake brand as well as Anthropologie, Free People and Nully, posted a 6.3% year-over-year (y/y) increase in net sales and a 12% improvement in earnings per sharefor the quarter ended July 31. Both metrics exceeded analyst consensus expectations. However, comparable sales grew only 2%, or less than half the rate of the year-ago period and slower than the company’s internal target, a result of cash register activity at Urban Outfitters branded stores declining at a high single-digit pace. Otherwise, results for other brands were supported by the company increasing its marketing. Last night, CEO Richard Hayne noted that retail sales decelerated in July and the trend hasn’t reversed. Shoppers are showing more discretion when making buying decisions, prompting the company to plan its current quarter with “measured caution,” including keeping inventory lean, potentially lowering prices and increasing advertising. URBN fell more than 14% following the earnings release.

- BJ’s Wholesale Club’s (BJ) earnings exceeded the analyst consensus estimate and jumped 10.4% y/y, but revenue climbed only 4% and missed expectations, causing shares of the company to fall 7% in premarket activity. Despite the miss, BJ’s reported that robust membership, accelerating traffic, unit sales growth, and fast-tracking of its digital business helped support results. BJ’s maintained its previous guidance, including expectations that comparable-store sales excluding gasoline will grow 1% to 2%, which is below the average analyst estimate.

- Viking Cruises’ (VIK) revenue climbed 9.1%, a result of the company expanding capacity and daily spending per cruise passenger growing. Both revenue and earnings exceeded consensus expectations. The company’s outlook points to the post-Covid-19 trend of strong travel demand continuing, with advanced bookings showing consumer resiliency as Viking Cruises’ customers continue to prioritize seeking meaningful experiences, according to Viking Chairman and CEO Torstein Hagen.

- Zoom Communications, (ZM) which has faced the challenge of weakening demand for its internet-based videoconference service due to workers returning to the office following the Covid-19 pandemic, posted earnings and revenue that exceeded expectations. The company’s guidance also surpassed the analyst consensus outlook. For the three-month period ended July 31, revenue climbed 2% y/y, marking the tenth-consecutive quarter in which the metric has weakened. On a positive note, the company’s new products—contact center, Zoom Phone and Workvivo, an employee experience platform—supported results. Zoom also reduced customer churn, a trend it attributes to the addition of artificial intelligence to its products. Prior to the earnings report, Zoom shares declined 18% but have since climbed 1.5%.

Markets Stage an Abrupt Reversal

Yesterday, I called for the possibility of an intraday reversal and we’re getting it roughly 24 hours later. All major equity indices have lost their gains and are now in the red with the Nasdaq Composite, Russell 2000, S&P 500 and Dow Jones Industrial benchmarks flying south by 1.1%, 0.7%, 0.5% and 0.4%. Sectoral breadth is negative with 8 out of 11 sectors losing on the session. Technology, consumer discretionary and communication services are suffering the most with the components down 1.4%, 1%, and 0.4%. Energy, financials and real estate are offsetting some of the pain with upside gains of 0.4%, 0.3% and 0.3%. Treasurys are getting sold aggressively too, with the 2- and 10-year maturities changing hands at 4% and 3.85%, 7 and 5 basis points (bps) heavier on the session. The dollar is taking its cue from rates and running north with its gauge up 32 bps. The greenback is appreciating against all of its major contemporaries, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Commodities are mixed with silver, copper and gold down 1.8%, 1.5% and 1.2%, but crude oil and lumber are up 1.7% and 1.6%. WTI crude oil is trading at $74.18 per barrel, recovering from a four-day losing streak stemming from global demand worries.

Powell Likely to Choose Stairwell Rather than Elevator

Tomorrow’s Jackson Hole presentation has the potential to induce volatility back into the markets. Historically, the Wyoming venue has been a setting for bold monetary policy announcements and pivots, not just your typical Fed meeting. Will Powell allude to a slow walk down the monetary policy stairs or a speedy elevator ride down to the basement? While equity bulls would certainly prefer the former rather than the latter, the seasonals of this market alongside extended valuations point to risk being skewed to the downside. Recall 2022 with its mic-drop moment when Powell came out and really put the marketplace in line with a surprise slider pitch while he was up in the count 1-2. The ball resembled an outside two-seamer only to make it right over the plate and strike out market bulls. Stocks embarked on a freefall into October.

To learn more about ForecastEx, view our recent podcast with CEO David Downey here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.