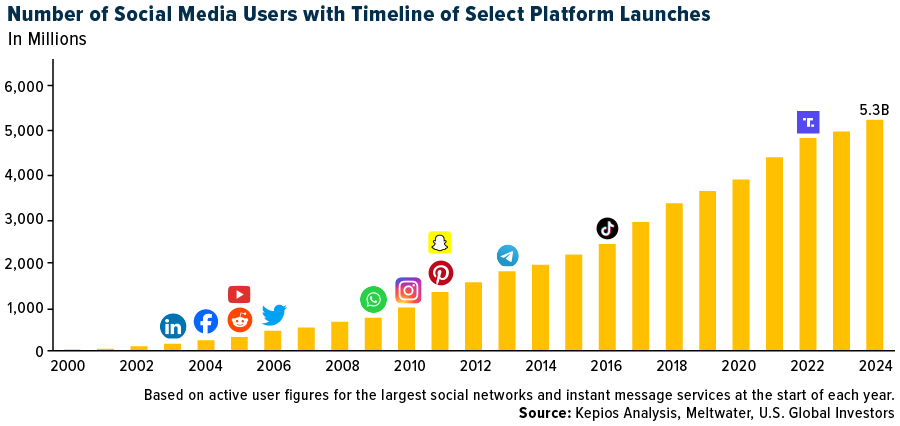

Social media has become the place where many of us spend our time, share our lives and, increasingly, get our news. An estimated 12 billion combined hours are spent every day on these platforms, which now host over 5.3 billion unique “identities” or accounts.

With scaling like that, misinformation can spread like wildfire. We’ve all seen the headlines, the “fake news” and the deepfakes that make you question your own eyes.

For investors, this isn’t just about the latest gossip. Misinformation (information that’s false or inaccurate) and disinformation (fake news deliberately meant to confuse and deceive) can move markets. A recent study showed a correlation between social media interactions and short-term stock market movements.

This isn’t just noise; it’s noise with consequences. Last year, Nationwide Mutual Insurance found that more than a third of non-retired investors aged 18-54 acted on financial information from the internet or social media that turned out to be misleading or incorrect.

Government Overreach in the Age of AI

The rise of artificial intelligence (AI) further complicates matters. We’ve already seen instances of AI-generated images causing market jitters, such as when someone posted fake images of an explosion near the Pentagon last year. As AI technology advances, distinguishing fact from fiction will become increasingly more challenging.

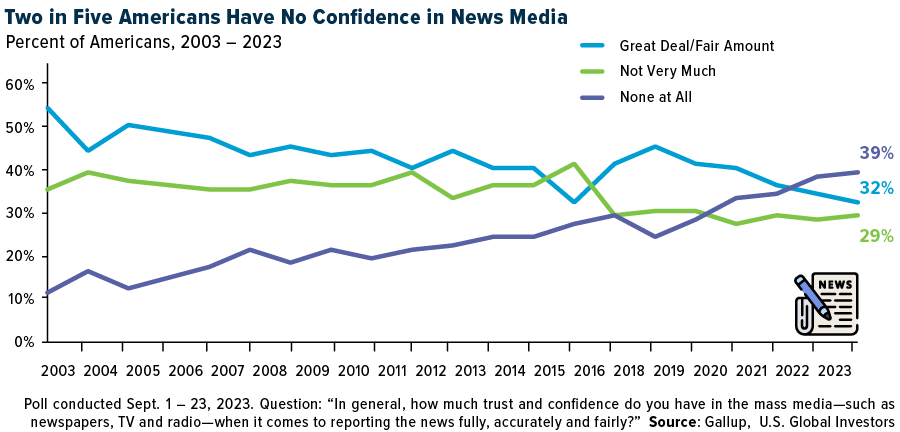

It’s no surprise that Americans are expressing a historic lack of confidence in news media and issuing calls for increased regulation of online content.

However, we must be extremely cautious about how we approach this issue. Governments, in their wisdom or perhaps in their panic, have decided to step in, and they’re not just playing referee… They’re threatening to be the players, coaches and umpires all at once.

Take the recent violence in the United Kingdom. False rumors quickly spread about the identity of the man who allegedly attacked and killed two British girls on July 29, leading to nationwide riots and the arrest of over 1,000 people. So far, two men have been sentenced to months in prison for their activity on social media.

While it’s understandable that authorities want to crack down on those inciting violence, the British government’s threats have, in my opinion, gone too far. London’s police chief has even suggested that American citizens may be extradited from the U.S. to the U.K. to face charges for online comments. This is a dangerous overreach that sets a troubling precedent.

Similarly, the European Union’s warning to Elon Musk about content moderation on X (formerly Twitter) ahead of his interview with former President Donald Trump last week smacked of attempted censorship. I agree that these platforms should have policies against explicitly illegal content, but vague “hate speech” laws are a slippery slope that can easily be abused.

Building a Balanced Information Diet

Here’s my take: Yes, misinformation is a problem. It can contribute to real-world chaos, from market fluctuations to societal unrest. But the solution isn’t to throw the baby out with the bathwater. We need to be smarter, not just louder.

That starts with educating ourselves. In the investment world, we live by “trust, but verify.” It’s time we apply this thinking to our information diet by fact-checking the news as though our portfolios depend on it. And just like our portfolios, it’s important to diversify where we get our news.

Having said that, I believe that if a social platform is going to moderate content, it must do so transparently. Let’s know the rules of the game. Vague threats of “hate speech” without clear definitions? That’s like playing chess where the rules change every move.

Vigilance and Liberty

Benjamin Franklin wisely said that those who would give up their liberties for a little temporary safety deserve neither liberty nor safety. The challenges of being an informed citizen and investor in today’s information landscape are real, but I don’t believe they justify heavy-handed government intervention. Misinformation is a beast, but so is overreach. Let’s stay vigilant, think critically and remember that the free flow of information—even when it’s occasionally messy—is essential for both healthy markets and healthy democracies.

Stay invested, stay informed and most importantly, stay free.

—

Originally Posted August 19, 2024 – The Growing Threat of Government Overreach in Digital Spaces

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.