The September blues are hitting Wall Street today as investors embrace risk-off postures in light of four-consecutive years in which the back-to-school month has dished out equity losses. Moreover, market participants are scooping up stocks in the defensive healthcare, utilities and consumer staples sectors to hide from potential economic turbulence. Treasurys, put options and forecast contracts are also of great interest today, with yields drifting south and volatility levels flying north amidst a pickup in earnings uncertainty. The economic calendar failed to offer support to market bulls, with worse-than-projected contractions from both ISM-Manufacturing and the Census’s Construction Spending reports.

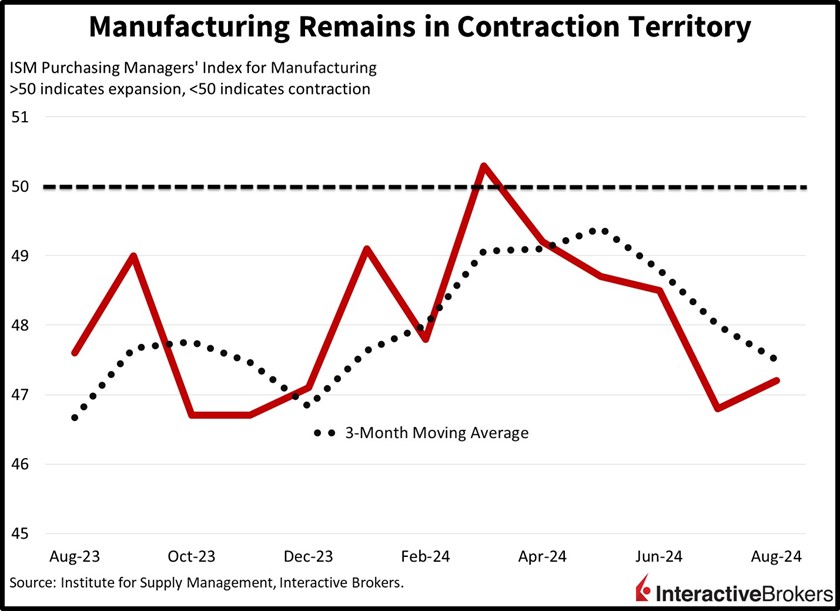

Manufacturing Malaise Continues

Manufacturing activity contracted for the fourth consecutive month in August, according to this morning’s Purchasing Managers’ Index (PMI) from the Institute for Supply Management (ISM). Last month’s score of 47.2 for the manufacturing PMI missed the median estimate of 47.5 but illustrated a softer pace of decline than July’s 46.8. Sluggish ordering activity, employment, production and inventories all arrived beneath the contraction-expansion threshold of 50, with figures of 47.4, 45.9, 44.5 and 43.4. Despite softening demand and hiring, cost pressures didn’t cooperate, with the price component arriving at 52.9, accelerating from the previous period’s 52.1. Finally, while a score below 50 depicts recessionary conditions in the goods producing sector, a score less than 42.5 is more consistent with an overall economic downturn.

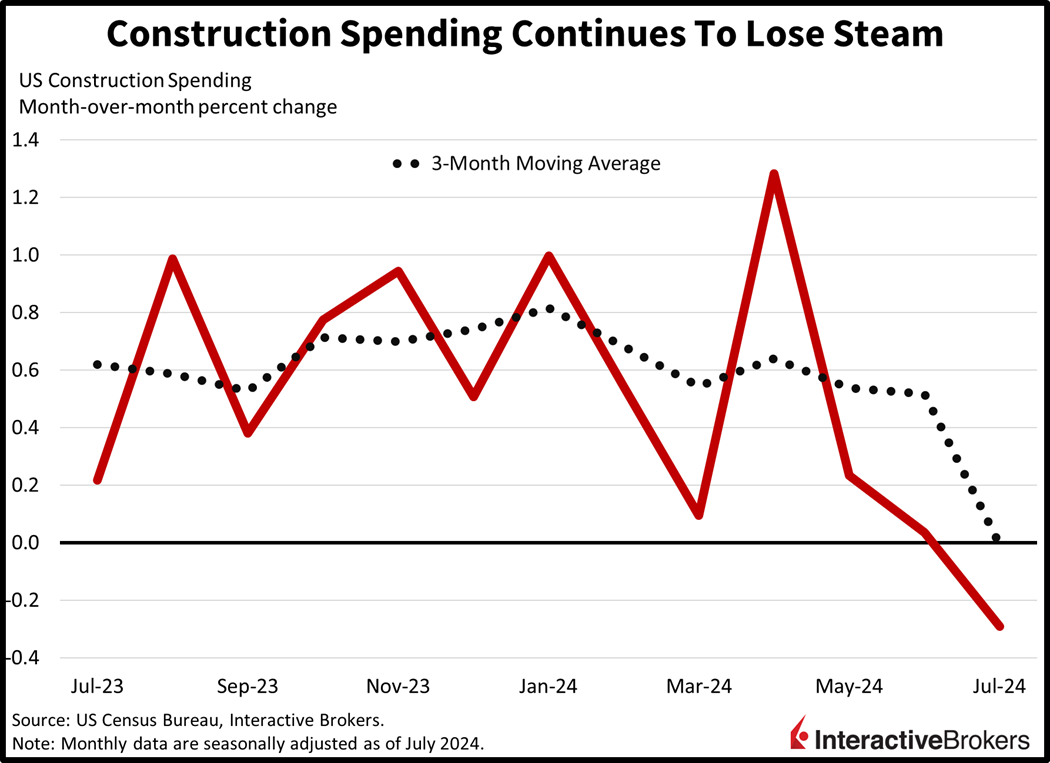

Bulldozers Dozed in July

Construction outlays experienced broad weakness in July as elevated financing costs and stretched affordability took a bite from residential and commercial activity. Spending declined 0.3% despite expectations for a flat number which would’ve matched the former month. On a month-over-month (m/m) basis, the residential and commercial segments decreased 0.4% and 0.2%, respectively. Other categories with significant declines and their noted contractions include the following:

- Religious, 2.2%

- Health Care, 2.0%

- Educational, 0.9%

- Public safety, 0.8%

- Highway and street, 0.8%

- Conservation and development, 0.8%

- Communication, 0.7%

- Lodging, 0.6%

- Amusement and recreation, 0.6%

The following categories along with their m/m change were the only groups to show increases:

- Water supply, 2.0%

- Transportation, 1.4%

- Office, 0.6%

- Sewage and waste disposal, 0.5%

- Manufacturing, 0.1%

Bulls Take a Break as Summer Vacation Ends

The back-to-school season isn’t just producing frowns for some students that wish the summer was just a little bit longer, it’s also dealing investors with losses. We’re seeing heavy selling pressure on Wall Street with all major indices losing on the session. The Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial benchmarks are travelling south by 2.2%, 2.1%, 1.3% and 1%. Sector breadth is awful with the three defensive segments and rent rolls helping to cushion the blow. Indeed, consumer staples, real estate, healthcare and utilities are the sole gainers and are up 0.8%, 0.4%, 0.3% and 0.2%. Leading to the downside are technology, energy and materials, which are falling 3%, 2.5% and 1.6%. Treasurys are catching a bid against the backdrop, however, with the 2- and 10-year maturities changing hands at 3.89% and 3.85%, 4 and 7 basis points (bps) lighter on the session. The dollar is gaining, however, as the Fed and Bank of Japan appear disciplined in engineering monetary policy, with the former institution expected to reduce rates slowly while the latter is open to hiking more if price pressures don’t cooperate. The Dollar Index is up 21 bps as the greenback appreciates relative to most of its counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian dollars. It is depreciating versus the yen, though, and traders around the world are bracing for the possibility of another dramatic unwinding of the yen carry trade. Commodities are getting smoked with crude oil, copper, silver, lumber and gold down 4.6%, 2.9%, 2%, 0.6% and 0.5%. WTI crude is trading at $71.15 per barrel on the back of incoming supply increases from OPEC+ and dismal demand conditions from the globe’s largest oil importer, Beijing.

Volatility Is Likely in the Coming Months

This year’s equity market has been remarkable with investors managing a plethora of headwinds while only stomaching one negative month—April. The rubber may be meeting the road, however, as monetary policy uncertainty coincides with political unknowns. Additionally, the Street is expecting robust profit growth next year, with estimates up in the double digits on a year-over-year percentage basis. Meanwhile, current earnings calls are telling a story of cautious consumers and households that are running out of money before the month is over. Any turbulence in the outlook for the bottom line will certainly generate selling pressures like we’re seeing today. The flip of the coin, however, is that sluggish activity is typically met with liquidity injections, which can stimulate growth and lead to a continuation of bull markets. Finally, IBKR Forecast Traders are looking to capitalize on political quarrels or offer insurance against Washington disputes, with the government shutdown question by September 30 priced at $0.30 for the Yes and $0.68 for the No.

To learn more about Forecast Contracts, please view our recent podcast with Wall Street Veteran and ForecastEx CEO David Downey here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.