Markets were advancing cautiously ahead of tomorrow’s Consumer Price Index, which will give investors the first look at August inflation data. Traders are anxiously awaiting the figures, as the report is likely to influence the tempo and posture of the Fed’s journey down the monetary policy stairs. Meanwhile, the de-inversion of the yield curve has market players nervous, as it has historically pointed to economic downturns around the corner. Still, analysts remain confident that next year’s earnings picture will be buoyant.

All Eyes Are on Inflation

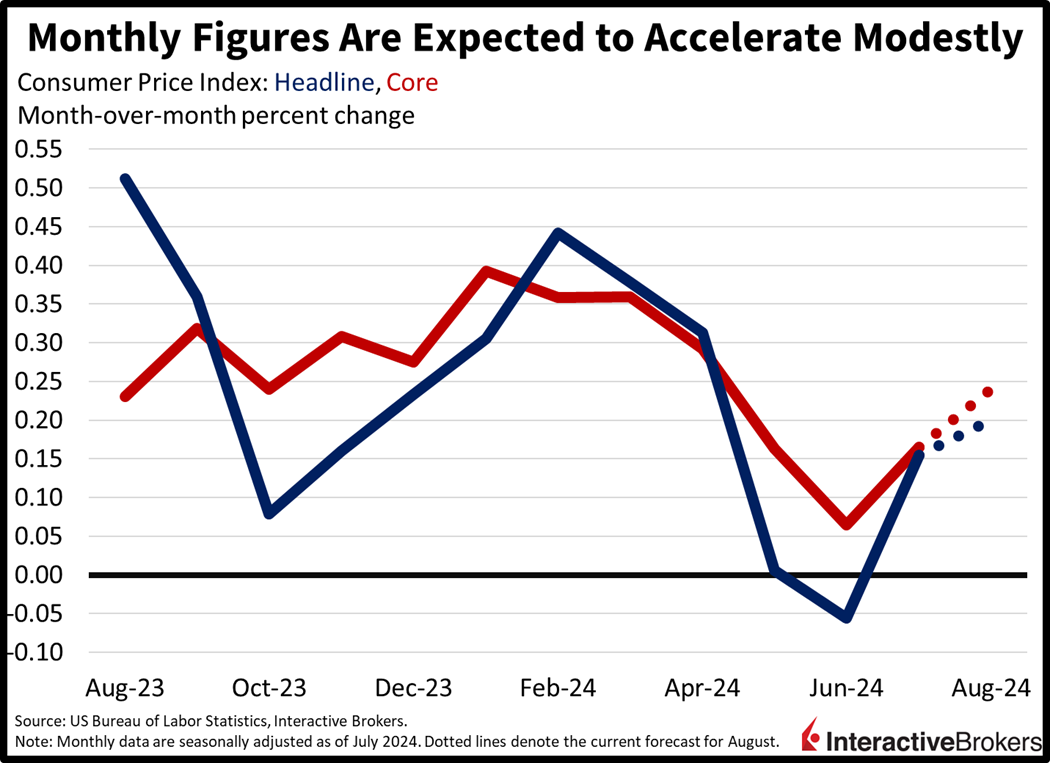

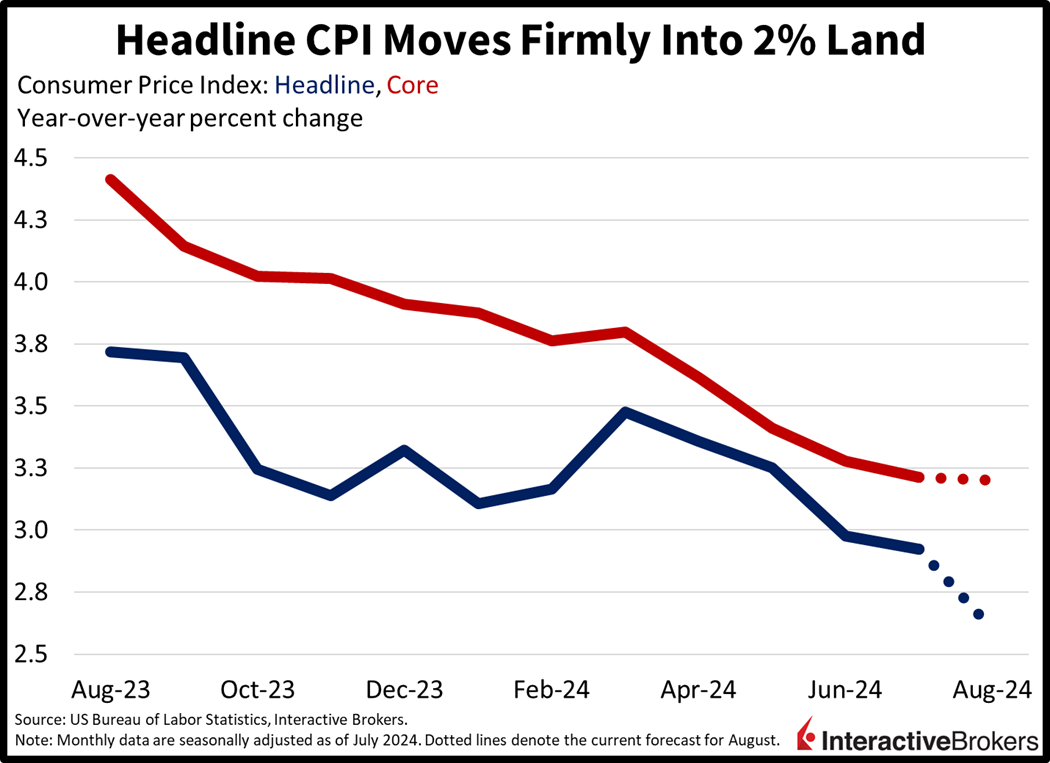

Tomorrow’s Consumer Price Index (CPI) is likely to reflect price increases of 0.2% month over month (m/m) and 2.6% year over year (y/y). Core prices, which exclude food and energy, are seen rising 0.2% m/m and 3.2% y/y. I’m anticipating that shelter, food, medical care and transportation services will support price pressures while costs for gasoline, automobiles and apparel offer relief to households.

Artificial Intelligence Dominates Recent Earnings Calls

Oracle, Skillsoft and Taiwan Semiconductor Manufacturing just reported results that illustrate the growing importance of providing technology and services for artificial intelligence (AI), as illustrated by the following earnings highlights:

- Oracle (ORCL) reported profits and sales that exceeded analyst expectations and said its revenue climbed 8% y/y while earnings per share jumped 19%. Results were fueled, in large part, by increased demand for its cloud services that train AI large language models. Oracle cloud infrastructure products produced the strongest growth, followed by cloud services and license support. In yesterday’s earnings call, CEO Safra Catz said demand is stronger than Oracle’s production capability and the upper range of the company’s guidance for current-quarter revenue surpassed expectations. Oracle shares jumped 13% yesterday.

- Skillsoft, (SKIL) which provides a platform of employee training services for businesses, announced that it launched a product with Microsoft to train individuals to use AI. It also added personalized AI learning experiences. For the second quarter, Skillsoft’s overall revenue declined 6% y/y while its net loss of $40 million increased from $32 million during the same timeframe. In the meantime, the company is restructuring by creating a dual business unit structure, which Executive Chair and Chief Executive Officer Ron Hovsepian says has already started to improve outcomes for the company. Shares of Skillsoft were down more than 14% in early trading.

- Taiwan Semiconductor Manufacturing Co. (TSM) reported this morning that revenue in August climbed 33% y/y, which while below the 45% growth rate for the prior month, still pointed to strong demand for computer chips for AI applications. More than half of the company’s revenues are generated by products that accommodate the technology. Shares of TSMC jumped more than 10% yesterday after the company said its Arizona facility’s production yield, in a trial run, matched the results of its facilities in Taiwan. However, shares declined approximately 2% this morning.

Investors Prep for a Hat-trick of Data

Asset prices are moving modestly north as Wall Street looks forward to market moving data tomorrow, Thursday and Friday. While the CPI is certainly the main event, the subsequent two days will offer the Producer Price Index and Consumer Sentiment, which are also critical for investors’ optimism or caution, the path of the Fed and earnings expectations. Equity indices are mixed against this backdrop, with the Nasdaq Composite and S&P 500 benchmarks gaining 0.5% and 0.2%, while the Russell 2000 and Dow Jones Industrial baskets are both losing 0.3%. Sectoral breadth is positive with 7 out of 11 components gaining. Leaders are comprised of the real estate, technology and consumer discretionary segments. They are up 1.1%, 1% and 0.8%. Conversely, the laggards are represented by financials, energy and materials, which are down 1.6%, 1.5% and 0.1%, respectively. Traders are scooping up fixed-income instruments, with the 2- and 10-year Treasury maturities changing hands at 3.63% and 3.67%, 4 basis points lighter on the session. The dollar is near the flatline, however, with the greenback appreciating against the euro, pound sterling, yuan and Aussie and Canadian dollars. The US currency is depreciating versus the yen and franc though. Commodities are suffering losses for the most part, with crude oil, copper and lumber lower by 4.1%, 1% and 0.5%, but gold and silver are marginally countering the pain with upside of 0.3% and 0.2%. WTI crude is trading at $65.91 per barrel as OPEC+ cuts its demand forecast for the second time in two months, citing weakness in Beijing, the world’s top energy importer. Furthermore, the nation’s increasing reliance on electric vehicles is weighing on the outlook for the critical liquid.

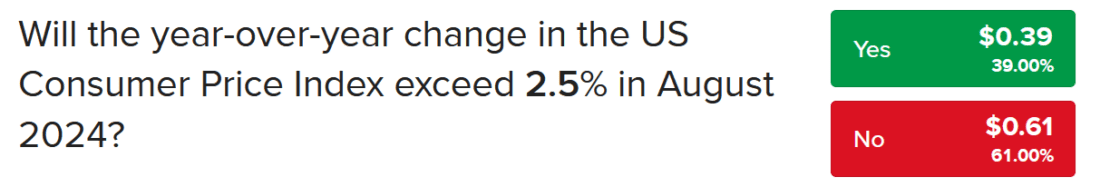

Forecast Traders at Odds Over CPI Consensus

With the Wall Street consensus and I both expecting tomorrow’s CPI to hit 2.6%, an opportunity exists in the brand new IBKR Forecast Trader market. In fact, the over, or Yes, contract on a reading above 2.5% is priced at just $0.39, offering a 156% return to the buyer if the figure arrives in-line with estimates or higher. That is, the buyer of the Yes contract at $0.39 will receive $1.00 if he/she correctly predicts a number above 2.5%, which adds up to a profit of $0.61. Our new market is revolutionary as financial market participants can invest, speculate and hedge using forecast contracts. They can now worry less about how the market will react to the CPI and focus more on getting the forecast right. This is an appealing feature because there have been too many instances of traders forecasting a statistical release accurately, only to see asset prices move in the opposite direction of what would have been expected, or not at all. These cases have sometimes led to smiles being turned upside down.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.