Finally, the long-awaited day arrives. We seemingly have been discussing the potential outcomes for this afternoon’s FOMC meeting for months, not just the six weeks since the last meeting. A cut of some sort is fully priced in; the drama revolves around the 25 vs. 50-basis point soap opera. We’ll finally know the outcome at 2pm EDT today.

My personal view ahead of the meeting is that the Fed should err to the side of caution and cut by only 25bp, even if the market views the larger cut as more likely. I have outlined this viewpoint in various pieces recently (ad nauseum?), most recently yesterday. Those who clamor loudly for aggressive cuts tend to assert that monetary policy is needlessly restrictive. Based on what? The near-record levels of stocks? The plunging bond yields? The general availability of credit for worthy borrowers? Sure, there are impending signs of economic weakness, hence the logic behind a prophylactic 25bp cut, but it is hard to reconcile concerns about recession with expectations for double-digit earnings growth over the coming quarters.

Furthermore, after seven straight up days for the S&P 500 (SPX), I began to become concerned that equity markets have set themselves up for a potential “sell the news” event this afternoon and tomorrow. The FOMC could certainly disappoint markets with a smaller cut, but at this point, I believe that without supporting data from the Summary of Economic Projections or true Goldilocks rhetoric from Chair Powell, investors may have already priced in a rosy outlook that would be difficult to improve upon.

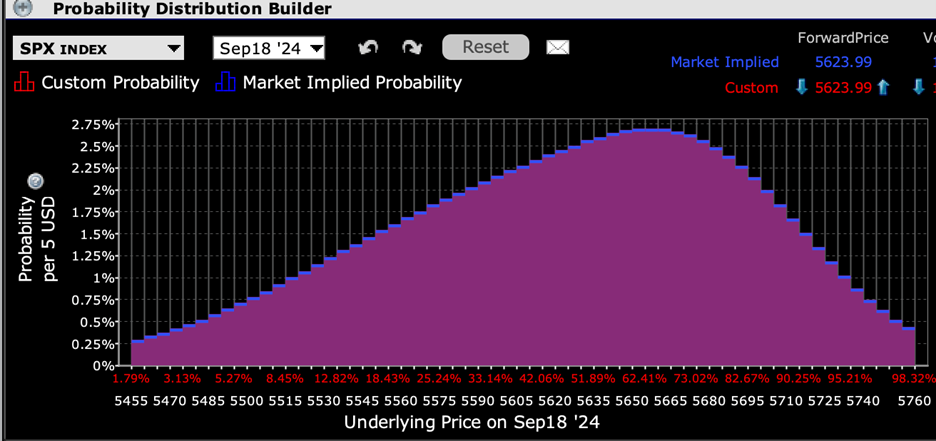

Let’s see if options markets share my concern. Clearly there is some risk aversion priced in, as we see VIX over 19 after printing around 16.70 at this time yesterday. Beginning with the implied probability distribution for SPX options expiring today and Friday (a quarterly expiration, by the way), the answer is “no”:

IBKR Probability Lab for SPX Options Expiring September 18, 2024

Source: Interactive Brokers

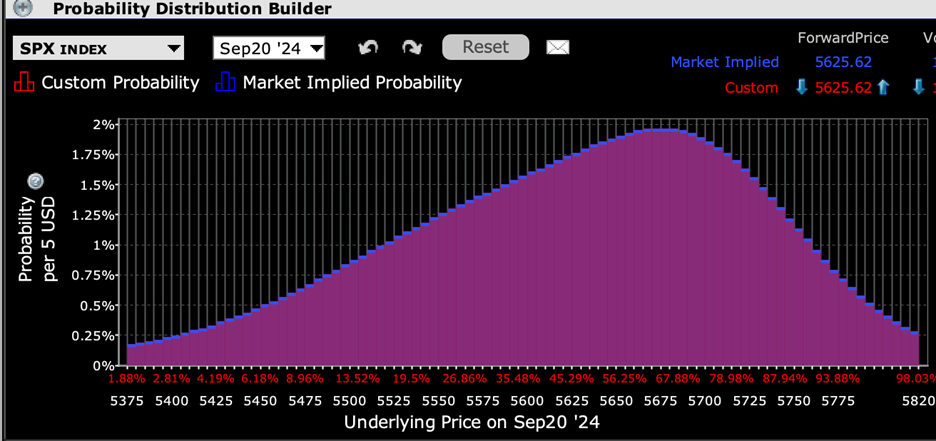

IBKR Probability Lab for SPX Options Expiring September 20, 2024

Source: Interactive Brokers

Both of these show peak probabilities above current levels, about ½% higher for today and about 1% higher for Friday. This is not a market view that is pricing for risk aversion.

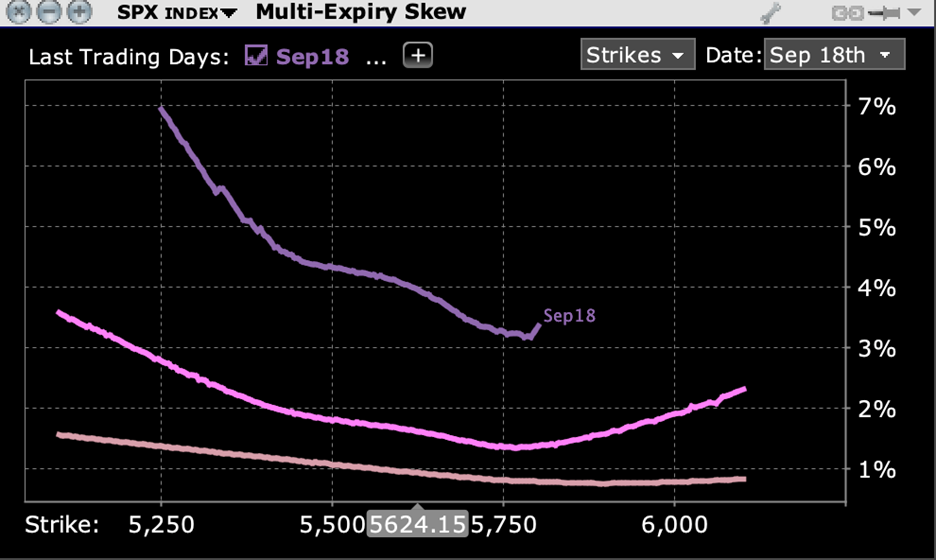

Options skews, on the other hand, do understandably show concern for a more substantial selloff. They are quite steep for today and relatively steep for Friday, at least compared with options that expire on October’s monthly expiration:

Multi-Expiry Skew for SPX Options Expiring Sept 18th (top), Sept 20th (middle), Oct 18th (bottom)

Source: Interactive Brokers

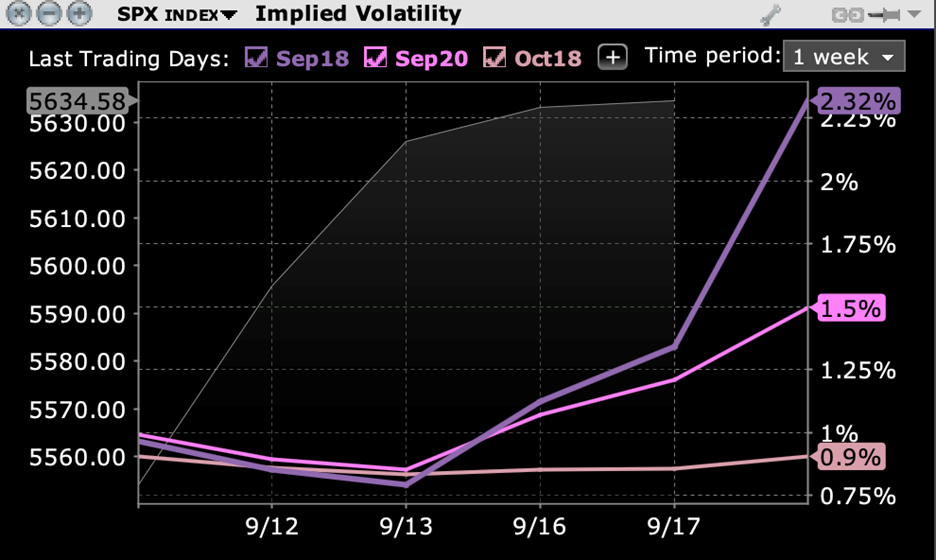

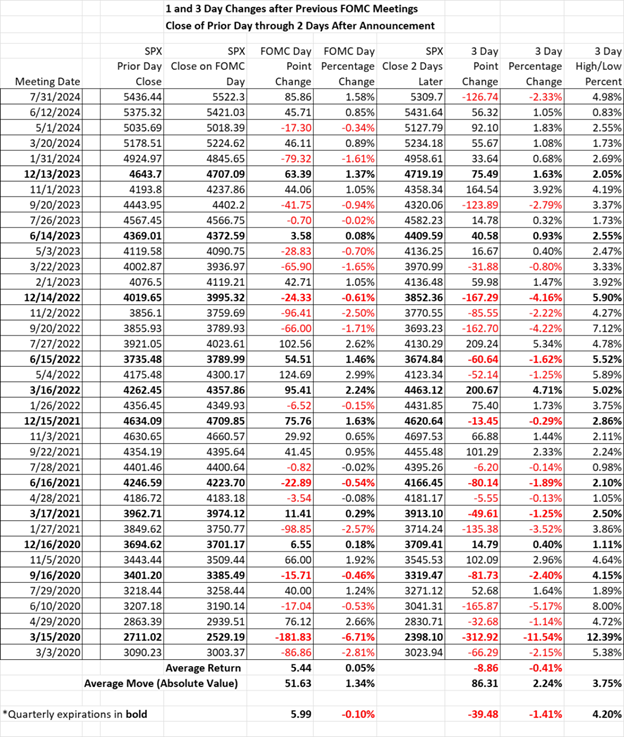

The relatively high levels of near-term implied volatilities do indeed show some concern about significant intraday moves this week. Today’s options imply a daily move of over 3%, while Friday’s options imply daily moves averaging over 1.5%. That is indeed considerable, even in comparison with recent history (see table below). That said, the following chart shows just how dramatically those volatility expectations grew in just the past couple of days:

SPX At-Money Implied Volatilities Over the Past Week for Options Expiring Sept 18th (dark purple), Sept 20th (lighter purple), October 18th (pinkish)

Source: Interactive Brokers

So here we stand: options markets are indeed pricing in the likelihood for a significant move today and for the rest of the week. That is quite understandable when there is virtually no consensus for today’s FOMC’s activity. But with the exception of those who are paying up for 5-10% downside, the majority of traders are still poised for a potential rally after the meeting and press conference. No matter what your expectations might be, this is a day when risk management is key. We can reasonably expect that something might happen to markets this afternoon, but traders should be prepared for a wide range of potential outcomes.

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. “Characteristics and Risks of Standardized Options”

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.