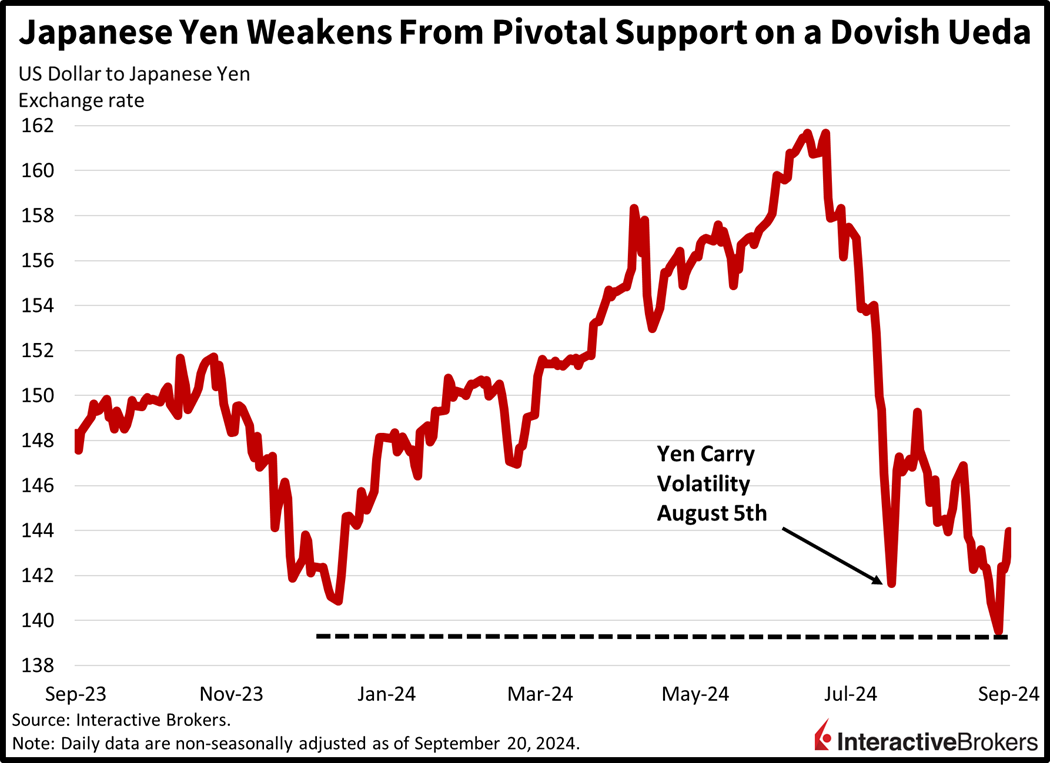

Markets are facing some selling pressure following yesterday’s ferocious risk-on rally which was a day delayed considering the Fed reduced rates by a half-point during the prior trading session. Investors are offloading Treasurys as they wake up and smell the coffee, realizing that the 50 may have been enacted because the institution felt they were late and it’s possible that future trims will follow the traditional quarter-point pace down the monetary policy stairs. Across the Pacific, meanwhile, news that the Bank of Japan acted as expected by keeping its key benchmark unchanged is serving to strengthen the dollar and quell volatility levels. Indeed, the Tokyo tender bounced off key support at 140, with traders relieved that the central bank didn’t dish out a surprise hike like in July.

BoJ Will Hike When Conditions Permit

The Bank of Japan (BoJ) maintained its main borrowing level at 0.25%, the loftiest figure since 2008, as Governor Kazuo Ueda referenced patience along the institution’s stop-and-go march up the monetary policy stairs. Ueda mentioned the need to scrutinize economic growth, consumption trends, inflation developments and wage pressures while confirming that the central bank will not hike amidst market instability. Against the backdrop of measured tightening, however, the institution is expecting price pressures to increase through 2025. In fact, inflation has accelerated for four consecutive months, as rate watchers are responding by penciling in an increase at October’s meeting, which by coincidence ends on spooky Halloween, a few weeks after the beginning of the new Prime Minister’s term. The BoJ is the only major central bank raising at this juncture.

Beijing Surprises by Doing Nothing, For Now

West of Tokyo, the People’s Bank of China unexpectedly left rates steady, despite the nation suffering from a dismal outlook. Decelerating consumer spending, a softening employment market and elevated household and corporate debt loads are weighing on overall sentiment. Furthermore, the shift from globalization to regionalization led by the West, has generated weak export prospects and sluggish manufacturing activity, areas the global trade powerhouse relied on heavily to fuel its economic progress in the past. However, Beijing is expected to release a supportive policy package in the coming days.

Week After September OPEX is Typically Awful

Markets are giving back some of yesterday’s exuberance, with all major stateside equity benchmarks taking losses, yields and the dollar climbing, while utilities stocks and gold notch more all-time highs. The Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial indices are losing 0.9%, 0.8%, 0.5% and 0.3%. Sectoral breath is awful with only the safe-haven and defensive utilities group gaining; it’s up 1.5%. Concurrently, the other 10 sectors are traveling south, led by technology, materials and industrials, which are down 1.1%, 0.9% and 0.9%. Rates and the dollar are higher, in response to a dovish message out of Tokyo and a consideration that if the economy doesn’t fall apart, the Fed is likely to walk down the monetary policy stairs in quarterly increments. The 2- and 10-year Treasury maturities are changing hands at 3.64% and 3.76%, 5 and 4 basis points (bps) heavier on the session. The Dollar Index is up 37 bps as it appreciates versus most of its major counterparts including the euro, pound sterling, franc, yen and Aussie and Canadian dollars. The greenback is depreciating versus the yuan though on Beijing’s surprise pause. Commodities are mixed with gold and silver up 1.3% and 1.2%, copper and crude oil lower by 0.6% and 0.4%, but lumber is near the flatline.

Packed Week Ahead

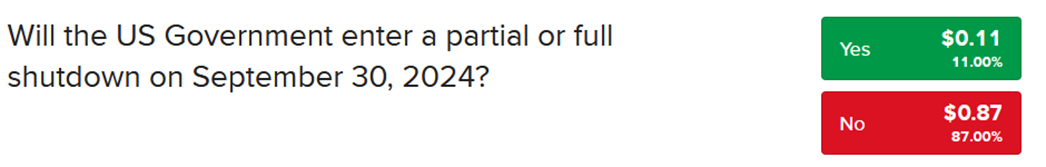

Today’s triple witching trading occurs as we flip the options expiration calendar to October, with the last week of September historically being one of the most bearish from a seasonal perspective. But stocks have defied old norms, with the month delivering gains to investors despite significant risks on the horizon. Top of mind is the upcoming presidential election, just shy of 7 weeks from today with republicans and democrats still in disagreement over a spending bill that must be passed by October 1 to avoid a government shutdown. The IBKR Forecast Trader doesn’t grant high odds of a shutdown, however, with the Yes contract priced at a mere $0.11 (source: ForecastEx). Is a mood shift likely as traders worry about the wide range of political outcomes amidst worries that rate cuts won’t save the exhausted consumer? Maybe, but who dares to stand in front of this buoyant market that seemingly never runs out of buyers? Still, possible danger next week, ladies and gentlemen, may stem from Capitol Hill, dialed back easing expectations and/or inferior seasonals. Finally, the next seven days offer a plethora of central bank speakers, including Powell and Ueda, as well as a packed economic calendar featuring flash PMIs, consumer confidence, new and pending home sales, durable goods, August’s personal income & outlays and more.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.