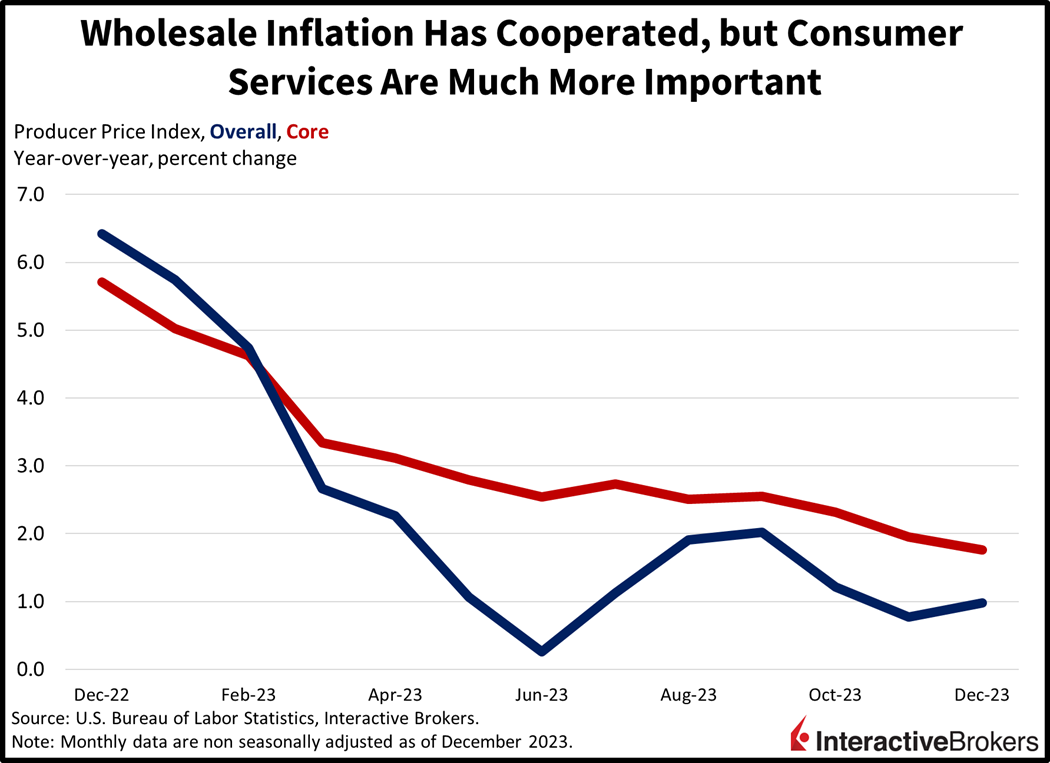

In yet another example of investors becoming increasingly choosy at the data buffet restaurant, players are ignoring yesterday’s hotter-than-expected Consumer Price Index in favor of this morning’s lighter-than-expected Producer Price Index. The problem is that the PPI is much more sensitive to goods and commodities, while the CPI weighs services and labor market dynamics much more heavily. Indeed, the US economy is services oriented and labor intensive, making the CPI a much more useful indicator of inflation trends. Similar to last week’s emphasis on ISM-Services employment while disregarding Job Openings, Unemployment Claims, ADP Jobs and BLS Jobs, the marketplace is placing their focus on yet another data point that supports a rate cut while ignoring a more significant one that bolsters a rate hold.

Wholesale Inflation Reflects Progress

Wholesale prices experienced relief last month on the back of lighter manufacturing demand. The PPI fell 0.1% month-over-month (m/m) while rising 1% year-over-year (y/y), lighter than projections calling for increases of 0.1% and 1.3% and near November’s -0.1% and 0.8%. The core PPI, which excludes food and energy, was unchanged m/m while rising 1.8% y/y, less than expectations of 0.2% and 1.9% and close to the previous month’s 0% and 2%. Price relief was driven primarily by goods, whose prices dropped 0.4% m/m while services prices were unchanged. Prices for energy, foods, trade services, and transportation and warehousing services dropped 1.2%, 0.9%, 0.8% and 0.4% m/m, respectively. The other services category did increase 0.4% during the month, however, driven by a 3.3% m/m increase in prices for securities brokerage, dealing, and investment advice.

Shutdown Odds Increase

Congress is under considerable pressure as the looming threat of a government shutdown rapidly approaches. Speaker Mike Johnson might have to scratch his own bipartisan deal, as he’s under pressure from House budget hawks that don’t like it, adding to the uncertainty surrounding the path lawmakers will take to ensure government funding. The approaching January 19 deadline adds urgency to the situation, making it crucial for a resolution to be reached swiftly.

Middle East Tensions Persist

The US and the UK initiated attacks on Yemen in retaliation to maritime incidents in the Red Sea. The international community’s responses to the strikes on Houthi facilities in Yemen have varied, with Oman in the Middle East expressing disagreement, stating that the actions went against its advice. WTI crude oil was up 3% earlier but has pared most of its sharper gains on concerns of a wider economic slowdown and is now only up 0.3%, or $0.21, to $72.98 per barrel.

Regional Bank Failures Weigh Upon Money Center Earnings

Special charges associated with the regional banking debacle have dinged earnings for some of the nation’s largest financial institutions, according to quarterly reports released this morning. At the same time, JPMorgan’s top executive has warned of a potentially challenging economy in the coming months. Highlight from the reports include the following:

- JPMorgan’s fourth-quarter profit of $9.31 billion, or $3.04 a share, declined 15% from the year-ago quarter. The bank dished out $2.9 billion for a special charge related to uninsured deposits at Silicon Valley Bank and Signature Bank, both of which collapsed early last year. The charge will help replenish the coffers of the Federal Deposit Insurance Corp (FDIC). Without this charge and other one-time expenses, JPMorgan would have produced an earnings per share (EPS) of $3.97, significantly above the analyst expectation of $3.35 a share. Revenue of $38.57 billion climbed 12% y/y but missed the analyst expectation of $39.73 billion. Despite the miss, consumer banking revenue climbed 15%, a result of home lending revenue increasing following the acquisition of First Republic last year. The bank’s credit card transactions climbed 8% and credit card loans increased 14%, illustrating that households are still relying on credit card debt. In a related matter, JPMorgan Chief Executive Officer Jamie Dimon cautioned the economy faces numerous headwinds. Inflation is likely to be stronger than anticipated with the economy being fueled by deficit spending and stimulus. Furthermore, the transition to a green economy, improvements to supply chains, military spending and healthcare costs are likely to increase demand for government spending.

- Citibank announced it will eliminate 20,000 positions to slash up to $2.5 billion in expenses. Additional measures will result in eliminating up to $53 billion in expenses in the medium term. The announcement accompanied Citigroup reporting that it suffered from a fourth-quarter $1.8 billion loss, or $1.16 a share. The loss includes various one-time expenses, such as a $780 million charge tied to the severance and a $1.7 billion charge to shore up the FDIC. Without these charges, Citi would have produced an EPS of $0.84. Analysts anticipated an EPS of $0.10. The bank’s $17.4 billion in revenue declined 3% y/y, a result, in part because of losses associated with Argentina’s peso devaluation and divestitures and missed the analyst expectation of $18.7 billion. The company’s wealth management area experienced a 3% decline in revenues, driven by lower spreads on deposits.

- Bank of America’s EPS of $0.70, not including one-time charges, beat the analyst consensus expectation of $0.68. The bank took a $1.6 billion charge for moving away from using the London Interbank Interest Rate in certain commercial loan contracts. It also took a charge of $2.1 billion for replenishing the FDIC account. The bank also saw debt that is unlikely to be recovered increase from $931 million to $1.2 billion quarter-over-quarter. Chief Financial Officer Alastair Borthwick maintains that the economy is likely to benefit from consumer spending because household finances are supported by a tight labor market.

March Cut Odds Rise

Markets are mixed today with a light PPI report supporting optimism for a Fed rate cut and offsetting cautious earnings commentary from the banks amidst continued escalation in the Middle East conflict. Equities are generally lower while bond yields are shifting in bull-steepening fashion. For equities, the cyclically tilted Dow Jones Industrial and Russell 2000 indices are down 0.5% and 0.1%, respectively, while the Nasdaq Composite and S&P 500 are up 0.1% each. Sectoral breadth is split with communication services (+0.7%) and energy (+0.5%) leading the gainers while consumer discretionary (-0.8%) and health care (-0.4%) decline the most. In fixed-income land, the 2- and 10-year Treasuries are experiencing yield declines of 10 and 1 basis points (bps) as the instruments trade at 4.15% and 3.95%. The dollar is roughly unchanged with the US currency gaining against the yuan, pound sterling, and euro while declining relative to the franc, yen and Aussie and Canadian dollars.

Earnings Season is Pivotal

With cyclicals and technology shares near all-time highs, earnings reports next week are likely to significantly impact investor sentiment. Today’s commentary from the banks intensified fears of a global economic slowdown, while the manufacturing sensitive PPI came in significantly below expectations. Furthermore, the sharp bull-steepening across the yield curve is narrowing the gap between the 2- and 10-year Treasury maturities, a pattern that is worrisome if it continues. The rapid de-inversion of the yield curve often precedes risk-off shifts in markets. The spread between the two instruments was as low as 108 bps in July, but it has increased to a mere 20 bps and may be signaling economic volatility ahead.

Visit Traders’ Academy to Learn More About the Producer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.