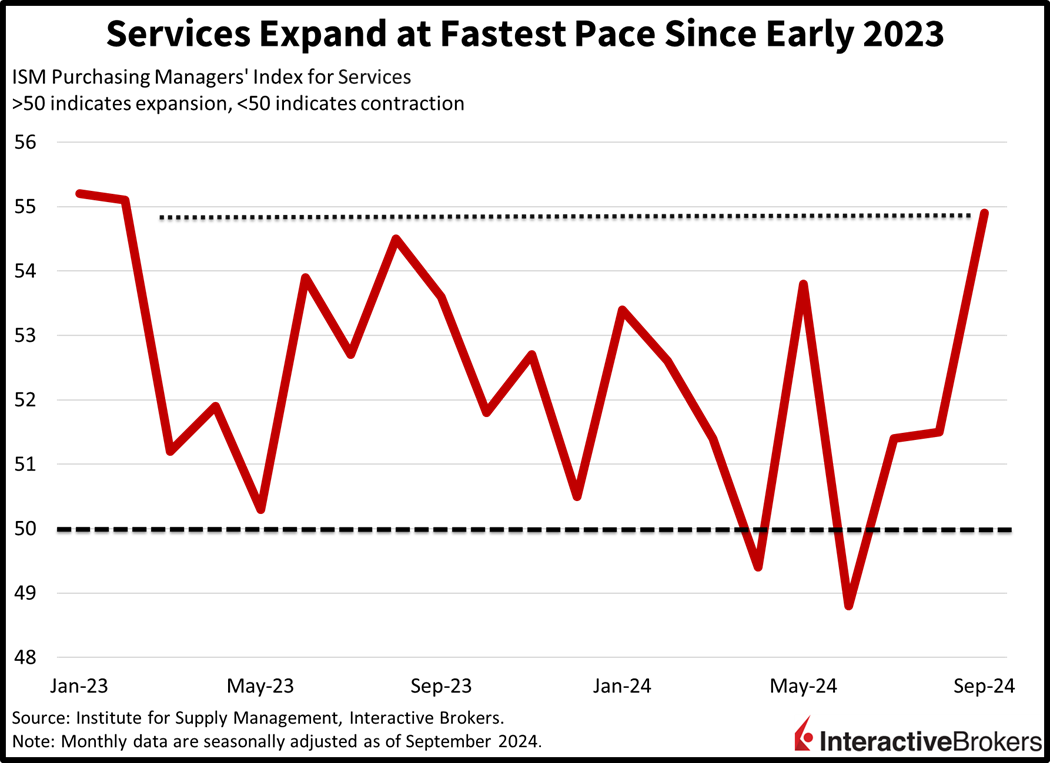

Intensifying geopolitical hostilities have investors reaching for their risk-off playbook, but scorching US economic data and continued labor disputes on the East and Gulf coasts are serving to cloud the outlook, sending yields north. Market participants are awaiting another violent response in the Middle East while bidding up crude oil futures, energy and utilities stocks and equity index pullback insurance as a result. Meanwhile, rates are jumping due to an unresolved port situation and this morning’s huge upside beat on ISM-services, which notched its hottest level in 19 months while the pivotal prices paid component rose to its loftiest height since January. Subdued unemployment claims released earlier also served to temper recession fears together with the ISM, pushing back on Fed rate cut projections but bumping up inflation expectations.

Servicers Report Robust Sales, Weak Hiring

A pullback in headcounts didn’t stop servicers from fulfilling increasingly thick order books, with this morning’s Purchasing Managers’ Index for Services from the Institute of Supply Management (ISM) rising to its highest figure since February 2023. September’s result of 54.9 trounced expectations of 51.7 as well as August’s 51.5, driven by sharp increases in demand and business activity. Indeed, the new orders and production components rose to 59.4 and 59.9, but firms did have to raise charges, with the prices paid segment accelerating to 59.4. Employment did offset some of the positivity; however, coming in at 48.1, as uncertainty in the political arena has kept the lid on recruiting efforts.

Little Hiring, Little Firing

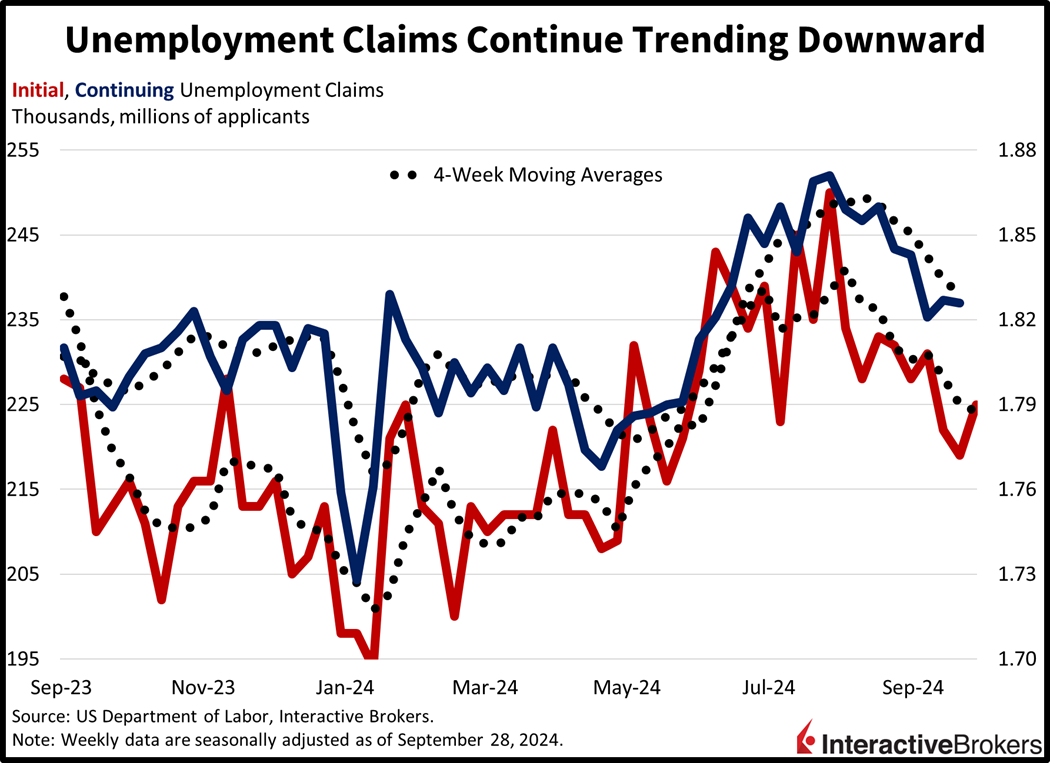

Firms are certainly reducing their rates of hiring, but they have avoided large-scale firings so far this cycle. The weekly unemployment report reflected continued strength in the labor market, with initial claims coming in at 225,000 for the week ended September 28, slightly above the median estimate of 220,000 and the previous week’s 219,000. Furthermore, continuing claims arrived at 1.826 million for the week closing on September 21, essentially unchanged from the prior period’s 1.827 million. Four-week moving average trends ticked south on both fronts, from 225,000 and 1.834 million to 224,250 and 1.829 million.

Geopolitics, Ports Weigh on Stocks

Markets are mixed as investors navigate an uncertain landscape in the Middle East and in Washington while they are also patiently awaiting tomorrow’s payroll jobs Friday. This month has been a down one for equities so far, but market bulls are trying to turn it around similar to how they successfully reversed what was a negative September. Stocks are continuing to pare some of last month’s gains today, with all major stateside indices lighter on the session. The Russell 2000, Dow Jones Industrial, S&P 500 and Nasdaq 100 are suffering losses of 0.8%, 0.6%, 0.3%, and 0.2%. Sectoral breadth is also negative with 8 out of 11 industries lower, weighed down by consumer discretionary, materials and real estate, which are all losing 1.1%. But traders are scooping up names in the energy, technology and utilities spaces, with those areas up 0.8%, 0.5%, and 0.1%.

Inflationary Signals Send Yields North

Yields, the greenback and certain commodities are rising in response to a tricky Middle East situation and resurfacing concerns about price pressures on the back of ISM-Services and a lack of progress at the ports. Treasurys are being sold with the 2- and 10-year maturities changing hands at 3.69% and 3.83%, 4 basis points (bps) heavier on the session. The Dollar Index is taking its cue from rising rates and stronger economic performance on a relative basis. The gauge of the US currency is up 44 bps as it gains versus all of its major counterparts including the euro, pound sterling, franc, yen, and Aussie and Canadian tenders. Commodities are mostly higher, with crude oil, silver and lumber up 2.7%, 1.1%, and 0.3%, while copper is down 2.7%, and gold remains near its flatline. WTI crude changed hands at $73.92 per barrel today, its highest level since September 3.

Hedge Elections Outcomes Today!

October has been a weaker month for stock bulls with conditions worsening in the Middle East and at the ports. And while rising hostilities could have been expected by some market participants, the crisis on the coasts took many, including myself, by surprise. These events are occurring just as folks are hedging and speculating for tomorrow’s nonfarm payrolls report, with IBKR Forecast Trader participants expecting a figure north of 147,000, while the median estimate is somewhat under at 140,000. I’ve revised my estimate up a bit to 85,000, as I’m anticipating a sizable downside miss. Finally, our IBKR Forecast Trader will begin to list contracts for the 2024 elections today at 5:15 pm ET, enabling investors to hedge the outcome of this specific, major event. The top of mind one, of course, will be Harris or Trump? But other contracts addressing significant election questions will be listed, such as will there be a blue sweep, red sweep, split congress, as well as specific senatorial races and more!

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.