A year ago, I shared with you my thoughts on the immigration crisis, both here in the U.S. and Europe. At the time, there was speculation that international bad actors may be at least partially to blame for the record numbers of immigrants pouring across the U.S. Southern Border and arriving by boat in Southern Europe. Below is an update to the story.

Immigration is once again making headlines (has it ever stopped?), and it’s not just the sheer numbers that have people talking. Concerns about mass immigration—both legal and illegal—have dominated political and economic conversations in the U.S. and Europe.

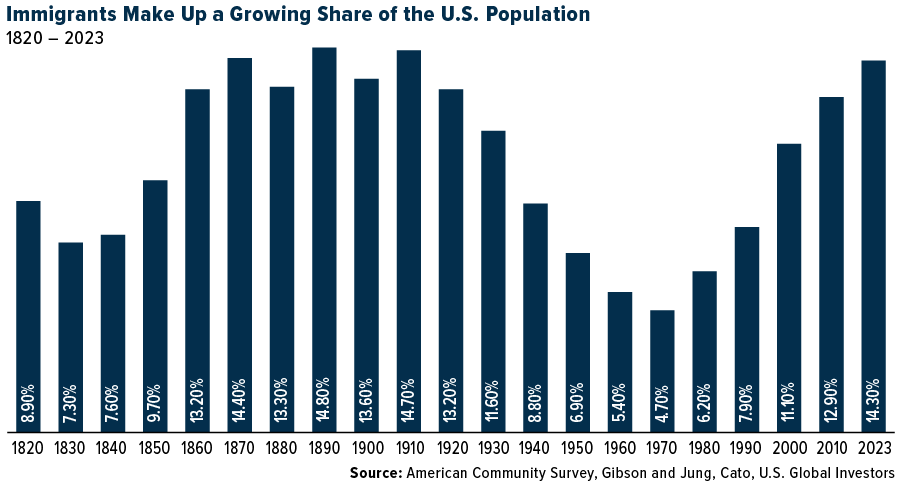

Although the number of migrants crossing into the U.S. has eased significantly in the past 12 months, the underlying challenges remain. The Center for Immigration Studies estimates that the undocumented immigrant population in the U.S. stands at 14 million, a huge increase from just a few years ago. The share of foreign-born residents is now over 14% of the total population, its highest level since the early 1900s, when waves of immigrants came from Italy, Poland and elsewhere.

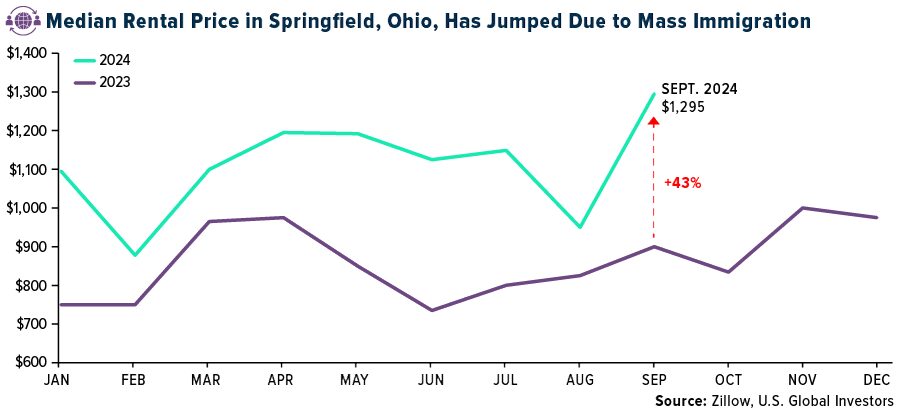

Springfield’s Skyrocketing Rents

Today, the new arrivals are straining resources in ways that directly impact the American taxpayer and investor alike.

Let’s take Springfield, Ohio, as a microcosm of what’s happening across the country. You’ve probably heard that this town of 58,000 has recently seen a large influx of Haitian asylum seekers, leading to skyrocketing housing costs and a sharp rise in the cost of living. The median rental price in Springfield jumped 43% in just one year, according to Zillow. Locals are feeling the pinch at the pump and the grocery store as inflation ripples through their economy.

It’s not just prices that are going up. Health care providers are stretched thin, as more translation services and additional staff are needed to accommodate the growing population. In September, Ohio Governor Mike DeWine announced $2.5 million in state support for Springfield, but the burden on local taxpayers is undeniable.

We’re seeing similar stories play out across the U.S. as towns and cities grapple with the surge of new arrivals. In New York City, Mayor Eric Adams, recently indicted on federal corruption charges, reported last summer that the city expected to spend $12 billion over the next three years on housing, food and health care for recently arrived immigrants. To cover these costs, the city plans to cut services across the board—sanitation, public education, even the police force. The fiscal strain is real, and it’s hitting Americans where it hurts most.

Immigration Is Testing Europe’s Social Welfare Spending

What’s happening in the U.S. is mirrored on a much larger scale across Europe. Over the past decade, 29 million immigrants—both legal and illegal—have poured into the region, overwhelming an already dysfunctional immigration system. Concerns about public safety and inadequate integration policies have led to widespread public unrest. Just look at the riots in the U.K., where immigration has emerged as a defining issue.

Investors should be paying close attention. Western Europe, traditionally known for its social safety nets and generous welfare systems, is struggling to accommodate this massive population influx. Europe’s current situation is a reminder that unchecked migration, without the proper systems in place, can lead to long-term fiscal challenges.

Legal Immigration As A Solution To Shrinking Fertility Rates

Having said all that, it’s important to recognize the value of legal immigration. With fertility rates having fallen well below the replacement level—or 2.1 children per woman—the U.S. and Europe face the prospect of near-zero population growth. Legal immigrants, then, play an essential role in maintaining productivity and supporting programs like Social Security.

The hard truth is that the U.S. and Europe face declining populations and a shrinking tax base. I believe the solution lies in smart, sustainable immigration policies—ones that emphasize legal pathways and prioritize integration.

—

Originally Posted September 30, 2024 – The Fiscal Impact Of Mass Immigration On U.S. And European Taxpayers

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.