Your Weekly Roadmap with Jay Woods, CMT

1/ Economic Data – CPI, PPI

2/ FOMC Minutes

3/ Earnings Season Begins

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Economic Data – CPI, PPI

Traders will be focused on the instant classic of a series between the Phillies and Mets. Add in the Yankees and Royals and the floor will be buzzing with chatter. However, seeing this is a newsletter about the markets, let’s focus there.

There are 29 days until the Presidential election. Yet, none of the market’s focus this week will be on that important date. I will continue to say the market doesn’t care about your politics, but it does care about economic data and those that drive it.

This week we will get the first CPI and PPI numbers since the 50-basis point rate cut, plus a deep look into what exactly went on behind closed doors at the most recent Fed meeting.

If that wasn’t enough, on Thursday Elon Musk will preside over the much anticipated Tesla event – the debut the Robotaxi and his vision of autonomous driving. Lastly, this Friday is the official kick-off to earnings season.

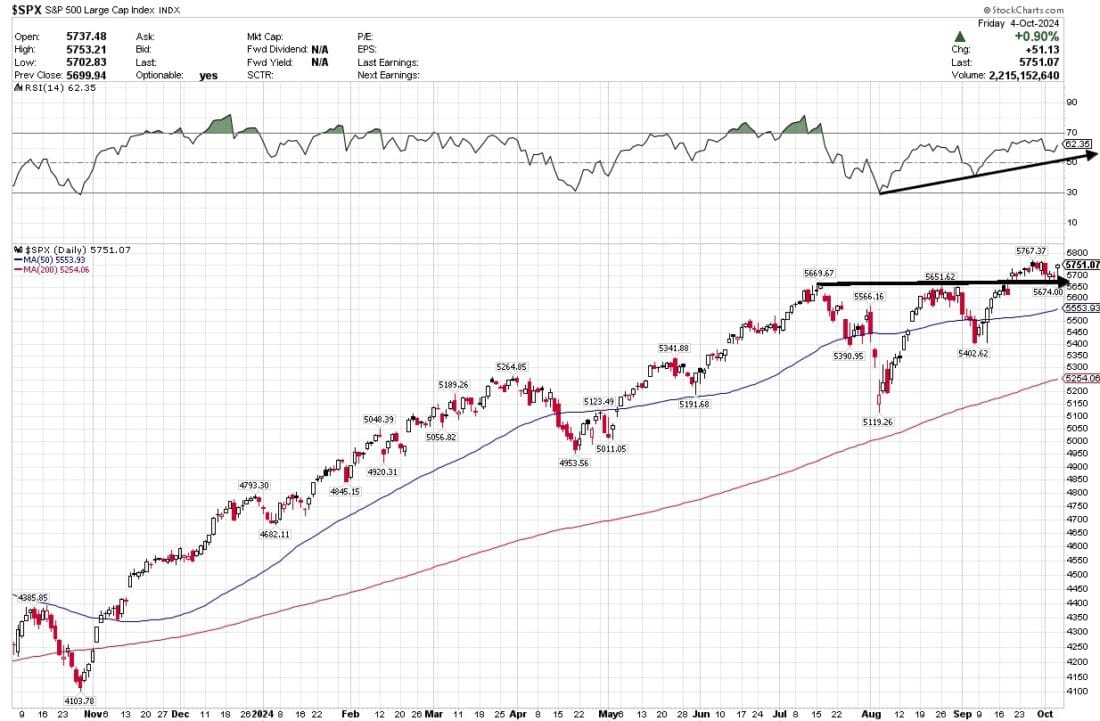

Technically speaking the S&P 500 tested and held a key technical level we discussed over the last few weeks. It sold off to 5650 which was the breakout level in September. That old resistance level acted as support and the index bounced higher.

Also confirming the move was the RSI which continues to make higher lows and has yet to reach overbought territory indicating the trend is still intact and there is room to move higher.

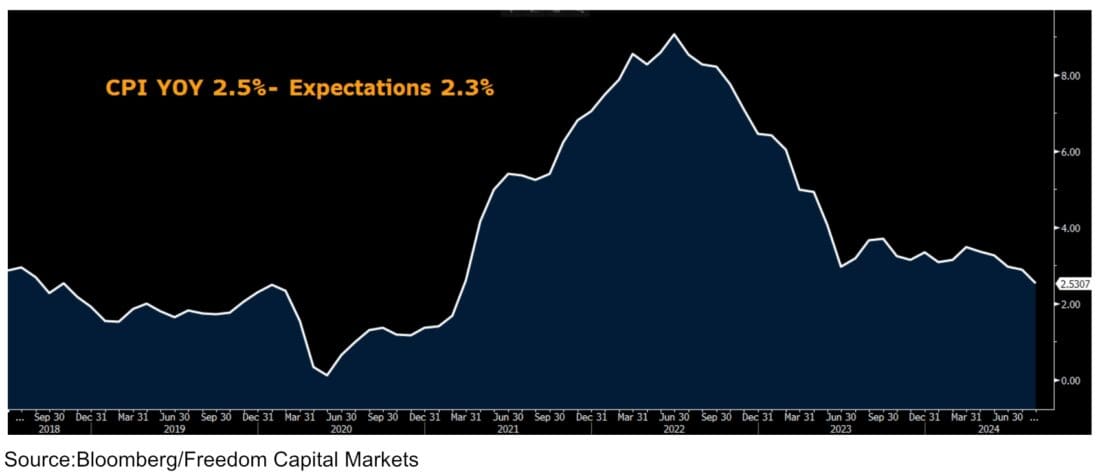

CPI data will be released at 8:30 this Thursday. It continues to trend lower towards the Fed’s desired 2% goal. This month expectations are for numbers to sink to its lowest levels since early 2021.

Recent CPI data has continued to meet economists expectations, but when numbers surprise, markets respond with added volatility. Numbers in-line may lower the odds of any rate cut at the next meeting. Numbers higher and expect market volatility to increase as many will question that cuts are having an inverse effect on inflation.

2/

FOMC Minutes

For years the minutes from the previous FOMC meeting have been a non-event. That has changed recently. The prior meeting minutes came after there was no cut but they showed that the decision was more heated than the unanimous vote to leave rates unchanged really was.

The minutes will give us a better peek of the debate behind the scenes when they finally decided to cut by 50 basis-points. This rate cut was by a surprising ½ point and had one dissenting vote on the record. That in itself is a rarity. In a Jerome Powell led Fed, a dissenting vote speaks volumes.

There was clearly a divide in the room and the minutes may give investors more clarity as to why they decided 50 over 25 and if there are bigger issues to be concerned about as they continue to fight inflation without upsetting the labor market.

Not only will we get the minutes of the last meeting but we will get many Fed speakers throughout the week. Let’s see if we get new comments about recent unemployment data and thoughts on pending economic news.

3/

Tesla Event

On October 10th, Elon Musk will host one of his most anticipated events ever when he debuts the robotaxi. The design and reveal of its autonomous driving features have been discussed and hyped for roughly a decade.

Will Elon Musk deliver or is this more hype? There have been so many questions about his full self-driving auto and investors want this event to deliver on more substance.

Last week shares tumbled -4% despite posting a year-over-year sales increase. The electric vehicle maker narrowly missed analyst delivery estimates causing the pullback.

Going into the news, shares of Tesla had rallied as much as 35% over the last eight weeks. Shares are now up less than 1% for the year, severely underperforming the S&P 500.

4/

Earnings Season Begins

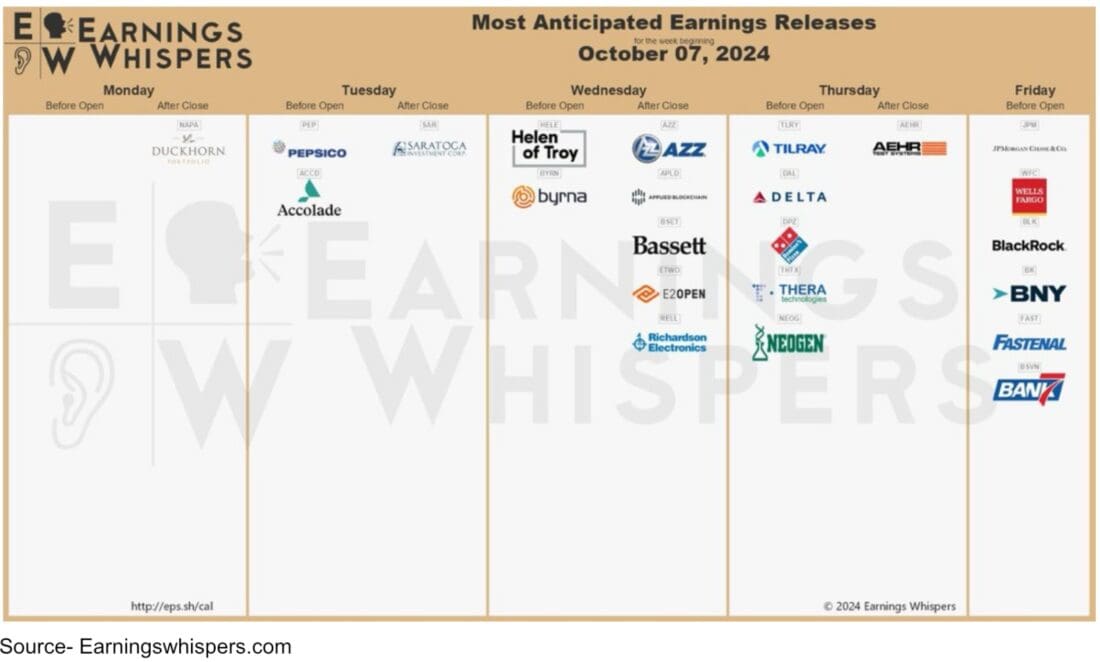

We officially kick-off Q3 earnings season when the financials start reporting on Friday. We highlight JPM, but keep an eye on other banking giants in Citi, Wells Fargo and BNY Mellon.

—

Originally posted 7th October 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.