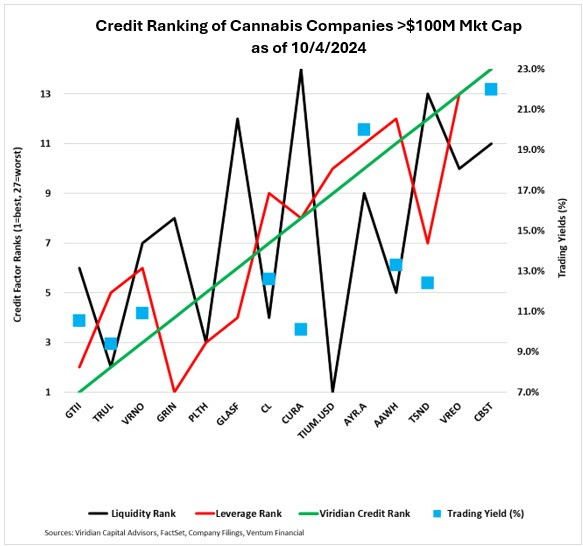

As Florida’s pivotal vote on recreational cannabis looms, investors are eyeing key opportunities in the market. The Viridian Credit Tracker ranks AYR Wellness AYRWF as a strong buy, with a compelling 20% yield driven by its significant presence in Florida’s cannabis market. With the potential for Florida voters to approve recreational use, AYR stands to gain considerably, making it a prime target for investors before the vote.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

AYR Wellness Offers 20% Yield: Capitalize on Florida’s Potential Vote

According to the Viridian Credit Tracker from Viridian Capital Advisors, AYR’s exposure to Florida’s market gives it a unique advantage ahead of the state’s potential legalization of recreational cannabis.

With a 20% trading yield, AYR outpaces many of its competitors. If Florida approves recreational cannabis, AYR’s valuation could see a substantial boost, making this stock a strategic buy for investors ahead of the vote.

Cresco Labs vs. Curaleaf: A 250 Basis Point Difference

Another suggested pair trade from the report is to buy Cresco Labs CRLBF at a 12.6% yield and sell Curaleaf CURLF at 10.1%. This trade offers investors a 250 basis point yield upgrade, backed by Cresco’s solid financials and credit improvement. Investors looking for higher returns and credit strength should consider this opportunity.

Read Also: EXCLUSIVE: 80% Growth Despite The Chaos: How Dutchie, C3 Defy 2024’s Cannabis Slump

TerrAscend: Why 12% Yield Might Not Be Enough

In contrast, TerrAscend TRSSF, which offers a 12% yield, is recommended as a sell. While TerrAscend remains a significant player in the cannabis industry, its lower yield and reduced exposure to Florida’s growth potential make it less appealing compared to AYR.

Cannabist Faces Liquidity Challenges

Despite the attractive spreads among top stocks, Cannabist CCHWF ranks as the weakest credit in the group, largely due to liquidity concerns following recent asset sales. Investors should note that Cannabist’s lower credit rating may limit its near-term upside despite potential improvements in the future.

Take Action Now: Florida’s Vote Could Change the Game

With Florida’s cannabis market potentially expanding, investors looking to maximize gains should consider this pair trade: buy AYR at 20%, sell TerrAscend at 12%, and look into Cresco Labs at 12.6% versus Curaleaf at 10.1%. The vote could transform the landscape for cannabis stocks, and taking action before this pivotal event could provide substantial returns.

Read Next: SEC Charges ‘Magic Mushroom’ Co. Minerco In $8M Pump-And-Dump Scheme

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.