Markets are facing heavy selling pressure today on the back of lackluster big-tech earnings from Magnificent 7 members Microsoft and Meta. Additionally, talk on the street of delisting AI darling Super Micro Computer due to accounting and integrity irregularities is also weighing on overall tech sentiment. Meanwhile, the economic calendar featured lighter-than-expected unemployment claims, stronger-than-projected consumer spending and EU inflation that arrived slightly higher-than-estimated. Bond yields are taking a break from their recent drift north, as investors unload stocks in favor of fixed-income instruments.

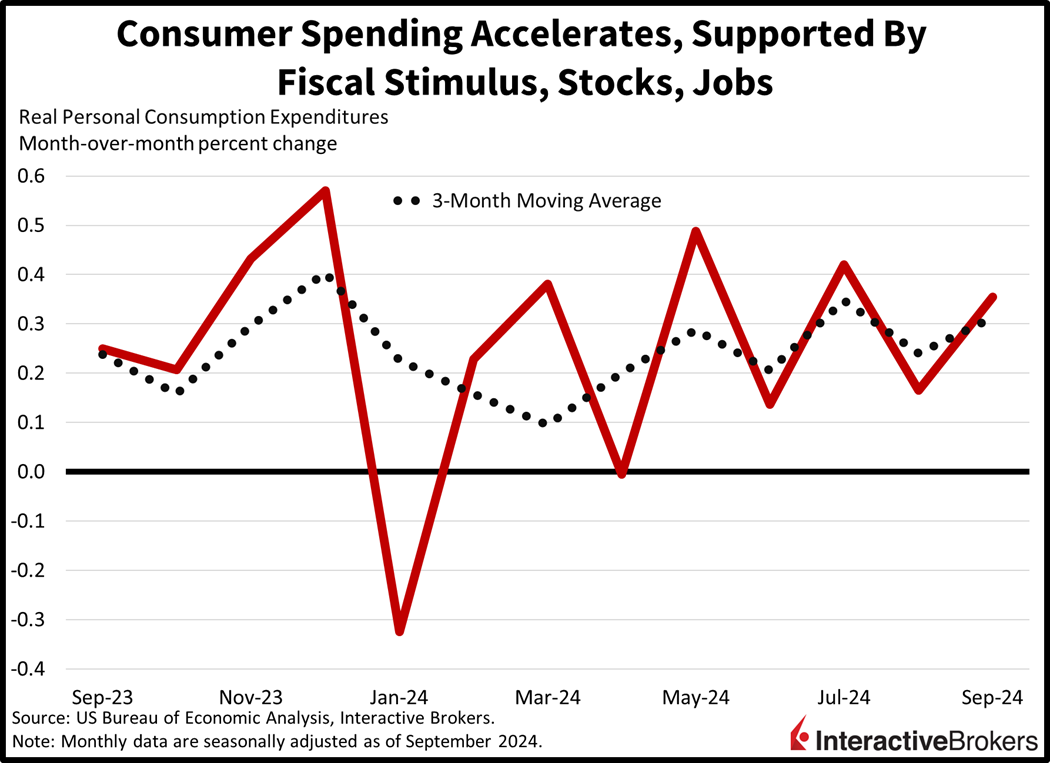

Consumer Spending Accelerates Sharply

This morning’s Personal Income and Outlays Report from the US Bureau of Economic Analysis depicted accelerating consumer spending and tempered inflation in September. The pace of consumption rose 0.5% month over month (m/m), beating the 0.4% expectation and the 0.2% rate from the prior month. Consumption was driven by goods with the rate of volumes rising 0.7% m/m as services spending slowed slightly to 0.2% during the period. Amongst products, nondurables advanced 0.8% while durables grew 0.4%.

The PCE Price indices rose 0.2% m/m and 2.1% for headline and 0.3% m/m and 2.7% for core, generally in-line with expectations. The previous month’s figures came in at 0.1% and 2.3% for headline and 0.3% and 2.7% for core. In September, prices for goods declined 0.1% while costs for services increased 0.3%. Food charges rose 0.4% while energy costs increased 2%.

Unemployment Claims Ease

This morning’s unemployment claims data came in hotter than expected with employers holding off on firing workers. Initial unemployment claims during the week ended Oct. 26 fell from 228,000 to 216,000 while analysts were expecting 229,000. It was the third consecutive week of declining first-time claims. Meanwhile, for the week ended Oct. 19, continuing claims fell from 1.888 million to 1.862 million. Analysts anticipated a tally of 1.890 million. While weekly data is highly volatile, continuing claims, which represent individuals who are already receiving benefits, provide insight into the ease with which individuals can return to the workforce. On a longer-term basis, the four-week moving averages for initial and continuing claims retreated from 238,750 and 1.862 million to 236,500 and 1.860 million, respectively.

Pay Increases Moderate, But Still Too High

At a time when investors are carefully watching the labor market to assess the impact of the Federal Reserves’ jumbo 50-basis point (rate cut, increases in workers’ compensation are moderating slightly, according to the Bureau of Labor Statistics’ Employment Cost Index. The gauge climbed 0.8% during the recent three-month period, its smallest gain since the second quarter of 2021 and below the 0.9% rate anticipated by analysts. In the second quarter of this year, the index advanced 0.9%. On a 12-month basis, labor costs climbed 3.9% compared to the 4.1% year-over-year (y/y) climb as of the end of June. Still, these labor charges are inconsistent with 2% inflation in the long term.

Eurozone Inflation Picks Up

Looking beyond the US, the eurozone experienced a 0.3% price gain m/m and 2% y/y in October, according to the Eurostat Harmonized Index of Consumer Prices (HICP). The core figures, which exclude food and energy, came in at 0.3% m/m and 3.7% y/y. Price gains were led by unprocessed foods, industrial goods, energy, and the processed food, alcohol and tobacco category, with charges increasing 2.1%, 0.7%, 0.4% and 0.3% during the period.

Tech Continues AI Push While Consumers Splurge

Meta (META) Chief Executive Mark Zuckerberg last night emphasized that the company still has ample opportunity to grow revenue and earnings by increasing its commitment to AI, but the initiative, not surprisingly, will cost billions of dollars. Nevertheless, it is likely to produce a strong return on investment. The Facebook parent previously estimated that it would dish out from $37 billion to $38 billion on the technology this year, but now says the minimum outlay will be $38 million. Spending on AI will also increase next year. Meanwhile, Meta said its existing AI services have contributed to its third quarter revenue and earnings climbing 19% and 35%, respectively, y/y, with both metrics exceeding expectations. Microsoft (MSFT), with a 16% y/y increase in revenue and an 11% gain in earnings, produced strong results with its Azure cloud services. Its revenue jumped 33% with more than a third of the increase driven by the company’s artificial intelligence products. Outside of the Mag 7 group, Mastercard (MA) said revenue from its payment network was 11% higher in the third quarter y/y, pointing to healthy consumer spending, according to the company’s CEO, Michael Mieback. Excluding one-time costs, its profit climbed 2% while its total revenue advanced 13%. In another consumer-related matter, Uber reported a 17% y/y revenue increase in its core ride hailing, or mobility, segment and a 16% improvement in its delivery services. While its overall revenue exceeded the analyst consensus expectation, its earnings fell short of forecasts.

Jobs Friday Outlook

I expect job growth to come in at 125,000 in tomorrow’s report as non-cyclical sectors continue to comprise the majority of employment gains. Indeed, education, healthcare and government have been the major drivers of headcount additions this year. Conversely, economically sensitive segments have slowed their roster expansions, as uncertainty regarding the economy, interest rates and politics have weighed on hiring plans. I expect wage pressures to rise 0.4% m/m and 4.1% y/y while the unemployment rate remains steady at 4.1%. Overall, ferocious stateside economic performance has been fueled by deficits, jobs and stocks. This trio has fueled continued consumer-spending strength. Finally, it seems that when the data has turned south, it has immediately picked up in subsequent reports. Turning to our IBKR Forecast Trader, participants are expecting a figure well in excess of 129,700 for payrolls alongside an unemployment rate near 4.1%.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.