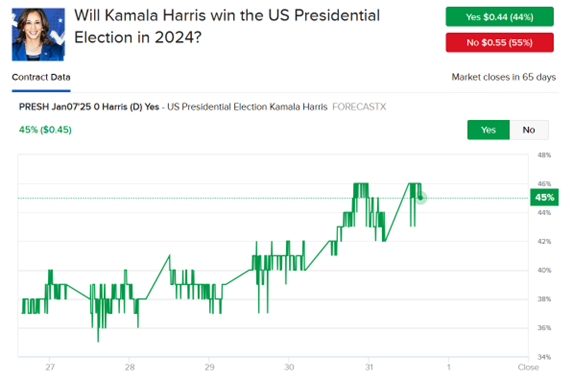

Stocks are starting November on the right foot after stumbling on spooky Halloween. Yesterday’s sharp slip pulled equities lower for October, marking the first down month since April. Today’s bullishness is motivated by a stellar earnings report from big-tech behemoth Amazon and subdued interest rates at the short end. Borrowing costs are indeed taking a breather from their relentless surge on the back of much weaker-than-projected jobs and ISM-manufacturing reports. But the long end isn’t cooperating and is rising partially on Vice President Harris narrowing the gap towards winning the White House, because she is less likely to impose fiscal restraint relative to former President Trump. Meanwhile, this morning’s nonfarm payrolls report was expected to be a wild one, as hurricanes Milton and Helene alongside the Boeing labor strike disturbed traditional reporting flows.

Hiring Hurt by Storms, Strikes

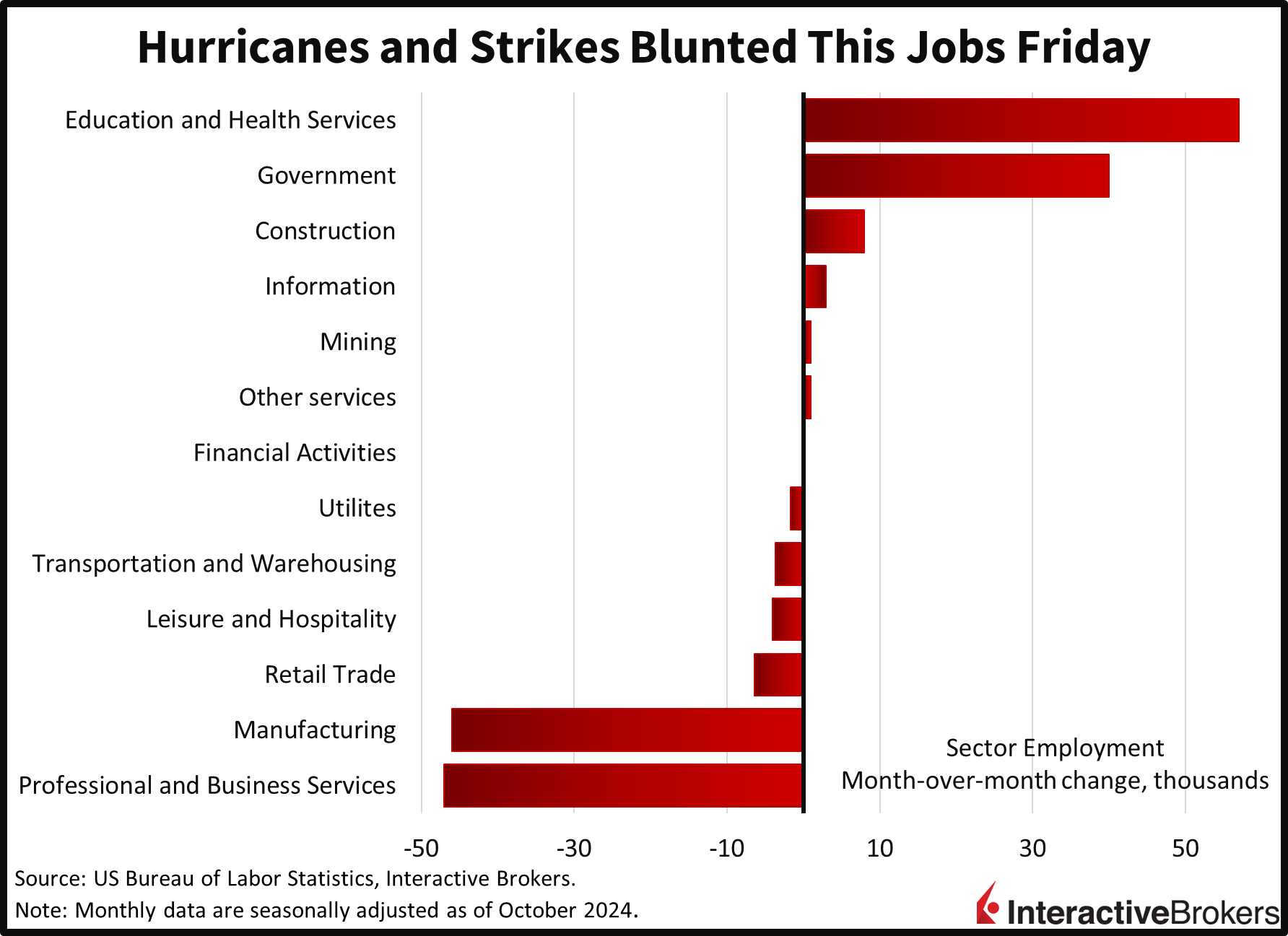

The disruptive forces of hurricanes and the Boeing labor strike throttled October hiring with nonfarm payrolls growing by only 12,000 positions, according to this morning’s Employment Situation Report from the Bureau of Labor Statistics. Payroll weakness was broad-based but excluded the non-cyclical education, health services and government groups. The weak overall result fell substantially from September’s gain of 223,000 and missed the analyst consensus forecast of 106,000. Manufacturing shed 46,000 positions, largely a result of strike activity within the durable goods segment. The losses were only partially offset by small increases in construction, information, mining and the other services group. The professional and business services classification, furthermore, declined by 47,000, with the weakness focused primarily among temporary employees. The retail, leisure and hospitality, transportation and warehousing and utilities segments all saw rosters reduced by less than 10,000.

Wages Up, Unemployment Steady

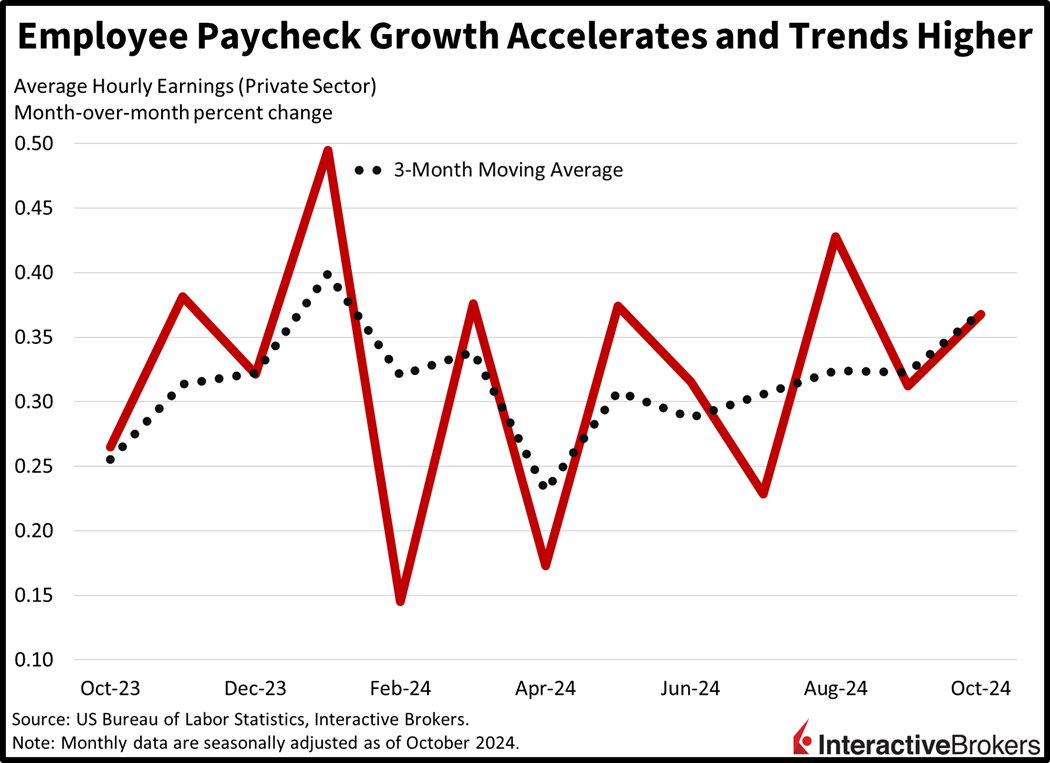

Wage pressures continued in October while September’s low 4.1% unemployment persisted, matching estimates. While average hourly earnings increased by 0.3% month over month (m/m) in September, it climbed 0.4% in the recent reporting period, ahead of projections calling for an unchanged figure. Paycheck gains on a year-over-year (y/y) basis also came in at the forecast pace of 4.0%, 10 basis points (bps) hotter than the prior month. In another matter, the labor participation rate declined marginally from 62.7% in September to 62.6% with 220,000 individuals leaving the workforce. Analysts expected no change. Meanwhile, the October average hourly work week was unchanged at 34.3 hours. It exceeded the anticipated 34.2 result.

Manufacturing Downturn Extends

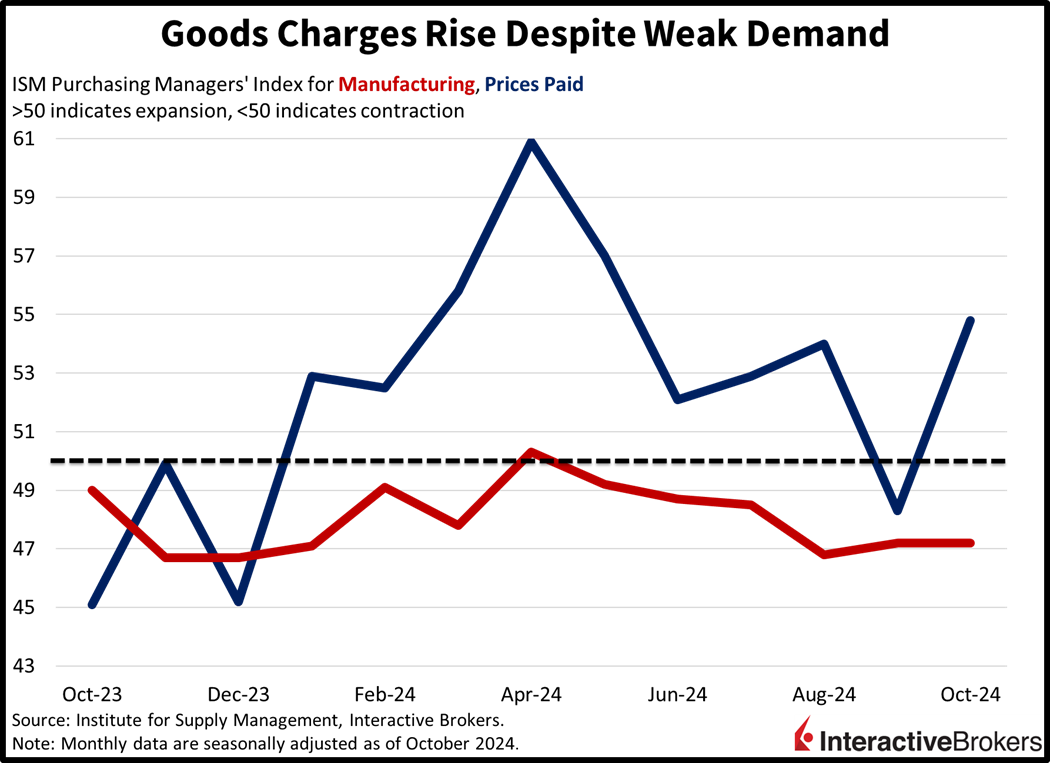

The manufacturing sector contracted for the seventh consecutive month, according to the Institute of Supply Management’s (ISM) Purchasing Managers’ Index. October’s ISM arrived at 46.5, well below the expansion-contraction threshold of 50 and the median estimate of 47.6. The result was also down from September’s figure of 47.2. Weighing on the headline were employment, production and new orders, which came in at 44.4, 46.2 and 47.1. Despite much weaker demand conditions, the prices paid component surged to 54.8, pointing to continued cost pressures despite languishing purchasing activity.

Home Builders Rushed To 6% Mortgages

Contractors dusted off their idle hammers in September with the pace of construction spending climbing as builders took advantage of the short period during which mortgage rates were hovering in the low 6s. The pace of construction outlays rose 0.1% m/m, matching August’s rate of growth and exceeding forecasters’ expectations that total spending would stay flat m/m. Driving the gain was a 0.4% increase in new single-family investments, which offset a 0.1% decline in multifamily expenditures.

Artificial Intelligence Captures the Limelight

Amazon (AMZN) said its capital expenditures (CapEx) climbed 81% y/y to $22.6 billion during the third quarter primarily to develop generative AI. During an earnings call last night, CEO Andy Jassy maintained that the initiative will eventually be appreciated by both customers and investors. Next year, Amazon will plow $75 billion into CapEx with the potential benefits from AI being a once-in-a-lifetime opportunity. On an encouraging note, the company reported strong quarterly earnings and revenue beats. Apple (APPL), for its part, posted a new high record for revenue. Early sales of iPhone 16 phones, that offer AI features, were slightly stronger than for the iPhone 15 model. In another AI matter, Intel (INTC) said its third-quarter revenue resulting from the technology climbed to $3.35 billion, surpassing the analyst expectation of $3.1 billion. While Intel’s overall revenue exceeded expectations, its earnings fell short of estimates, a result of impairment charges. Regarding the personal computing sector, Intel has launched its second-generation Core Ultra Chips. The laptop components are designed to provide AI processing.

Equities Stage Broad Rally

Stocks are running to start the month as investors enter a seasonally friendly period for risk assets. All major averages are moving north with the Nasdaq 100, Dow Jones Industrial, S&P 500 and Russell 2000 gaining 1.1%, 1.1%, 1% and 0.9%. Sectoral breadth is robust with all segments gaining on the session, led by consumer discretionary, technology and financials; they’re up 2.4%, 1.1% and 1%. Treasurys are shifting in bear-steepening fashion with yields on the 2- and 10-year maturities at 4.15% and 4.34%, the former is lower by 1 bp while the latter is higher by 5 bps. The long end is also helping the Dollar Index, which is gaining 22 bps as the greenback appreciates relative to most of its counterparts, including the euro, franc, yen, yuan and Aussie tender. It is depreciating versus the Canadian currency and the pound sterling, however. Commodities are mostly bullish with lumber, silver, gold and copper gaining 0.8%, 0.2%, 0.2% and 0.1%. But WTI crude oil is changing hands at $70.05 per barrel, a 0.6% decline, as energy players appear unfazed by a possible attack on Jerusalem by Tehran.

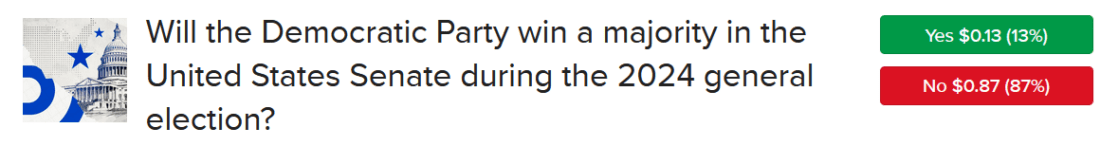

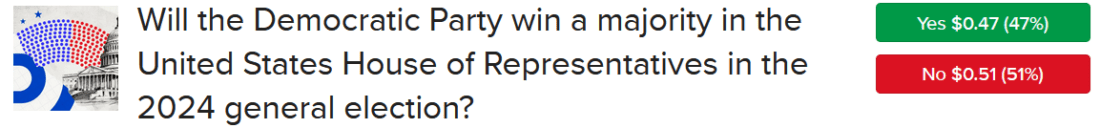

Harris Gains Among Forecast Traders

As we close the week and advance through the new month, the presidential election will be top of mind and followed by a less significant interest rate decision from the Federal Reserve. Our brand new IBKR Forecast Trader reflects that Vice President Harris’s odds have improved sharply in just the last few days, jumping from a low of 35% on Monday to highs of 46% yesterday and today. Nevertheless, a red sweep is still narrowly favored with GOP control of the chambers of Congress priced at 87% in the Senate and 51% in the House. Finally, this morning’s weak data led to our Fed Funds contract pricing a near certainty of a 25-bp reduction by the central bank next week as the probability of a pause stands at just 9%.

Note: The green Yes and red No reflect the highest bids at the time of publication while the line chart reflects the last trade.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.