Your Weekly Roadmap with Jay Woods, CMT

1/ Impact: Election & Fed Decision Days

2/ November Spawned a Monster

3/ Earnings Homestretch

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Impact: Election & Fed Decision Days

We are coming off the busiest week of earnings and following it up with an election for the ages which seems to be a coin-flip as we head into decision day. Add in a Fed meeting where the expectations are for another 25-basis point cut followed by a Jerome Powell press conference and this week’s market headlines could be epic.

So multiple choice – who is the most important person for the markets this week?

If you answered B – Jerome Powell, then you are correct. It is safe to say his monetary policy has been the driver of the bus when it comes to the economy.

This week we get to hear from him and more eyes may be focused on the reaction to the 10-year yield than the equity market. The 10-year has risen over 60-basis points since the first rate cut. This is a trend that has caught many off guard and if it continues could dampen the overall market.

As for the election results, it’s very cliche to say the “market likes certainty” and we didn’t appear to get that immediately after the last election cycle. Yet, we rallied. Regardless of outcome, it will be the Fed and their monetary policy that will drive the overall economy.

However, if the man that appointed Jerome Powell to Fed Chair wins, then look for future headlines that may call for his resignation. First things first, let’s get through this week, then see if that will be a 2025 story to watch.

2/

November Spawned a Monster

November kicks off what is historically the best stretch of the year for the market and Friday got us pointed in the right direction with the S&P 500 gaining 0.4%.

The monster as mentioned in the headline above refers to a potential rally over the coming weeks and not just a great Morrissey song (did you think I would be predictable and use the punny headline November Reign?). Election aside, November has closed higher over 11 of the last 12 years and is the best performing month.

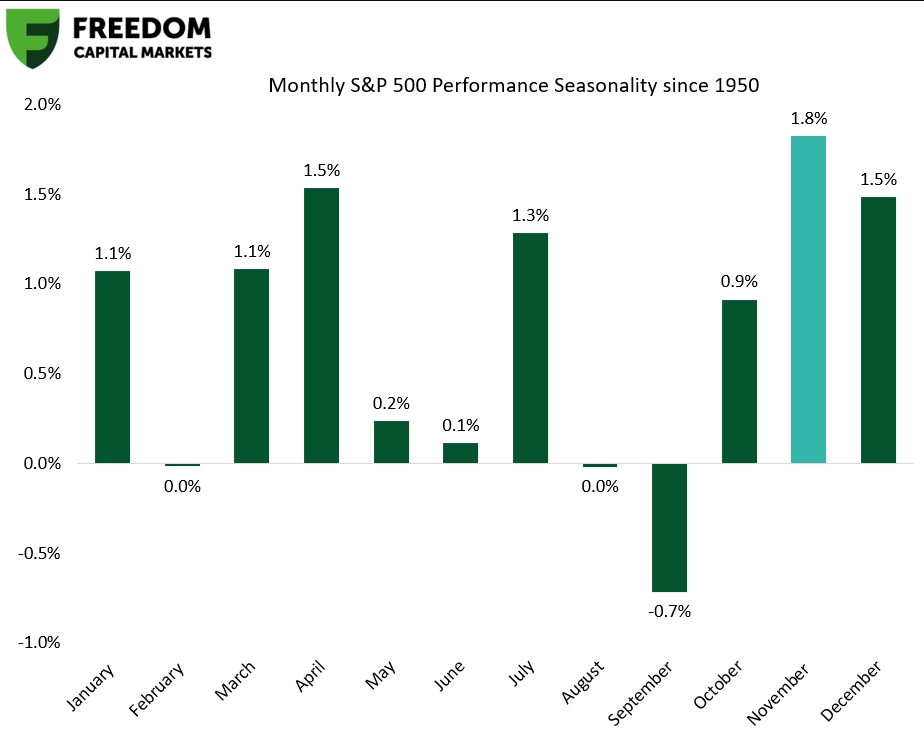

The average gain going back to the inception of the S&P 500 has been 1.8% also making it the best month of the year over the long term, Guess what’s second best? Yep – December. In fact the next six months are historically the strongest stretch for the market over the long term.

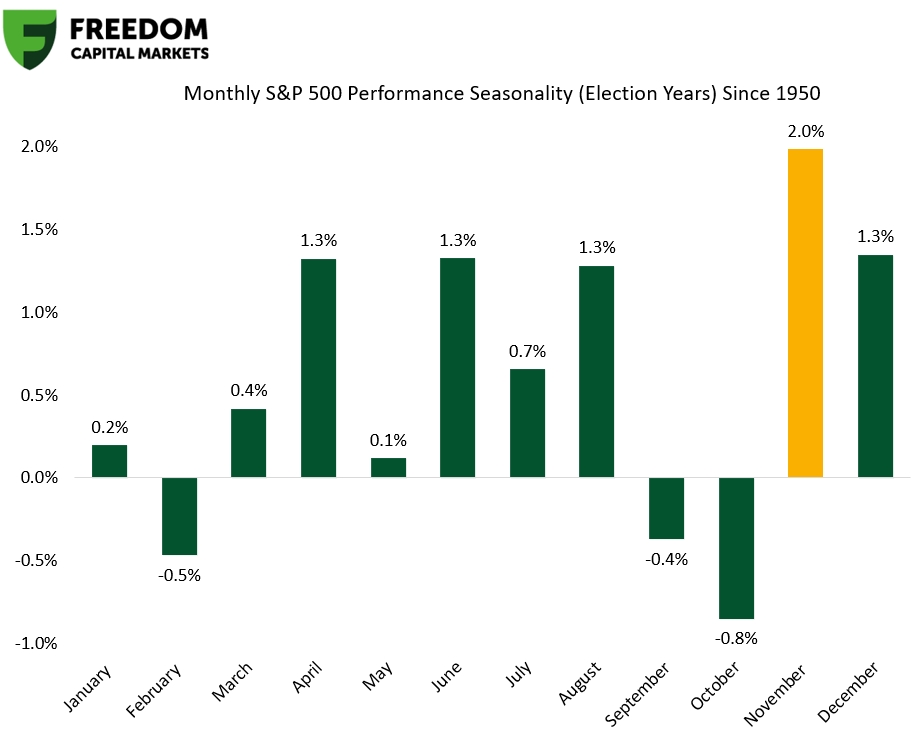

How about November in Presidential election years? It’s actually a tad stronger with an average gain of 2%.

It sure doesn’t mean that’s the future course of this market, but it sure is interesting to see the consistency over this time period.

3/

Earnings Homestretch

Earnings Scorecard. According to FactSet data, 70% of the companies in the S&P 500 have reported results for the third quarter. So far 75% have beaten earnings estimates, which is below the 5-year average of 77%, but equal to the 10-year average of 75%.

In aggregate, companies are reporting earnings that are 4.6% above estimates, which is below the 5-year average of 8.5% and below the 10-year average of 6.8%. Historical averages reflect actual results from all 500 companies, not the actual results from the percentage of companies that have reported through this point in time.

Uncle Warren. Warren Buffet’s Berkshire Hathaway (BRK/B) reported earnings on Saturday that missed estimates due to an increase in insurance underwriting expenditures.

Mr. Buffett and his conglomerate also announced they reduced their position in Apple. During the quarter they sold another 100 million shares of their top holding to reduce their total holding to 300 million. With those recent sales and an almost complete exit from Bank of America, they are currently sitting on over $325 billion in cash.

The cash raise makes many wonder why one of the greatest investors in the world is moving cash to the sidelines. He has raised concerns about the tax rate going up next year. It also has many wondering if he is more pessimistic about the US economy than others. They haven’t done a major deal in quite some time, so maybe they are raising more cash for a big acquisition as well.

As of now investors will have to wait and see what the next move will be. Shares of the biggest financial stock and 7th highest weighted S&P 500 are up 26.8% year-to-date coming into today’s reaction to the weekend’s results.

Earnings. We are down the homestretch of earnings season as 70% of the S&P 500 have reported results. This week the rush continues as a slew of well known companies that may be in many of your personal portfolios report.

—-

Originally posted 5th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.