We tend to think of the video streaming wars in relation to the content providers. Companies like Netflix, Amazon, and Alphabet are investing heavily to win customer eyeballs as people transition from spending most of their video-watching time on cable to largely watching streaming TV. But there is another layer to the streaming wars: connected TV (CTV) hardware and CTV operating systems.

Unsurprisingly, big technology companies like Alphabet, Amazon, and Apple have invested heavily to try and win in this theater of the streaming wars. But one independent player is beating all of them: Roku (ROKU 0.06%). The company has the No. 1 CTV operating system in the United States, and it continues to grow users and streaming hours at a rapid pace.

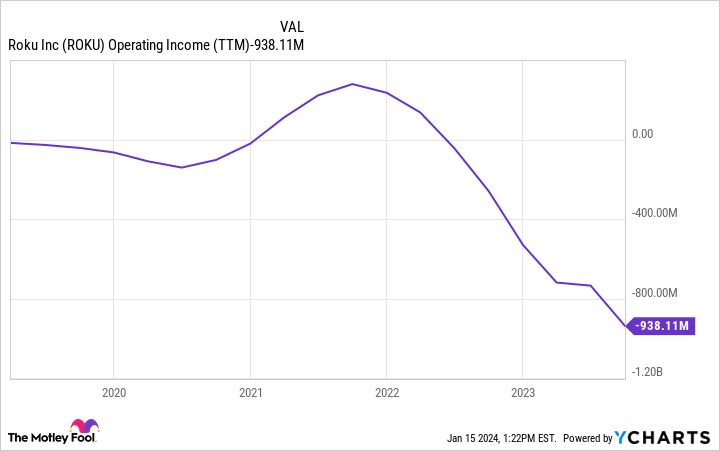

And yet due to investor worries about unprofitability, its stock is off 82% from the all-time high it set during 2021. But Roku management is confident the company is ready to refute these concerns and get into the black in 2024. Does that make the stock a good turnaround bet this year?

The road to 100 million users

The first step in Roku’s business plan — explicitly stated by the company — is to build scale by getting more people to adopt the Roku OS for their CTV needs. It does this by selling USB sticks and other devices that give existing TVs the Roku OS; partnering with manufacturers to preinstall its OS on their TVs; and building its own Roku-branded TVs. At the end of 2023’s third quarter, Roku counted 75.8 million active accounts — up 16% year over year.

Roku has consistently grown over the last decade despite competition from the technology giants, and it remains the top TV operating system in the United States. It’s on pace to hit 100 million active accounts within a few years. Now, it is trying to expand internationally, specifically with a focus on Latin America. Roku has the No. 1 CTV operating system in Mexico (with its population of over 100 million), and has a heavy presence in Brazil and Chile.

Importantly, Roku doesn’t make money selling its hardware. It sells its TVs, USB sticks, and other devices at a loss to try and undercut the competition. Its devices segment had a gross margin of negative 7.5%.

You might think this is a flawed business model, and to be fair, it is a big reason why Roku’s consolidated business is unprofitable at the moment. But the company may have a trick up its sleeve to help get it to profitability.

Profitability will need to come from growth in advertising

So how does Roku plan to make money? Simple. It wants to take its scale in video streaming and leverage it to build a digital advertising business. Last quarter, 26.7 billion hours of video content was streamed through Roku devices, making it one of the most popular platforms in the world.

To monetize this content, Roku wants to grow “platform” revenue from digital advertising and content distribution deals. Its platform segment generated $787 million in revenue last quarter with a 48.1% gross margin. In future quarters, that segment’s gross margin should be closer to 60%, as last quarter’s results included a one-time restructuring charge.

One problem Roku has is that its biggest partners — namely YouTube and Netflix — have used their negotiating leverage to keep from sharing advertising revenue with Roku. Between them, those two dominant streaming services account for more than half of the video streaming hours viewed in the United States — and Roku is currently not getting a piece of the advertising pie from those hours. It aims to solve this issue by driving growth in its own advertising-supported streaming service, The Roku Channel. That service grew streaming hours by 50% year over year in the third quarter and is now a top-five application within the Roku OS.

TV and video advertising is a huge market, with estimated global spending of over $300 billion annually. Over the next few years, the vast majority of this advertising spending will leave traditional sources and move to CTV. Even though Roku will not see most of this revenue, it can still build a sizable CTV advertising business anchored by The Roku Channel. Over the last 12 months, the segment has generated just under $3 billion in sales. It wouldn’t be surprising to see this double to $6 billion over the next five years.

ROKU Operating Income (TTM) data by YCharts.

Is Roku stock cheap?

Roku shares are difficult to value due to the fact that the company is unprofitable today. However, we can make some estimates of how much the company could earn if it can continue scaling its digital advertising business.

Let’s exclude the devices segment as it makes no money. If Roku can bring its high-margin platform segment revenue to $6 billion, it wouldn’t be out of the question for the company’s consolidated profit margin to reach 20%. On $6 billion in revenue, that would equate to $1.2 billion in annual earnings.

Today, Roku has a market cap of $12.2 billion. Dividing that by $1.2 billion would give Roku a forward price-to-earnings ratio of just 10 — if it can keep scaling its platform segment and start expanding its profit margins. If it achieves that within the next four to five years, Roku’s stock will likely perform well over that time frame.

It is hard to predict whether Roku’s stock will rebound in 2024. Short-term predictions about stock movements are difficult. But if the company keeps growing its advertising revenue, the stock will do well over the rest of this decade.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Netflix, and Roku. The Motley Fool has a disclosure policy.