1/ Pressing Upside Bets

2/ Sellers Start Selling

3/ Pressing Downside Bets

4/ Buyers Battle Back

5/ When All Seems Lost…

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Pressing Upside Bets

With the bull run continuing across risk assets, many market participants are feeling left behind, succumbing to “FOMO” and pushing prices even higher. During this time, technical analysts can offer a friendly reminder to always think about where an asset has come from and where it has the potential to go.

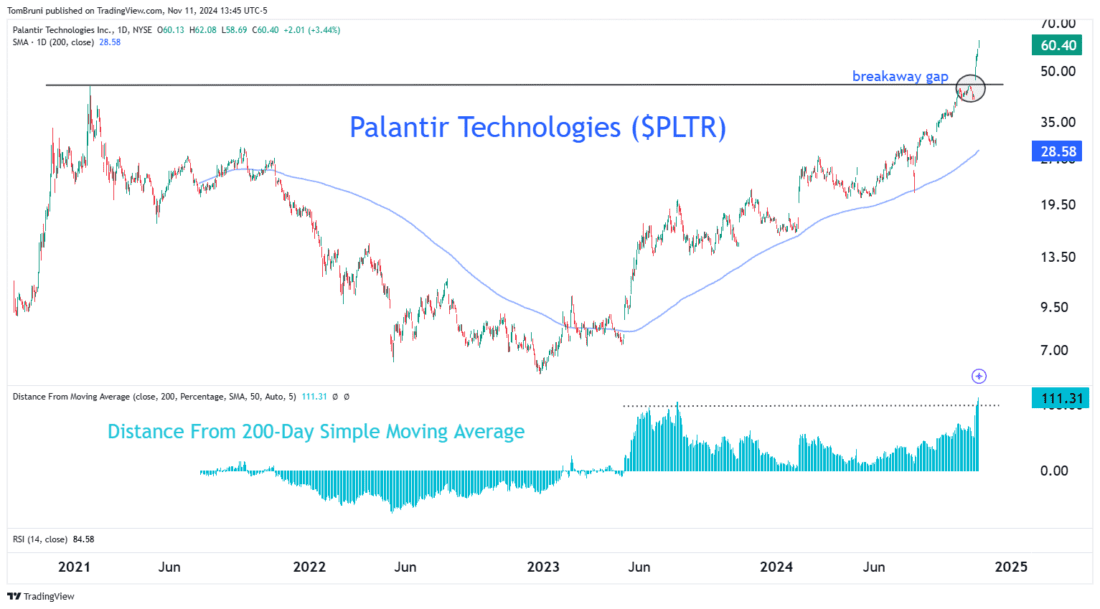

One way to measure this is by looking at a stock’s price relative to its 200-day simple moving average. That technical indicator measures a stock’s long-term trend to where prices eventually tend to revert if they get too stretched from it.

Below is a solid example of this using Palantir Technologies ($PLTR). The stock recently broke out to new all-time highs via a “breakaway gap” through its 2021 highs, a very bullish sign. However, the stock is now more than 110% above its 200-day moving average, exhibiting how “stretched” it is relative to its longer-term trend. This represents a potentially higher-risk environment for shares, as prices could “mean revert” to their long-term trend.

This condition can resolve itself as a correction where prices fall to the moving average, or over time, where price growth slows and allows the moving average to catch up. The bulls would prefer the latter outcome, but for now, they’re pushing through any potential downside risk and paying higher and higher prices for the red-hot stock.

2/

Sellers Start Selling

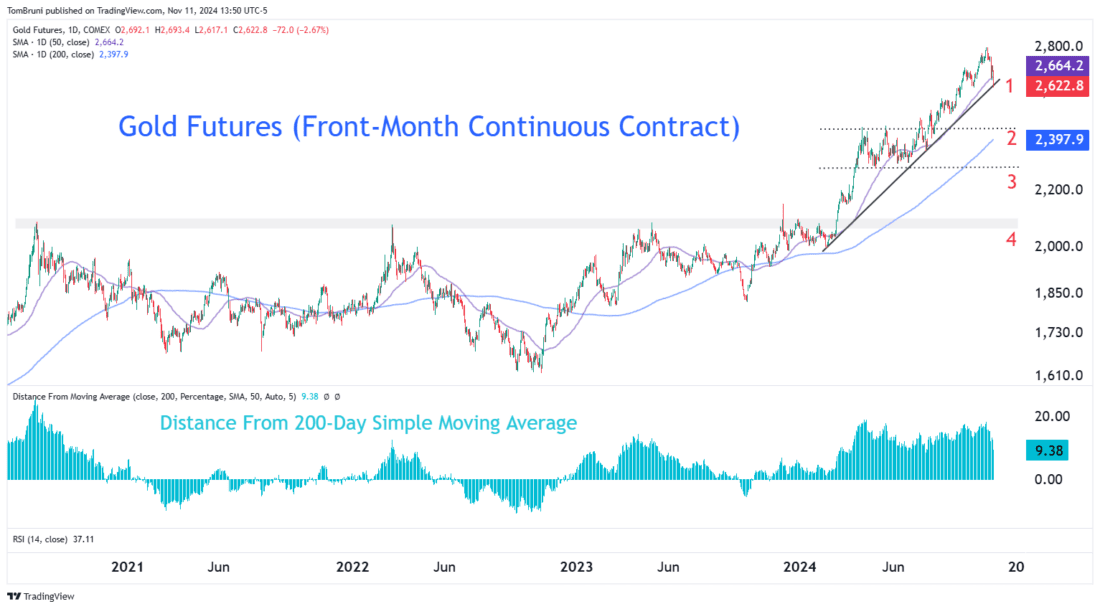

One asset that was recently in a similarly stretched position relative to its 200-day moving average is gold ($GLD). The precious metal broke out of a three-year base earlier this year and has been running higher aggressively, getting as much as 20% above its trend.

With short-term momentum fading, traders and investors are eying several potential levels. The first is trendline support and the 50-day moving average near 2,625, while its long-term breakout level is between 2,050 and 2,100.

Clearly, the market is still in an uptrend, but now buyers must decide how quickly they will step in and “buy the dip.” On Stocktwits, retail investors and traders are currently ‘bearish’ on gold as the focus shifts towards assets (like crypto) with more upside momentum, suggesting more potential downside ahead.

3/

Pressing Downside Bets

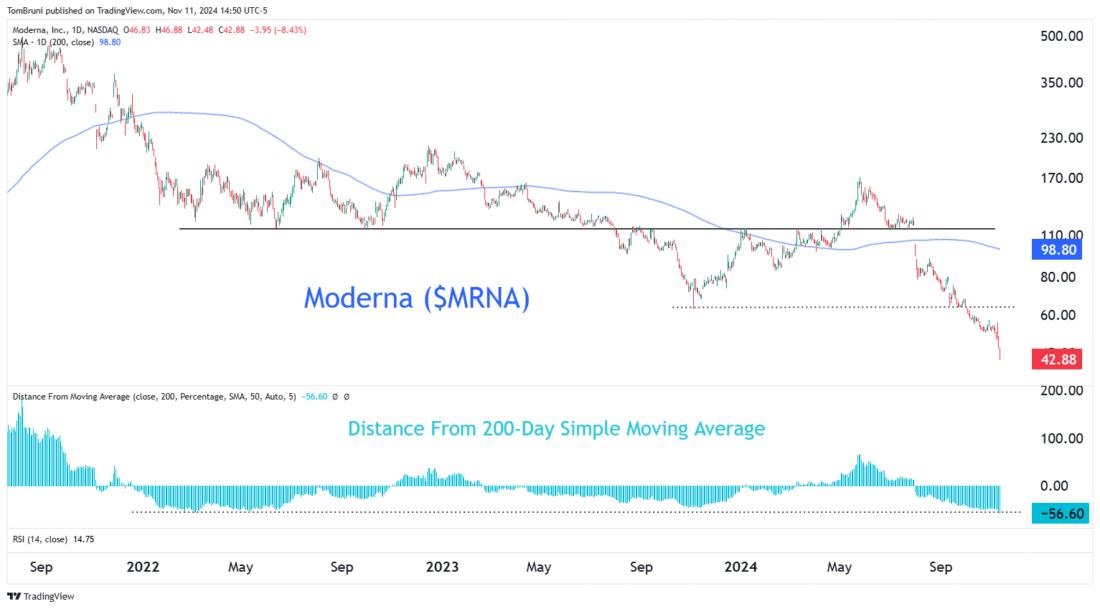

Chasing prices to the upside isn’t the only thing happening; traders and investors are chasing to the downside as well. Vaccine maker Moderna ($MRNA) is a good example, as it hits 52-week lows and stretches nearly 60% from its 200-day moving average.

Much like Palantir, one side of the market is clearly dominating this stock and is pressing their bets further. Eventually, shares will revisit their long-term trend, but sellers are betting on a consolidation rather than a major rally in prices.

With Stocktwits community sentiment hitting ‘bullish’ levels today, it appears some retail investors and traders have noticed how stretched the rubber band has gotten and are betting on a squeeze to the upside.

4/

Buyers Battle Back

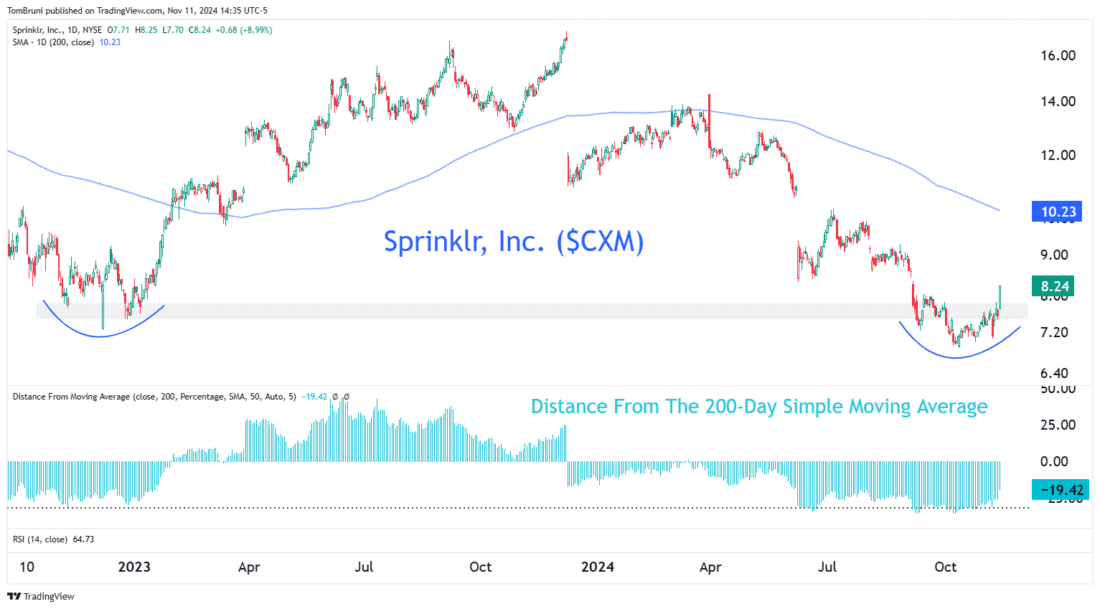

Meanwhile, much like gold, Sprinklr, Inc. ($CXM) is an example of a stock where the winning side of the market is punished for pressing its bets. Shares recently reclaimed their 2022 lows after falling 30% below their 200-day moving average, a level that’s provided support in the past.

The productivity software small-cap stock currently has 7% of its float short, but the Stocktwits community is not yet betting on a short squeeze. Sentiment remains ‘bearish’ despite shares rallying almost 10% today. Still, some say shorts are vulnerable to more pain ahead as buyers bet on further mean reversion.

5/

When All Seems Lost…

So, if it’s tough to press bets in extended stocks or assets, what is a trader or investor to do in these assets? The answer may be to wait for a more attractive risk-to-reward opportunity, even if it takes a while to present itself.

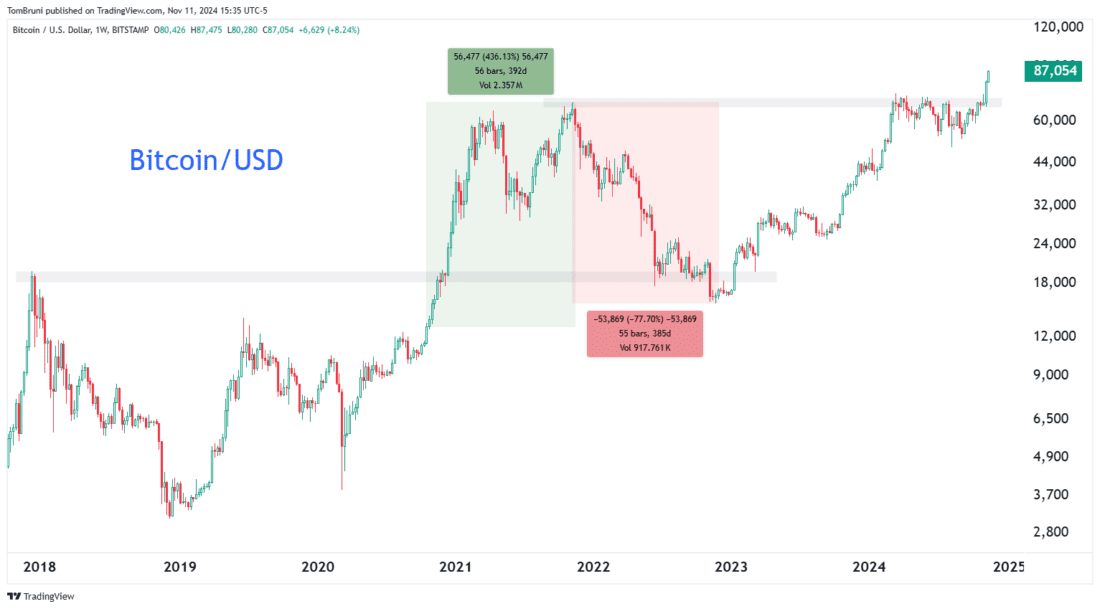

A great example of this in action is Bitcoin following its breakout in late 2021. The cryptocurrency rallied over 400% in the year after the breakout, leaving many to believe they’d never be able to get in at lower prices again. Flash forward a little more than a year and prices had corrected nearly 80%, bringing them right back to the original breakout level.

Now, that’s not to say that will happen again this time. But the point is that market opportunities present themselves all of the time, just not in the timeframe we’d like them to. Still, it’s important to remain patient and wait for a risk-to-reward opportunity that aligns with our long-term goals, risk tolerance, and overall investment objectives.

This perspective is important to keep, especially in today’s environment where it feels like you’re missing the boat on the next greatest trade or investment. Maybe you will, but history tells us that the boat will either tend to make another pass…or another better boat will emerge. You just need to be patient. Stay safe out there, folks, and speculate responsibly!

—-

Originally posted 12th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Security Futures

Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, please read the Security Futures Risk Disclosure Statement. For a copy visit ibkr.com

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.