Stocks are facing heavy selling pressure as the Trump rally shows signs of fading. On the one hand, investor sentiment is souring following Fed Chief Powell commenting yesterday that the central bank isn’t in a hurry to lower borrowing costs, despite the institution lightening its key benchmark by 75 bps in just the last eight weeks. Today’s economic calendar wasn’t friendly to equity bulls either, as stronger-than-expected retail sales coincided with upside beats on import and export prices as well as New York Empire Manufacturing.

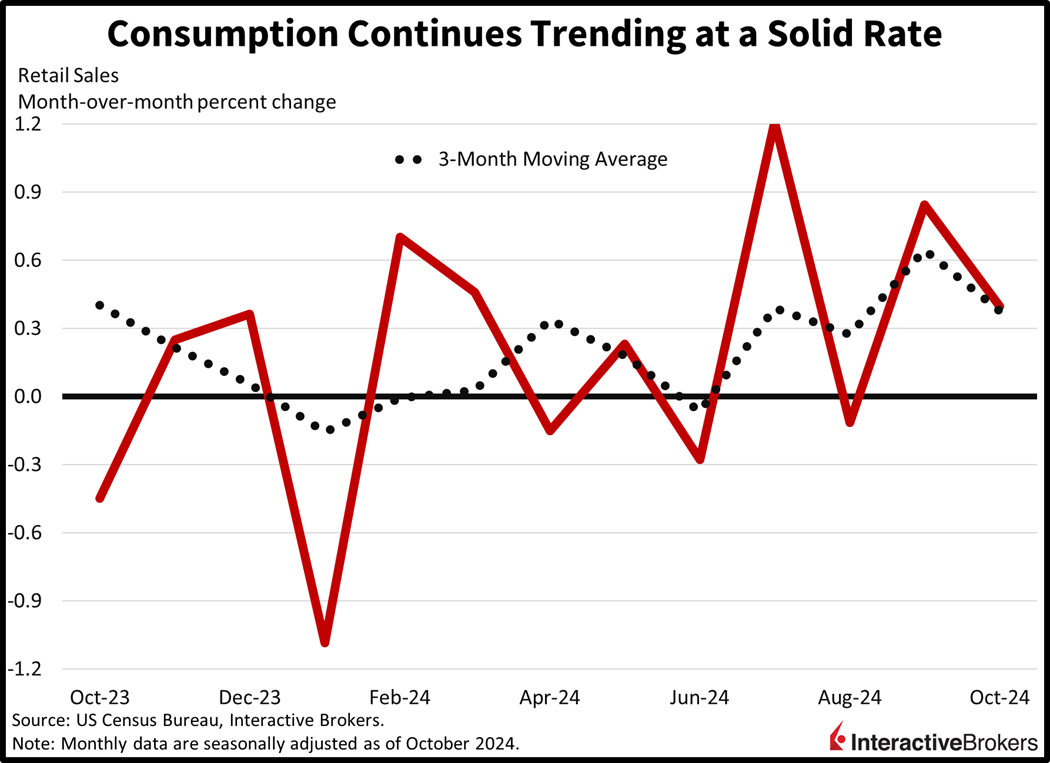

Retail Sales Trend Higher

After several months earlier this year of up and down spending resembling flicking a light switch on and off, consumers continued to illuminate their daily lives in October with retail sales climbing 0.4% month over month (m/m) following an upwardly revised 0.8% increase in September, according to the Commerce Department’s Census Bureau. The increase exceeded the median forecast of 0.3%. After excluding automobiles and gasoline, however, outlays grew just 0.1% compared to the 0.3% projection and the preceding month’s 1.2% advancement.

Among the report’s 13 major categories, eight advanced, similar to September’s broad-based growth. Last month, the electronics and appliance stores group and the motor vehicle and parts dealers classification led gains with sales heading north by 2.3% and 1.6%, respectively.

Other areas that progressed along with the extent of the increases were as follows:

- Dining and drinking establishments, 0.7%

- Building materials, garden equipment and supplies dealers, 0.5%

- Ecommerce, 0.3%

- General merchandise stores, 0.2%

- Food and beverage shops, 0.1%

- Gasoline stations, 0.1%

Categories hit by the largest sales declines included the clothing and clothing accessories sector and the health and personal care stores group with contractions of 0.2% and 1.1%, respectively. Other groups that experienced declines and the extent of the changes were as follows:

- Sporting goods, hobby and music, 1.1%

- Furniture and home furniture stores, 1.3

- Miscellaneous store retailers, 1.6%

Hurricanes Support Consumer Spending

Consumer spending during the month was influenced by the devastating effects of hurricanes Helene and Milton. For example, Home Depot (HD) recently reported that the storms accounted for a net contribution of $200 million in sales during its third quarter. Grocery store operator Publix, which isn’t publicly traded, furthermore, estimates that its third-quarter sales gained a 0.6% tailwind from the hurricanes. Monster Beverage (MNST) also felt the brunt of the storms– the adverse weather shut down one of its brewing facilities.

Goods Exhibit Price Pressures

In other developments, export and import prices rose 0.8% and 0.3% m/m last month, exceeding the anticipated -0.1% on both fronts as well as the previous month’s declines of 0.6% and 0.4%. Turning to manufacturing, industrial production contracted 0.3% m/m in October, exactly as expected and printing a shallower slip than September’s 0.5%. But in New York state, manufacturing activity expanded strongly this month, with the Empire State Manufacturing Index notching a score of 31.2, well ahead of the projected fall of 0.7 as well as October’s -11.9.

Semiconductor Buyers Pause

Applied Materials Inc. (AMAT) issued fiscal first-quarter sales guidance that fell short of analyst estimates, causing its stock price to plummet more than 8% this morning and raising concerns that buyers of computer chips may be delaying making purchases. The company, while maintaining the overall semiconductor market is still healthy, also reported a decline in sales in China. In another earnings development, Alibaba (BABA) reported a 58% y/y profit increase, largely a result of its equity holdings appreciating, while revenue climbed only 5%, missing expectations. At a time when Chinese officials are trying to shore up the country’s languishing economy, Alibaba’s main retail units, Taobao and Tmall Group, reported only a 1% increase in revenue. Shares of Alibaba were down 2.53% this morning.

Trading Screens Turn Ugly

Trading screens aren’t pretty today as indiscriminate selling occurs across equities and longer-term fixed income. All major US equity benchmarks are taking losses with the Nasdaq 100, S&P 500, Russell 2000 and Dow Jones Industrial indices down 2.1%, 1.1%, 1% and 0.6%. Sector breadth is negative, but 4 out of 11 segments are gaining, led by utilities, financial and real estate, which are up 1%, 0.4% and 0.2%. Weighing on the averages, however, are technology, communication services and healthcare; they’re down 2.1%, 1.7% and 1.6%. The 2- and 10-year Treasury maturities are changing hands at 4.32% and 4.46%, the former is lighter by 3 basis points (bps) while the latter is heavier by 1. The dollar is down 21 bps as the greenback depreciates versus the euro, franc, yen and Aussie tender while it appreciates against the pound sterling, yuan and the Canadian currency. Commodities are mixed with gold, copper and silver modestly higher by 0.2%, 0.1% and 0.1%, but lumber and crude oil are down 1.4% and 0.3%. WTI crude is trading at $68.35 per barrel on an abundant supply outlook met with dismal demand prospects out of the world’s number one importer, Beijing.

An Optimistic Outlook for Earnings

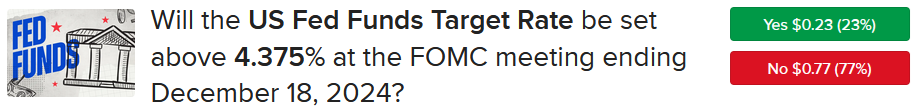

Looking ahead, the next seven weeks tend to be some of the seasonally strongest periods of the year. But with a lack of weakness during traditionally sluggish September and October, some folks are wondering if we’ve backloaded seasonality. Others, however, point to managers fearing material underperformance and are calling for a catch-up Santa Claus rally into year-end. Upside into the new year is warranted in my view, as the policy mix proposed by the new White House administration, which includes reduced taxation, lighter regulations and a push to onshore manufacturing, is quite positive for earnings prospects and risk assets. And while Fed Chair Powell spoke about taking it easy on the way down, our IBKR ForecastTraders still price a 77% chance of a 25-bp trim at next month’s meeting, while Fed Funds players are at 62%. Finally, look out for next week’s crucial economic reports, including homebuilder sentiment, housing starts/permits, existing home sales, unemployment claims, flash PMIs, personal income and outlays and more.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.