Americans plan to spend more on holiday shopping this year than they did last year.

That’s the takeaway from pretty much every consumer survey conducted over the past several weeks. Below are some highlights (emphasis added):

-

“Our proprietary survey of ~2,000 US consumers reveals a more positive outlook for holiday shopping versus 2023 and 2022. Overall, 37% of consumers are planning to keep their holiday budgets roughly the same, 35% expect to spend more, and 22% expect to spend less yielding a net of +13%.“ – Morgan Stanley (11/13)

-

“Consumer sentiment has also shown signs of improvement, and the 2024 Bank of America Holiday Survey suggests people are planning to spend $2,100 outside of typical obligations and necessities this holiday season, up 7% YoY.“- BofA (11/12)

-

“According to The Conference Board Holiday Spending Survey, the average US consumer intends to spend $1,063 in nominal terms on holiday-related purchases in 2024, up 7.9% from $985 in 2023. This is also higher than in 2022 ($1,006) and 2021 ($1,022). On gifts, consumers plan to spend an average of $677, up 3.4% from $654 last year. After slumping last year, consumers’ budgets for non-gift items such as food, decorations, and wrapping paper are also up 17% at $387.“ – The Conference Board (11/12)

-

“Some 89% of consumers admitted they’re tempted to spend more than they should during the holiday season, while 94% indicated they’d be tempted to make an unplanned purchase if the item were on sale. Over half (55%) of consumers said holiday deals have caused them to overspend; these big spenders said they are most likely to splurge on gifts for others.“ – Experian (11/4)

-

“Consumers are reaching a little deeper into their pockets this season, their average holiday budget rising 4% y-o-y to $613, according to Accenture’s 18th Annual Holiday Shopping Survey.“ – Accenture (10/30)

Upgrade to paid

-

“In a year when sustained consumer spending propelled growth and helped the economy skirt recession, we’re calling for a fairly modest holiday sales season. We look for holiday sales to rise just 3.3% in November and December compared to last year, which is slower than last year and below the long-run average.“ – Wells Fargo (10/28)

-

“Gallup’s initial measure of Americans’ 2024 holiday spending intentions finds consumers planning to spend an average of $1,014 on Christmas or other holiday gifts. This is substantially more than their forecast of $923 at the same time last year, signaling that the 2024 holiday shopping season could be a bit kinder to U.S. retailers.“ – Gallup (10/25)

-

“Consumer spending on the winter holidays is expected to reach a record $902 per person on average across gifts, food, decorations and other seasonal items, according to the National Retail Federation’s latest consumer survey conducted by Prosper Insights & Analytics. The amount is about $25 per person more than last year’s figure and $16 higher than the previous record set in 2019.“ – National Retail Federation (10/22)

-

“U.S. consumers are set to spend 4% more on holiday shopping this year, with average spending projected to reach $948, compared to $911 in 2023, according to the KPMG 2024 Consumer Holiday Shopping Survey.“ – KPMG (10/21)

-

“After expressing record holiday spending intentions in 2023, respondents are yet again planning to up their purchases, and expect to spend $1,778 (+8% year over year) this holiday season. The uptick in spend is attributed to a rosier economic outlook (+9 percentage points [PP]), perceived higher prices (70%), and an increase in spend by the $100K to $199K income group (+17%).“ – Deloitte (10/15)

-

“Despite 59% of consumers saying that inflation will probably influence their holiday spending this year, overall spending is projected to increase by 7% to an average of $1,638 per shopper.” – PwC (10/1)

We’ll have to wait to see if consumers come through and actually spend more this year.

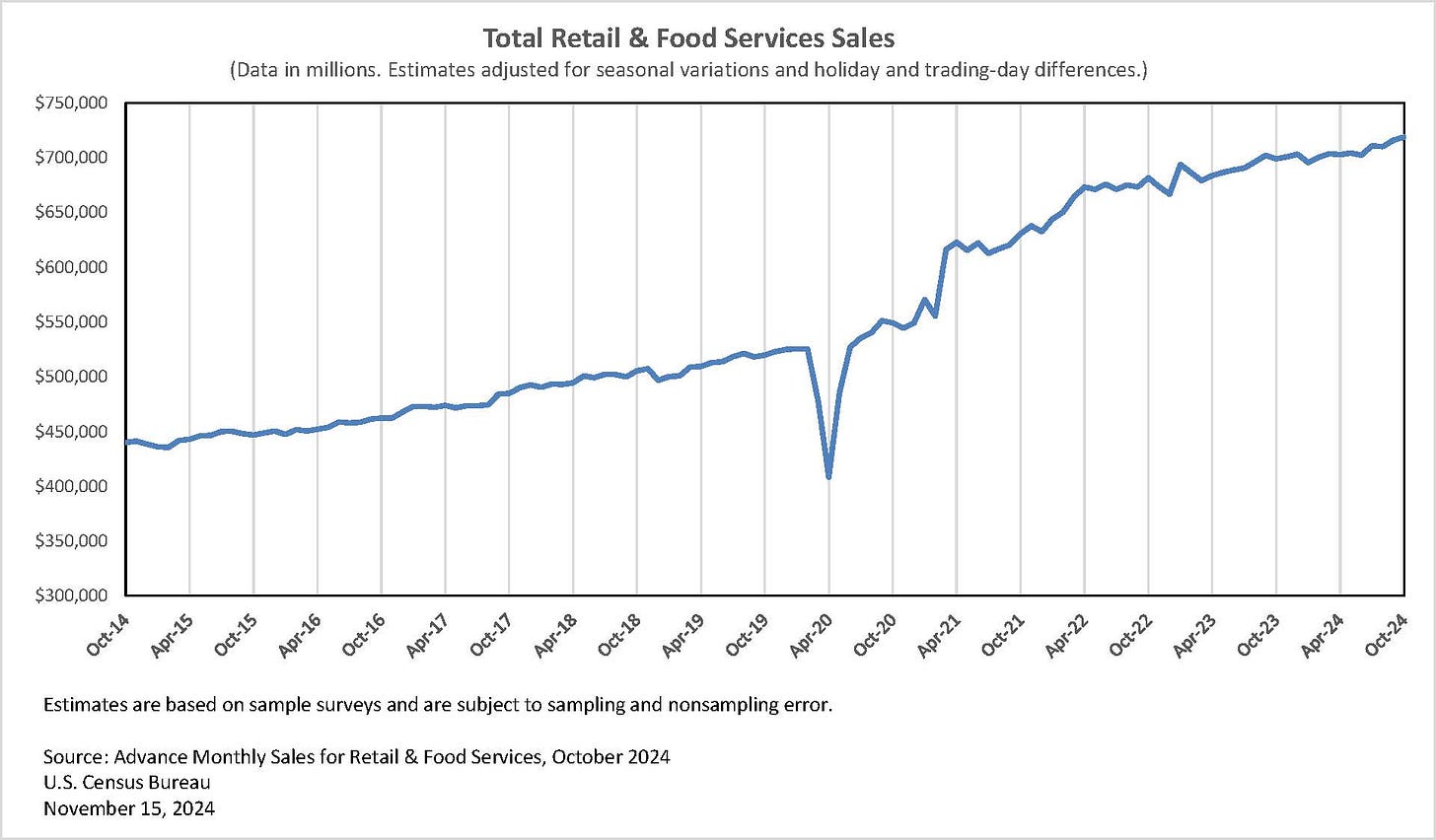

If they do, it would be consistent with the years-long narrative of record consumer spending. Just this past Friday, we learned retail sales in October rose to a record $718.9 billion.

Retail sales continue to set new record highs. (Source: Census)

All this spending has been supported by healthy household balance sheets and real income growth.

Upgrade to paid

Household Finances Are In Good Shape

Sure, households aren’t as flush as they were earlier in the economic recovery — but they remain strong relative to history. (More here and here.)

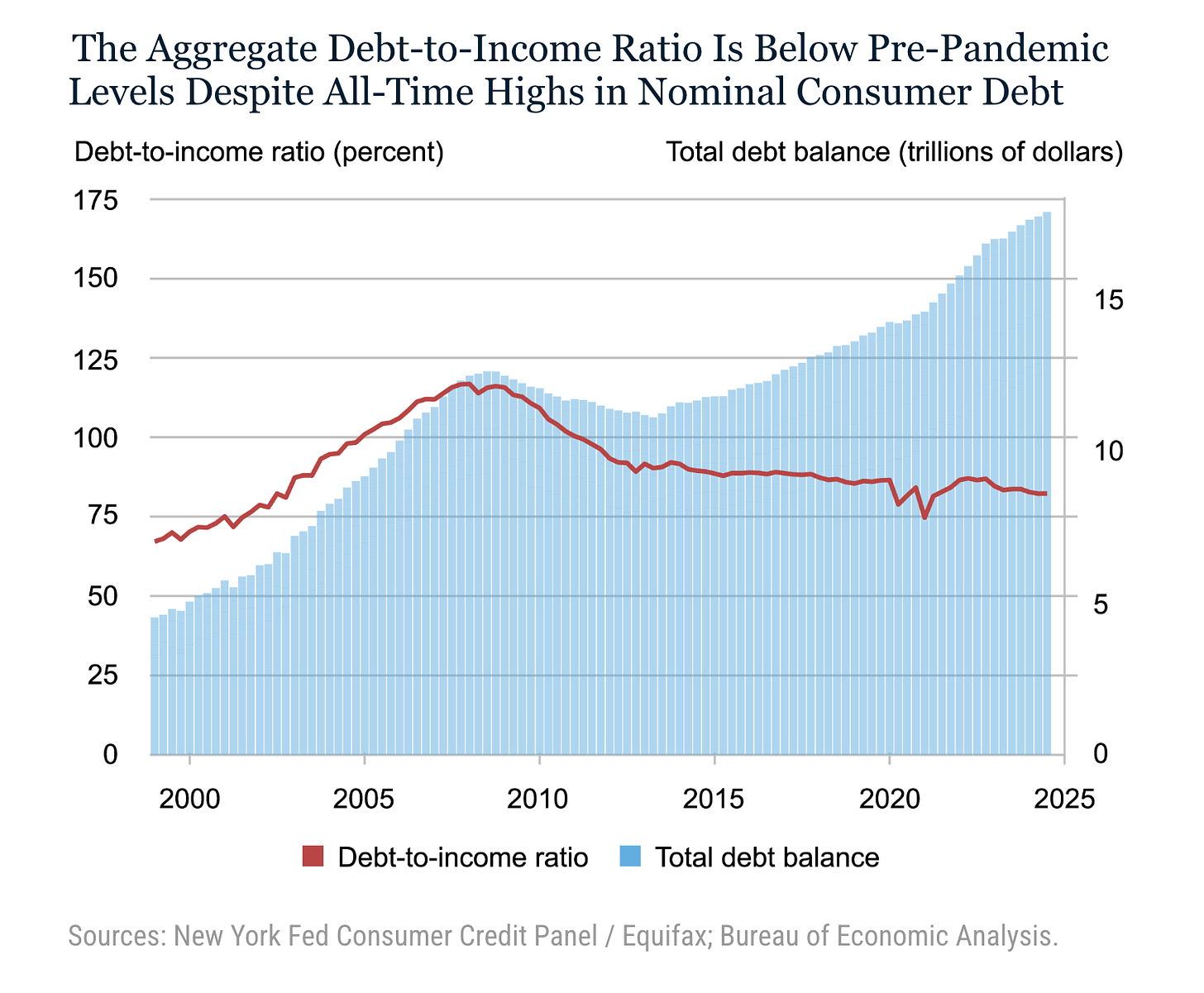

This is best reflected by the debt-to-income ratio, which remains at historically low levels even as aggregate debt has been rising.

Debt levels remain manageable despite rising to record highs. (Source: NY Fed)

“Although household balances continue to rise in nominal terms, growth in income has outpaced debt,” wrote Donghoon Lee, Economic Research Advisor at the New York Fed.

It’s a reminder to take headlines like “US Household Debt Rises to $17.94 Trillion: N.Y. Fed“ and “Credit card debt hits record $1.17 trillion“ with caution because they lack the context you need to avoid drawing the wrong conclusions. Better headlines read like “Household debt is up, but Americans are in a better spot to pay it“ and “NY Fed says household debt up in third quarter as rising incomes ease debt burden.“

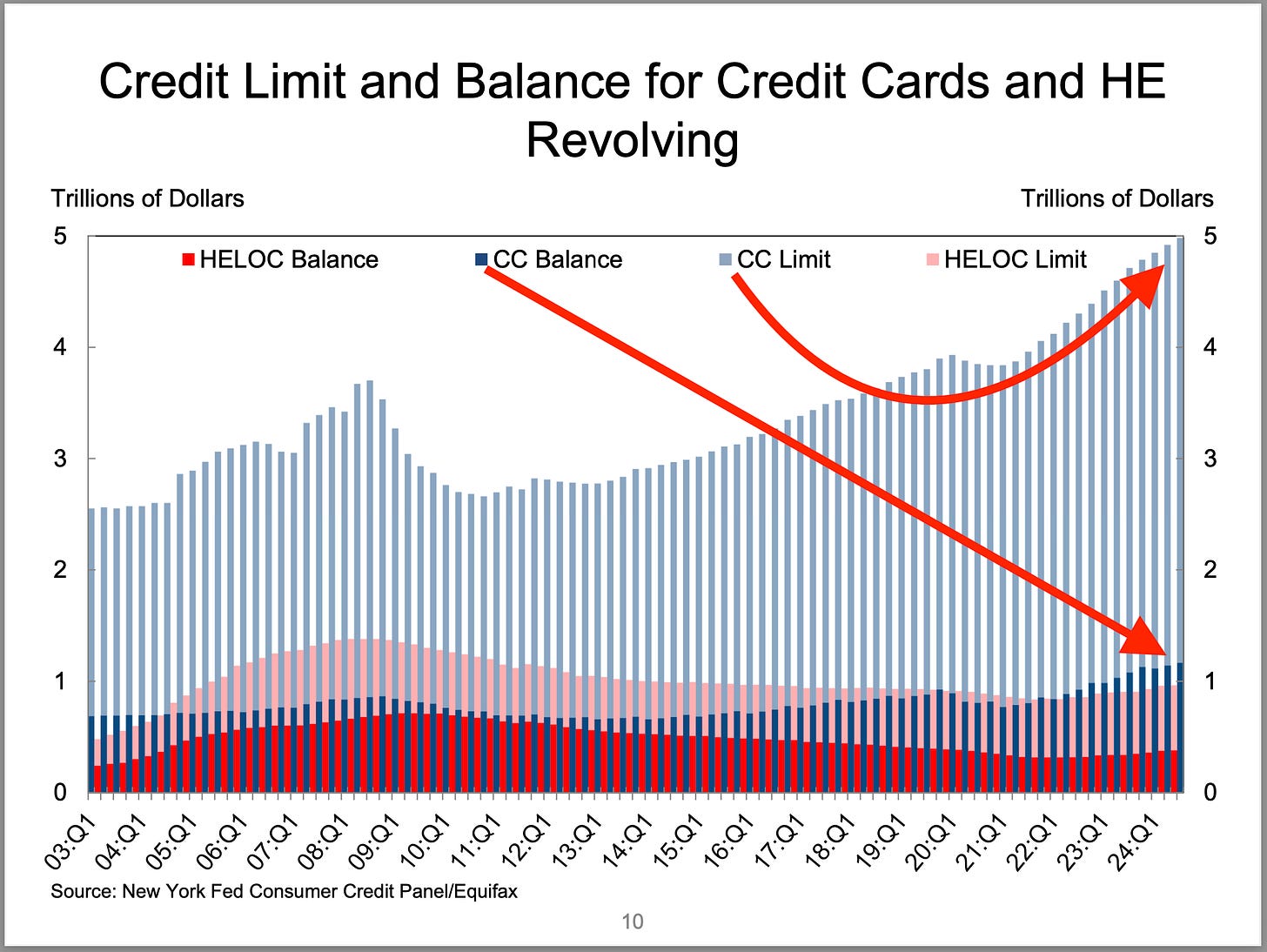

And in case you’re wondering: Households have a long way to go before they max out their credit cards, as the New York Fed chart below shows.

Credit cards are not close to being maxed out. (Source: NY Fed)

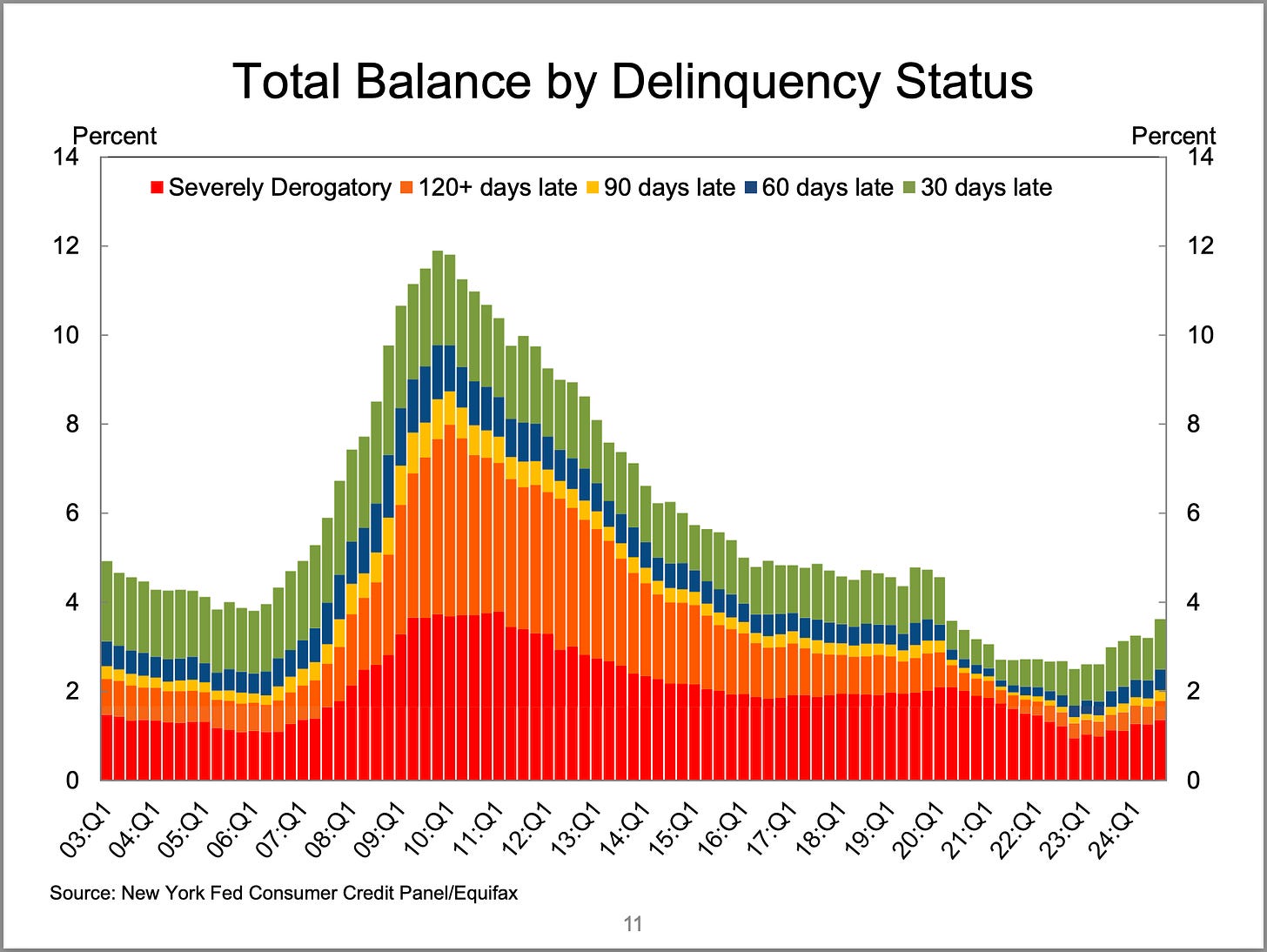

Yes, debt delinquencies have been rising. It’s an economic warning sign to keep an eye on. But for now, they can be characterized as normalizing.

“Aggregate delinquency rates edged up from the previous quarter, with 3.5% of outstanding debt in some stage of delinquency,“ New York Fed researchers noted. That’s significantly below Q4 2019 levels.

Debt delinquencies are rising, but they’re mostly normalizing back to prepandemic levels. (Source: NY Fed)

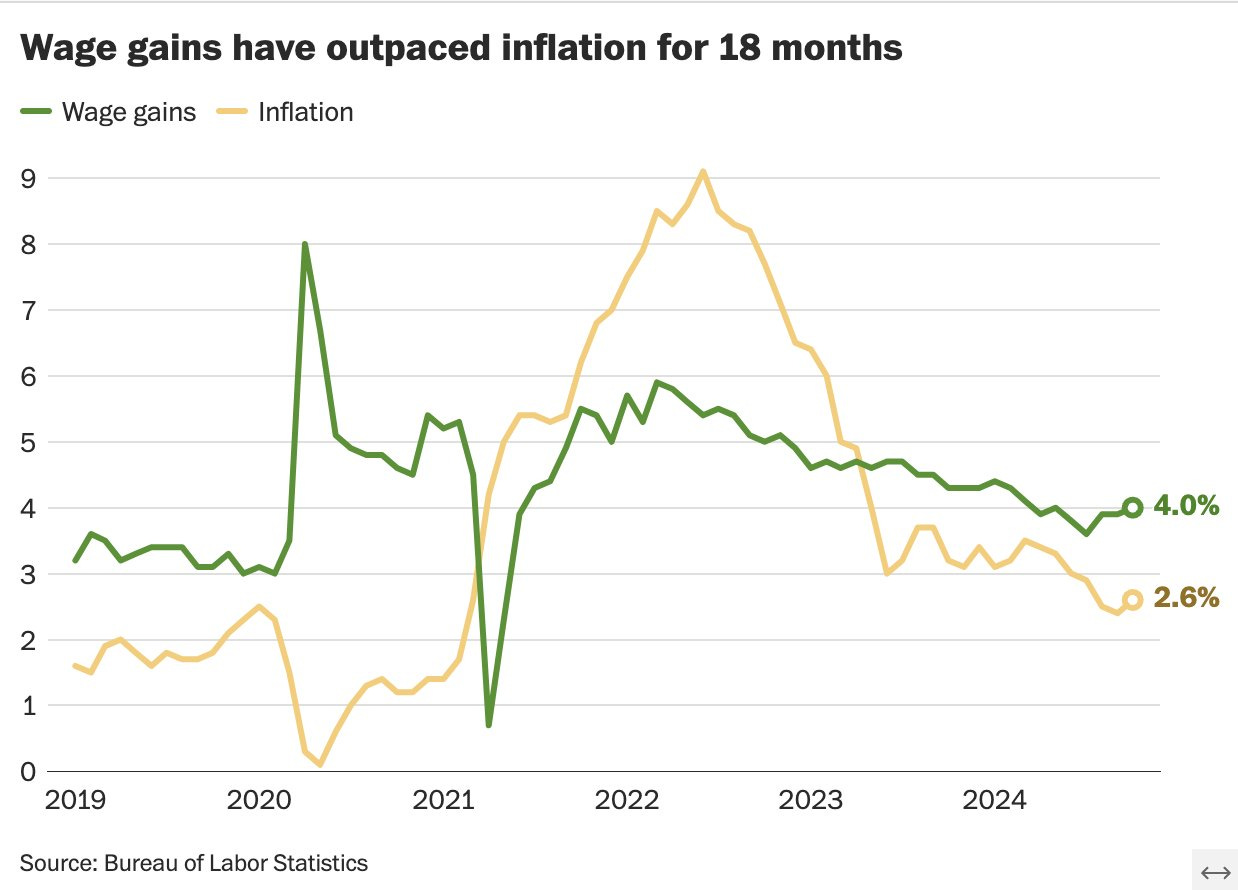

Also, it’s notable that wage growth has outpaced inflation for 18 months.

Wage growth has outpace inflation for 18 months. (Source: @byHeatherLong)

“This is how most Americans will ultimately be able to get ahead,” The Washington Post’s Heather Long wrote. “Prices won’t go down, but wages will go up enough to offset the higher prices.”

We’re also on a 46-month streak of net job creation in America. When more people have jobs, more people have money to spend.

Zooming Out

With a new political party moving into the White House next year, we can expected an upheaval in consumer sentiment.

But as we’ve learned in recent years, people won’t put their lives on hold just because sentiment is poor. If they have money, they will spend it.

A version of this post was originally published on Tker.co.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.