Q3 S&P 500® EPS growth expected to come in at 5.4%, the fifth consecutive quarter of growth

In focus earnings reports this week: Nvidia, Walmart, Lowe’s, TJX Companies, Target

Large cap outlier earnings in the next two weeks: Bath & Body Works, Snowflake, Urban Outfitters

The Q3 earnings season is coming to a close in its usual fashion, with a word from retailers. With 93% of S&P 500 companies reporting at this point, YoY S&P 500 EPS growth has settled around 5.4%, while revenue growth increased 5.5% for the quarter.1

The retailers will offer some much needed insight on the state of the US consumer when they report this week. While consumers have remained relatively resilient in the face of inflation over the last year, uncertainty still abounds, and a more cautious consumer has been noted by certain companies. Last week the retail party started with results from Home Depot and Dillard’s.

Home Depot beat expectations on both the top and bottom-line for Q3, but noted customers were deferring big ticket projects.2 Department store, Dillard’s, was also able to beat analyst expectations on EPS and revenues, but reported YoY declines for both metrics. Same store sales were also down 4% from the year-ago quarter.3

A slightly more positive look at consumer spending came from Disney’s Q3 report. The media giant’s entertainment segment came in with revenue growth that increased 14% YoY.4 This segment includes traditional TV networks, direct-to-consumer streaming and films, showing consumers are willing to spend on entertainment. Even Disney’s experiences segment which includes theme parks and consumer products saw 1% revenue growth after posting a downturn last quarter.5

One big detriment to the retail industry has of course been inflation, and while it has improved it remains stubborn as seen in last week’s CPI figures for October. The 12-month inflation rate moved up to 2.6%, from 2.4% in September.6 A major contributor to this increase was sticky shelter prices which continued higher.

Another potential area of concern for retailers is the proposed tariff policies by President Elect Donald Trump. The proposal includes a universal 10 – 20% tariff on imports from all foreign countries and an additional 60 – 100% on imports specifically from China.7 The National Retail Federation recently reported that such tariff proposals could cost American consumers up to $78B in annual spending power. NRF Vice President of Supply Chain and Customs Policy, Jonathan Gold said “This tax ultimately comes out of consumers’ pockets through higher prices.”8 On this week’s earnings calls we’ll likely hear retailers’ plans on how they may deal with these potential tariffs.

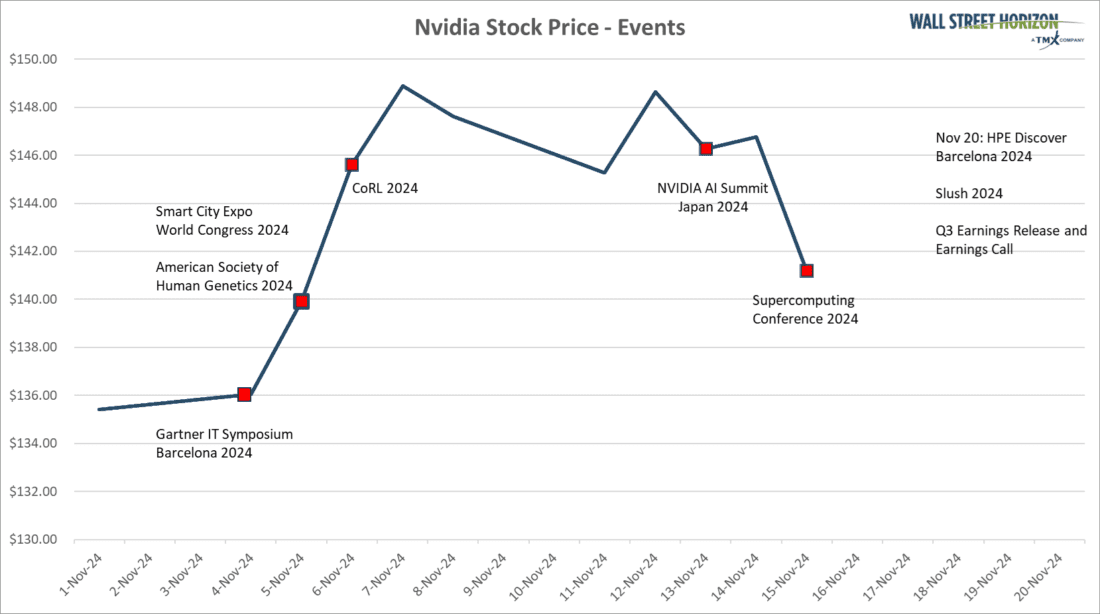

Event Cluster for Nvidia

This week also brings highly-anticipated results from Nvidia. The AI darling will report Q3 results on Wednesday, Nov 20. The stock has rallied 205% YTD on the back of AI demand. Last month Nvidia CEO Jensen Huang told CNBC that its Blackwell chip is in full production and that demand was “insane.”9

Along with its upcoming earnings call, we’ve noticed Nvidia participating in a lot of prominent tech conferences in the last month, continuing to establish itself as a leader in the AI space.

Wall Street Horizon has found that while a standalone event such as a company’s upcoming earnings release date may affect volatility, investigating multiple events closely in relationship to one another can give a more complete picture of a company’s financial health. Observing the information pre-event, during the event and post-event and how they interact can be critical to understand how events relate to trading and risk strategies. Just this month alone leaders at NVDA have spoken at six conferences, with two more slated for November 20.

Source: Event Dates from Wall Street Horizon, Stock Prices from TMX Money

Outlier Earnings Dates for the Rest of the Q3 Season

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.10

In the next two weeks we get results from a handful of companies that have pushed their Q3 2024 earnings dates outside of their historical norms. Three companies of note are Snowflake (SNOW), Bath & Body Works (BBWI) and Urban Outfitters (URBN). While Snowflake has pulled its earnings date forward, BBWI and URBN have later than usual and therefore have negative DateBreaks Factors*.

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Snowflake

Company Confirmed Report Date: November 20, AMC

Projected Report Date (based on historical data): Wednesday, November 27, AMC

DateBreaks Factor: 3*

Snowflake is set to report Q3 2024 results on Wednesday November 20, a full week earlier than expected. SNOW has always reported on a Wednesday since its 2020 IPO, and is continuing with that trend. However, the cloud-based data storage company typically reports Q3 during the 48th or 49th week of the year, this year they have moved much earlier into the 47th week of the year.

Bath & Body Works

Company Confirmed Report Date: November 25, AMC

Projected Report Date (based on historical data): Wednesday, November 20, AMC

DateBreaks Factor: -3*

Bath & Body Works is set to report Q3 2024 results on Monday, November 25, five days later than expected. This is the latest the retailer has reported Q3 results in at least the last ten years, and the first time they’ve reported in the 48th week of the year, typically announcing results in the 46th or 47th week of the year.

Urban Outfitters

Company Confirmed Report Date: November 26, AMC

Projected Report Date (based on historical data): Tuesday, November 19, AMC

DateBreaks Factor: -3*

Urban Outfitters is set to report Q3 2024 results on Tuesday, November 26, one week later than expected. This move pushes the report into the 48th week of the year after reporting in the 47th week last year. This also denotes the latest Q3 earnings date for URBN in at least the last ten years.

On Deck This Week

This week all eyes will be on major retail reports, including results from Walmart and Lowe’s on Tuesday and Target and TJX Companies on Wednesday, as well as Nvidia’s much-awaited Q3 report also out on Tuesday.

Source: Wall Street Horizon

Q3 Earnings Wave

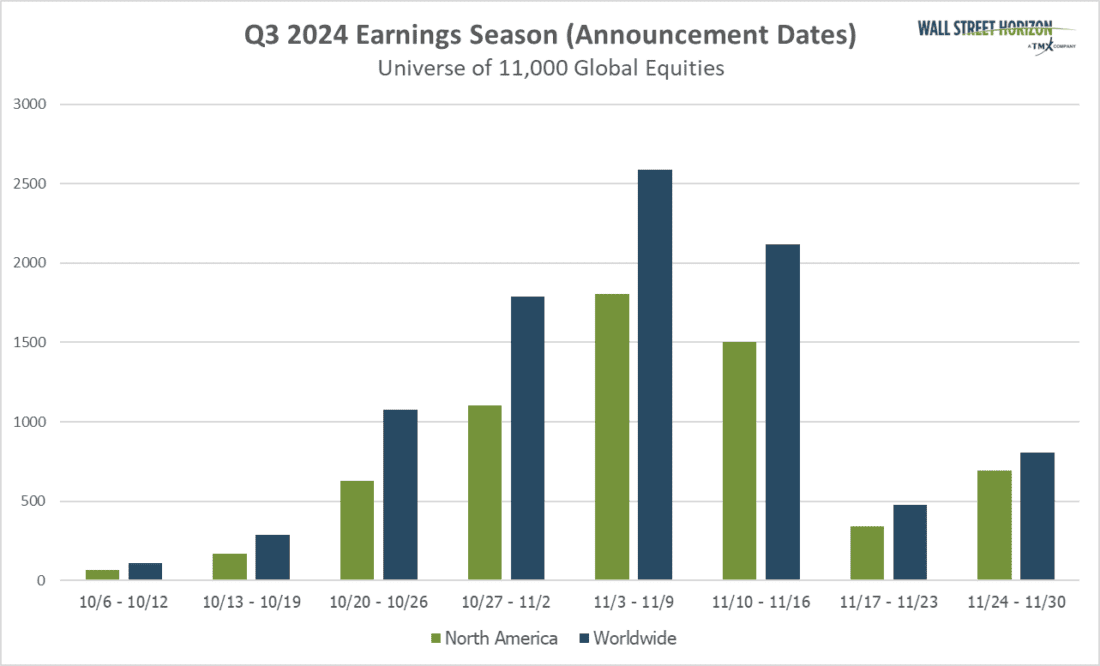

Peak earnings season has concluded for Q3 2024, with 78% of companies having reported earnings (out of our universe of 11,000+ global names). The Q4 2024 earnings season will kick off on January 10 when big US banks begin to report.

Source: Wall Street Horizon

—

Originally Posted November 18, 2024 – The Retail Earnings Parade for Q3 Begins just as Holiday Shopping Season Commences

1 Earnings Insight, FactSet, John Butters, November 15, 2024, https://advantage.factset.com

2 The Home Depot Announces Third Quarter Fiscal 2024 Results; Updates Fiscal 2024 Guidance, November 12, 2024, https://ir.homedepot.com/

3 Dillard’s, Inc. Reports Third Quarter and Year-to-Date Results, November 14, 2024, https://investor.dillards.com

4 The Walt Disney Company Reports Fourth Quarter and Full Year Earnings for Fiscal 2024, November 14, https://thewaltdisneycompany.com

5 The Walt Disney Company Reports Fourth Quarter and Full Year Earnings for Fiscal 2024, November 14, https://thewaltdisneycompany.com

6 Consumer Price Index Summary, U.S. Bureau of Labor Statistics, November 13, 2024, https://www.bls.gov

7 “Trump’s tariff plan: Why he’s pushing for them, and how they might end up raising prices,” CNBC, Ryan Ermey, November 7, 2024, https://www.cnbc.com

8 “Trump Tariff Proposals Could Cost Americans $78 billion in Annual Spending Power,” National Retail Federation,” November 4, 2024, https://nrf.com

9 “Nvidia CEO Jensen Huang says demand for next-generation Blackwell AI chip is ‘insane’,” CNBC, CJ Haddad, October 3, 2024,https://www.cnbc.com

10 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.