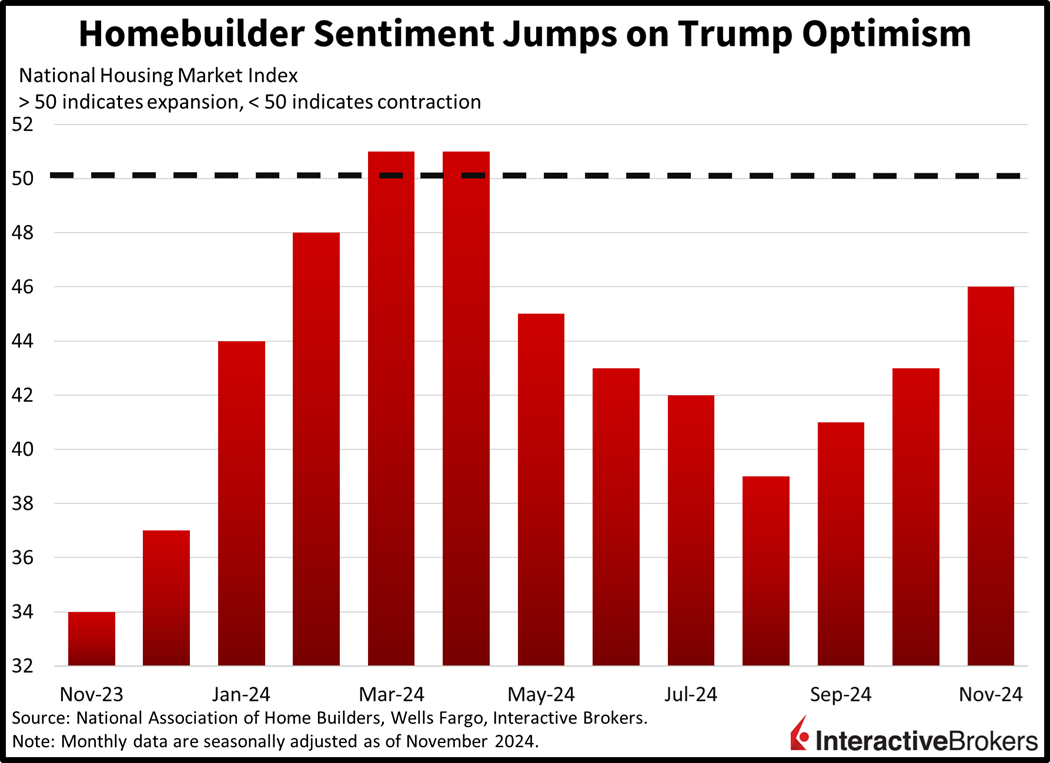

Stocks are recovering from last week’s selloff as investors look ahead to retail and tech earnings in the next few days with AI juggernaut Nvidia taking center stage after the bell on Wednesday. Meanwhile, yields are catching a lift on rosier economic growth expectations as well as concerns about fiscal stimulus, which this morning drove the 30-year to its loftiest level since May. Also offering rates a bump was this morning’s stronger-than-projected homebuilder sentiment print, which has been consistently gaining ground since August and reached its tallest level since April. And while construction folks are incredibly enthusiastic about sales into next year, the headline figure for this month remains in contraction territory, as buyer traffic is constrained with mortgages sporting a seven-handle. Still, participants in the space reported broad-based improvements in the sector, likely linked to expectations that the incoming administration will seek to bolster the real estate market.

Homebuilder Optimism Surges on Trump Win

Sentiment among home construction companies has climbed to a seven-month high with the November NAHB/Wells Fargo Homebuilder Sentiment Index jumping from 43 to 46. Analysts anticipated a score of 44. This result was driven by optimism that the Trump Administration will ease regulations. Additionally, some builders believe that home shoppers who were reluctant to sign closing contracts due to uncertainty about the presidential race will resume their home searches now that the election is concluded. Conversely, with mortgage financing costs closely correlated with the bond market, rising yields on long-term debt during the past few weeks are concerning.

Nevertheless, all three broad categories within the index improved, marking a three-month streak of the measurements moving somewhat in unison. Current sales conditions, which represents nearly 60% of the index’s makeup, rose from 47 to 49, while sales expectations in the next six months jumped seven points to 64. Finally, the NAHB gauge of traffic of prospective buyers advanced from 29 to 32.

In a related matter, the percentage of builders reducing prices was nearly steady, dropping from 32% to 31%. The size of the average price reduction declined one point to 5% and the use of sales incentives fell from 62% to 60%. Additionally, sentiment improved in two regions: the Northeast strengthened from 52 to 59 and the Midwest moved from 43 to 49. The South, however, declined from 43 to 42 while the West dropped from 44 to 39.

Trump Rally Resumes with Broad Equity Gains

Stocks are surging across the board as the Trump rally regains steam with all major benchmarks and sectors positive today. The Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial indices are 1%, 0.8%, 0.5% and 0.1% higher. The consumer discretionary, communication services and energy components are contributing the most with positive returns of 1.3%, 1% and 0.9%. Fixed-income is also responding to the animal spirits, with yields on the 2- and 10-year Treasury maturities changing hands at 4.33% and 4.47%, 2 and 3 basis points (bps) heavier on the session. The dollar is paring some of its recent progress, however, with the greenback’s gauge lower by 17 bps. The US currency is deprecating versus the euro, pound sterling, franc and Aussie and Canadian counterparts but is appreciating relative to the yen and yuan. Commodity majors are pointing north with crude oil, silver, gold, copper and lumber gaining 3.1%, 3.1%, 1.9%, 1.2% and 0.3%. WTI crude oil is trading at $69.03 per barrel on rising hostilities between Moscow and Kyiv.

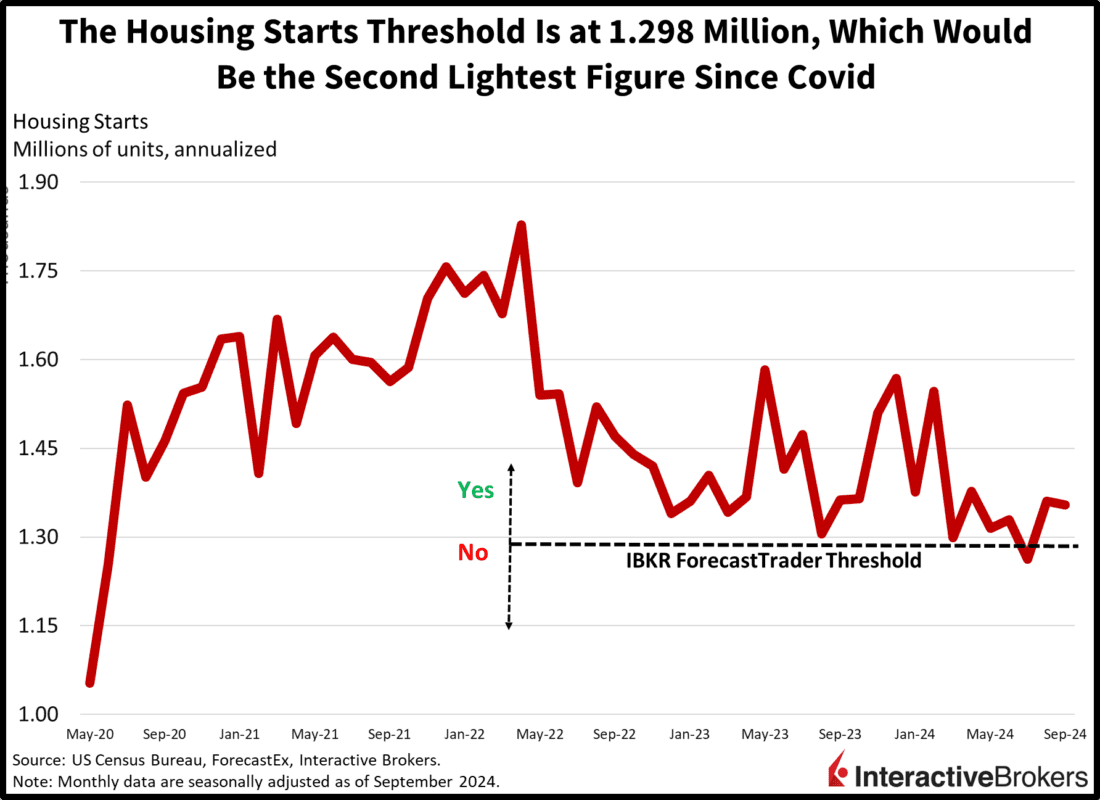

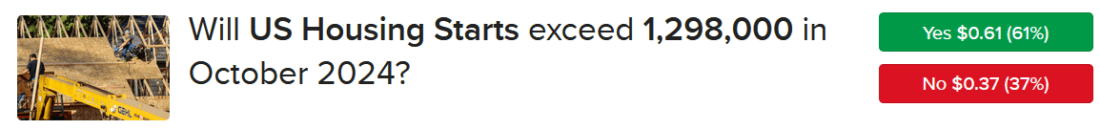

ForecastTrader Points to Below Consensus Housing Starts

While residential construction companies are exuberant as they expect many more shovels to hit the ground into next year, an important reminder lies in understanding that sentiment and actual results can differ wildly. Just look at how consumer sentiment and confidence have been weaker in the past few years while economic growth and household spending have remained robust. This time, however, we’ll see if tomorrow’s real estate data covering last month correlate with rising optimism in the space. Indeed, both housing starts and building permits are due at 8:30 am ET, and the IBKR ForecastTrader platform and the Wall Street consensus are near each other on permits but far away on starts. Our platform is pricing 61% and 44% chances of figures north of 1.298 million and 1.45 million on starts and permits, while the median Wall Street estimate is at 1.34 million on the former and 1.43 million on the latter. Finally, the animal spirits from this morning’s NAHB report, rising economic growth expectations and the discrepancy amongst analysts point to the potential for the Yes contract on starts to be correct and reward investors. Additionally, a figure of 1.298 million would be amongst the lightest since COVID-19, which is quite unlikely, as just one month—last July—fell below that threshold since the pandemic.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.