1/ Dollar: Bullish or Bearish?

2/ $NATGAS Above the VWAP

3/ Breakout Setup!!

4/ Strong Relative Strength

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

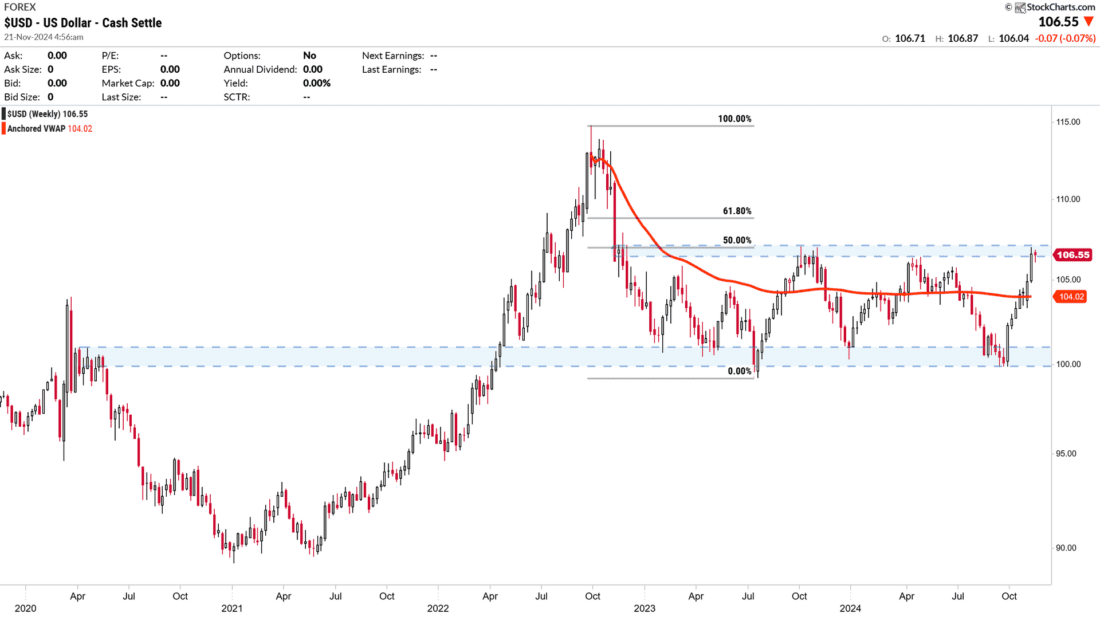

Dollar: Bullish or Bearish?

The US dollar has remained in the area that has been acting as resistance since 2022. After 7 weeks of continuous advance, the week has been quite flat, with a price that does not give any sign of its next move.

The American currency has been oscillating sideways, since 2022, between 99 and 106. The upper zone of this range (resistance), which coincides with the 50 level of the Fibonacci retracement marked since its most recent high, is containing the price. The price has already accumulated 3 clear bounces in each attempt to overcome this level.

Courtesy of StockCharts.com

The question is, will it be different this time? There are several factors that will undoubtedly impact the near future.

The impact of a second Trump term on the USD will depend on the interplay between his policies and global dynamics. In the short term, the USD could benefit from his protectionist and expansionary stance. However, in the longer term, fiscal pressures and international perceptions of the US could weigh on the dollar, especially if other countries diversify their reserves and promote alternatives to the USD-dominated system.

2/

$NATGAS Above the VWAP

During the winter (October-March), demand for natural gas tends to increase significantly due to its use as a heating source in the northern hemisphere.

Possible scenarios in the short term for Natural Gas are:

- Higher prices if the winter is colder than anticipated.

- Downward pressure if inventories remain high and demand does not reach expected levels.

Courtesy of StockCharts.com

The price has remained bullish since the beginning of February and has already managed to cross above the VWAP drawn from its 52-week high, which had been acting as resistance to the price since August 2022.

Both the MACD line and its histogram have given a positive reading, signaling a possible change in the trend of natural gas towards a bullish direction. The upward momentum is gaining strength.

3/

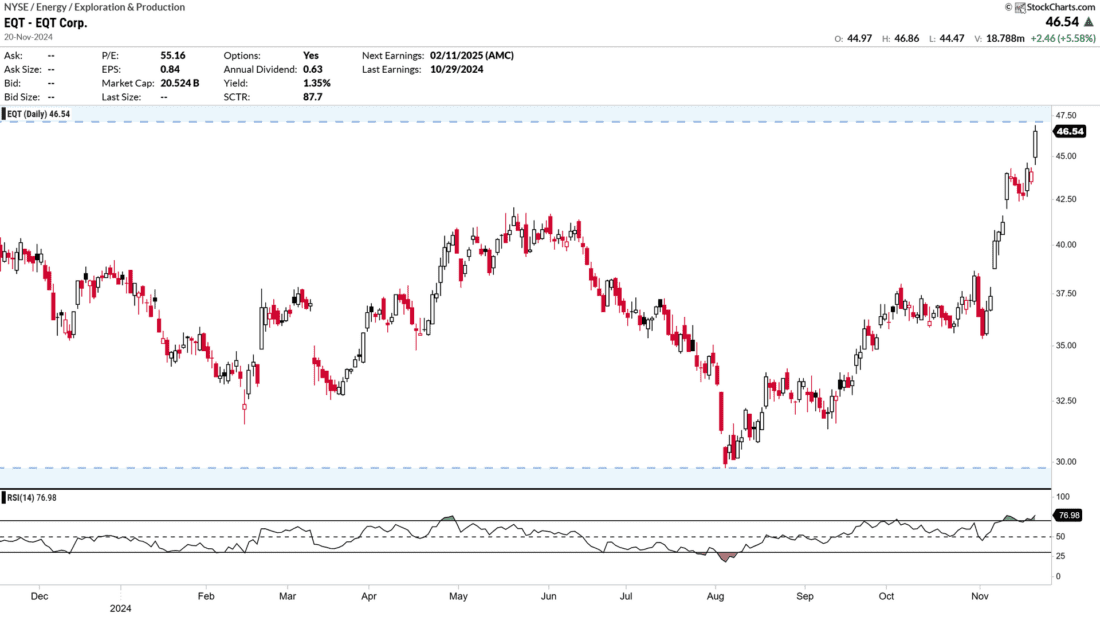

Breakout Setup!!

EQT Corporation, the leading U.S. natural gas producer, is strategically positioned to take advantage of future natural gas demand. However, analysts maintain a mixed approach, with a majority leaning toward “hold” recommendations as the outlook for natural gas prices remains subdued in the near term.

EQT’s correlation to natural gas prices remains a critical factor. If gas prices hold or rise, EQT is likely to continue higher.

Courtesy of StockCharts.com

After forming a huge base, between 2017 and 2022, the price has stopped its ascent, started in 2020, and has consolidated within a range. The share price is leaving us with a bullish setup, which will be confirmed if we finally have a breakout above resistance levels. At the moment, the price is starting to visit the resistance of the range, after an almost +28% increase that was marked just before the end of November.

EQT presents itself as an interesting opportunity for investors with a medium to long term perspective, especially those who believe in an eventual natural gas rally.

4/

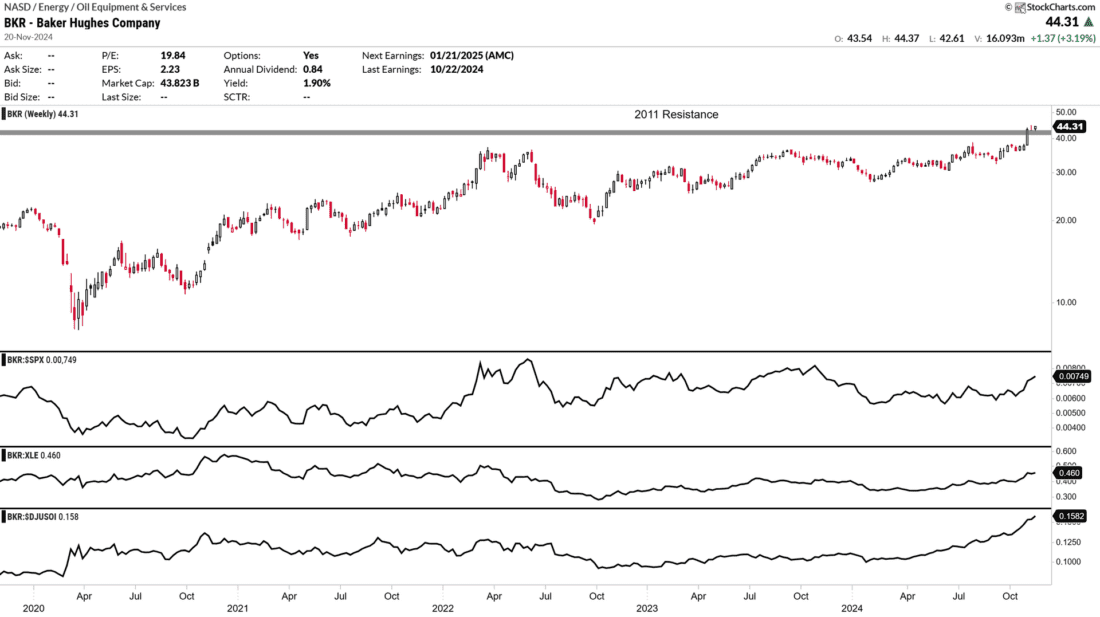

Strong Relative Strength

Baker Hughes Company (BKR) is an energy technology company with a portfolio of technologies and services that span the energy and industrial value chain.

The price remains above the resistance (2011) recently overcome, while its relative strength ratios against its industry, sector and the market remain positively sloped. A clear sign of strength.

Courtesy of StockCharts.com

Baker Hughes is now on track to end 2024 up more than 25%, which would mark its fourth straight winning year.

Following this run, the average analyst surveyed by LSEG sees the stock gaining slightly under 3% over the next year. Most analysts have buy ratings on the stock.

—

Originally posted 21st November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.