By Fadi Dawood

1/ Bullish Trend Reversal in $PYPL

2/ $GM Signals a Bullish Breakout

3/ $AXP Chart Shows Steady Climb

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Bullish Trend Reversal in $PYPL

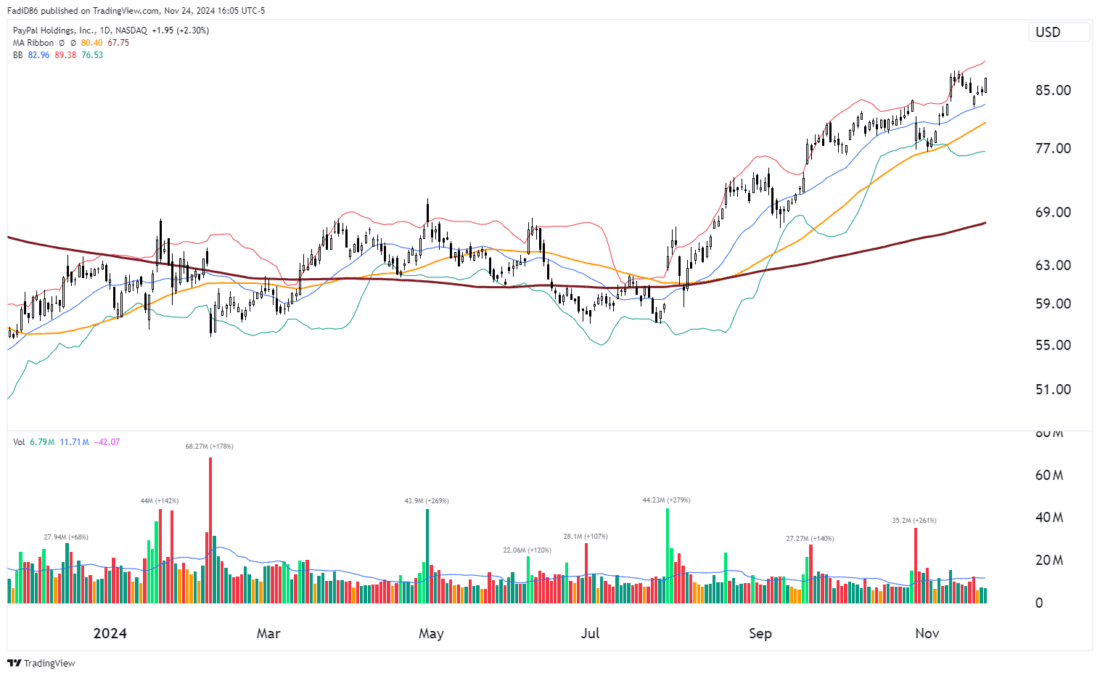

PayPal Holdings, Inc. (PYPL) is showing promising signs of a comeback, with its chart signaling a developing uptrend and renewed optimism among investors. After months of struggling below key resistance levels, the stock has broken out and is beginning to rebuild its bullish momentum.

PYPL is steadily recovering, with prices now trading firmly above all major moving averages. The 200-day SMA (thick maroon line), which had acted as a ceiling for much of the year, has been decisively cleared. The upward-sloping 50-day SMA (orange) and 20-day SMA (blue) further confirm that the trend is strengthening across the board.

The stock recently climbed to highs near $87 and is consolidating near the upper Bollinger Band. This positioning suggests that bullish momentum remains intact, though a brief pullback could provide a healthier base for further gains. PYPL’s ability to reclaim and stay above the 200-day SMA earlier in the year marked a significant shift in sentiment and set the stage for the current rally.

Volume tells an encouraging story. There have been multiple high-volume up days throughout the rally, especially during breakouts above resistance levels. This indicates strong institutional participation in the uptrend. Notably, the recent pullbacks have occurred on lower volume, suggesting profit-taking rather than outright selling.

PYPL’s chart tells a story of recovery and renewed momentum. With strong volume support, rising moving averages, and price action consistently improving, the stock is setting up for continued gains. For traders and investors, this is a name to watch closely as it rebuilds its long-term bullish case

2/

$GM Signals a Bullish Breakout

General Motors (GM) is hitting the gas on its bullish breakout, with the chart reflecting a powerful uptrend and growing investor confidence. Over the past year, GM has transitioned from consolidation to a strong rally, pushing higher and showing no signs of slowing down.

The stock’s long-term trend is unmistakably bullish, as prices continue to hold well above the rising 200-day SMA (thick maroon line). This key level has served as a foundation for GM’s sustained upward trajectory. Meanwhile, the shorter-term 50-day SMA (orange) and 20-day SMA (blue) are firmly trending upward, signaling that momentum is accelerating across multiple timeframes.

GM recently surged to new highs near $60, a level that could pave the way for further gains. The stock has spent much of its rally hugging the upper Bollinger Band, reflecting strong upward momentum. Earlier this year, it successfully bounced off the 200-day SMA, a critical turning point that reinforced the bullish trend.

Volume tells a compelling story of conviction behind GM’s rally. Spikes in volume during key up days, such as the October breakout, highlight strong institutional buying. In contrast, pullbacks have been accompanied by lighter volume, a classic sign that selling pressure is limited while bulls remain firmly in control.

GM’s chart is the perfect storm of rising momentum, bullish volume patterns, and strong support levels. With the stock positioned near its highs, this trend looks poised for more upside, offering a compelling opportunity for traders and investors alike

3/

$AXP Chart Shows Steady Climb

American Express ($AXP) is making a strong case for sustained growth, with its chart highlighting a steady uptrend and reliable support from key technical levels. Over the past year, the stock has delivered consistent gains, supported by bullish momentum and favorable market sentiment.

AXP’s long-term trend is firmly bullish, with prices well above the upward-sloping 200-day SMA (thick maroon line). The 50-day SMA (orange) and 20-day SMA (blue) are also rising, signaling increasing momentum and reinforcing the stock’s strength across all timeframes. This alignment of moving averages reflects a market that continues to reward buyers.

The stock is trading near its all-time high of $302, following a series of higher highs and higher lows—a hallmark of a strong uptrend. AXP has consistently held above its 20-day and 50-day SMAs, suggesting a steady climb with minimal interruptions. Prices have frequently hovered near the upper Bollinger Band, indicating persistent bullish momentum, though occasional pullbacks have kept the trend healthy.

Volume supports the trend, with notable spikes during breakout sessions, such as the February rally, confirming strong institutional interest. Pullbacks, when they occur, have been accompanied by lighter volume, showcasing a lack of significant selling pressure. This pattern reinforces the sustainability of the ongoing rally.

$AXP is a textbook example of a steady uptrend, supported by rising moving averages, bullish volume patterns, and consistent price action near its highs. With the stock firmly in an upward trajectory, traders and investors should watch for pullbacks to key support levels as potential opportunities to participate in this strong trend.

—-

Originally posted 25th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.