From SIA Charts

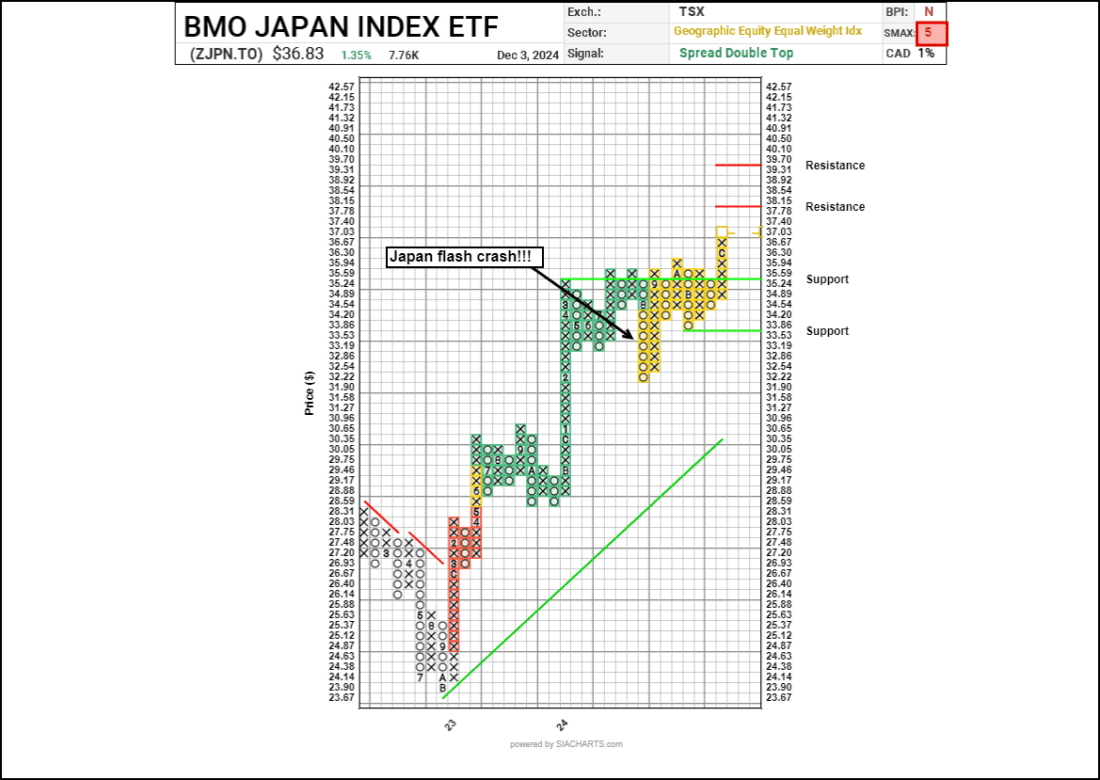

1/ BMO Japan Index ETF (ZJPN)

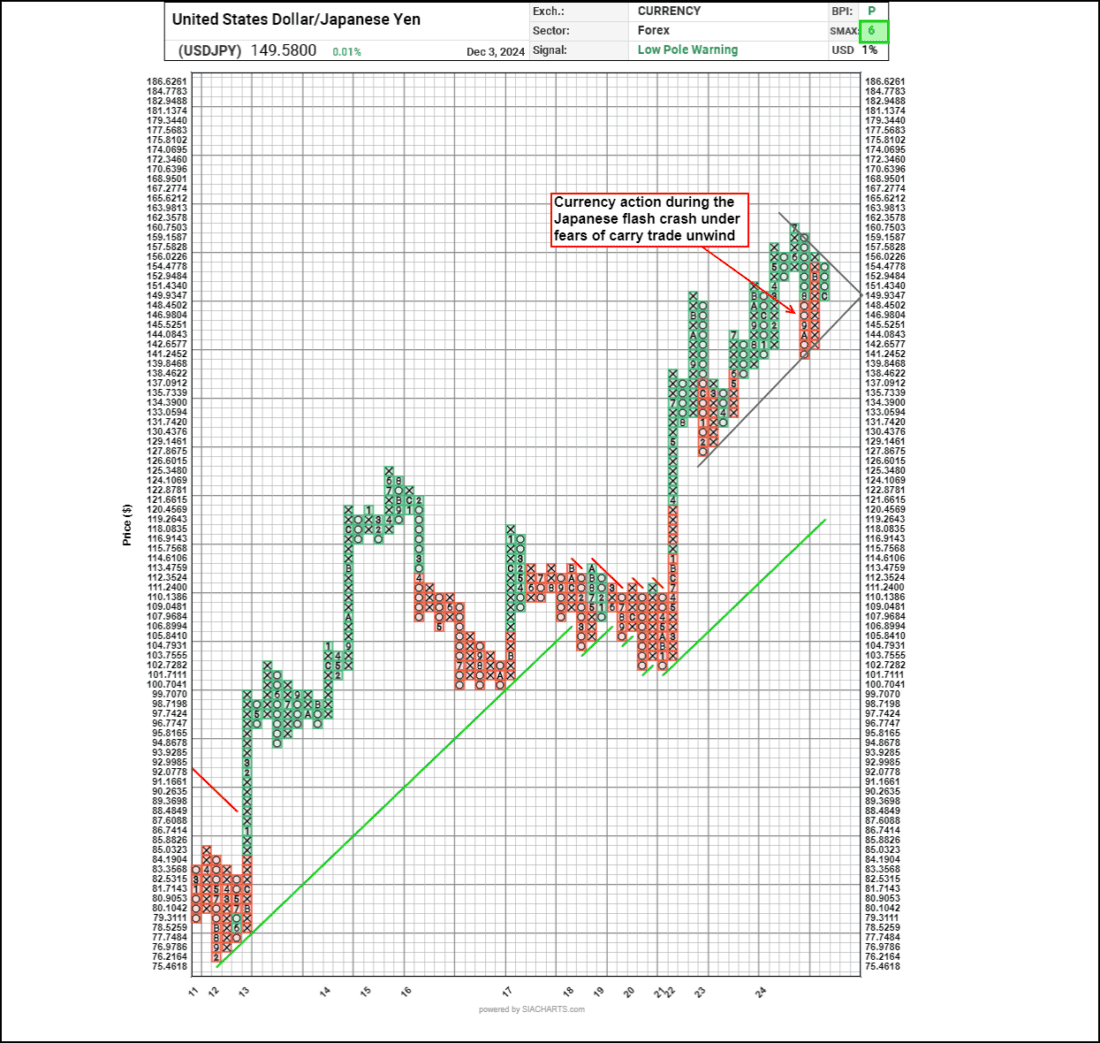

2/ USDJPY

3/ Point and Figure Chart

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

BMO Japan Index ETF (ZJPN)

Courtesy of SIA Charts

On July 31, 2024, the Bank of Japan raised its key interest rate to 0.25%, up from 0%, aiming to curb the yen’s sharp decline against the U.S. dollar. This move strengthened the yen, which had dropped to around 160 yen per dollar, a concern for Japan given its reliance on imports like oil and food. Just four months earlier, Japan had raised rates above zero for the first time in 17 years. In August, Japan’s stock market experienced a significant drop, with the Nikkei 225 index plunging 12.4%, marking its largest one-day percentage loss since 1987. This triggered a global market rout, causing major losses worldwide, though the impact was short-lived. Amid turmoil in South Korea, money flows appear to be shifting, potentially favoring Japan. These developments are particularly relevant to the Japanese carry trade, a strategy where investors borrow yen at low rates to invest in higher-yielding, appreciating assets abroad, such as the U.S. dollar. While the carry trade can be profitable due to the interest rate differential, it carries risks like currency fluctuations, rising interest rates, and global market volatility, which could lead to significant losses if conditions change. Currently, these risks seem muted as Japan-focused ETFs are experiencing strong point-and-figure breakouts. However, many of these positions remain in the neutral zone according to SIA reports, particularly the SIA All CAD ETF Report, which tracks 859 unleveraged Canadian ETFs daily, helping identify assets and sectors gaining momentum.

2/

USDJPY

Following the market pullback this summer, advisors are closely monitoring both emerging and developed markets. The BMO Japan ETF (ZJPN) stands out, moving up 23 positions in the past week and 40 positions over the past month. This is in stark contrast to the 77-position drop in the last quarter, as reflected in the SIA All CAD Report. A technical analysis of the BMO Japan Index ETF shows that while the unit’s relative strength declined after August’s flash crash, it never entered the SIA “unfavored” red zone. Meanwhile, the US Dollar/Japanese Yen pair shows a positive trend, with a price discovery triangle forming, typically resolving in the direction of the trend. The SMAX score of the US Dollar/Japanese Yen, a near-term indicator that compares relative strength across asset classes, turned red during the crash but has since switched back to green as can be seen in the first chart, signaling resilient market conditions.

Courtesy of SIA Charts

3/

Point and Figure Chart

Finally, this point-and-figure chart for BMO Japan ETF shows a strong breakout with multiple double tops, signaling potential continued strength, particularly as the broader market watches for further developments amid the instability in South Korea.

Courtesy of SIA Charts

—-

Originally posted 5th December 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.