Part I of this series discusses the wisdom of crowdsourcing, while Part II explores the concept of give-to-get.

For a long time, Vinesh Jha, CEO of Estimize, founder of its parent company ExtractAlpha, and a pioneer of crowd-sourced earnings estimates, was skeptical about AI’s value for investment strategy. But in recent years, his skepticism has been moderating.

“At first, I didn’t really see the practical value. The early iterations were nice, but they weren’t productivity enhancers, and for what we do it still wasn’t there. Making cool images in the style of Picasso is great, but I didn’t see how it was going to help us.”

Jha makes a sharp distinction between AI and the machine learning that’s so important to what Estimize delivers.

“There’s a joke going around that puts it pretty well into perspective: machine learning is written in Python; AI is written in PowerPoint. I think a lot of the recent buzz is mostly a marketing thing.”

Jha goes on to say that what ExtractAlpha does with machine learning isn’t AI but “AI-adjacent.”

“Part of what we do is analyze text to assess market sentiment. We take something like an earnings call transcript or a news article, process it and turn it into something you can trade on. Our machine learning programs are built to ‘read’ text the way humans would and glean insights from it. For example, we have an earnings call transcript signal for US firms that’s been super successful for years.”

He notes that his team recently launched a new signal that reads Japanese news from Nikkei.

“There again, machine learning is really good at predicting stock prices. But it’s interpretative, not generative: it’s about taking existing text and pulling insights from it. What it doesn’t do is generate anything truly new.”

One area he thinks generative AI is truly useful, however, is code generation.

“It’s useful in nearly every vertical that uses technology. AI tools are now available that can build code snippets in your preferred coding environment. You have to adjust them to make them work, so there’s growing pains, but for specific tasks AI can build the first version pretty well. For now, it’s mostly used for menial coding tasks, but it can be a huge timesaver. Hopefully, over time, it’ll get more sophisticated.”

He notes another example now being explored by several firms: analyzing the body language, tone of voice and facial expressions of CEOs and CFOs when they present company results. When ready, the technology could be extended to Fed meetings, telegraphing potential rate changes.

“AI won’t replace a great quant analyst any time soon, but it can help the process become more efficient. It can grab a particular data set and process it, even build a website that displays it in a useful way. It can also help with summarization, which is particularly useful for non-quant analysts who look for the most relevant news from filings, transcripts, press releases and so on. A well-trained AI can put that information together at the level of detail that gives an analyst something actionable – succinct bullet points written in clear English, for example.”

Jha acknowledges that AI might also have a place in rebuilding factor models that have been available for a long time. But he believes that coming up with genuinely new insights that lead to new signals is still out of reach.

“AI still can’t think out of the box because, in a way, it is the box. When you fill it with the cumulative knowledge of all that’s come before, it can do useful things. But a human being still needs to review whatever it compiles and decide how, or even if it can be used.”

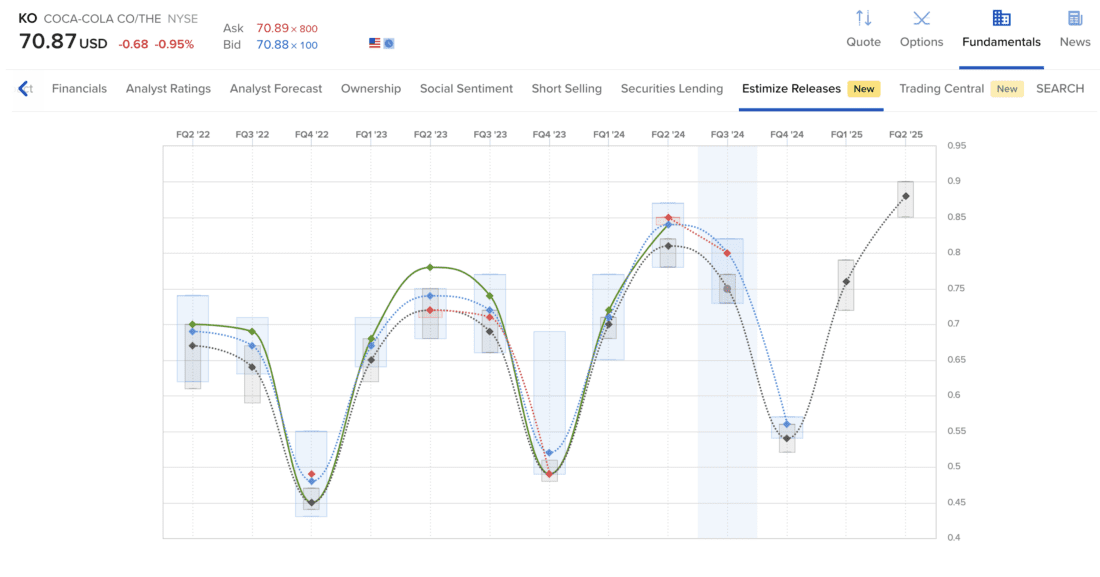

Source: Estimize screenshot from Discovery

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.