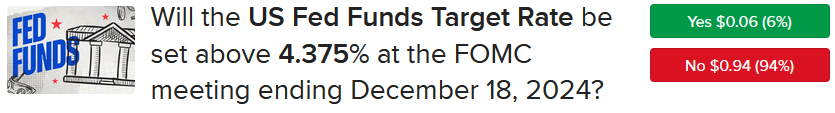

Stocks are buckling following a stronger-than-expected US retail sales report, which is weighing on the liquidity outlook and the number of Fed cuts anticipated next year. Similarly, British monetary policy prospects tilted in the hawkish direction following the first acceleration in wages in over 13 months. But weaker-than-projected stateside figures from capital-intensive industries issued after 9:10 am ET brought in the bond bulls, as industrial production and homebuilder sentiment missed estimates. Canadian fixed-income instruments are also catching a bid following this morning’s 1-handle on CPI, as price pressures fall below the BoC’s target. Meanwhile, IBKR ForecastTrader participants are largely awaiting the results and commentary from the Fed’s two-day meeting ending tomorrow, with current contract pricing factoring a near certainty of a 25-bp trim in roughly 26 hours alongside a 69% probability of a January pause. They’re also looking forward to other economic data releases out this week, including housing starts, PCE inflation, GDP, consumer sentiment, initial jobless claims and Hong Kong’s CPI.

Source: ForecastEx

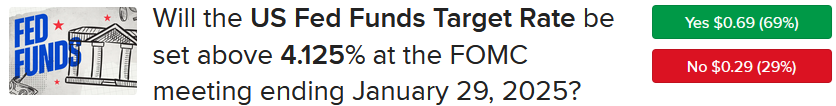

Shoppers Leave the Lights On

Earlier this year, monthly consumer spending variations resembled flicking a light switch on and off, but in November, shoppers emulated the Motel 6 tagline, “We’ll leave the light on.” The bright month was driven by consumers increasingly flocking to car dealers and cranking up their online sales apps. Transactions increased 0.7% month over month (m/m) after growing an upwardly revised 0.5% in October and 0.8% in September, according to the Commerce Department’s Census Bureau. The November increase exceeded the median forecast of 0.5%. After excluding automobiles and gasoline, however, outlays grew just 0.2%, matching October’s result but falling short of the 0.4% projection.

Among the report’s 13 major categories, seven advanced, one was unchanged and five retreated. In November, the motor vehicle and parts dealers classification and the ecommerce retailers group led with sales heading north by 2.6% and 1.8%, respectively. The strong results are attributed to automobile dealers providing end-of-year discounts and online retailers offering holiday shopping incentives. More broadly, strong equity markets, home value appreciation and a tight job market that has driven increases in real income have also helped to rev up volumes.

Other areas that progressed along with the extent of the increases were as follows:

- Sporting goods, hobby, musical, 0.9%

- Building material and garden equipment, 0.4%

- Furniture and home furnishing stores, 0.3%

- Electronics and appliance stores, 0.3%

- Gasoline stations, 0.1%

The miscellaneous store retailer group and restaurant and bar category experienced the largest declines, with consumption falling 3.5% and 0.4%, respectively. Furthermore, the clothing and clothing accessories category dropped 0.2% while general merchandise stores activity retreated 0.1%. Sales were flat m/m in the health and personal care stores classification.

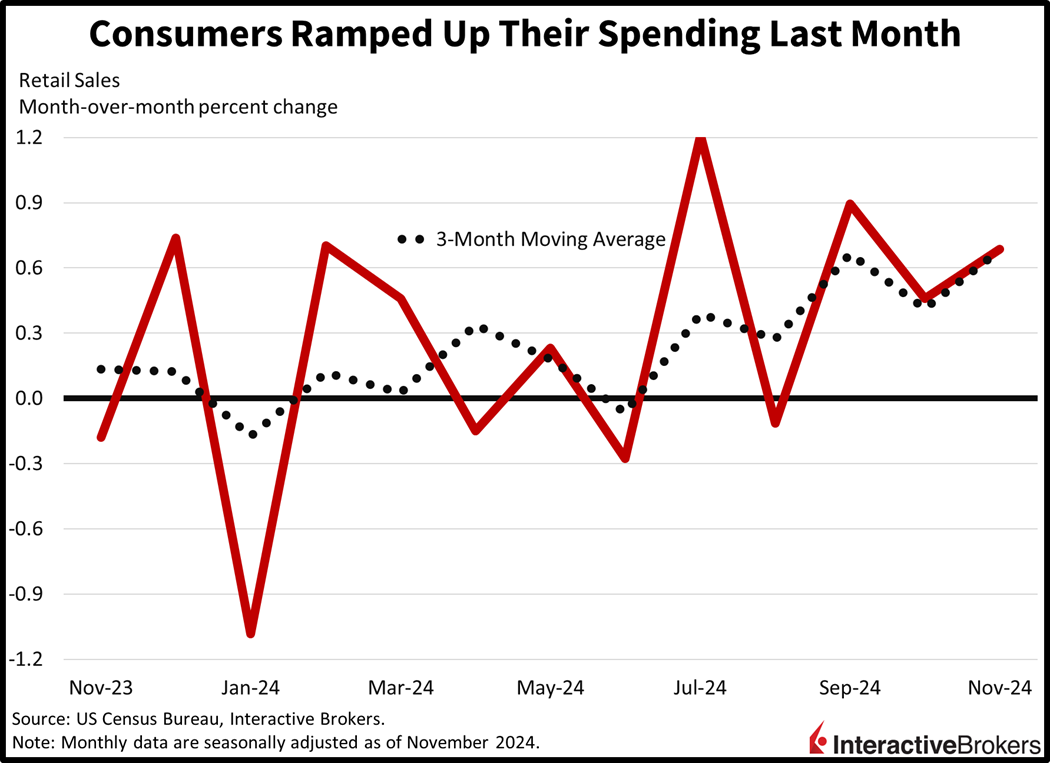

Homebuilder Sentiment Flat

December sentiment among home construction companies was unchanged m/m at 46, lingering at its highest level since April, when it hit 51, according to the NAHB/Wells Fargo Homebuilder Sentiment Index. Analysts anticipated the score would climb to 47; however, sales expectations for the next six months hit 66, up from 63 and the strongest reading since April 2022. Additionally, overall sentiment improved in two regions: the Northeast strengthened from 57 to 62 and the South moved from 42 to 48. The West, however, went from 39 to 38 while the Midwest stayed at 48. While the index’s gauge of current sales conditions continued at 48, sentiment regarding traffic of prospective buyers fell one point to 31. More broadly, optimism that the Trump Administration will ease regulations was tempered by concerns about a shortage of buildable lots, high mortgage rates and elevated construction costs.

In a related matter, the percentage of builders reducing prices and the average price reduction, at 31% and 5%, respectively, were both unchanged from November. The use of sales incentives, at 60%, was also unchanged.

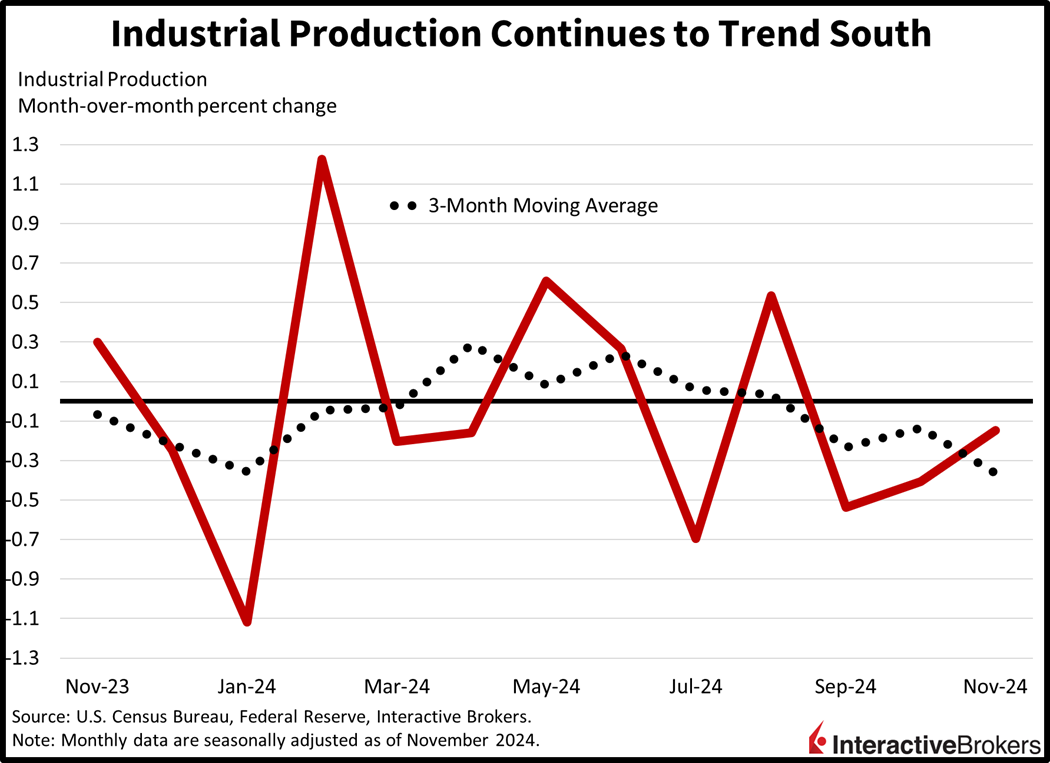

Industrial Production Falls

While shoppers picked up their activity last month, industrial production eased off the gas pedal, falling 0.1% m/m, according to the Federal Reserve. The result was much worse than projections for a 0.3% increase but less dire than October’s 0.4% decline. The utilities and mining categories were the weakest amongst major industry groups with declines of 1.3% and 0.9%, partially offset by a 0.2% increase in the manufacturing segment. Across major market groups, final products rose 0.2%, as a 1.2% increase in business equipment offset a flat consumer goods category. The nonindustrial supplies and materials major market groups, however, were down 0.5% and 0.3%, while the construction sub-group slipped 0.2%.

Canada Inflation Is Below Target

North of the US border, Canada’s inflation moved lower than the central bank’s target. The November Consumer Price Index (CPI) rose just 0.1% m/m and 1.9% y/y, lighter than the expected 2%, which would’ve equaled October’s result. There was broad deceleration and deflation present within the report as the household operations, furnishings and equipment category, clothing and footwear segment and health and personal care component saw 0.5%, 0.4% and 0.1% m/m price declines. Amongst the areas seeing costs increase were transportation, the recreation and education category, shelter, food and the alcoholic beverage, tobacco and cannabis segment, which saw charges climb 0.6%, 0.6%, 0.3%, 0.2% and 0.1%. Housing costs slowing from 0.7% m/m to 0.3% was a significant driver in lessening the inflationary impact.

UK Wages Strengthen

British wage growth accelerated for the first time since August 2023 and the news is darkening the path for BoE accommodation. UK average weekly earnings accelerated to 5.2% year over year (y/y) in the three months ending in October, exceeding the projected 5% as well as the previous period’s 4.9%. The unemployment rate held steady at 4.3%, unchanged from the preceding reading and in-line with estimates. The figures have driven the expectation of 75 basis points (bps) of cuts next year down to 55% from 90% before the print.

Aussie Optimism Falls

Across the pacific, Australian consumer sentiment weakened this month as uncertainty regarding the outlook offset improvements in current conditions. The Westpac Consumer Confidence Index arrived at 92.8, below the 94.6 from November. While folks appeared confident in buying major household items and in maintaining employment, inflation stickiness, geopolitical uncertainty, an expectation of higher-for-longer borrowing costs, a lack of confidence regarding home purchasing and pessimism on real estate prices countered short-term optimism.

China Braces for Trump 2.0

North of Melbourne in Beijing, Chinese Premier Li Qiang motivated government officials to complete economic tasks quickly as we flip the calendar to the new year. The nation is facing a sense of urgency as the Trump administration sets up shop in Washington in about a month and has delivered hawkish rhetoric to the US’s Far East trade partner. The Trump overhang looms significant in Beijing, and top leaders fear that a lack of readiness can leave the Chinese flat-footed heading into 2025.

Markets have a bearish bias as folks await numbers, text and a Chair Powell presentation from the Fed tomorrow afternoon. All major equity benchmarks are tilted lower as traders fear that this morning’s robust retail sales report may serve to push the central bank in a hawkish direction. The Russell 2000, Dow Jones Industrial, S&P 500 and Nasdaq 100 indices are lower by 1.3%, 0.6%, 0.4% and 0.3%. Sectoral breadth is negative with 8 out of 11 segments losing on the session and being dragged down mostly by energy, financials and industrials, which are moving south by 1.4%, 0.8% and 0.7%. Meanwhile, upside representation is comprised of real estate, consumer discretionary and communication services; they’re all gaining a modest 0.1%. Treasurys have flipped from losses to gains after a few economic reports that missed estimates compelled interest in fixed income. Still, the 2- and 10-year maturities are changing hands at 4.25% and 4.39%, 1 bp lighter on the session. Comparably, the dollar is near its flatline but its appreciating relative to the euro, franc, yuan, and Aussie and Canadian tenders. The greenback is depreciating versus the pound and yen, however. Commodities are trading south for the most part with crude oil, copper, gold and silver lower by 1.6%, 1.3%, 0.6% and 0.3%, but lumber is up 0.9%. WTI crude is trading at $69.07 as demand concerns weigh on the critical liquid.

Fed to Adjust Neutral North

A critical aspect of tomorrow’s Fed decision will be the level at which the central bank think’s its key benchmark should be to establish monetary policy that is neither contractionary nor expansionary. With inflation showing modest acceleration and growth picking up despite the Fed’s current rate at a mid-point of 4.63%, I believe the neutral rate of this economy is closer to 4% rather than 3.5% or 3%. But top of mind for market participants will be the number of rate cuts penciled in for next year alongside plans for the Fed’s balance sheet, which is now down to $6.9 trillion from a high of $8.97 trillion as of April 2022. But the bar for reductions has been pulled lower, with current probabilities expecting between 1 and 2 25-bp trims next year. The drop in expected easing is opening the door for a friendly Powell tomorrow, because if the central bank’s Summary of Economic Projections, or dot plot, reflects between 2 and 3 cuts instead of 1, then chances are equities will finish off the year with a bang. But a recognition from the FOMC of global uncertainty, international developments and potential hawkish trade restrictions that may weigh on the Fed’s ability to ease could generate volatility in markets. Finally, given the Fed’s super-sized adjustment in September and dovish commentary for the most part, I’m expecting the FOMC to save its hawkish remarks for next year.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.