It’s an important lesson in business — companies that fail to adapt fall behind. One familiar example is Blockbuster Video, which could have purchased Netflix for $50 million, but the CEO didn’t see any value in the idea. Netflix is now worth nearly $400 billion, while Blockbuster is history.

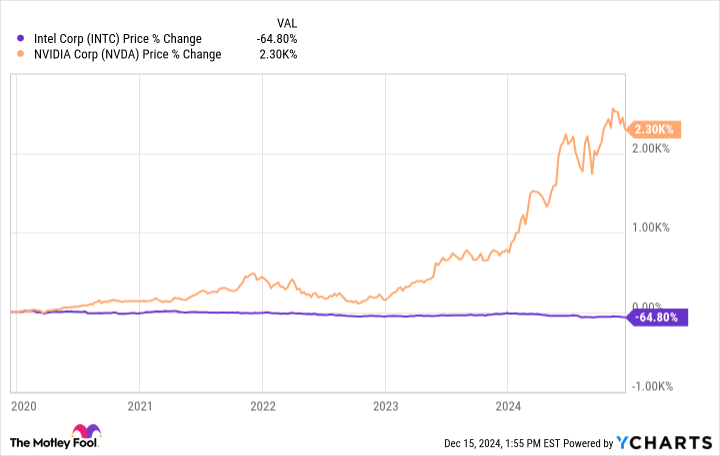

Intel (INTC -1.24%) is experiencing something similar although not as permanent. It’s unlikely that Intel will go out of business; however, missing out on smartphones (more on this below), the recent failure to embrace artificial intelligence (AI), and other missteps have the company reeling. The proof is in the pudding. Nvidia stock has skyrocketed, while Intel has crashed:

Intel is undergoing a much-needed leadership change now, but turnarounds take time. Meanwhile, these two AI stocks below could outperform.

Arm Holdings

When Intel missed out on supplying the chips for the iPhone, it was a devastating blow and a massive boon for Arm Holdings (ARM -3.27%). Arm-based chips are in more than 99% of global smartphones. Talk about dominating the market. Arm doesn’t make the actual chips; it designs the framework (which it calls the architecture) for the chips and licenses the designs to other companies, notably the tech giants. Arm makes money from licensing and royalties for products containing its chip architecture.

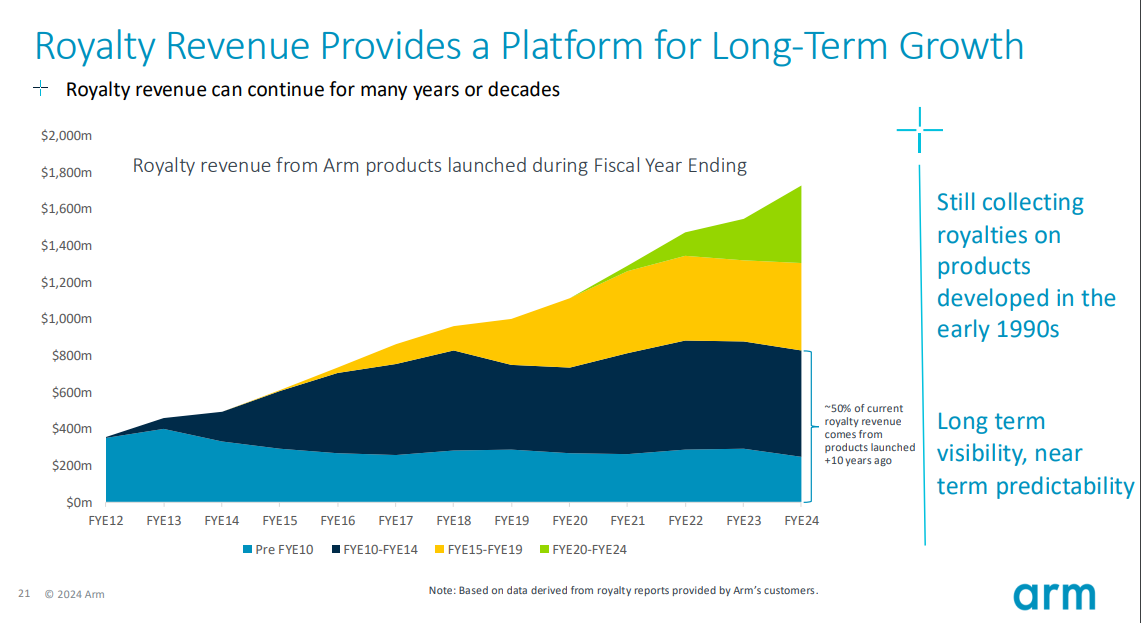

Arm’s revenue hit a record $844 million last quarter, the second quarter of fiscal 2025, ended Sept. 30, on 5% year-over-year growth. Growth was throttled due to the timing of some licensing revenue, so Arm expects 13% growth next quarter and 22% for the fiscal year, based on the midpoint of its guidance. One of the best things about Arm’s business model is lasting revenue. As shown below, the company still receives royalties for products developed decades ago.

Image source: Arm Holdings.

This strategy provides consistent sales and boosts profitability since few costs are associated with products developed years ago.

Arm has several sales verticals, including mobile, cloud computing, automotive, and the Internet of Things (IoT). As of fiscal 2024, the company held 41% of the market share in automotive, 15% in cloud, 54% in IoT, and 99% in mobile. Arm’s market dominance in several sectors bodes well for growth.

As of this writing, Arm’s stock price has appreciated 93% so far in 2024, giving it a $153 billion market cap. This means it trades for 39 times its midpoint sales guidance for this fiscal year, quite a steep price. However, Arm will eventually grow into its valuation. Interested investors should consider dollar-cost averaging to lessen the risk of buying at a near-term high and take advantage of potential dips in the stock price.

Marvell Technology

You have undoubtedly heard of Nvidia, the world’s data center beast with a $3 trillion-plus market value. Nvidia provides high-powered graphic processing units (GPUs) that facilitate lightning-speed data processing. But Nvidia doesn’t act alone. Data centers also need other infrastructure, like the optical interconnects, switches, controllers, and more that Marvell Technology (MRVL 3.64%) produces.

Gigantic data centers are being built at a brisk pace. For instance, Amazon just announced a $10 billion investment in an Ohio center, Microsoft has broken ground on billion-dollar projects in several states, and Elon Musk’s xAI supercomputer is forecast to contain 1 million GPUs. These massive builds are tremendous tailwinds for Marvell, which expects a total market opportunity of $75 billion by 2028.

Marvell’s revenue hit $1.5 billion in the latest period, the third quarter of its fiscal 2025, ended Nov. 2, on 7% growth. The data center accounted for $1.1 billion of total sales, a 98% year-over-year increase. Marvell expects to accelerate total sales growth next quarter to 26% or $1.8 billion.

Marvell isn’t operating profitably yet; however, many significant expenses are non-cash, like depreciation, restructuring charges, and stock-based compensation. The company reported an impressive non-GAAP (adjusted) operating margin of 30% last quarter.

On Wall Street, 33 of 36 analysts rate the stock a buy or strong buy, yet the average price target is $118 per share, slightly lower than the $123 price as of this writing. The analysts will probably begin increasing their targets as revenue accelerates. Still, investors should consider using the same risk mitigation buying techniques mentioned above.

Hopefully, Intel’s turnaround will be swift and successful. But it has a long way to go. In the meantime, AI stocks like Marvell and Arm Holding have much more momentum and upside.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Intel, Microsoft, Netflix, and Nvidia. The Motley Fool recommends Marvell Technology and recommends the following options: long January 2026 $395 calls on Microsoft, short February 2025 $27 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.