From SIA Charts

Originally Posted December 19th, 2024

2024 Market Performance Overview and Key Takeaways

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

2024 Market Performance Overview and Key Takeaways

As advisors count down the final trading days until the new year, SIA is busy taking stock of the benchmarks and reviewing indexes for their trading ranges. Generally speaking, SIA is a forward-looking system, but looking back at the prior year can be helpful as well, especially for relative strength analysis, which is the hallmark of the SIA platform. This exercise further strengthens the SIA Charts’ relative strength rankings, which identify outperforming asset classes on a relative basis, where outperformance often reflects improving investor expectations for strong growth. Let’s continue taking stock of what 2024 has provided, especially in light of yesterday’s selloff in the broad market, which marked the 10th consecutive day of declines. Even with this pullback, the S&P 500 Index is still up 23.11%, while the S&P 100 mega-cap stocks performed a little better at 28.99%. The technology-laden NASDAQ Composite Index gained in line with the S&P 100 Index at 29.19%, while the Russell 2000 Index was late to the rally but still managed a 14.14% gain, with most of the rally occurring in the last 6 months as money shifted from the concentrated mega-cap names to the lower valuations found in small-cap stocks. In Canada, the S&P/TSX Composite is up 17.17% as a broad group, with the S&P TSX 60 nearly in line with the composite at 16.55%. In Canada, the mid-cap market performed best, with a gain of 19.85%. Similarly to the U.S. market, small-cap stocks, as measured by the S&P TSX Small Cap Index, lagged their larger counterparts, with a YTD return of 13.58%.

S&P/TSX Composite Index Point and Figure Trading Ranges

Courtesy of SIA Charts

Next, let’s go into a bit more detail on the indexes and draw some chalk lines to outline trading ranges and notable resistance and support levels. The first attached chart is that of the S&P TSX Composite Index, where a blue box highlights the 2021–2023 trading range that had been well-established. While this index performed well in 2021, with a 21.74% annual return, 2022 was particularly negative, with a loss of -8.66%. The bounce-back in 2023 was mild, with a gain of just 8.12%. As mentioned above, 2024 has been much better, with a gain of 17.17% thus far. These up-and-down moves essentially materialized as a trading range from 18,348 to 21,729, but in the summer of 2024, the index broke past the 21,729 level and rallied all the way up to 25,479 on the 1% point-and-figure chart. Yesterday’s selloff moved the chart into its first column of O’s since the start of autumn sessions, a three-box reversal that produces the first level of support at 24,485, with more support at the 23,066 level and, of course, the top of the 2021–2023 range at 21,729. Resistance is calculated by extrapolating the prior trading range with the stacked box of the same size, placing the top level of resistance at 26,251, followed by the latest high at 25,734. When looking at the chart with these illustrations in place, it paints a picture of a potential new trading range that SIA practitioners might want to keep handy for future reference. This exercise can be done for many of the broad indexes with similar results, but given that U.S. Small Cap stocks only began participating later in the year, it does appear that they are telling a slightly different story, so let’s dig into that now.

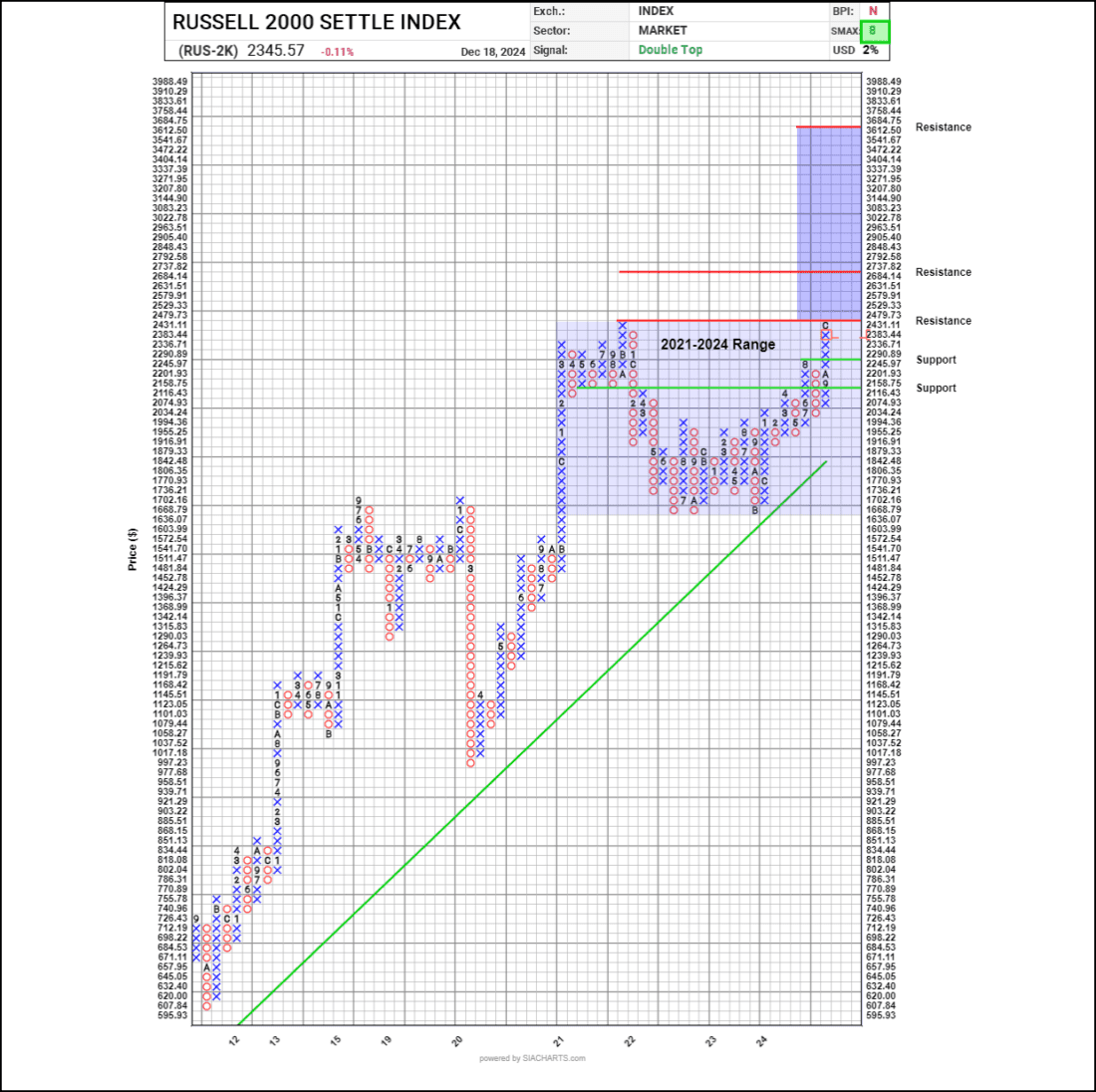

Russell 2000 Small-Cap Technical Analysis

Courtesy of SIA Charts

The Russell 2000 Index is a broad representation of the U.S. Small Cap market and has a similar trading range that it has been under for several years. At its lowest point, it finds support at the bottom of the added blue box, painting the picture of this range at 1,668, while the upper band is at 2,431. In a similar fashion, this small-cap index has had some good years and bad ones, with 2022 being particularly difficult for investors, with a -22.02% rate of return. However, 2023 and 2024 were much better, with 2023 producing 17.39% and 2024 yielding 14.14% YTD. Unlike most other indexes that ran outside their old trading ranges, the Russell 2000 is still trading within the confines of its old range. If this range is extrapolated upward with the same-size blue box, it suggests the Russell 2000 may have room to run. This will, of course, require follow-through on the chart, with a move to 2,479 and the associated spread double-top breakout at that level. The first resistance beyond this initial breakout would land at 2,737, as presented by the second red line, followed by the upper blue sky resistance level at 3,684. However, this remains speculative until an actual breakout occurs. In the meantime, it is evident that the small-cap segment of the market has great technical attributes, with an SMAX score of 8 out of 10. It is outperforming cash, bonds, currencies, and commodities, but still slightly underperforming against other broad equity groups.

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.