Markets are recovering strongly following lighter-than-projected price pressure figures from the Fed’s preferred inflation gauge, the PCE. Shortly after the report, however, Chicago Fed President Austan Goolsbee added additional fuel to fire by commenting that borrowing charges are going to come down next year due to inflationary forces moving in the right direction. Furthermore, positive revisions to the UMich consumer sentiment report included households having expectations of softer cost pressures over the medium- and long-term. Meanwhile, the global economic calendar also featured weaker-than-anticipated retail sales from the UK and Canada, while Hong Kong’s inflation report came in slightly below estimates. Turning to Capitol Hill, Republicans and Democrats are working to avert a government shutdown, but 38 GOP house members have voted against a Trump-backed spending bill that would have suspended the debt limit, citing a lack of federal spending cuts, generally speaking.

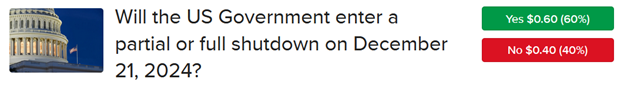

ForecastTraders Expect Shutdown

The likelihood of a government shutdown starting at 12:01 a.m. tomorrow increased significantly last night after legislators rejected a second proposal to extend the country’s debt ceiling to March 14. While Washington was planning to work on the issue today, substantial hurdles were expected to prevent a deal from being reached prior to the government closing. Indeed, IBKR ForecastTrader participants price the probability of a partial or full shutdown at 60%.

The costly event would stymie the federal government’s ability to pay millions of employees, including members of the armed services and TSA travel agents, while creating additional expenses, such as lost revenue and increased administrative work when the wheels of Washington start to turn again. According to Bloomberg, a 2019 report from the Senate Homeland Security and Governmental Affairs Committee found that shutdowns in 2014, 2018 and 2019 cost taxpayers a total of $4 billion. Other consequences would include closing parks, suspending regulatory actions, delaying or halting passport issuance and discontinuing the collection and distribution of various forms of data.

The bill rejected last night included many of the same disaster relief provisions as the first proposed funding resolution that was voted down on Wednesday. Both bills included $100.4 billion for victims of hurricanes Helene and Milton and $31 billion in farm aid. Unlike the original 1,547-page bill, which was rejected after President-elect Donald Trump and Elon Musk, who will co-chair a committee on government spending, criticized it, last night’s proposal would have extended the debt ceiling for two years. Trump had requested the extension, a move that critics said would block Democrats from using the ceiling as a negotiating chip during his presidency. While all but two Democrats voted no, 38 conservative Republicans also opposed it, citing a lack of federal spending cuts.

US Consumer Spending Picks Up

November’s Personal Income & Outlays report depicted strong goods spending amidst moderating services consumption. The pace of real consumer spending, which is adjusted for inflation, rose 0.3% month over month (m/m), a tenth lighter than expectations but an improvement from October’s 0.1%. Consumption was dominated by durable goods growing 1.8% m/m, while non-durables and services saw upticks of 0.2% and 0.1% during the period. Meanwhile, real incomes grew 0.2% m/m, also 0.1% below projections and beneath the previous period’s 0.6% gain. Because the pace of outlays exceeded the rate of compensation, the personal savings rate declined from 4.5% to 4.4% during the interval.

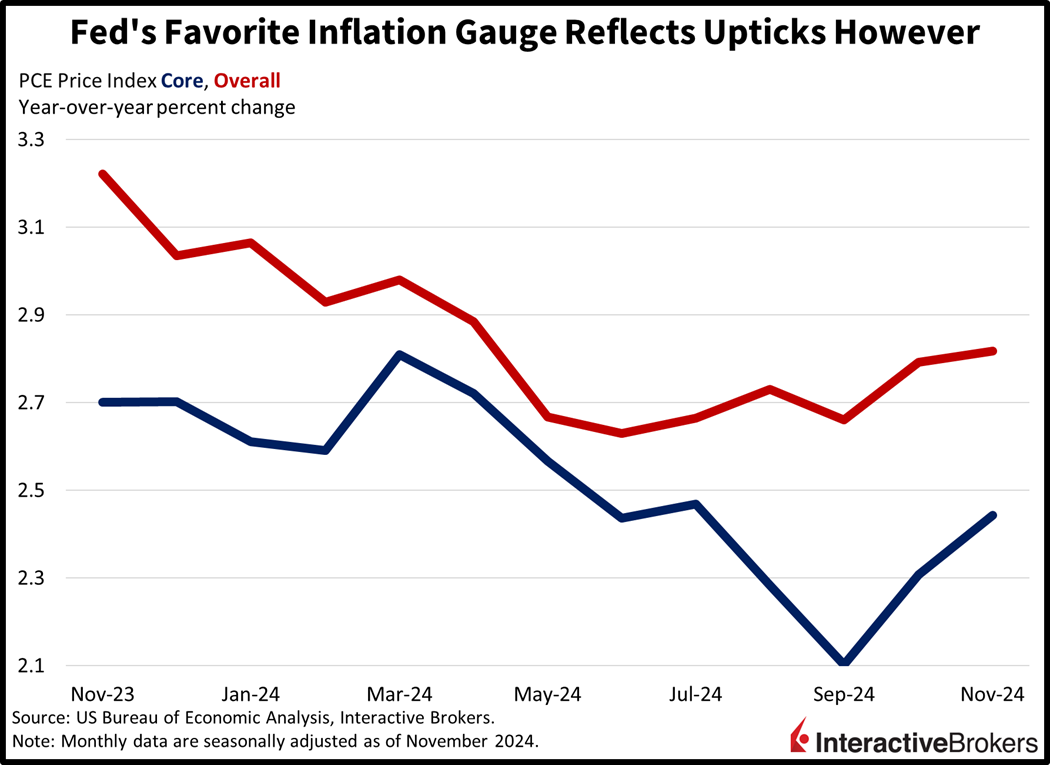

PCE Inflation Misses

The market loved the report’s softer price pressure figures, however. Price gains were lower than expectations by a tenth of a percent across the board. Indeed, the headline Personal Consumption Expenditures (PCE) price index rose 0.1% m/m and 2.4% year over year (y/y) last month compared to 0.3% and 2.3% in October. The core segment, which excludes food and energy due to their volatile characteristics, arrived at 0.1% m/m and 2.8% y/y, while October’s figures were 0.3% and 2.8%. Services, food and energy comprised most of the upward pressure, with prices climbing 0.2% m/m each, but durable and non-durable goods were flat during the period.

Consumer Sentiment Unchanged

Today’s final consumer sentiment figure from the University of Michigan (UMich) was unchanged from the preliminary report released two weeks ago. The headline figure remained the same amidst upward revisions in consumer expectations from 73.1 to 73.3 while the index for current conditions was downwardly adjusted from 77.7 to 75.1. But stock investors loved the downward revision to inflation expectations over one and five years, which moved from 2.9% and 3.1% to 2.8% and 3%.

Consumers Hold Out for Discounts

Consumers are holding off on buying full-priced athletic clothing but are continuing to flock to travel services. The slowdown in the industrial sector, meanwhile, has weighed upon results of FedEx. Those are a few points from the following highlights:

- Nike (NKE) reported a y/y decline in earnings and revenue but both metrics still exceeded analyst expectations. Nike CEO Elliott Hill said results were hurt by the company’s excessive use of discounting. After liquidating existing inventory, Nike will return to a full-price model for its online channel and seek to improve traffic across the company’s distribution channels by introducing new products and creating compelling stories. For the current quarter, it expects sales to decline in the low double-digits, which is worse than the analyst forecast.

- Carnival (CCL) reported record-booking levels for the next two years and said recent-quarter sales grew 10%. After reporting a loss in the year-ago quarter, Carnival said it produced an adjusted earnings per share (EPS) of $0.14. Both revenue and earnings exceeded analyst expectations. Chief Executive Officer Josh Weinstein says the company is experiencing a “strong demand environment.”

- FedEx (FDX) told investors its 2025 revenue could be curtailed by a challenging environment with weak demand from businesses for the company’s fastest and most profitable delivery services. For its fiscal year ending in May, its guidance for adjusted profits of $19 to $20 per share was lowered from its September outlook of $20 to $21 a share. While its adjusted EPS surpassed expectations, overall earnings and revenue fell short of analyst forecasts, a result of sluggish results in the domestic industrial sector. It also announced it will spin off its freight trucking business, which sent the company’s share price up 8% in after-hours trading.

Hong Kong Posts Benign Price Pressures

In Hong Kong, inflationary pressures remained steady in November despite expectations for an increase. Price pressures rose 0% m/m and 1.4% y/y, a tenth lighter than projected on both fronts. In October, prices climbed 0.2% and 1.4%. Last month, annualized charges for housing and transportation eased from 1% and 1.6% to 0.9% and 1.3%. Officials are expecting a pickup in domestic prices going forward due to strong economic growth, but international uncertainty related to the changing US government is weighing on the ability to forecast the environment for external cost pressures.

UK Retailing Reverses Decline

UK retail sales grew only 0.2% m/m in November, reversing a trend from the preceding month that experienced a 0.7% decline but falling below the analyst forecast of 0.5%. Supermarkets and other non-food stores led the increase while a drop in clothing retailers hampered overall results.

Retail sales in Canada advanced 0.6% m/m in October, matching September’s result but missing the analyst expectation of 0.7%. Sales expanded in five of nine subsectors, with new and used car dealers leading. Transactions at gasoline stations declined for the sixth consecutive month.

Investor Optimism Surges

Markets are taking Goolsbee’s dovishness alongside softer inflation figures from UMich and the PCE as reasons to drive prices much higher. Stocks are soaring, yields are plunging and the greenback is tanking against this backdrop. All major stateside equity benchmarks are gaining strongly. With the Dow Jones Industrial, Nasdaq 100, S&P 500 and Russell 2000 all up 1.8%. Sectoral breadth is terrific as all 11 sectors are participating, led by real estate, technology and healthcare; they’re up 2,7%, 2.1% and 2.1%. Treasurys are catching bids too, with the 2- and 10-year maturities changing hands at 4.28% and 4.49%, 4 and 8 basis points (bps) lighter on the session. Softer borrowing costs are weighing on the Dollar Index which is lower by 75 bps as the greenback depreciates versus all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are catching the bullish winds as well with silver, gold, lumber, copper, crude oil up by 1.5%, 1.3%, 0.4%, 0.4% and 0.4%. WTI crude is trading at $69.36 per barrel after suffering heavy losses in the morning.

Seasonal Strength Driving Stocks Higher

Despite stocks rallying today, risks of much higher interest rates still loom significant for the equity market. There’s an elevated chance that the Fed’s easing cycle is over as goods price pressures reignite next year while growth projections, inflation expectations and fiscal imbalances drive the long-end of the curve north. Valuations don’t matter if the Fed is in an appeasing stance, but they do once the central bank shifts toward apprehension. Finally, today was a good day for a relief rally considering strong seasonals, the PCE and UMich inflation numbers missing estimates while Goolsbee’s enthusiasm sent stocks to the moon, but elevated caution is warranted at this juncture. Price to earnings multiples are unlikely to expand further absent a sprint down the Fed’s monetary policy stairs.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.